Modern Treasury Ledgers

The Ledger for Real-time Money Movement

Scalable OLTP database for tracking transactions.

Modern Treasury lets us track studio balances reliably and transparently, ensuring that we don't have to manually verify studio balances before paying them out.

One Ledger. Every Transaction.

Ledgers gives you a single, immutable system of record to track balances, transactions, and money movement across your entire stack.

Unified System of Record

Use the Ledgers API to record all money movement across your payments stack.

Built-in Accounting Guarantees

Engineered with double-entry accounting principles for consistency, immutability, and auditability.

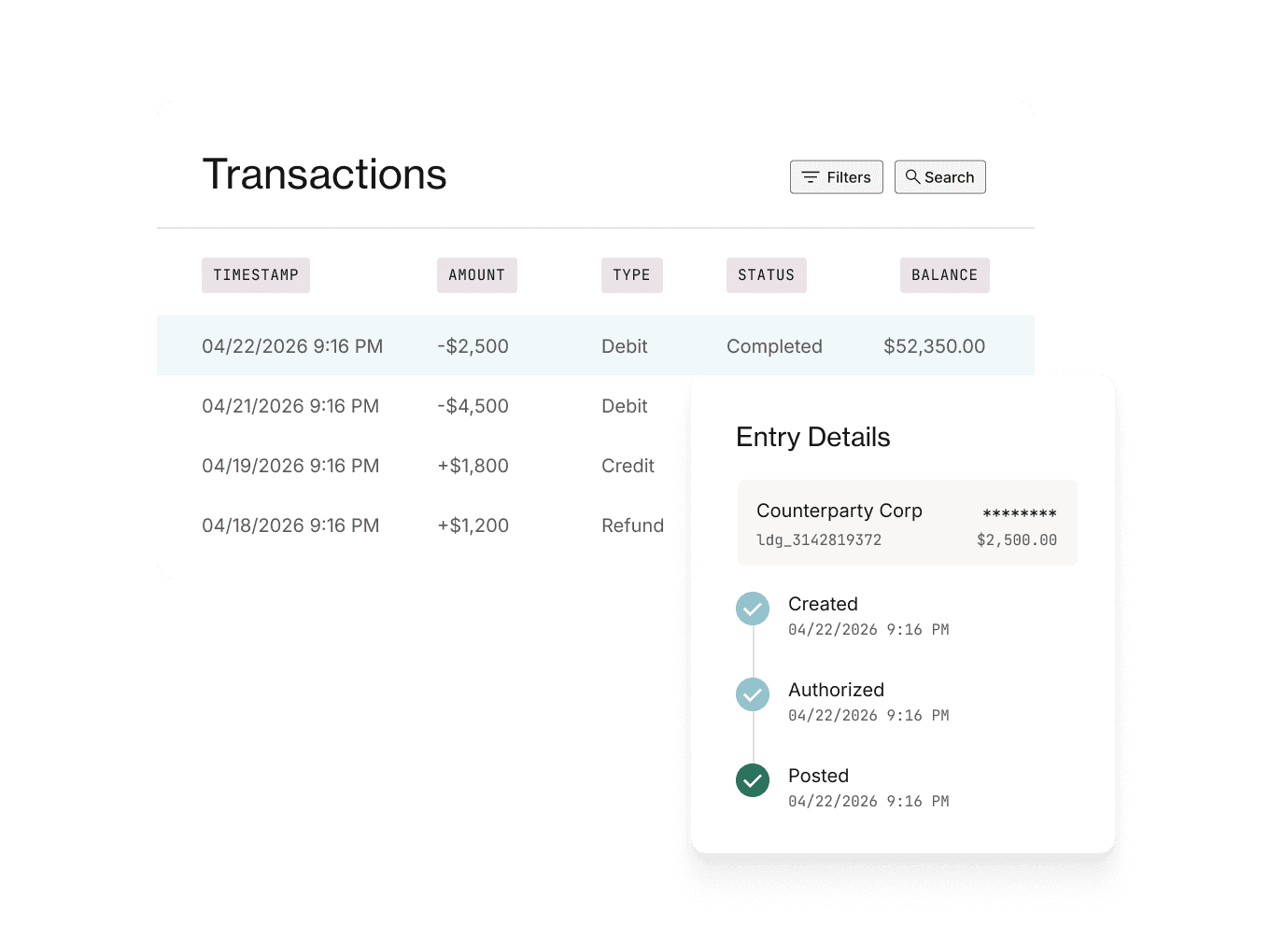

Real-Time Visibility

Query balances and transactions in real-time, and review audit trails for every account and transaction.

