Stablecoin Payment Accounts are here.Request Early Access →

Modern Treasury for Modern Exits

Learn how private equity–backed companies can transform payment operations from a back-office burden into a strategic asset. This journal outlines how Modern Treasury’s platform streamlines payments, improves reporting, and helps companies get exit-ready.

How private Equity (PE)-backed companies move money, and how efficiently they manage those flows, can make or break their trajectory. Payment operations are more than back-office mechanics; they’re a strategic lever for scale, accuracy, and financial visibility.

As companies grow, so do expectations. Investors want to steady margins, clean books, and systems built for rapid, profitable expansion. And with IPOs or acquisitions as common endgames, internal systems must stand up to scrutiny.

To prepare for a strong exit, companies need tools that make money movement seamless, reporting effortless, and financial operations smart from day one.

Typical Challenges in Scaling Payment Operations

When it comes to payment operations at PE-backed companies, numerous challenges can limit an organization’s ability to scale and achieve goals. Here’s why:

1. Rapid Growth Under Scrutiny

In today’s challenging deal environment, PE firms expect their portfolio companies to do more with less. Improving payment operations is a fast and high-impact way to support growth and margin goals. According to PwC’s 2025 midyear outlook, achieving the same Internal Rate of Return (IRR) today requires a fund to create two times the amount of enterprise value than in previous years. The narrow IPO or strategic sale routes highlight the need for operational discipline to support any growth strategy in the current climate of longer holding periods and higher interest rates.

2. Complexity From Add-Ons and Consolidation

A “buy-and-build” strategy, where Mergers and Acquisitions (M&A) accelerate growth, is a common approach. Consolidating multiple entities often does not include the consolidation of systems, resulting in fragmentation: multiple ledgers, disjointed payment processes across legal entities, and lack of centralized control.

3. Limited Real-Time Cash Visibility

When ledgers and payment flows are spread across different entities, businesses lose timely insight into cash positions, which undermines agility and decision-making. This is particularly top of mind in times of uncertainty. E&Y found that 74% of PE firms are focused on liquidity and working capital visibility more than usual this year.

4. Prolonged Manual Workflows Post-Merger

Even though a common goal of mergers is to drive efficiency, finance teams often deal with legacy processes long after close. Without automated systems, teams struggle to centralize payments and reporting quickly.

5. Challenges Launching Payment Products

Launching a payments product can be risky without domain expertise. Speed to market is crucial, yet most PE-backed companies aren’t set up for it. Delaying launch timelines and spending unnecessary engineering resources can defeat the purpose for companies that are focused on driving profitability.

6. Compliance and Scaling Reporting Demands

Growing companies must support increasingly complex regulatory and reporting requirements. Systems that work now often buckle under the pressure of audit preparation or exit readiness.

Each of these pain points around fragmented systems, manual reporting, and compliance risk highlights why companies need modern, unified platforms like Modern Treasury.

