Modern Treasury has acquired Beam.Build for what's next →

Unlock New Revenue

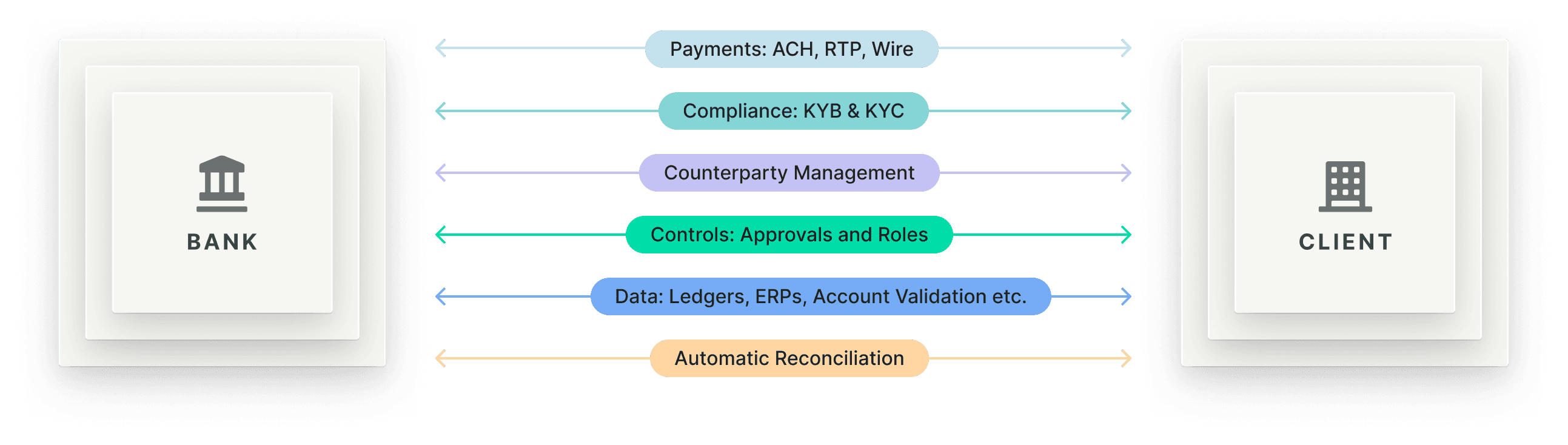

Modern Treasury enables your clients to go live with your payments and treasury products quickly, generating faster growth for your bank with a next generation technology stack.

Software-integrated payments are the future of commercial banking

Your most innovative clients need modern infrastructure and tooling to build, launch, and scale their products with your bank successfully.

Custom Software Workflows

- Payment counterparty onboarding, bank account validation, and KYC/KYB checks.

- Approval rules, audit logs, and roles-based access controls.

- Payment activity and cash balance monitoring across multiple bank accounts.

Programmatic transactions

- Payment counterparty onboarding, bank account validation, and KYC/KYB checks.

- Approval rules, audit logs, and roles-based access controls.

- Payment activity and cash balance monitoring across multiple bank accounts.

Third-party payments

- Tracking and displaying customer balances is critical when moving money on their behalf.

- Provide customers full visibility into transaction statuses for all payments.

- Monitor third-party transactions for fraud, sanctions, and BSA/AML violations.

Supercharge your payments and treasury products with software workflows and integrations from Modern Treasury.

Higher transaction volumes

Simple APIs and developer tools make it easier for your clients to automate fund flows, increasing transaction volumes for your bank.

More product expansion

Deliver new products to your clients with the same Modern Treasury integration, leading to faster adoption.

Faster client implementations

Software workflows, developer sandboxes, and pre-built integrations with your products help clients to integrate and go live rapidly.

Lower client support costs

Our platform improves client visibility into payment statuses, reconciliation, and issue monitoring, lowering support costs for your teams.

Retain all transaction volumes and the client relationship

As a third-party service provider, Modern Treasury doesn’t sit in the flow of funds. All transactions flow directly through your bank and you maintain an independent client relationship. Partnering with Modern Treasury is easy:

Step 1

We build the integration to connect Modern Treasury to your bank’s platform.

Step 2

Align on underwriting parameters to seamlessly onboard shared clients.

Step 3

Establish partnership operating model to support mutual clients as they scale.