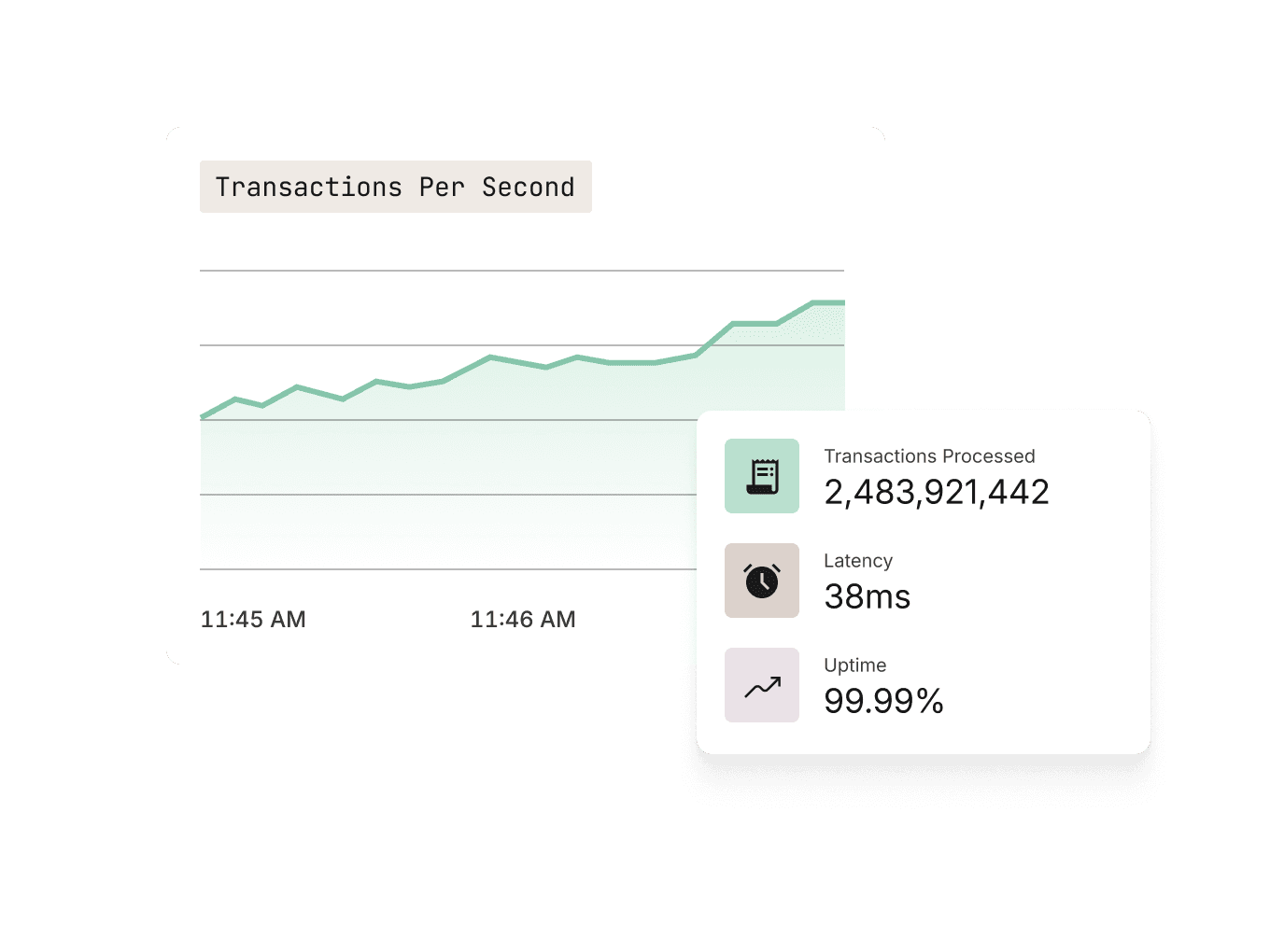

Built for Scale

Battle-tested infrastructure built to handle billions of transactions with high throughput and low latency.

