One API. Every Rail.

The payments platform that keeps up with the speed—and scale—of your business.

Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

The payments platform that keeps up with the speed—and scale—of your business.

Get the infrastructure you need to meet your customers where they’re at and deliver a more seamless experience at every stage of growth.

Scale payments seamlessly with automation.

Orchestrate money movement across multiple banks via ACH, wire, FedNow, RTP, and stablecoins.

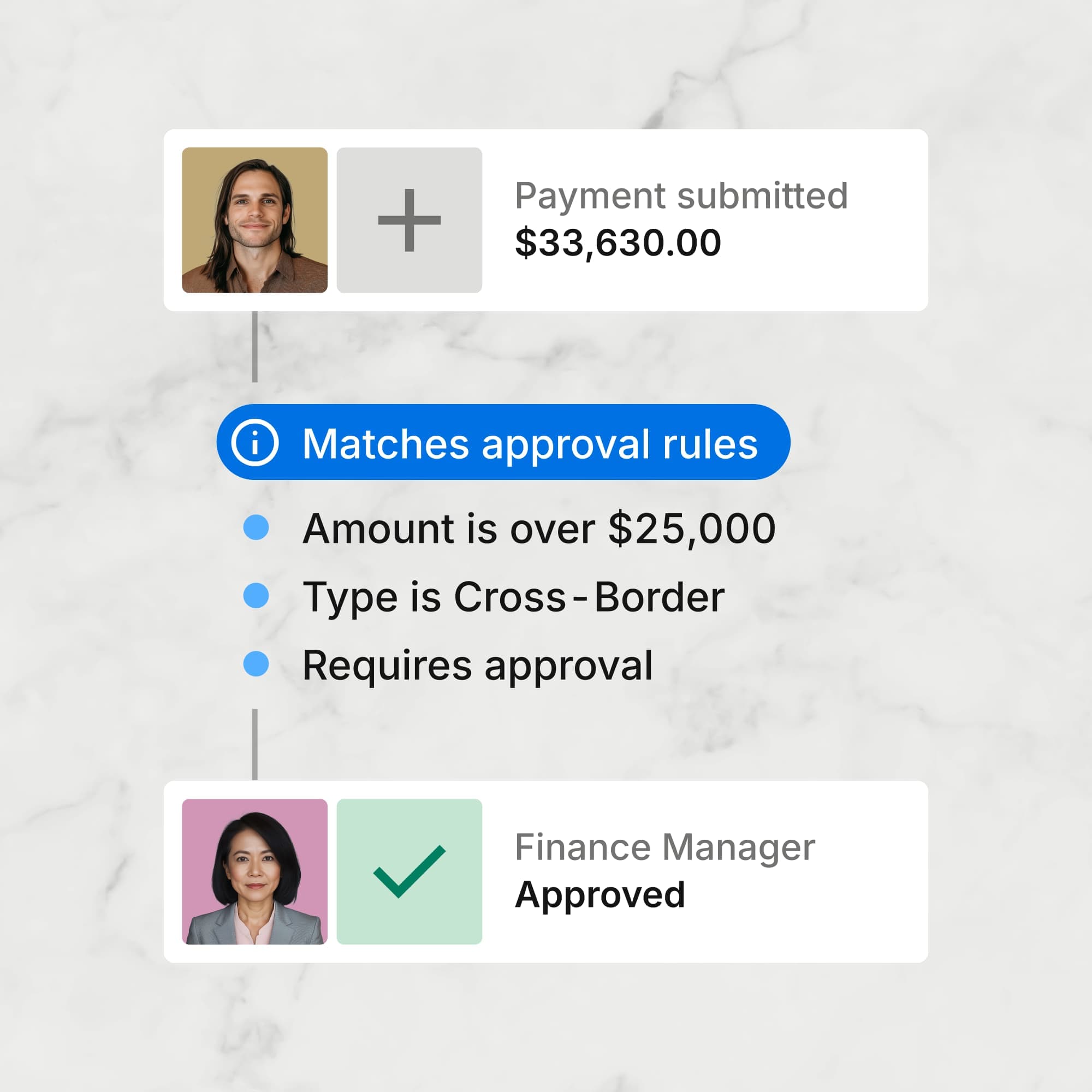

Minimize risk by managing legal entities, setting approval rules, and generating audit trails. No sweat.

