Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

August Changelog

In August, we shipped several new updates including a new payment order create experience, a payment order timeline, ledger account categories, and more.

August was a busy month at Modern Treasury, with numerous new features shipped across the entire product suite. Here’s a rundown of what we’ve been up to.

Developer Libraries in Python and NodeJS

We have released the first two beta versions of our developer libraries in Python and NodeJS. These server-side Software Development Kits (SDKs) support our most common Payments workflows and will soon support Ledgers functionality. We are actively adding additional features, languages, and API coverage. For any feedback on our existing API libraries, or to request additional features or languages, please reach out to us at sdk-feedback@moderntreasury.com.

Migration to Cursor-Based Pagination

We are changing our API's pagination method from offset to cursor-based. While offset pagination has served without issue up to this point, it becomes less performant as a database scales, and can run into issues when entries are added or deleted while the database is being queried. This switch to cursor-based pagination will allow for consistent speed as the number of items in a database grows and for more confidence in the accuracy of returned results.

Please see our API guide or previous journal for more detail on this change.

Payments Updates

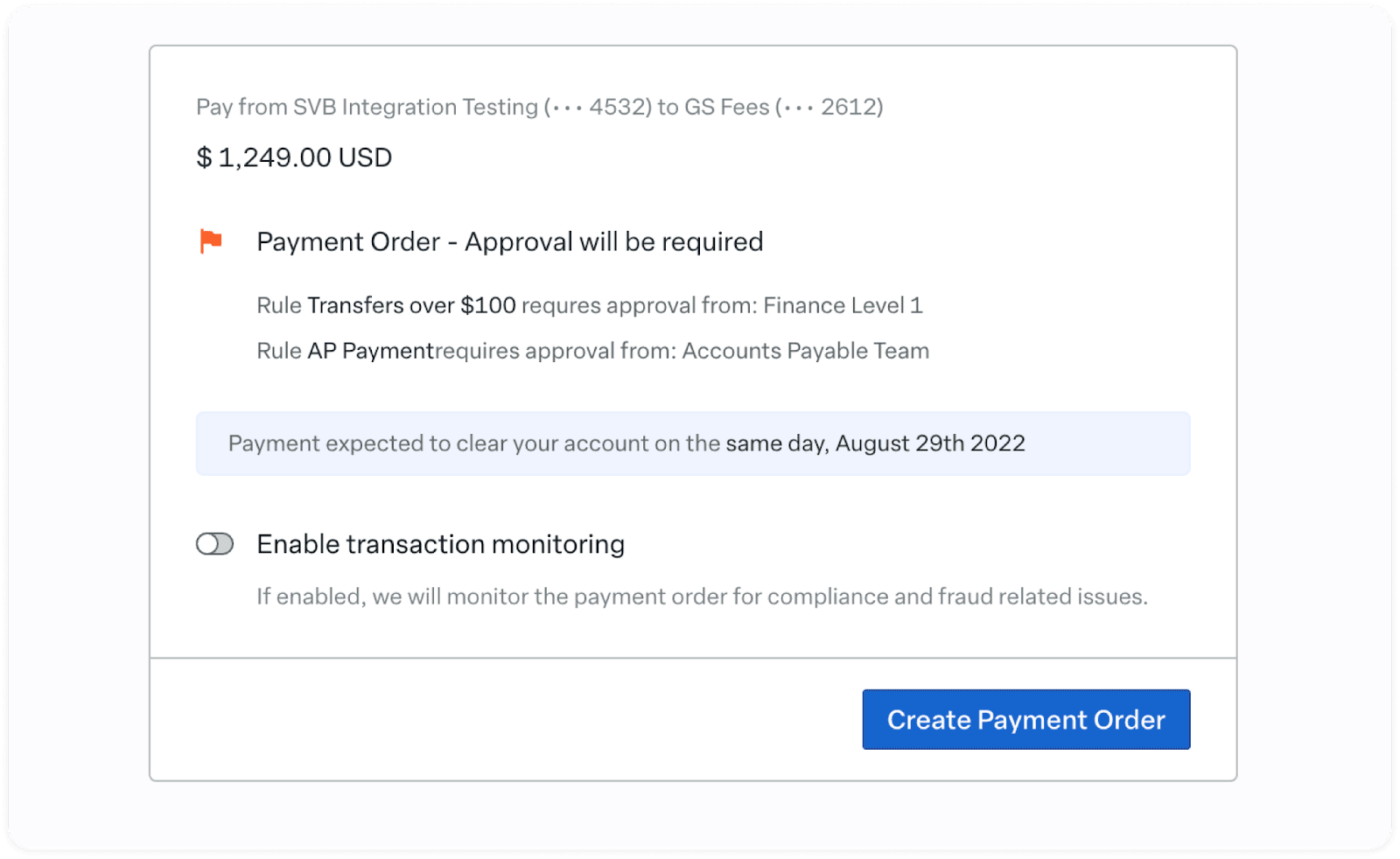

New Payment Order Create Experience

We enhanced the user experience when creating a new payment order in the web app. You can now create counterparties and external accounts without leaving the page. We have enhanced the feedback and errors you receive on the form, helping you easily identify and fix any formatting or validation issues.

We added a summary widget that updates live as you make changes to the form. The widget will tell you the high-level details of the payment order while also surfacing any timing or approval constraints based on the values of the payment order.

