Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Why We Built Payments

When we started Modern Treasury in 2018, we set out to fix an unglamorous problem, one we knew well from personal experience: moving money is difficult.

When we started Modern Treasury in 2018, we set out to fix an unglamorous problem, one we knew well from personal experience: moving money is difficult.

Banks ran (and largely still run) on legacy infrastructure–SFTP, brittle file formats, half-baked APIs, and manual processes that fall apart the moment you leave the happy path. So we built software and a unified API that sits on top of banks to help abstract away complexity. An API and operations layer that lets companies integrate with their banks, track money movement in real time, reconcile automatically, and actually know—at any moment—where their money is and who it belongs to.

That worked. Today, our customers move hundreds of billions of dollars each year with Modern Treasury. They range from YC and Series A startups to large fintech platforms and 130-year-old institutions modernizing for real-time payments. Our model has been simple. We provided the software. Our customers brought their banks.

But the world has evolved.

If you were a startup in 2018, SVB could help you get off the ground quickly. Banking relationships were easier to set up. The friction was real, but manageable. Over the last few years, that increasingly stopped being true. Banking-as-a-Service and new banks tried to fill the gap, but those solutions have been unable to satisfy market demand.

While banks have made efforts to modernize with APIs, the solutions are often cumbersome and costly to implement. At the same time, BaaS providers have grown more complex to integrate and operate. Founders kept buying the wrong thing: full bank accounts, sponsorship structures, compliance overhead—when all they really needed was to move money safely and correctly.

