Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Will FedNow replace PayPal?

No, FedNow is not expected to replace PayPal. While FedNow enhances interbank transactions, PayPal remains a popular choice for individuals and businesses due to its user-friendly interface and additional features, such as international payments and integration with e-commerce platforms.

FedNow is a system developed by the Federal Reserve to facilitate instant payments between banks, primarily targeting financial institutions. On the other hand, PayPal is a well-established digital payment platform that directly serves consumers and merchants, offering a wide range of services like online payments, money transfers, and buyer protection.

Connie Theien, SVP at the Federal Reserve System, explains the differences between FedNow and other payment rails. Watch the full conversation here.

Learn more

FedNow is a new payment rail that enables faster bank payments for financial institutions of any size, in any community, 365 days of the year.

Read more

FedNow will be used by any bank or credit union that chooses to adopt the service. Individuals, businesses, and government entities with accounts at participating banks will have access to FedNow.

The Fednow charge per transaction for sending money will be $0.045 for each credit transfer, paid by the sender. The charge per transaction to receive money will be $0.01 for each request for payment (RfP) message, paid by requestors.

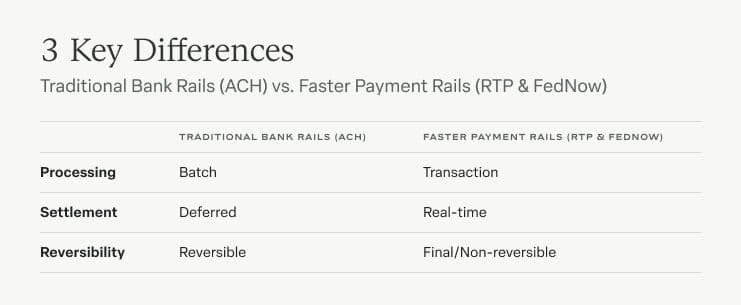

The primary difference between FedNow and RTP is that they are distinct payment rails managed by separate parties. FedNow (releasing in July 2023) is managed by the Federal Reserve and RTP (originally released in 2017) is overseen by The Clearing House.

The primary difference between FedNow and Fedwire is that FedNow will be available 24/7/365, whereas Fedwire operates weekdays only.

Read more

The FedNow service will work with those financial institutions that adopt it to facilitate faster payments for individual, business, and government use cases.