Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

Stablecoins Aren’t a Crypto Strategy. They’re a Payments Strategy.

How stablecoins fit into modern payments infrastructure. A practical guide for payments teams on using stablecoins alongside ACH, RTP, FedNow, wires, and cards.

Stablecoins are no longer primarily associated with crypto trading or speculation. They are increasingly being used as core infrastructure in modern payment systems, powering real-world money movement at scale.

Today, there is over $1 trillion in monthly stablecoin payment activity, according to Visa Onchain Analytics, driven by familiar payments flows like payroll runs, vendor payouts, cross-border settlements, and treasury movement.

The speculation phase is over. Stablecoins are being adopted at scale because they function like traditional payment rails, thanks in large part to regulatory clarity.

If you are building payments, this changes how stablecoins should be evaluated. They are not a crypto strategy or a parallel system. They are a payment method that needs to be integrated, operated, and governed with the same discipline as ACH, RTP, FedNow, cards, and wires.

From Crypto Experiment to Production Payments

Early stablecoin conversations focused on viability.

- Could blockchains move value reliably?

- Would pegs hold under stress?

- How would regulation evolve?

Those questions mattered when stablecoins lived on the edges of finance. Today, stablecoins are being used by banks, enterprises, and payment platforms to move real money through real systems.

Stablecoins now function as a globally accessible settlement layer. They move value continuously and operate outside traditional banking hours. Like every other payment rail, they solve a specific set of problems and are designed to complement existing rails, not replace them.

What matters now is execution:

- How stablecoins integrate into existing payment workflows

- How they are reconciled across fiat and on-chain systems

- How they are monitored, controlled, and governed at scale

Where Stablecoins Are Actually Being Used

The clearest signal that stablecoins have grown beyond crypto is how they appear in practice.

Today’s stablecoin volume is increasingly driven by everyday payment activity:

- Cross-border payments, where correspondent banking introduces cost, delay, and uncertainty

- Global payroll, especially for distributed teams operating across multiple currencies

- B2B vendor payments, where predictable settlement and programmability simplify operations

- Treasury movement, including after-hours liquidity transfers and internal fund allocation

- Tokenization of cash and short-duration assets, where stablecoins act as a programmable layer to connect payments, treasury, and capital markets workflows

Stablecoins are also powering a growing category of dollars-as-a-service. Neobanks and fintech platforms use them to offer USD-denominated balances, savings products, and yield opportunities, even in regions where traditional banking access is limited or fragmented. For users in emerging markets where currency devaluation is rampant, these products serve as a bridge to escape hyperinflation.

These are not edge cases. These are core financial workflows where stablecoins are being used to deliver speed, availability, and global reach, often in situations where traditional rails are constrained by geography, banking hours, or operational complexity.

Most Stablecoin Challenges Are Payments Challenges

On-chain, stablecoins generally do what they promise. Settlement is fast. Transfers are final. Availability is constant.

The friction shows up when stablecoins meet the rest of the financial stack.

Most platforms still rely on traditional fiat rails to move money into and out of stablecoins. Those rails were not designed for real-time settlement or continuous liquidity. When paired with always-on stablecoin rails, this mismatch creates operational complexity that feels familiar to anyone who has scaled payments before.

Teams end up managing prefunding requirements, intraday exposure, manual reconciliation, and operational workarounds across systems that were never designed to work together. These issues are often blamed on stablecoins themselves. In reality, they are symptoms of a payments infrastructure built for a single rail and stretched beyond its limits.

If you have built payments before, this pattern is familiar. Every rail introduces constraints. The job of a payments platform is to manage those constraints consistently, without leaking complexity to end users.

How to Think About Stablecoins If You Build Payments

Once stablecoins are treated as a first-class rail, the strategy conversation becomes clearer. The focus shifts to identifying where stablecoins add leverage and integrating them cleanly into an existing payments stack.

That requires the same fundamentals expected of any serious payments platform:

- Intelligent routing based on speed, cost, and availability

- A unified ledger that reflects reality across all rails

- Consistent exception handling and reconciliation

- Compliance and reporting that scale as new payment methods are added

The teams seeing real value are embedding stablecoins behind clean abstractions. Stablecoins become one option the system can choose, not a special case the product has to manage. End users never need to know which rail moved their money; they only need to know it arrived when and how they expected.