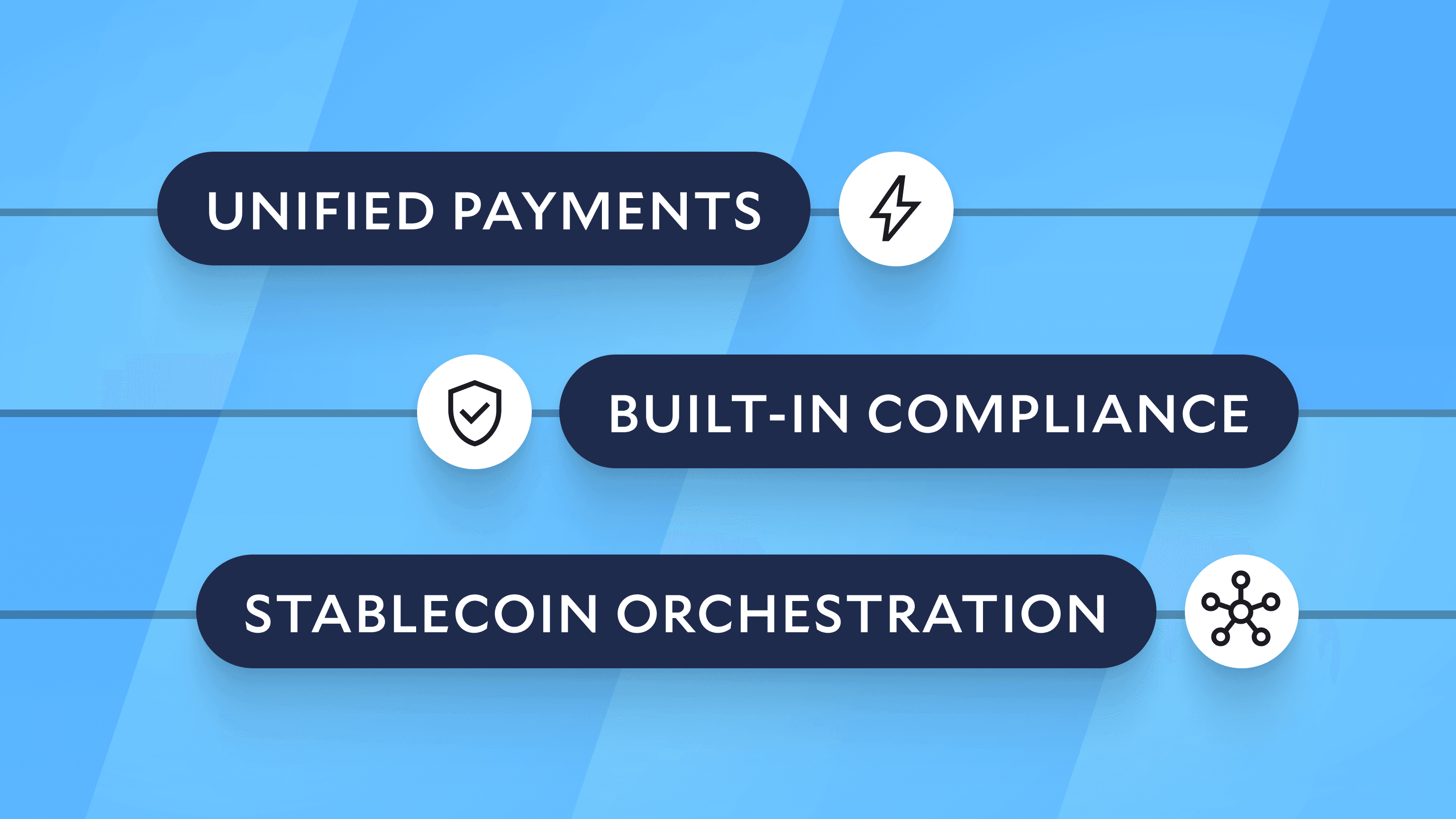

That’s why we built Payments as a full-stack payment service provider (PSP).

The core idea is simple: many companies don’t need a direct bank relationship. They need payment infrastructure—custodial accounts, access to rails like ACH and RTP, and the ability to pull money in, push money out, and distribute funds across multiple parties with full visibility and control. They don’t need full-fledged bank sponsorship. And forcing them into that shape just slows everything down.

So we built a product where Modern Treasury operates the program. We work with bank partners to provide FBO custodial accounts. Each customer gets sub-accounts, and their users can have sub-accounts as well. Every sub-account has its own real-time ledger with a balance and transaction history. We can always tell you exactly how much money is on our platform and who owns it—because that’s the system we’ve been running for years.

This isn’t theoretical. It’s built on the same ledgers, APIs, and processing infrastructure that have processed over $400 billion in payments.

We knew there was pain in the market, but as we’ve worked more closely with customers, I’ve been struck by just how acute it is. The use cases are incredibly diverse: platforms and marketplaces paying multiple parties; vertical SaaS companies embedding payments; investor platforms pooling and distributing funds; legal tech companies building modern payment workflows; and creator platforms managing reliable payouts to thousands of people every month.

With Payments, we are doing what Stripe did for cards, but for the trillions of dollars that flow via non-card rails globally. Banks and BaaS don’t serve these workflows well. And the result is companies struggling to get off the ground and scale with inadequate systems.

Speed matters here, too. Our customers get sandbox access immediately, because developers want to build and test ASAP. Setting up a program to test an idea during the YC batch shouldn’t take 8 weeks. Payments infrastructure should help you move faster, not force you to become an expert in compliance and bank program management before you’ve shipped anything.

One more piece matters: stablecoins. We acquired Beam last year because they built something rare—real on- and off-ramps that actually work. Receiving stablecoins, converting to dollars, and paying out instantly over RTP or card rails. But just as importantly, they understand the gritty details of fiat. Most stablecoin companies don’t.

The U.S. still runs on dollars. Increasingly, the rest of the world will too. ACH, RTP, and FedNow aren’t going away. The future belongs to platforms that are fluent in both fiat and stablecoins and can operate responsibly across them. Today, we’re the only company that brings nearly a decade of fiat expertise, along with on- and off-ramps that work in the embedded payments context.

Payments is built to be interoperable—whether you want Modern Treasury to operate as your PSP or you prefer to bring your own bank or add bank partners as you scale. The same ledgers, APIs, and infrastructure power both models, so you can start with the setup that fits today and expand over time without rebuilding your stack.

We built Payments to be the forever payments product for builders who want to move money the right way. It is faster AND better. This is a product the market has been waiting for.

If this resonates—if you’re building something where money needs to move—we’d love to talk.

Matt is co-founder and CEO of Modern Treasury. Previously, Matt worked at First Round Capital and Ultimate Kronos Group. Matt graduated with a BS in Computer Science from Dartmouth College, where he was captain of the men’s lightweight rowing team. Matt is an avid hiker and is known to celebrate company milestones with SusieCakes deliveries.