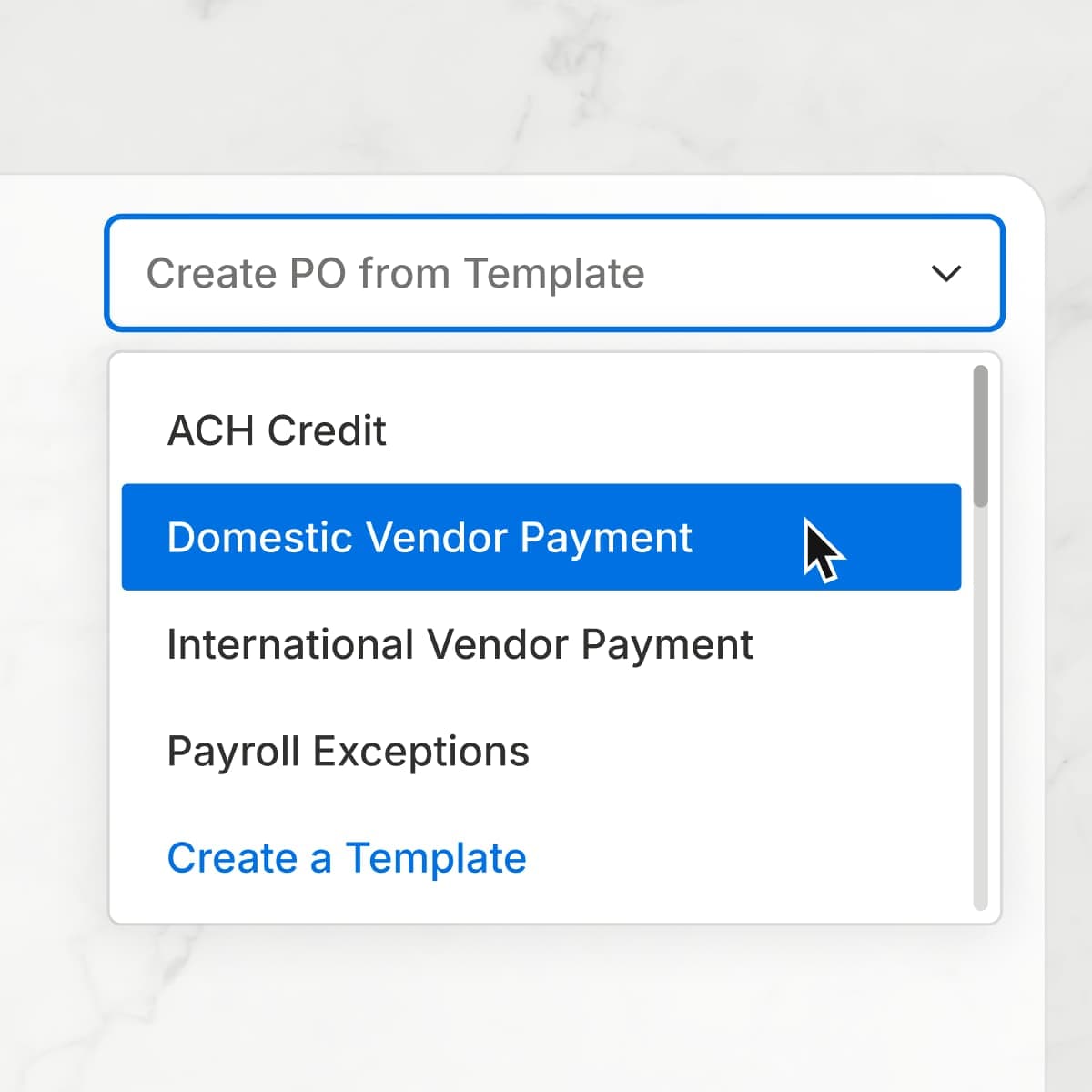

Standardize complex transactions like payroll, taxes, cross-border payments with templates and data validation.