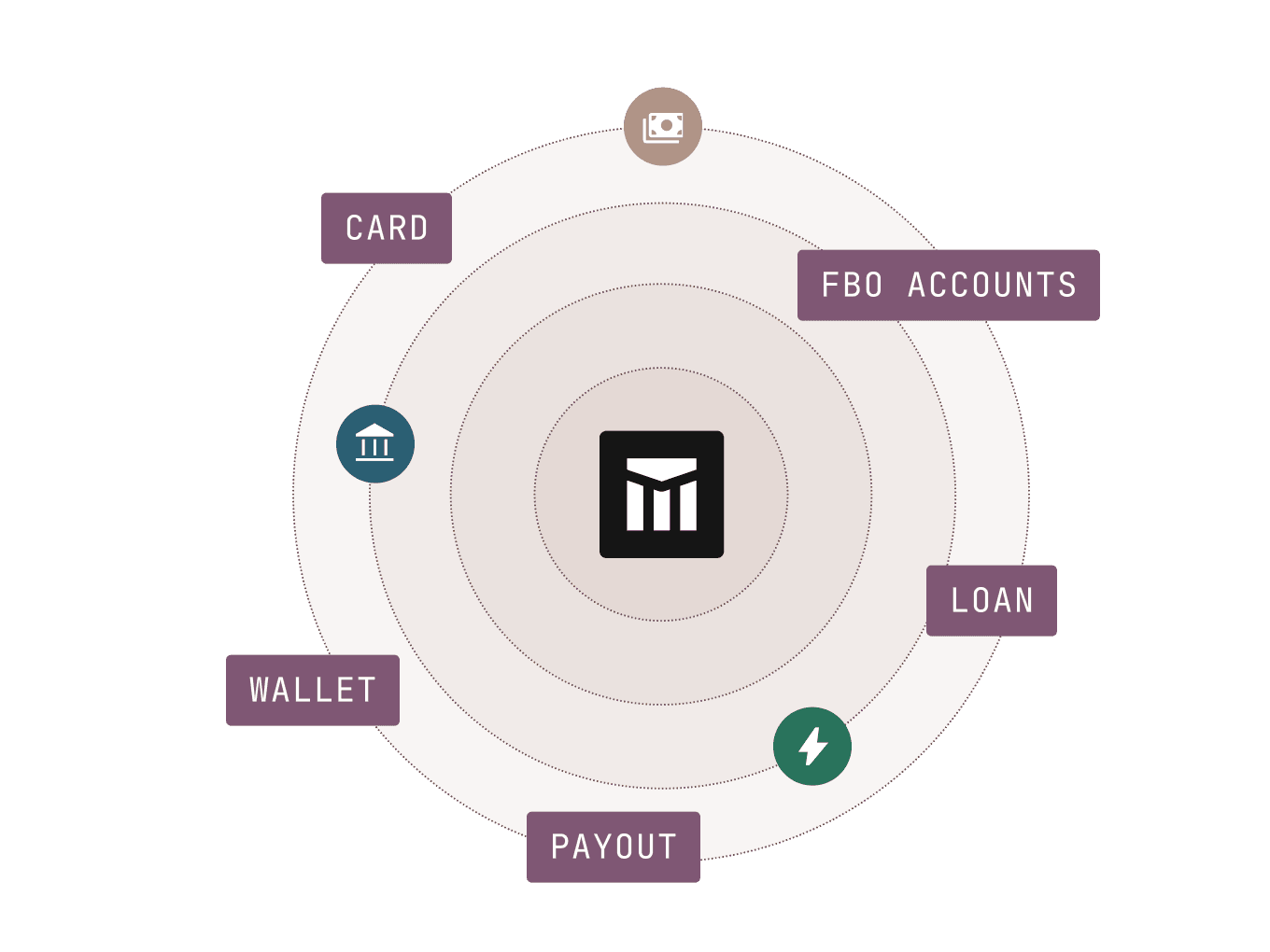

The Foundation For Any Product That Moves Money

Deliver world-class product experiences with reliable infrastructure.

