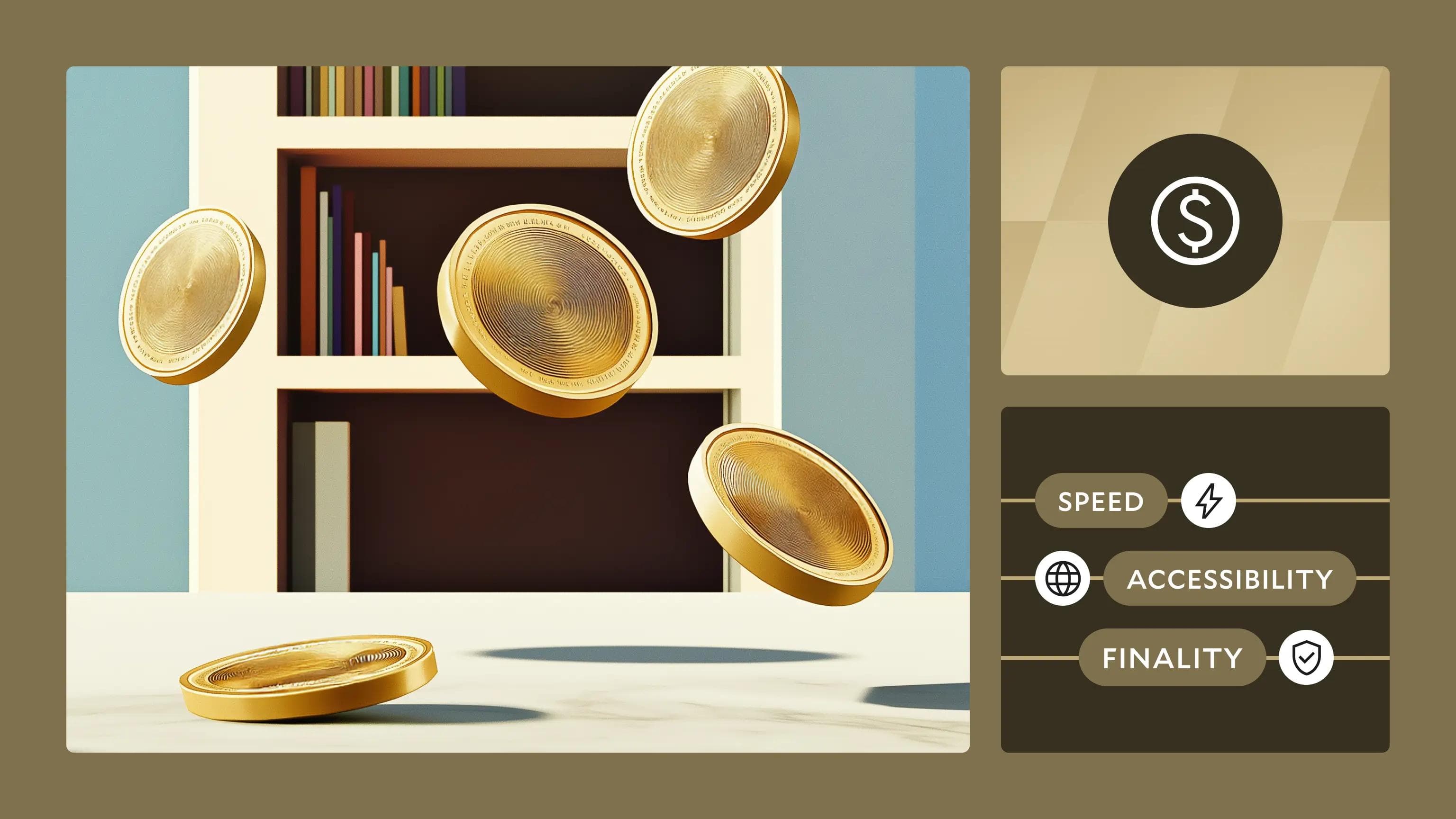

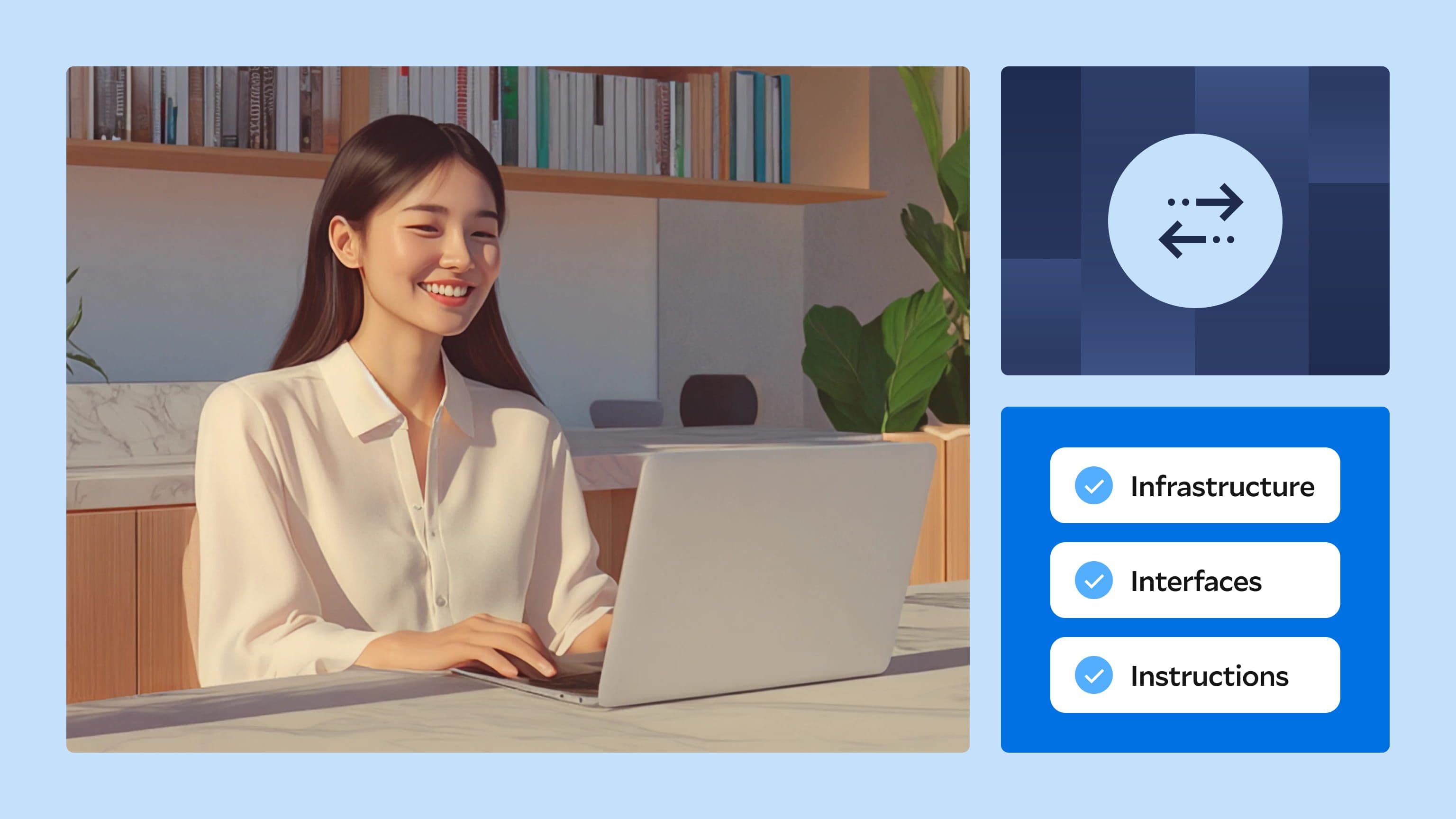

One API. Every Rail.

The payments platform that keeps up with the speed—and scale—of your business.

“Modern Treasury is more than just a technology service. They manage all the operational nuances of integrating new banks and adding new accounts and payment methods—so that my team can continue improving our core product.”