“Modern Treasury is more than just a technology service. They manage all the operational nuances of integrating new banks and adding new accounts and payment methods—so that my team can continue improving our core product.”

Level up the your customer experience with faster money and easier access, today.

Integrate with FedNow, RTP rails, and stablecoins for payment processing that’s faster than fast.

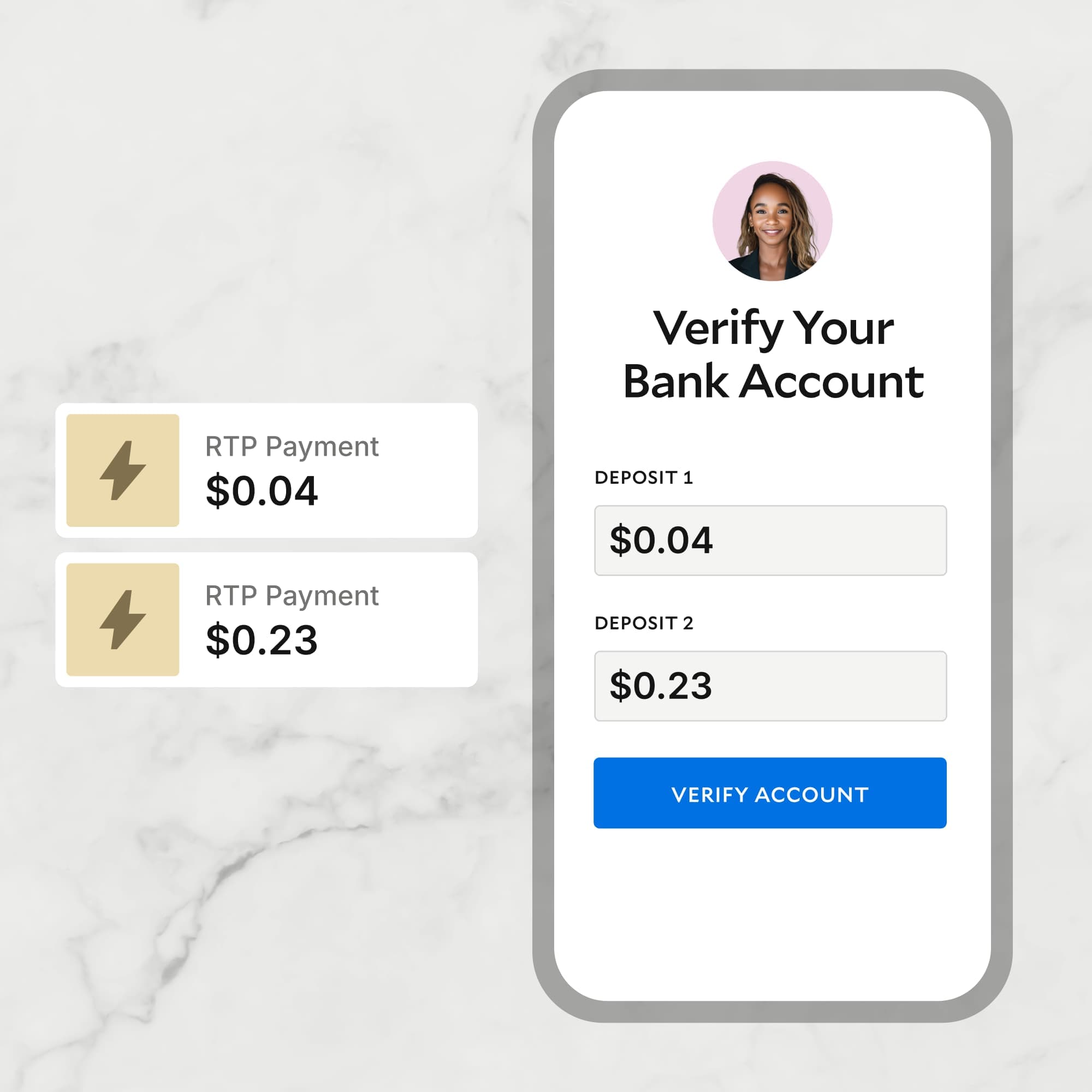

Verify bank accounts and counterparties in seconds with immediate microdeposits.