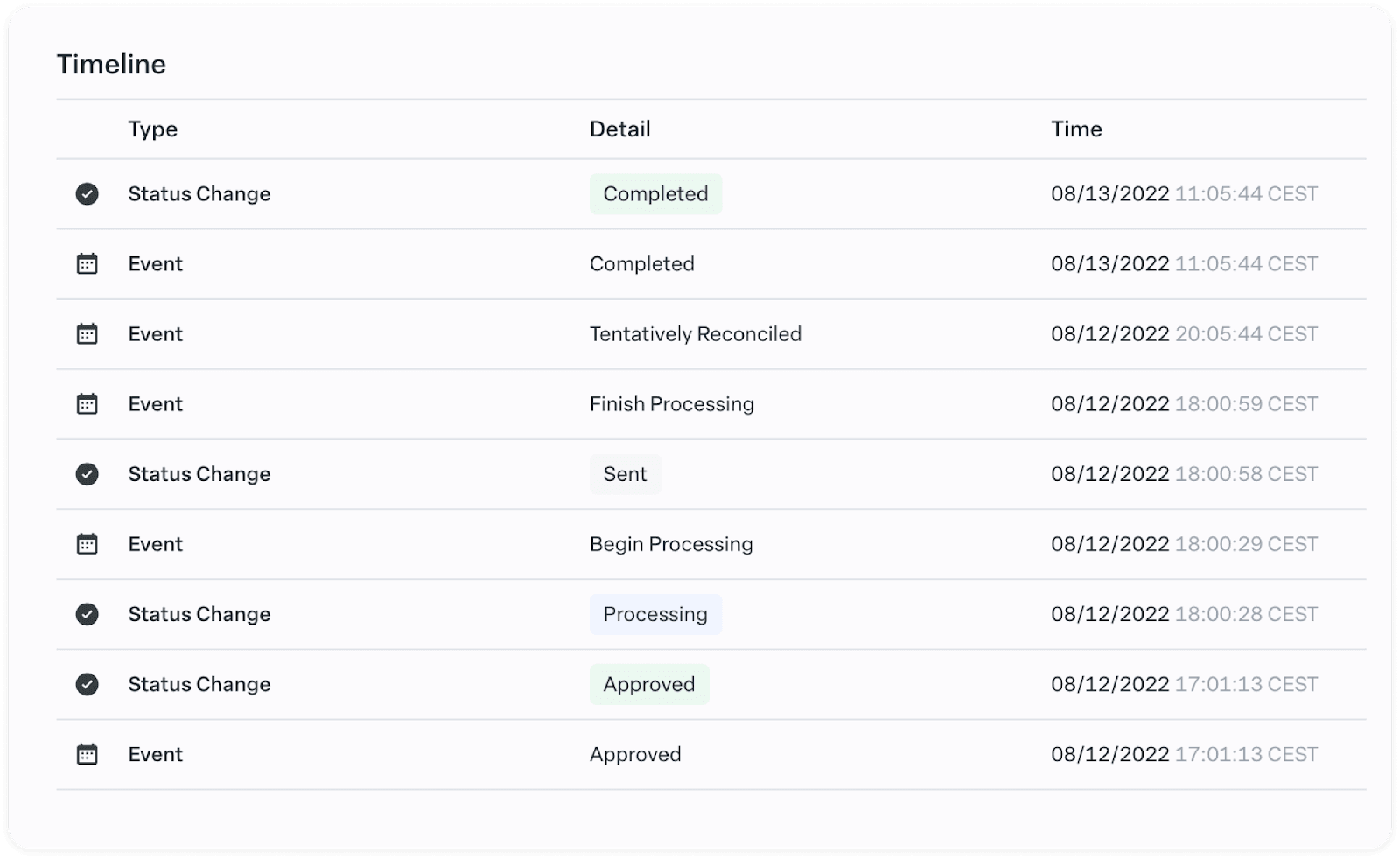

Payment Order Timeline

We updated the way we present Payment Order details by providing a new layout and a timeline. Previously we displayed information based on its type and in various key-value tables, which made it easy to see values but not understand their relationship to each other. With the new view, you can easily see when events or changes occurred and easily access the details in our new Quick View drawer.

Return Rate Charts

Nacha regulations require that you stay below three different threshold return rates. These rates are computed over a rolling two month period. Now, on your web app dashboard, there are two new charts for seeing your Nacha and overall return rates as well as the different contributing return codes. You can click these charts to drill down into your returns and further investigate. To learn more about Nacha return rates, you can click the question mark icon on the charts.

Ledgers Updates

Ledger Account Categories

Ledger account categories allow you to represent hierarchical account structures in your ledger. Ledger account categories can contain multiple ledger accounts or account categories, and can be queried to return a single total balance. You can also query ledger transactions by a ledger_account_category_id.

For example, if you are tracking loans in your ledger, you might represent the principal for each loan as a ledger account. You can create a ledger account category to track the total outstanding principal across all of these accounts.

Compliance Updates

Email notifications

Stay up to date with Compliance email notifications. Users can receive emails when there is a new compliance case to review. Additionally, users can receive notifications for automatically denied compliance decisions.

Pre-fill user onboarding forms

If you know information about a user, you can now pre-fill the user onboarding form. Streamlining the onboarding process is a better user experience and helps to improve completion rates.

User onboarding via API

You can now onboard users via API, giving you complete control over the user onboarding UI while using our robust KYC checks.

Decision feedback

Provide feedback about false alarms or missed fraud. This data will be used to improve the machine learning engine that powers the product. In the future, we will show you statistics about system performance, enable remediation for false alarms, and automate reporting of missed fraud.

Improved experience around displaying rules

Rule names are now displayed in the UI instead of rule IDs, so you can better understand what rules were triggered.

User onboarding updates

There is a new update endpoint, which enables you to update metadata for user onboardings.

Additionally, user onboardings now expire after 24 hours. This helps ensure that a user onboarding is only associated with one individual and cannot be reused.

There is also a new "processing" state for user onboardings. This helps you be aware of when user onboardings have been submitted but KYC checks have not been completed.

Next Steps

If you have any questions or feedback about any of these updates, or if you’re interested in trying one of Modern Treasury’s payment operations products, get in touch.