Stablecoins Inside a Unified Payments Platform

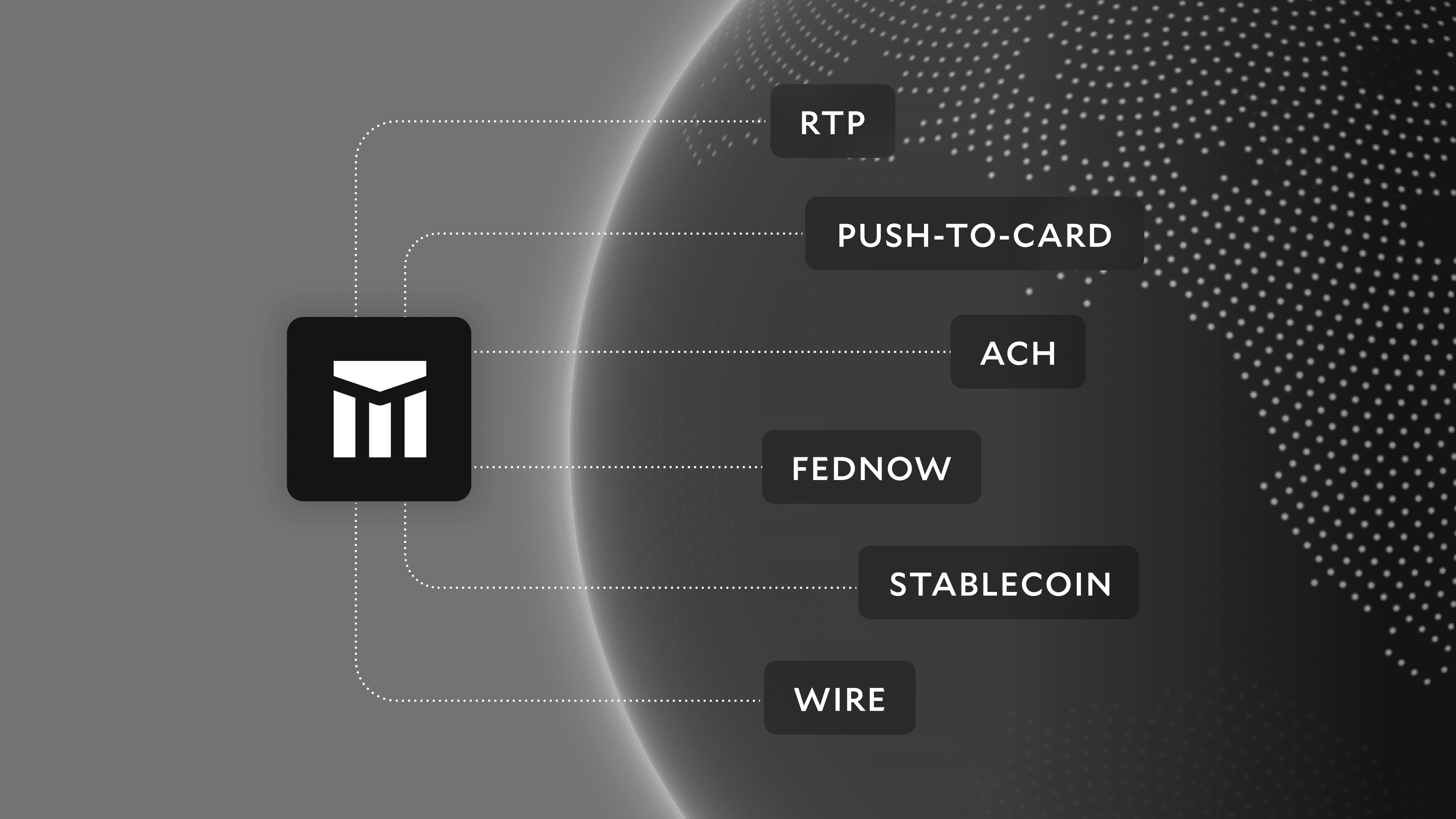

At Modern Treasury, we approach stablecoins the same way we approach every other payment rail: as infrastructure that must be orchestrated, monitored, and operated reliably at scale.

Modern Treasury Payments enables money movement across ACH, RTP, FedNow, wires, cards, and stablecoins through a single platform powered by a unified orchestration layer, ledger, and integrated compliance. This allows teams to use stablecoins when they add leverage and rely on fiat rails when required, without stitching together disconnected systems or rebuilding their architecture as new rails emerge.

As the payments landscape continues to evolve, Modern Treasury’s forever payments platform is built so teams can keep up with both traditional and digital rails without repeatedly rebuilding their architecture.

Daniel Mottice is Head of Stablecoins at Modern Treasury. Previously, he led teams at Visa Crypto and Visa Direct Payouts, where he helped build infrastructure for instant disbursements and digital asset payments.