Built for Your Use Cases

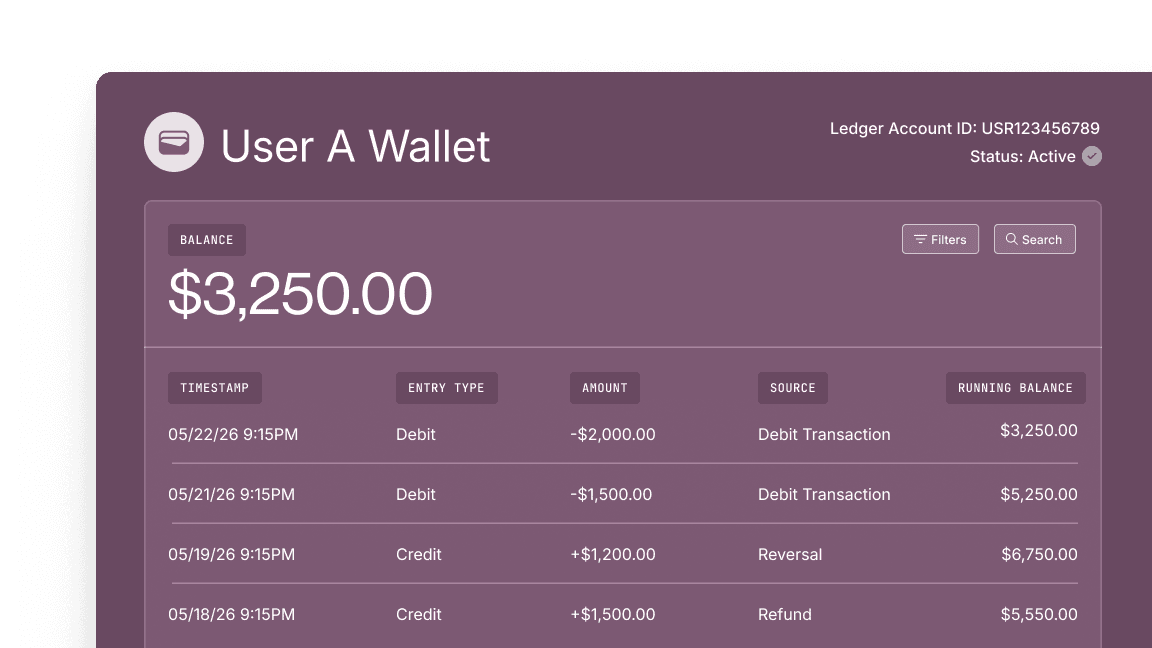

Build Digital Wallets.

Ledger transactions and aggregate user balances at scale.