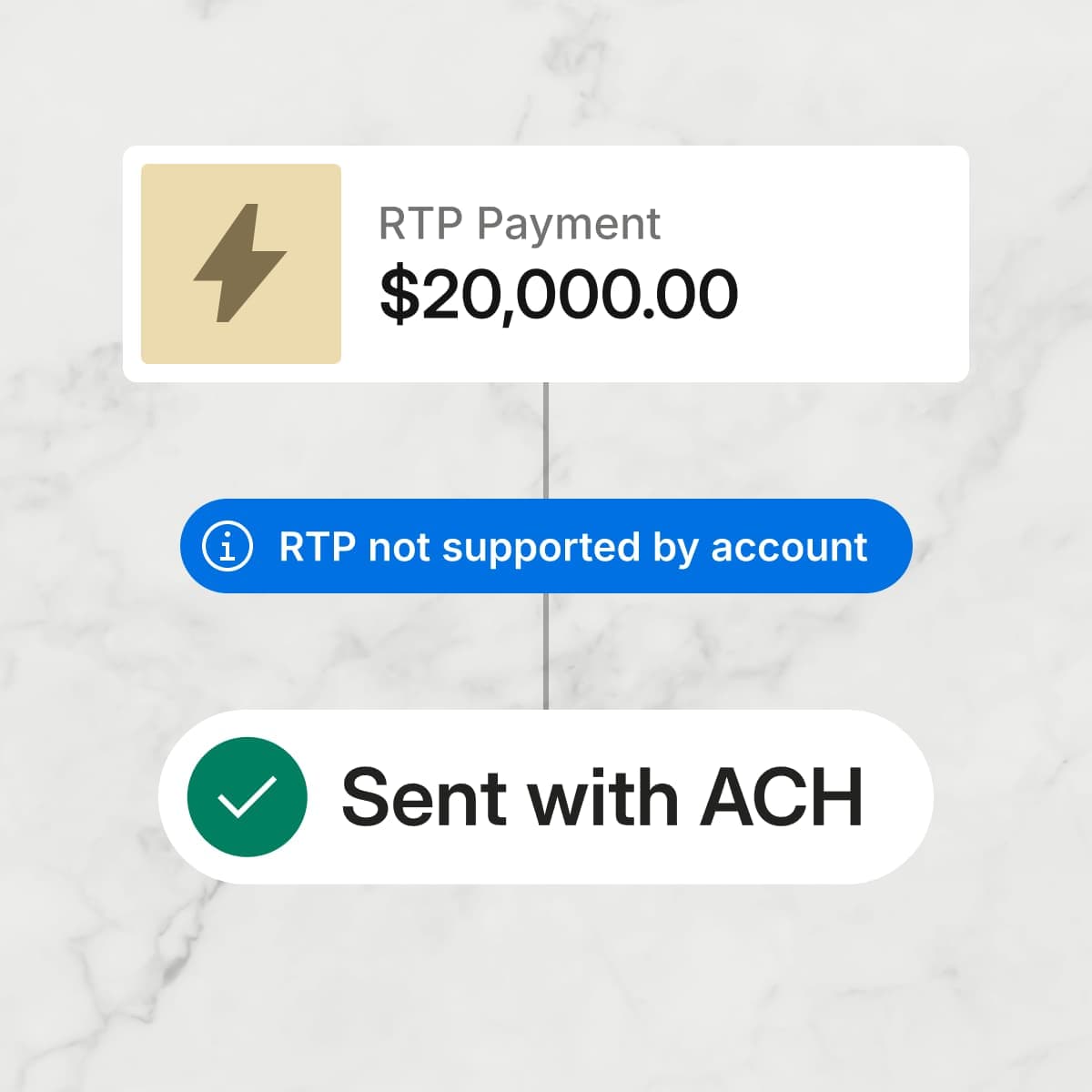

Give customers peace of mind with ACH fallbacks and real-time payment confirmations.

“Modern Treasury acts like a banking gateway for us. When a large enterprise or strategic customer expresses interest in us connecting to their bank, it is easier for that customer to adopt and use our product thanks to Modern Treasury’s robust bank partnerships.”

