Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

How will the FedNow service work?

The FedNow service works with those financial institutions that adopt it to facilitate faster payments for individual, business, and government use cases. FedNow is characterized by three qualities: instant transaction settlement, 24/7/365 availability, and immediate confirmation of the payment for both sender and recipient.

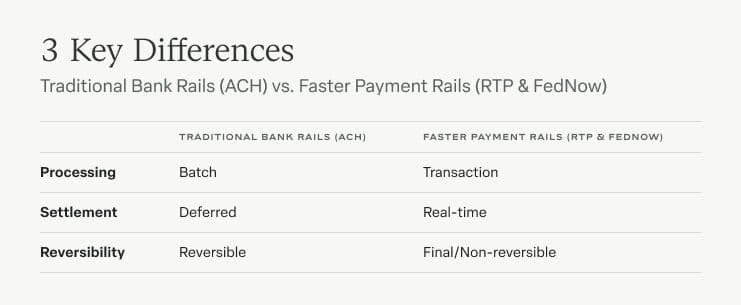

Faster payments like FedNow are distinct from traditional bank payments like ACH in three primary ways, detailed below.

Learn more

FedNow is a new payment rail that enables faster bank payments for financial institutions of any size, in any community, 365 days of the year.

Read more

FedNow will be used by any bank or credit union that chooses to adopt the service. Individuals, businesses, and government entities with accounts at participating banks will have access to FedNow.

Read more

The FedNow charge per transaction for sending money will be $0.045 for each credit transfer, paid by the sender. The charge per transaction to receive money will be $0.01 for each request for payment (RfP) message, paid by requestors.

The primary difference between FedNow and RTP is that they are distinct payment rails managed by separate parties. FedNow (releasing in July 2023) is managed by the Federal Reserve and RTP (originally released in 2017) is overseen by The Clearing House.

The primary difference between FedNow and Fedwire is that FedNow will be available 24/7/365, whereas Fedwire operates weekdays only.

FedNow will not officially replace PayPal or other instant payment services including Venmo, Zelle, or RTP.