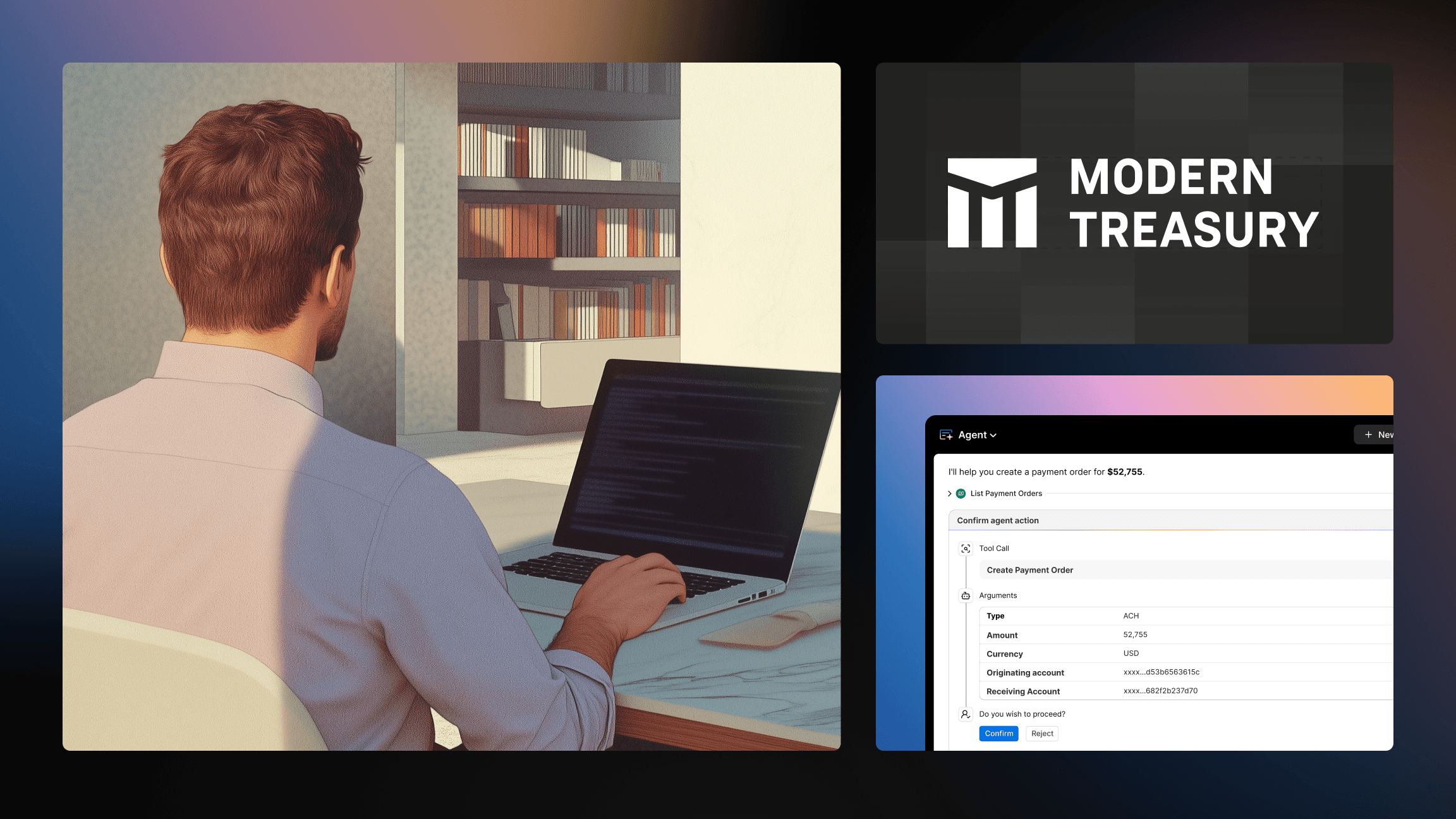

The AI Platform for Payments

Simplify your payment operations with one platform to move, track, and manage money with intelligence and speed.

