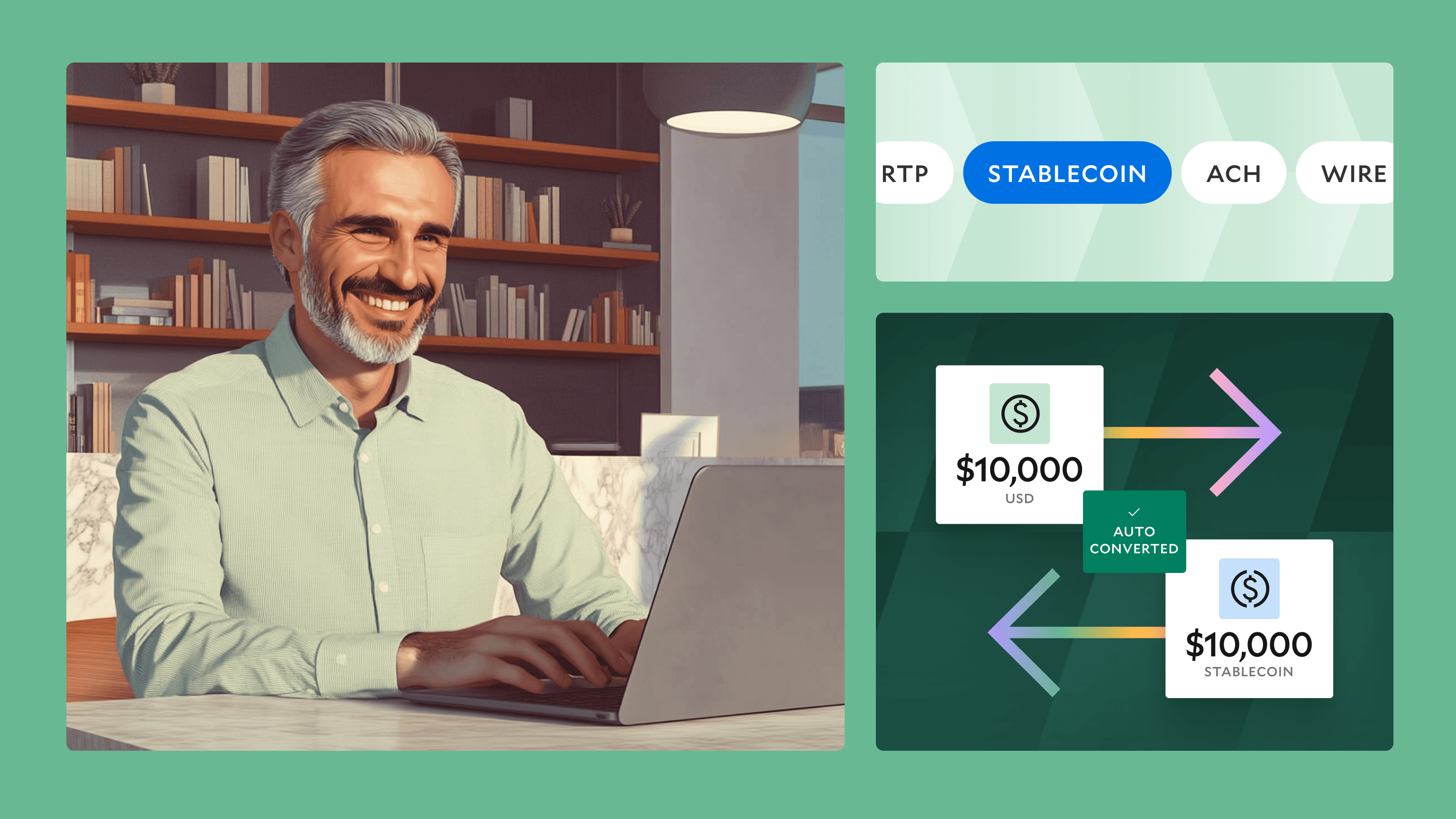

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Add Support for Collecting SSNs and EINs

In order to pay many types of counterparties, businesses need to collect and track Social Security Numbers (SSN) or Employer Identification Numbers (EIN). This is required in cases where you need to file a tax document, such as a 1099, and can also support compliance and control processes inside your company.

