The Foundation for Any Financial Product

Track, move, and manage money with confidence—on a database built for transparency, control, and scale.

Stablecoin Payment Accounts are here.Request Early Access →

Track, move, and manage money with confidence—on a database built for transparency, control, and scale.

From digital wallets to card programs to programmatic payouts, the most ambitious products need infrastructure they can trust.

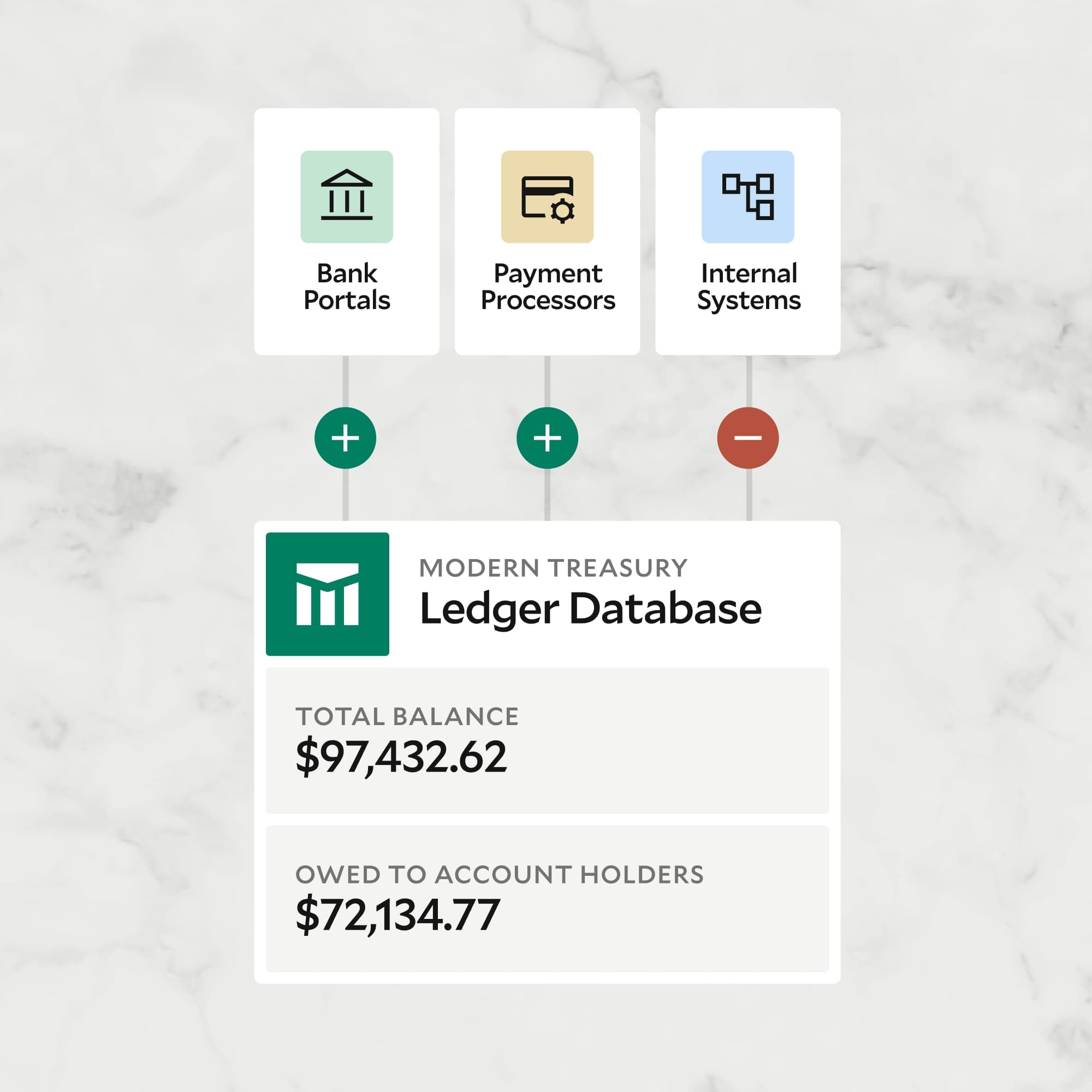

Reduce engineering lift by automating ledgering and payments through an API-first platform.

Track every payment from send to settle with a single, scalable database.

