Build and Ship Financial Products Faster

Trusted financial infrastructure that scales with you.

Modern Treasury has acquired Beam.Build for what's next →

Trusted financial infrastructure that scales with you.

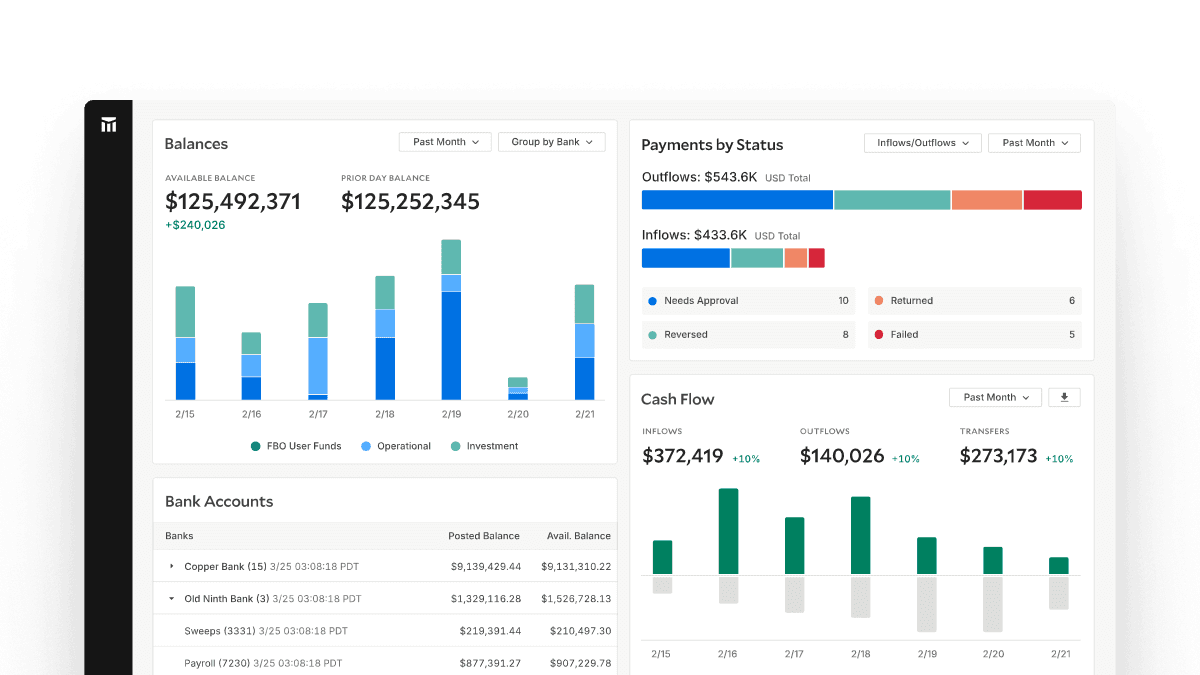

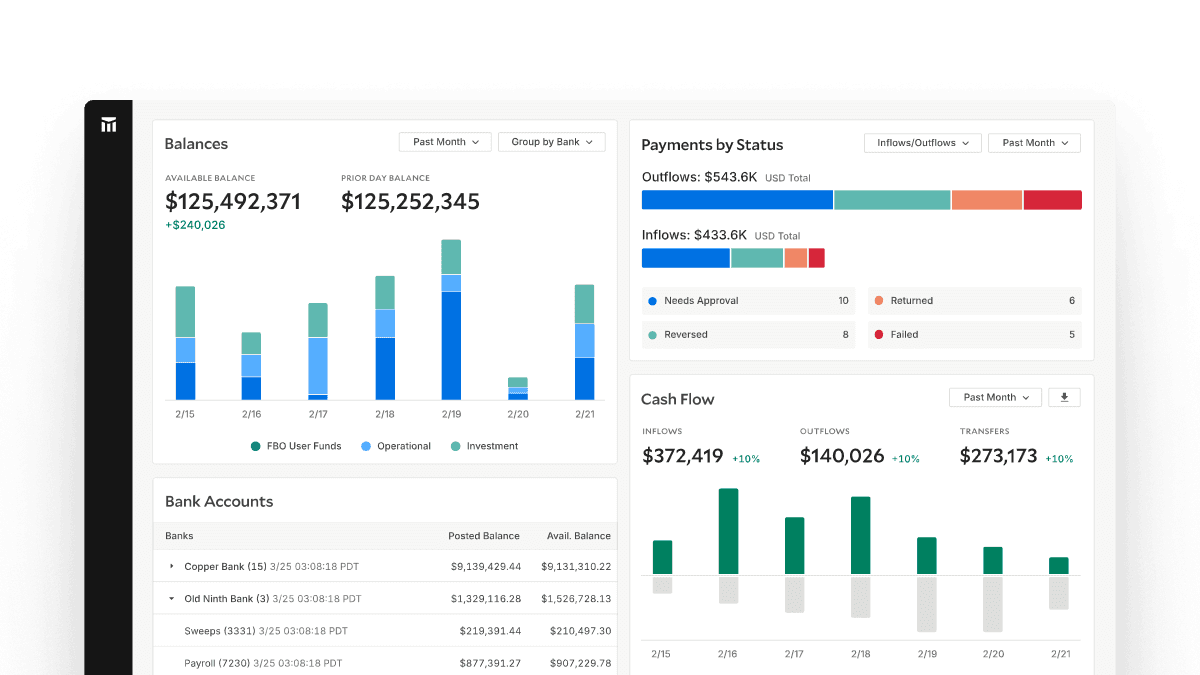

Balance tracking, real-time visibility, and world-class developer tools.

Simplify audits with centralized records, real-time tracking, and complete payment visibility.

Control who moves money and how, with secure approval flows and permission management for payment teams.

Build faster with modern APIs, webhooks, and SDKs that make it easy to integrate payments into your products.

Unify your entire financial stack with faster integrations and flexible connectivity for full visibility.

Tap into a vast network of direct bank integrations to move money faster, track it in real-time, and scale without limits.

Seamlessly exchange data with payment processors, card issuers, and a growing financial ecosystem.

Power smooth, secure information exchange across your ERPs and internal infrastructure.

Connect your financial data to your data warehouse and BI tools for quicker reporting, clearer insights, and better workflows.

“Modern Treasury didn’t exist, so we were building bespoke and rail-by-rail. But there is a better way…Infrastructure is like roads: The difference between gravel and an interstate highway. That’s what infrastructure can be for payments.”