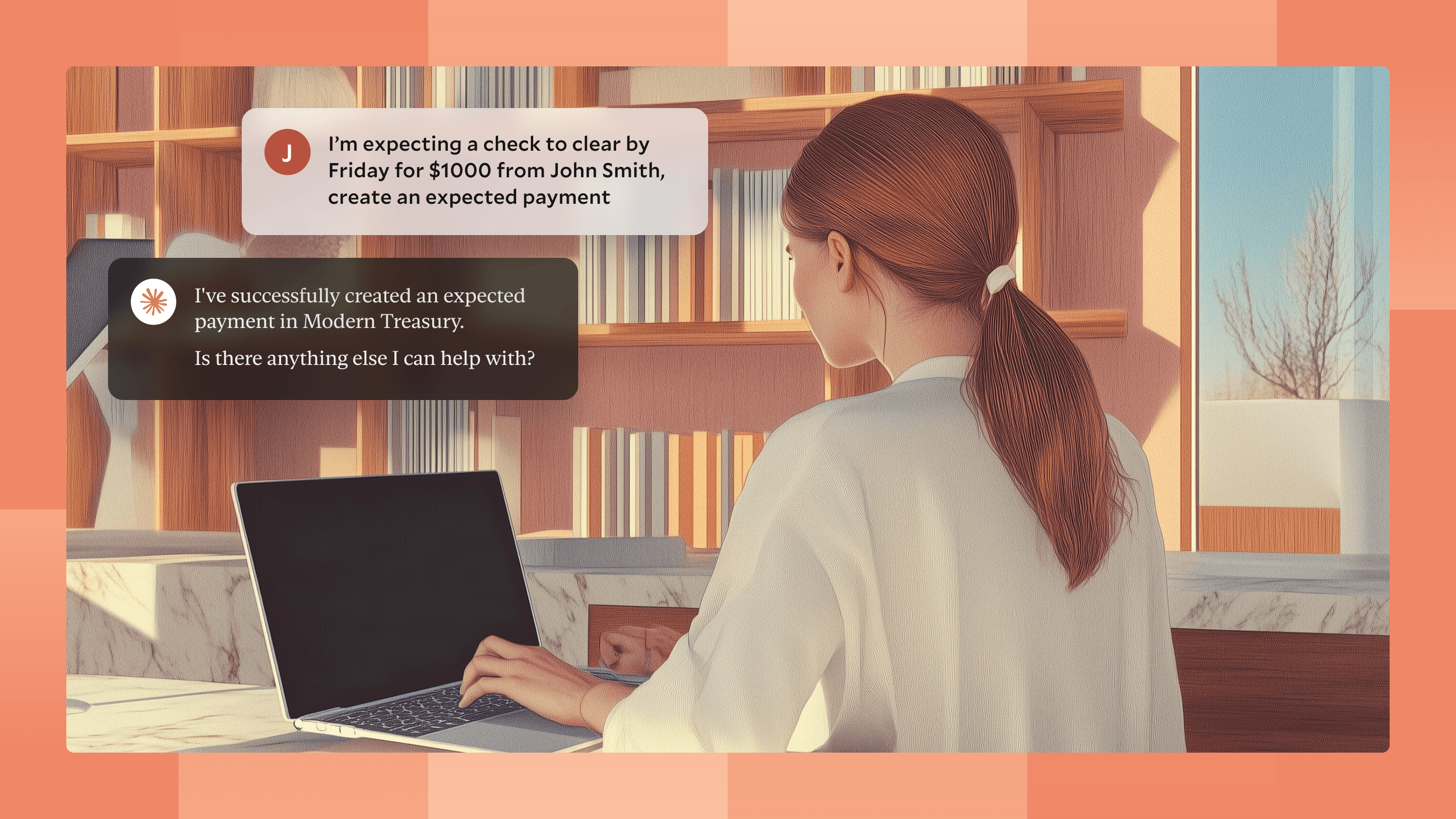

Explore with AI

In order to pay many types of counterparties, businesses need to collect and track Social Security Numbers (SSN) or Employer Identification Numbers (EIN). This is required in cases where you need to file a tax document, such as a 1099, and can also support compliance and control processes inside your company.

Modern Treasury now supports securely collecting and recording SSNs and EINs for counterparties. There are two ways to add a SSN or EIN to a counterparty.