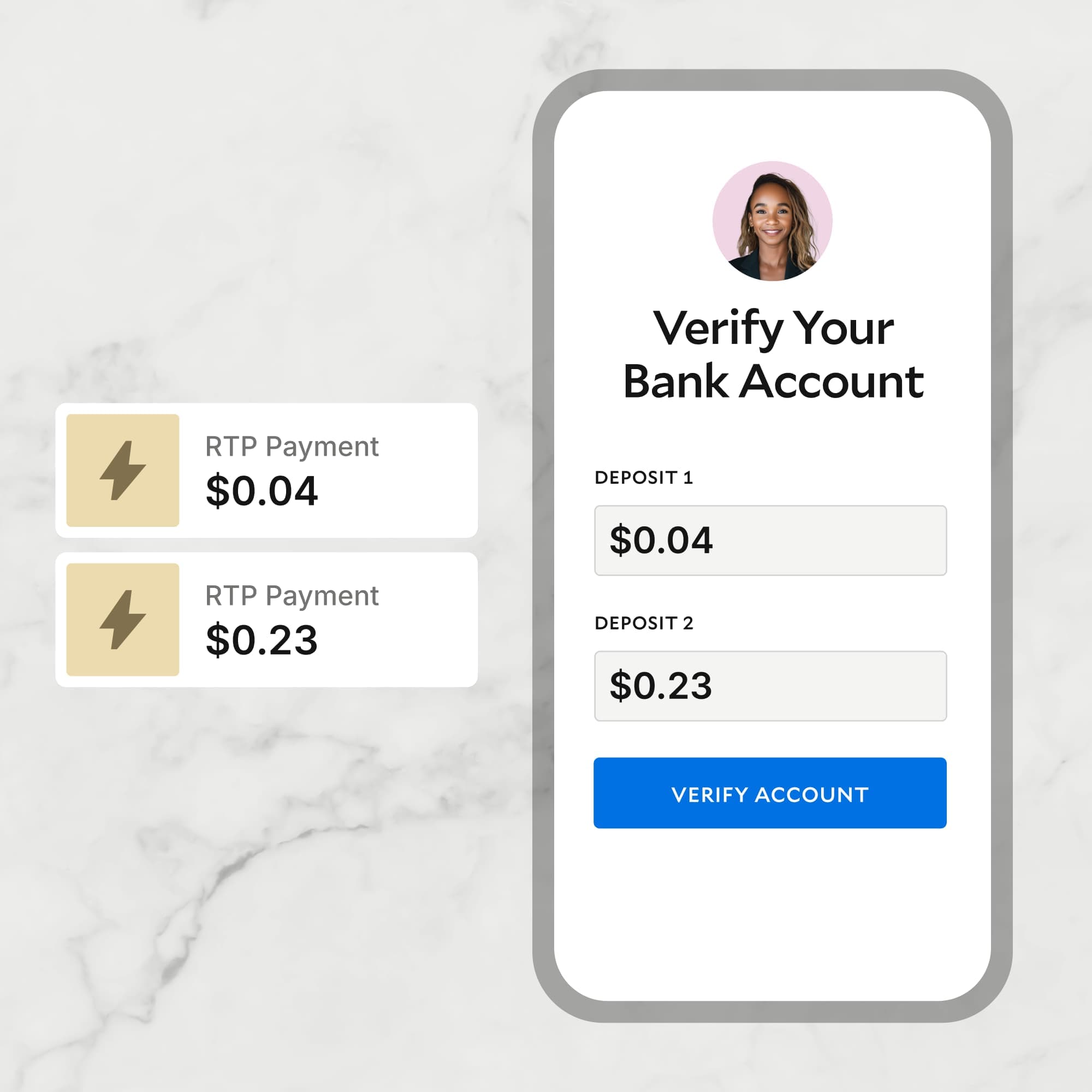

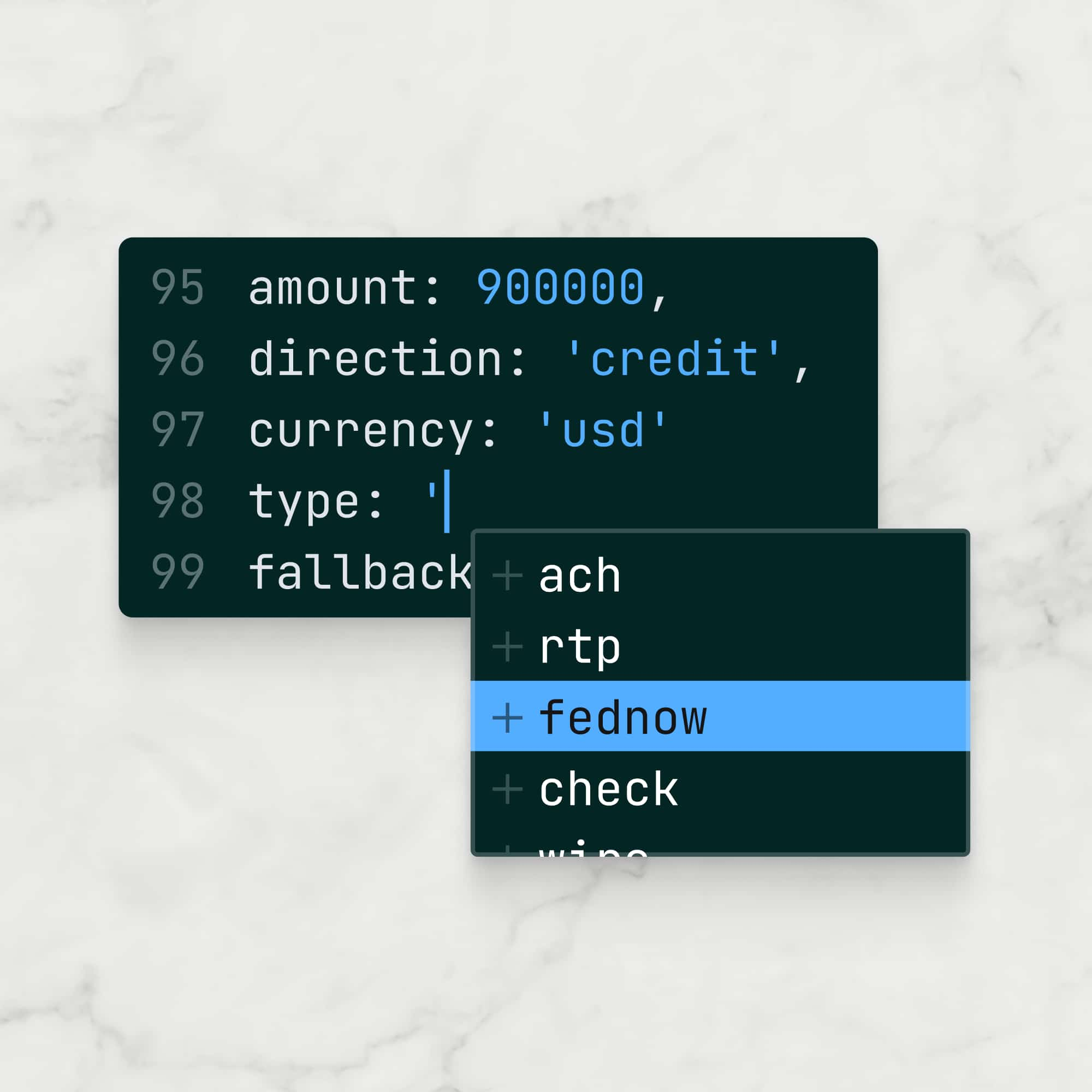

Streamline payment ops with a single API and dashboard that connects to ACH, wire, FedNow, RTP, and stablecoins.