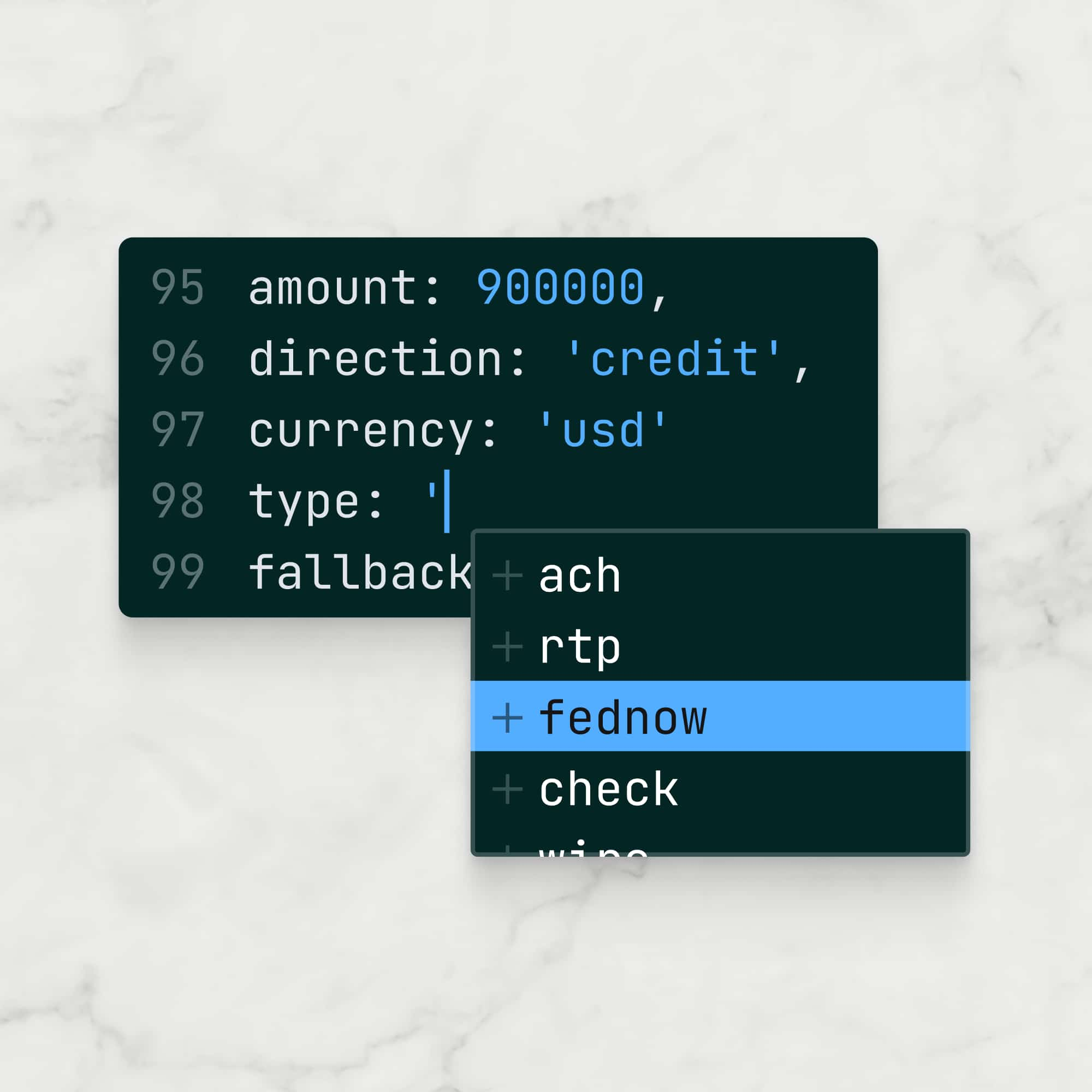

Automate payments across multiple banks and payment rails, including ACH, wire, FedNow, RTP, and stablecoins.

“There’s a lot of money coming in and a lot of money going out. By leveraging Modern Treasury, we have one place where money movement is tracked and our operations team can see the status of all the fund flows they handle.”

Build products faster and with confidence using pre-built bank integrations and an automatic ledger.

Save dev time and accelerate launches by offloading the heavy lifting.

Free up engineering resources by connecting to your banks in days instead of months.

“Modern Treasury had everything we needed. Having a single point of connection to a vendor simplified our development and allowed us to go faster.”