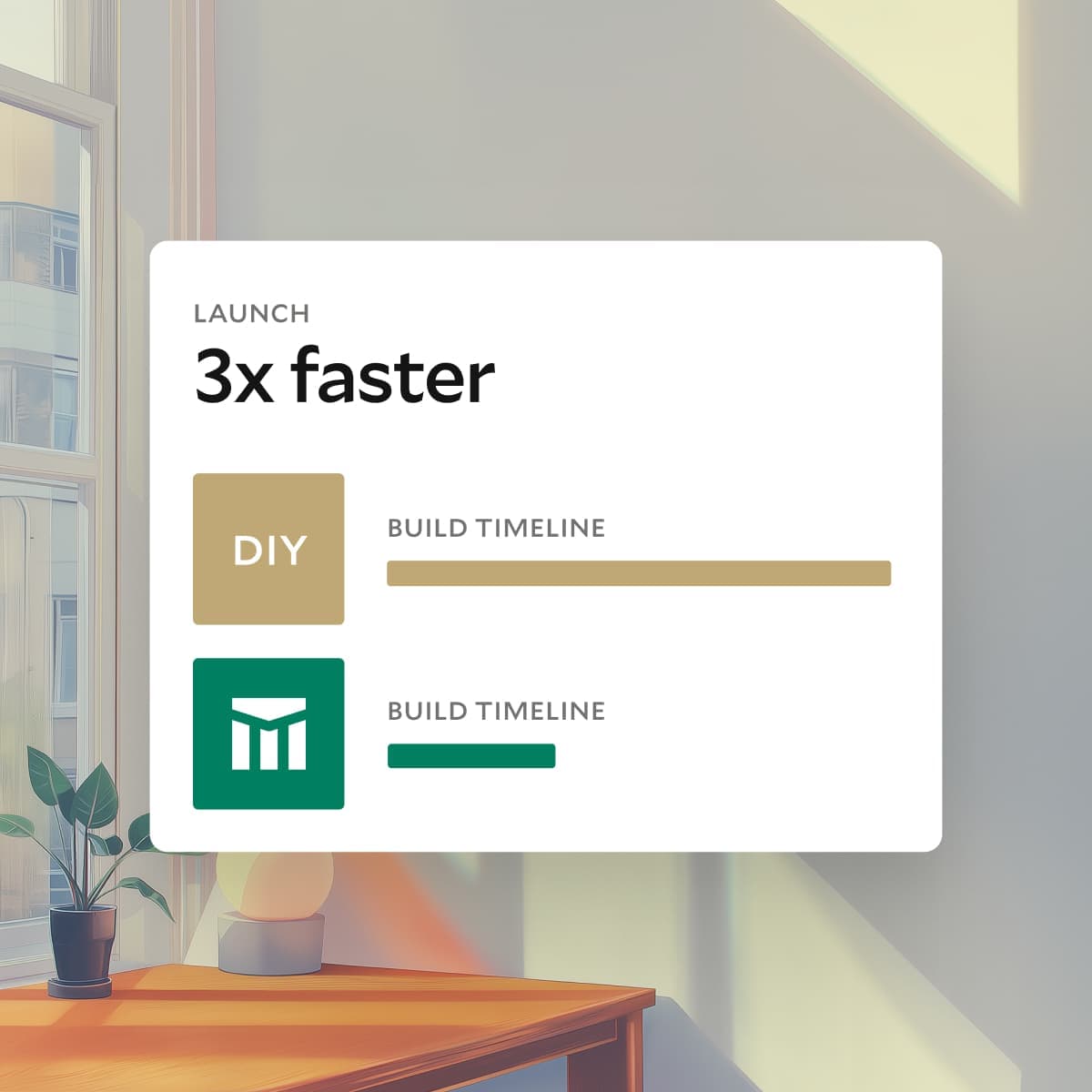

Save months of dev time with pre-built bank integrations, so you can focus engineering resources on what really matters: your core product.

Get visibility into every payment and balance, so you’re never in the dark. Total transparency means fewer surprises and more “aha” moments.

Early Access members will get early documentation, architecture previews, guidance from Modern Treasury’s product team, and an opportunity to preview new capabilities before the launch.