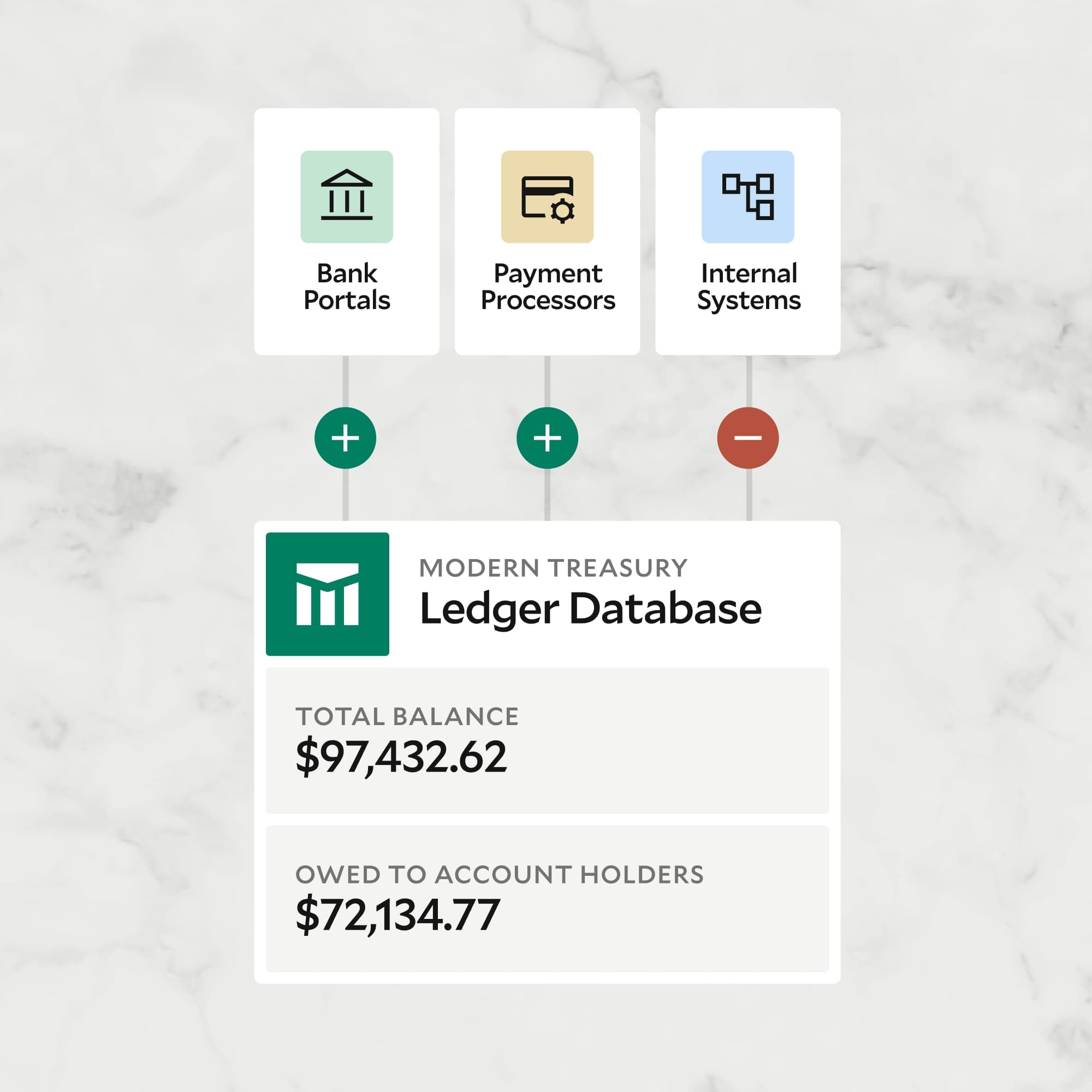

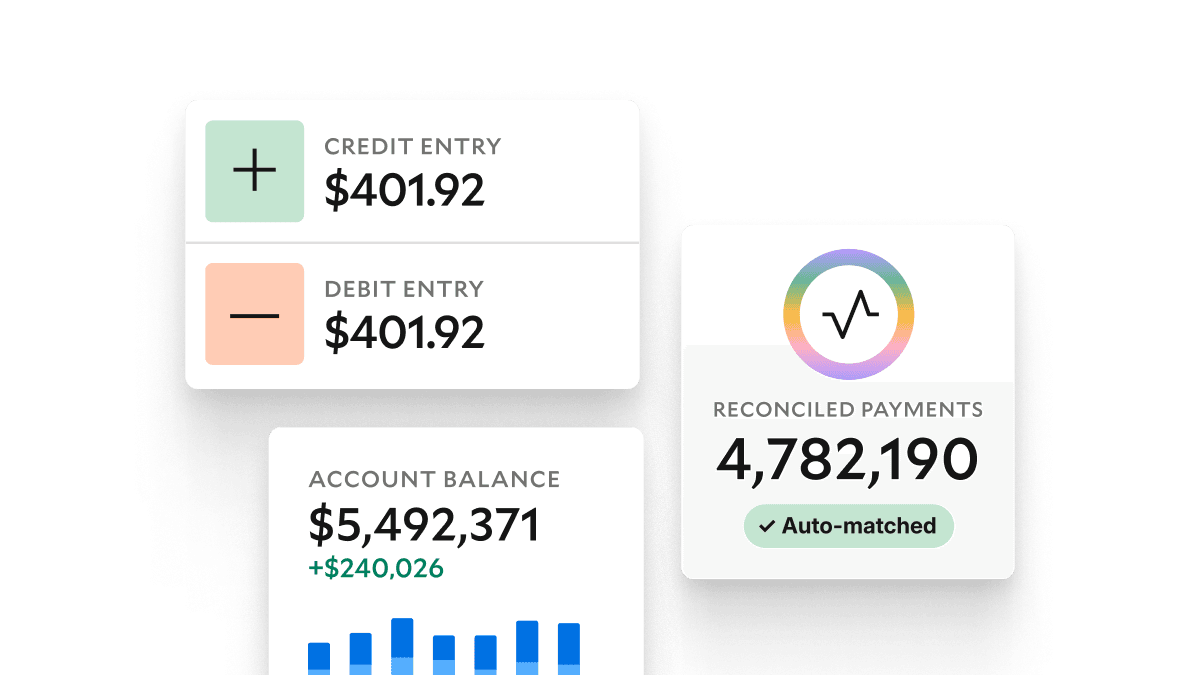

Gain confidence and real-time visibility into each transaction with a flexible and scalable ledger.

Work faster and smarter with an AI Agent and Workspace purpose-built for payments.