How Modern Treasury Transforms Payment Operations

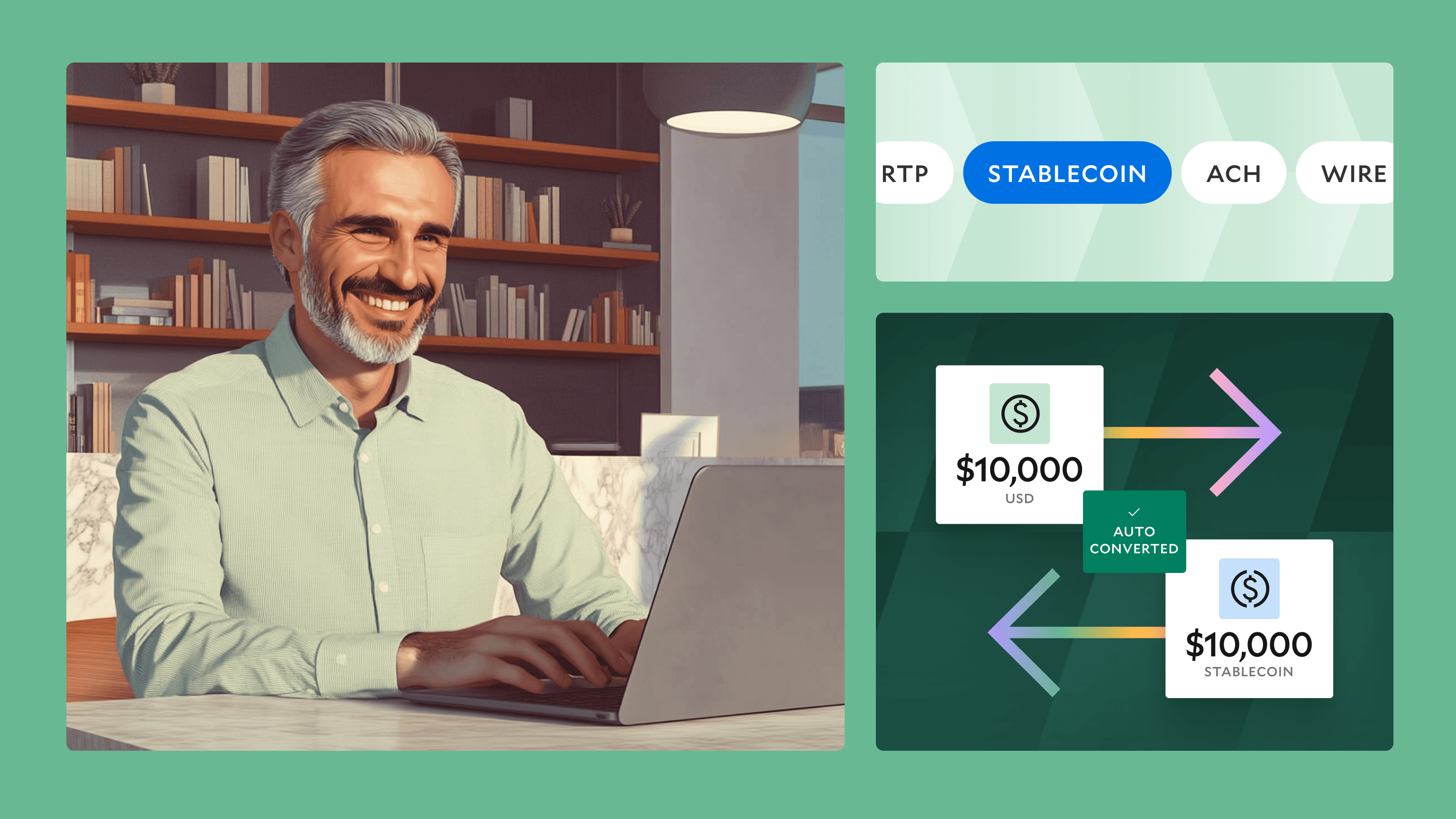

Modern Treasury helps provide a smarter foundation for scaling financial operations. Whether the goal is to launch a new payment offering or improve reporting and reconciliation, our platform helps companies move faster without compromising accuracy. Two areas where the impact is especially clear are payments infrastructure and ledgering.

1. Programmatic Payments: Faster Revenue, Smarter Reporting

Building a payments platform from scratch is complex, especially when integrating multiple banks. For firms launching new payment offerings, time and engineering bandwidth are at a premium. A unified API for managing bank integrations helps companies embed a payments system quickly and avoid wasted developer cycles, expediting time to market for new payment products.

Through direct bank integrations, faster payment rails, and ledgers, Modern Treasury helped Procore launch Procore Pay, an embedded payment experience that accelerates payments for contractors, beating industry payout timelines. By partnering with Modern Treasury, Procore expects to achieve 5x growth as they continue to expand their customer base, innovate new payment offerings, and evolve toward a money transmitter business.

2. Clean, Scalable Ledgers: Visibility You Can Trust

Creating a homegrown ledger that’s accurate, flexible, and audit-friendly often becomes a maintenance headache that slows product and finance teams. Modern Treasury’s off-the-shelf ledger lets finance and engineering launch faster, with transaction-level clarity from day one.

- Transaction-level logs link every payment to reporting and reconciliation.

- Automated reconciliation shifts teams from manual entries to strategic oversight.

- Unified ledger data across banks creates a single source of truth, which is key when preparing for investor diligence or an audit.

Alegeus used Modern Treasury to cut its reconciliation time by nearly 90%, achieve real-time fund visibility, and reduce risks, like fraud and leakage, as they scaled their business.

Laying the Groundwork for a Successful Exit

For PE-backed companies, payment operations are a key part of exit readiness. A scalable, well-structured payment infrastructure makes it easier to demonstrate financial maturity, support clean audits, and meet the rigorous reporting standards required in M&A or IPO scenarios.

The ROI is real. When payments are automated, reconciled, and ledgered in real time, teams reduce manual errors and spend less time untangling exceptions. That translates to better customer experiences, fewer write-offs, and more time spent on growth-oriented work. It also supports a leaner finance team, helping companies grow revenue without scaling headcount at the same pace.

Turning Operations Into Opportunity

Optimizing payment operations may not always be the flashiest initiative. But for growth-focused companies, it’s one of the most impactful. A streamlined, scalable financial backbone enables smarter decision-making, efficient execution, and long-term value creation.

Modern Treasury helps turn payment operations from a behind-the-scenes burden into a forward-facing advantage. For PE-backed companies, that shift is crucial. Clean, automated, and scalable infrastructure doesn’t just support growth: it proves readiness for it.

With Modern Treasury, portfolio companies gain the visibility, control, and automation needed to operate efficiently and meet investor expectations and demonstrate value at exit.

Ready to modernize your payment operations? Reach out to us.