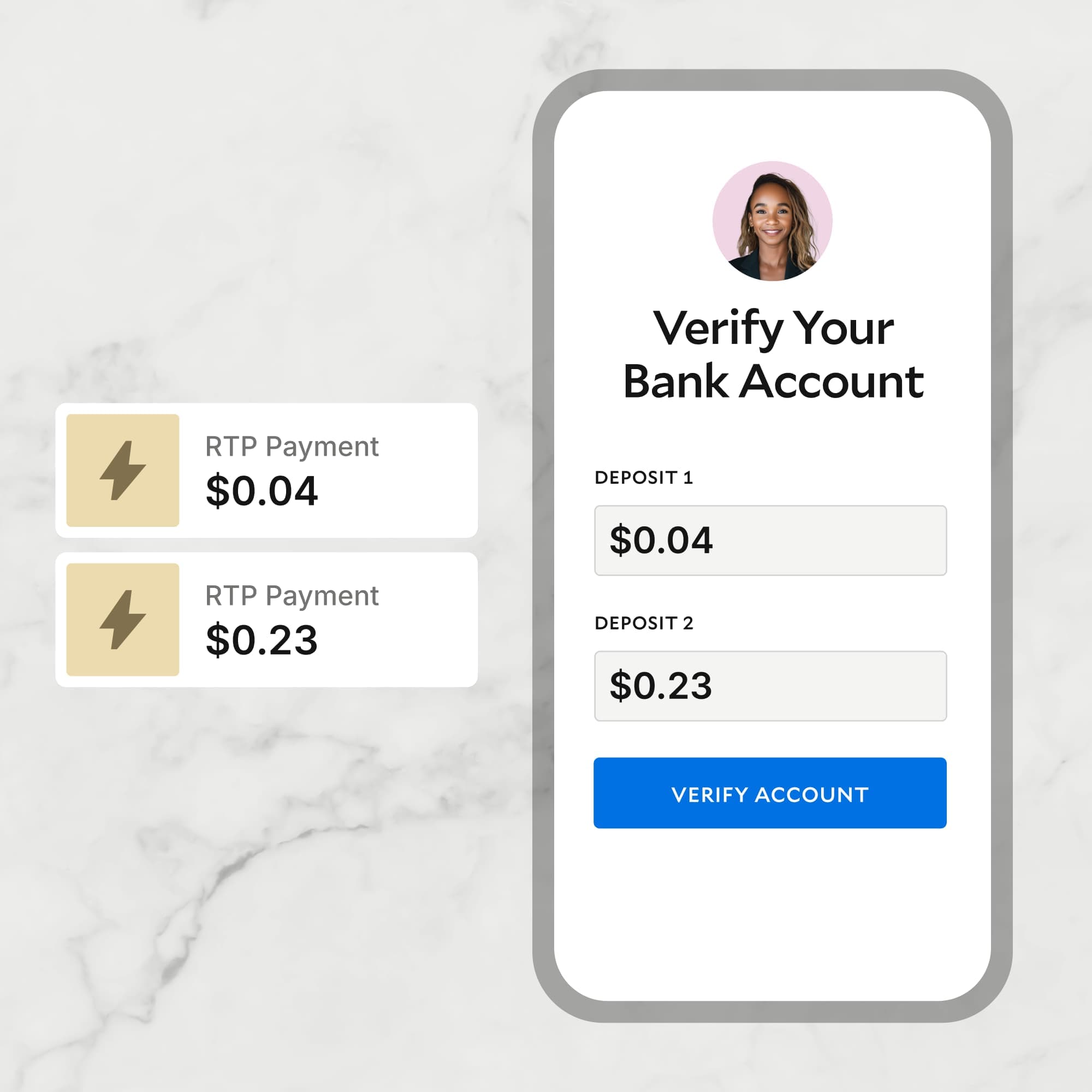

Deliver a seamless customer experience with a payments platform that’s always two steps ahead.

Create a product experience your customers can rely on with real-time transaction and balance tracking across all accounts.

Integrate FedNow and RTP with instant eligibility checks, ACH fallbacks, Request for Payment support, and real-time payment confirmations.

“Partnering with Modern Treasury is an exciting step forward in our journey to modernize our payment operations. By adopting their platform, we aim to streamline processes, enhance security, and deliver a seamless payment experience for our customers, agents, and partners.”