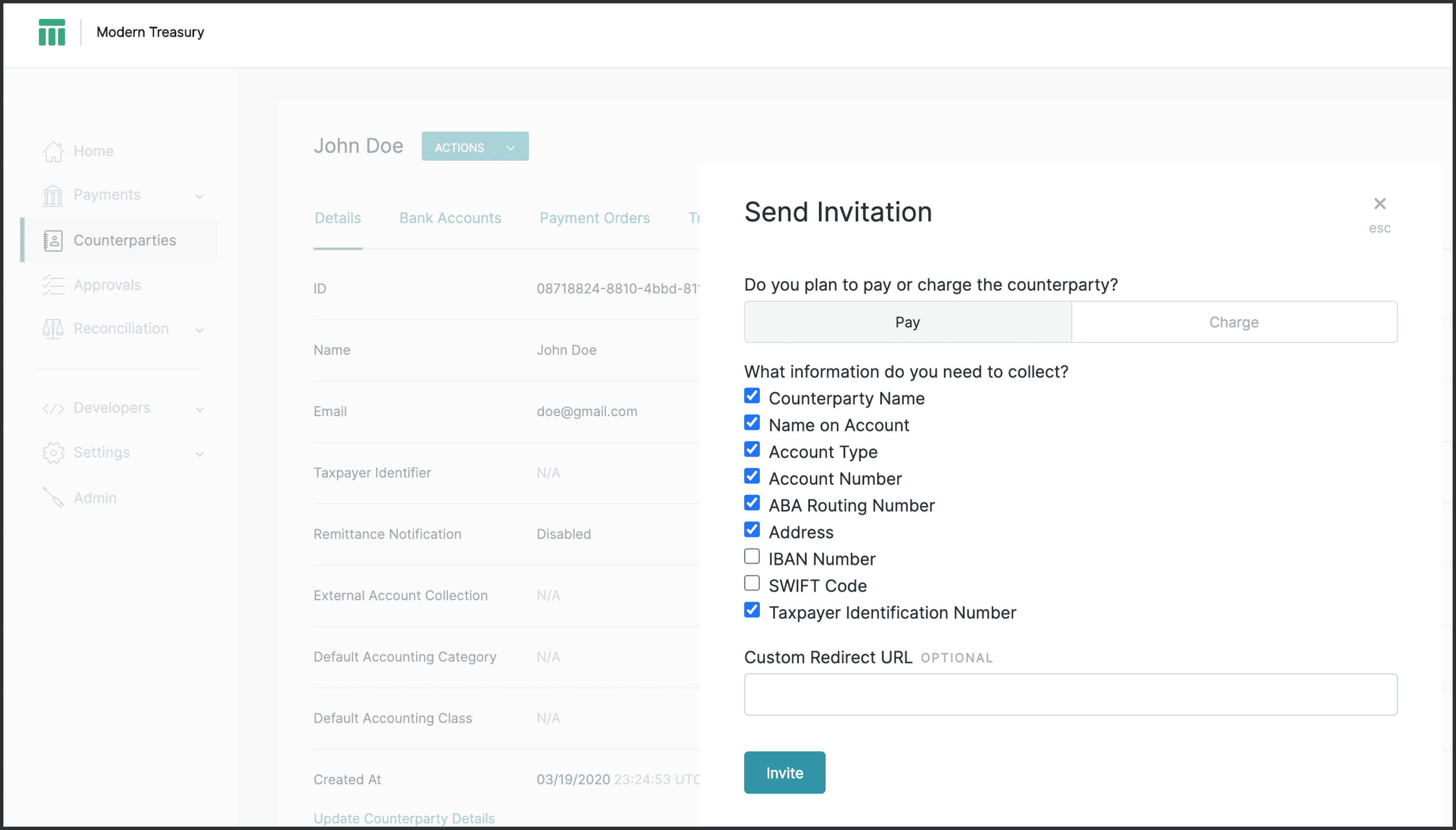

The first option is through our counterparty invitation product. When inviting a counterparty to be paid or charged, you can request they include their taxpayer identifier.

