Introducing Professional Services. Learn how we can help accelerate your payments transformation.Learn more →

Move, Track, and Reconcile Money in Real-Time

Automatic reconciliation, faster payments, and real-time financial data, assisted by AI.

Essential Infrastructure for the New Era of Payments

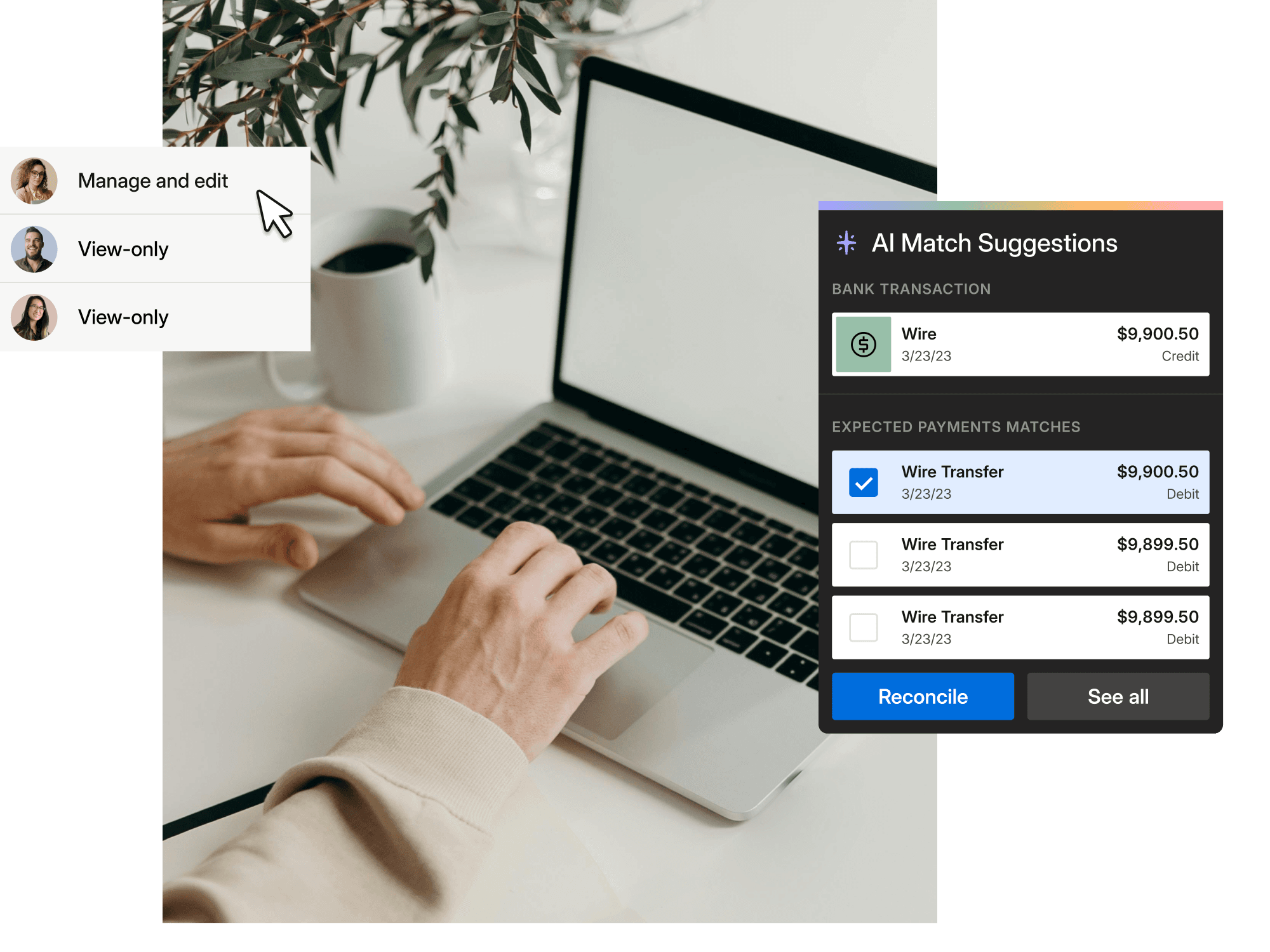

Real-Time Reconciliation

Get to 100% reconciled with a granular matching engine, AI-powered exception handling, and a system that learns over time.

One API for All Your Banks

Integrate with 40+ banks. Implement RTP and FedNow, and orchestrate payments across North America, Europe, the UK, and Australia.

A Central Source of Truth

Manage transactions and balances in a performant database. Unify your financial data and make sense of it with AI.

Enterprise-Grade Security

Support for RBAC, SSO, SCIM, and SIEM. SOC I, SOC II, and PCI DSS compliant.

Seamless Connectivity

Start faster with pre-built integrations and flexible methods to ingest data via UI and API.

Modular Architecture

Modernize your entire infrastructure, or solve specific pain points, at your pace.

Robust Controls

Granular, conditional, and sequenced approvals for payments and reconciliation.

Payments Transformation is Business Transformation

Whether your business is new to hyperscale or a generational company, Modern Treasury is the partner of choice to advance in the new era of payments.

Navan reimagined expense management

C2FO increased revenue by entering the flow of funds

DriveWealth unlocked real-time reconciliation

AI That Puts You In Control

From controlled AI suggestions to granular permissions, Modern Treasury has everything enterprises need to confidently manage money at scale.

Expertise That Cuts Through Complexity

Reach your goals by collaborating with our expert team to implement faster, unlock new use cases, and scale efficiently.

Resources for payments and finance leaders everywhere

See more in our Knowledge Hub

Payments primers, industry trends, and resources to help leaders navigate modern payments.

Try Modern Treasury and experience the future of money movement.

Subscribe to Journal updates

Discover product features and get primers on the payments industry.