Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

Add ACH Reversals

Today we’re happy to share that we’ve released a new ACH Reversals feature in our Payments product. ACH Reversals lets you reverse an ACH payment you initiated with the click of a button or an API call.

Imagine this: it’s 6:01 pm and ACH processing just wrapped up. And then you realize you sent someone the wrong amount of money. Or you sent it to the wrong person. Or you sent it twice. We’ve been there ourselves, and we’ve helped our customers who ended up in this position.

Luckily, the NACHA rules provide a mechanism for reversing ACH payments. But the process is onerous and usually involves: emailing a counterparty to alert them, calling your corporate bank to get a “Reversal Request” form, filling in said form, then scanning and emailing it back. It’s a headache.

We have observed our customers dealing with ACH reversals for the last few years. At some large companies, we were surprised to learn that they had a full-time person on staff to just handle reversals.

Today we’re happy to share that we’ve released a new ACH Reversals feature in our Payments product. ACH Reversals lets you reverse an ACH payment you initiated with the click of a button or an API call. This feature is currently available at Silicon Valley Bank.

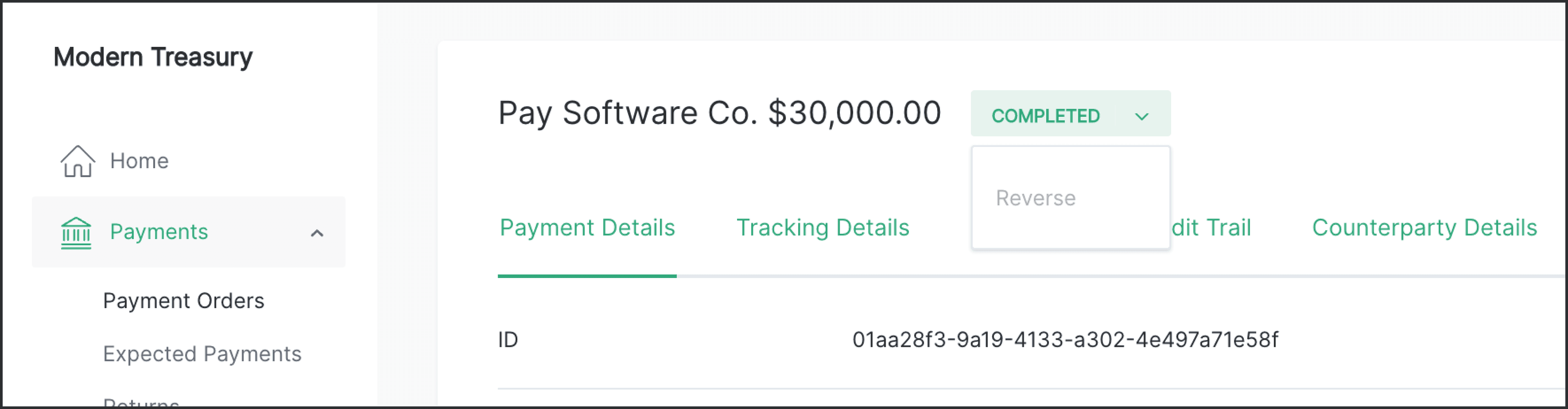

In the dashboard, users will now see an option in the payment order’s status dropdown to reverse the payment:

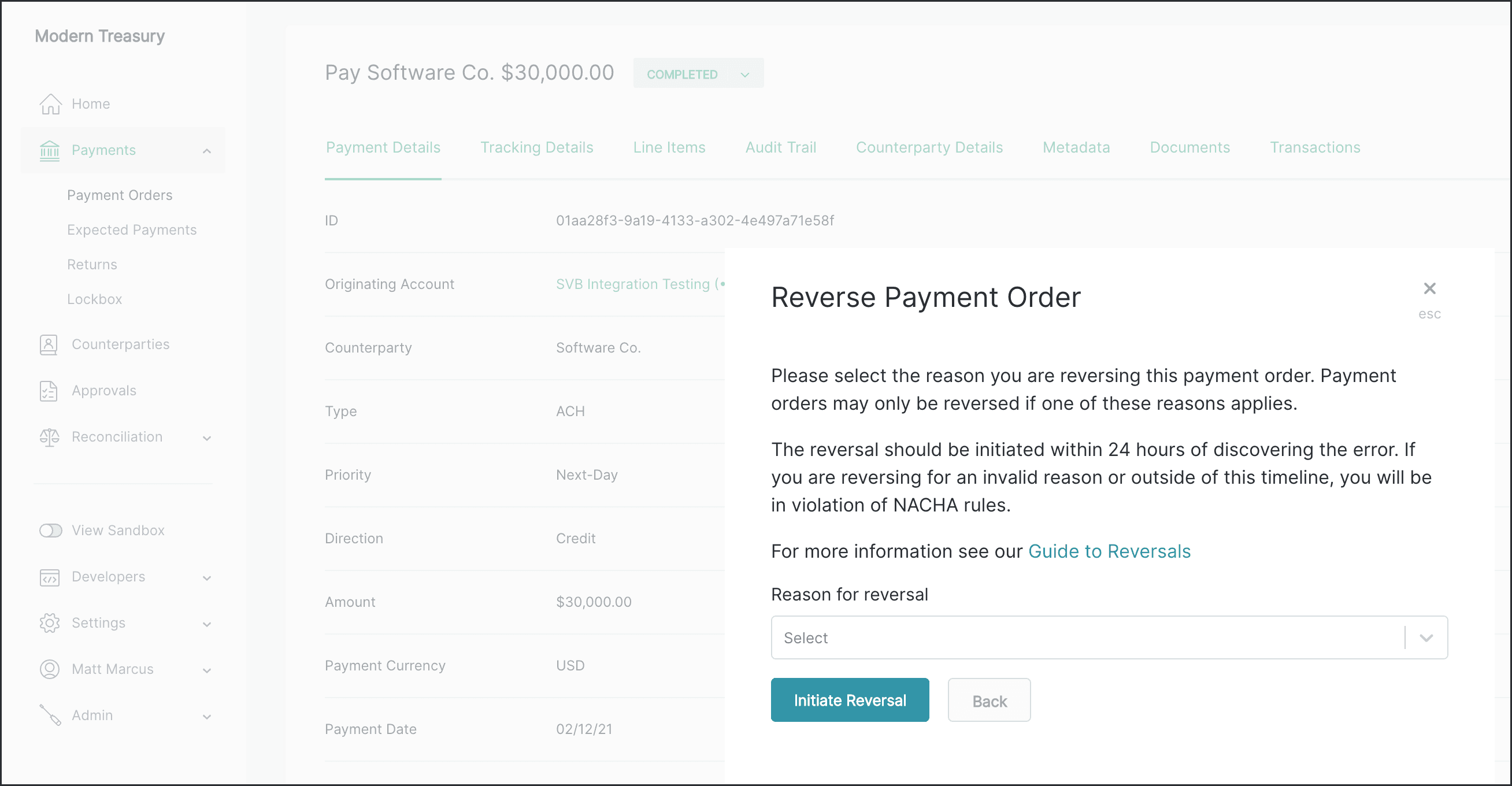

When clicked, a modal appears that outlines the NACHA rules for initiating reversals and asks you for the reason for the reversal.

NACHA has strict rules that dictate if a payment can be reversed. The reversal must be sent to the bank within 24 hours of noticing the error and no later than 5 banking days after settlement. The payment originator must also reach out to the payment recipient to inform them a reversal is in progress. Finally, the reversal must be initiated for one of five reasons:

- Duplicate payment

- Incorrect payment recipient

- Incorrect payment amount

- Payment date earlier than intended (ACH debit only)

- Payment date later than intended (ACH credit only)

Once you have initiated the reversal, Modern Treasury sends a new file to your bank. As soon as the reversal completes, the reversed transaction is reconciled to the original payment order.

If you want to automate your reversal workflows or build them into your own operations tools, you can use our API to initiate reversals. There is a guide that outlines the implementation, but in short the API call looks as follows:

Reversals is a fairly complicated system to build, but now it’s only 3 clicks in our dashboard or a one-line API call. Although we have made it simple, it is important to still comply with the NACHA rules. They recently updated their guidance on reversals, which included new penalties for violations. If you’re unsure about the guidance, please ask your account manager.

To learn more about ACH Reversals and how to leverage Modern Treasury, please sign up or reach out.