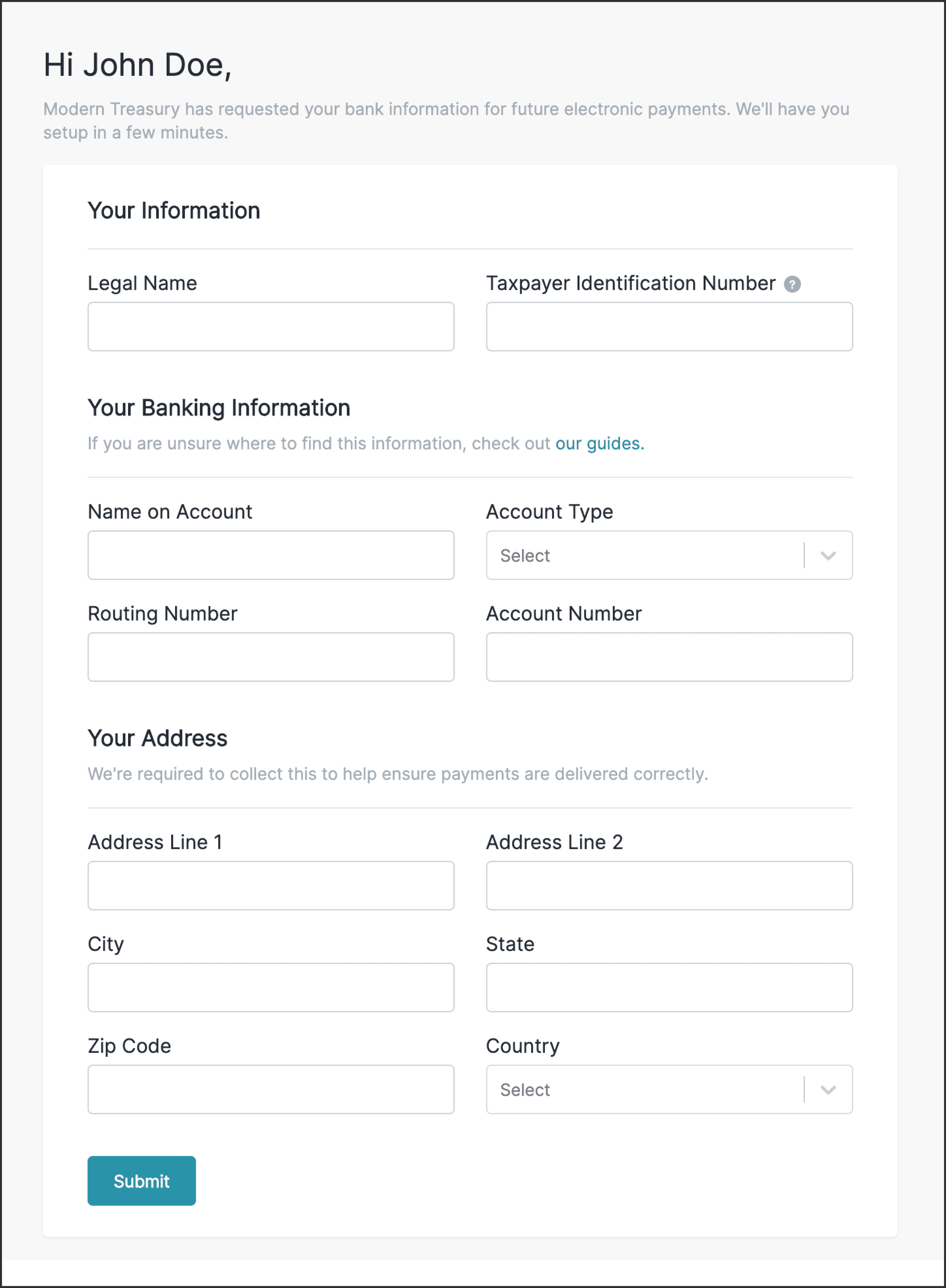

The counterparty would then be able to provide their taxpayer identifier when completing their invitation.

If you collect your counterparty’s SSN or EIN in your own application, the second option is to provide it to Modern Treasury via our API when creating a counterparty.

This feature critical to support our marketplace, real estate, and logistics customers. If you want to learn more about using Modern Treasury to manage payout flows with SSNs and EINs, schedule time with our team today.

Get the latest articles, guides, and insights delivered to your inbox.

Authors

Matt is co-founder and CEO of Modern Treasury. Previously, Matt worked at First Round Capital and Ultimate Kronos Group. Matt graduated with a BS in Computer Science from Dartmouth College, where he was captain of the men’s lightweight rowing team. Matt is an avid hiker and is known to celebrate company milestones with SusieCakes deliveries.