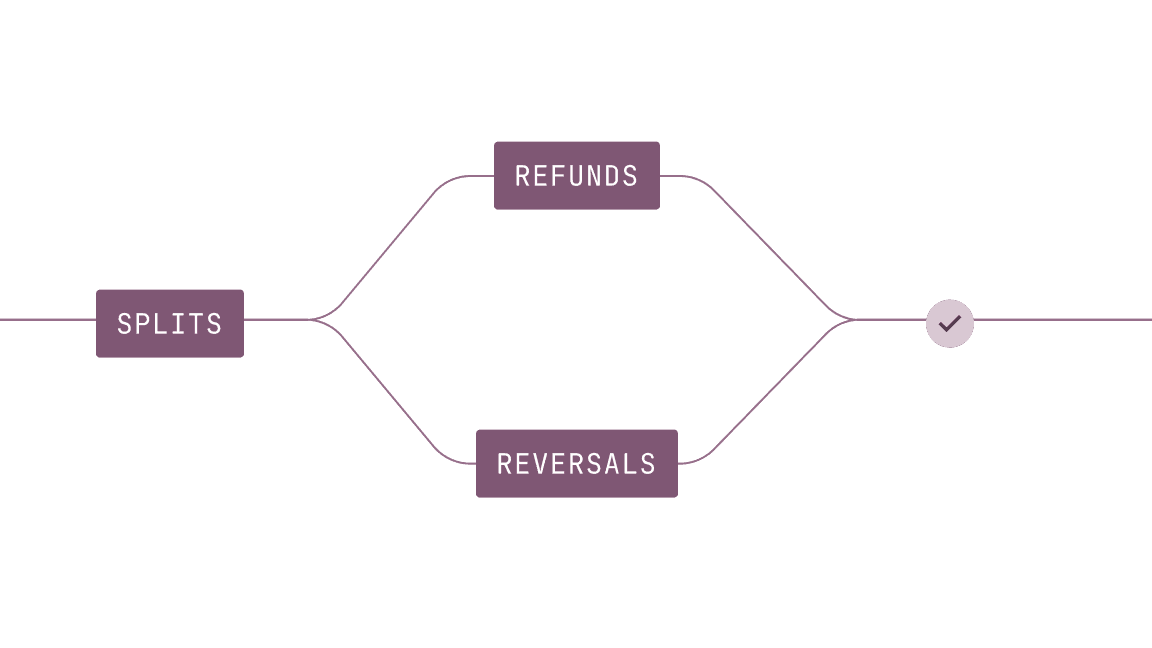

Support Complex Money Flows.

Handle splits, refunds, reversals, and closed-loop transactions cleanly.

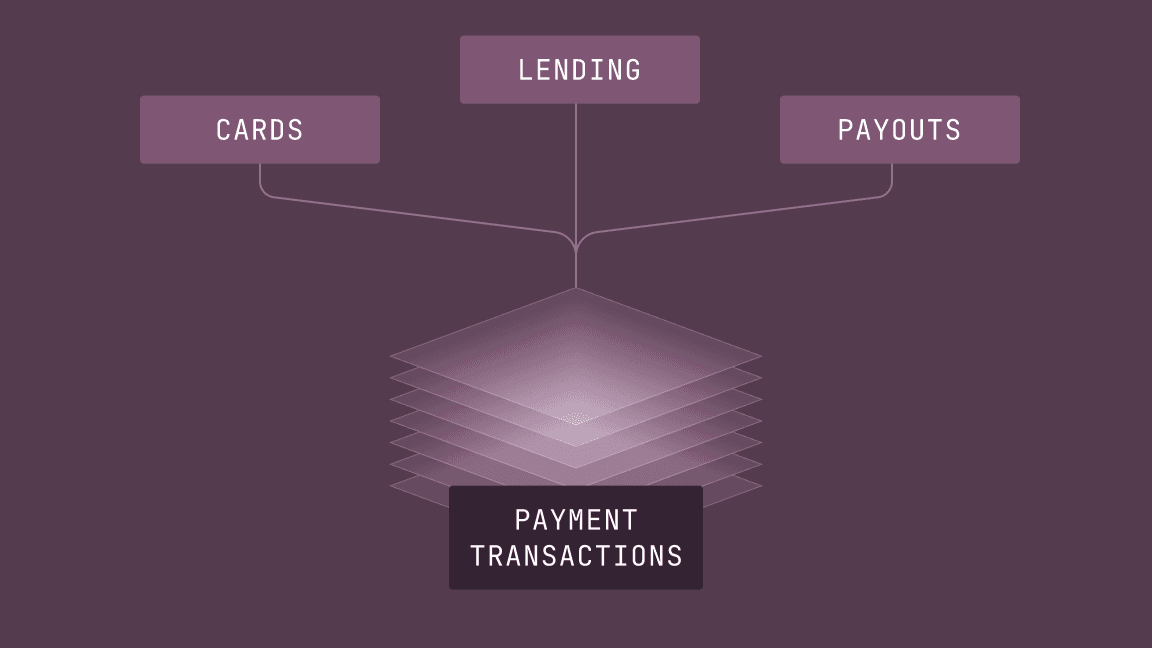

Power Card, Lending, and Payout Programs.

Maintain accurate balances before money moves.

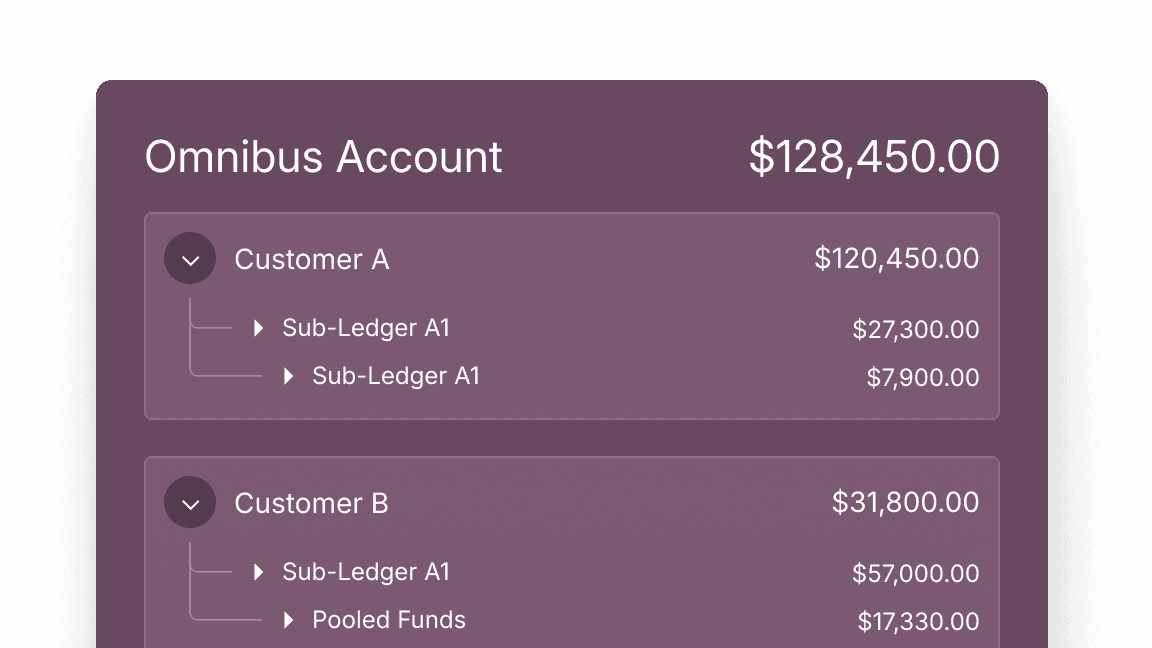

Manage Omnibus and FBO Accounts.

Track pooled funds with precise sub-ledgering and account hierarchies.

Build Faster with a RESTful API

curl --request POST \

-u ORGANIZATION_ID:API_KEY \

--url https://app.moderntreasury.com/api/ledgers \

-H 'Content-Type: application/json' \

-d '{

"name": "Marketplace Ledger",

"description": "Represents our USD funds and user balances"

}'Fully Managed Infrastructure

Focus on your product. Let us handle caching, provisioning, and maintenance.

Flexible Account Hierarchies

Nest millions of accounts in up to five levels of hierarchy with live balance aggregations.

Data Warehouse Sync

Support reporting and analytics workflows with automated exports to your warehouse of choice.

Account Reconciliation

Compare ledger account with bank account balances, identify and resolve drift.

Auto-Ledgering

Define ledgering rules for payment orders or ledger them atomically with a single API call.

Balance Monitors

Create webhook alerts based on specific balance thresholds.

Complete Audit Logs

Record and reconstruct all your transactions in an immutable ledger.

Balance Locking

Prevent transactions from overdrawing balances.

Account Settlements

Ensure every entry is accounted for in payouts and collections.

Ready to Build?

Let's talk about the use case and pricing that fits your roadmap.