Payment Order Templates: Transforming Manual Payments

Here, we’ll cover how this new feature enables finance teams to transform time-consuming, error-prone processes into streamlined, automated workflows that scale with their business needs.

As noted in our 2025 State of Payment Operations Report, manual payment processes are still creating significant operational friction for many businesses. The inefficiencies of manual processes not only waste valuable time—our research shows that 30% of companies report losing more than eight hours per week dealing with payment operations issues—but also increase the risk for errors and issues with individual payments themselves.

That’s why we’ve designed Modern Treasury's Payment Order Templates to address these challenges head-on, offering a sophisticated solution for organizations looking to standardize and streamline their payments even further. Here, we’ll go over how this new feature enables finance teams to transform time-consuming, error-prone processes into streamlined, automated workflows that scale with their business needs.

Manual Payments Lead to Errors and Payment Delays

Manual payment processes create inefficiencies that compound over the payment lifecycle, contributing to delays, higher costs, and compliance risks.

Initiating payments with fragmented workflows and manual inputs introduces errors. These errors carry over when finance teams review payments to ensure they adhere with specific bank requirements or internal policies. Any data inaccuracies or missing payment details can slow down processing times or lower transaction success rates.

Once they’re finally processed, the combination of disparate tools, processes, and data makes it a struggle for finance teams to maintain a clear record of payment flows. Not only does this impede downstream workflows, including reconciliation, reporting, and audit preparation, but it also imposes a persistent operational burden that only scales with payment volume.

More Control, Less Manual Work with Payment Templates

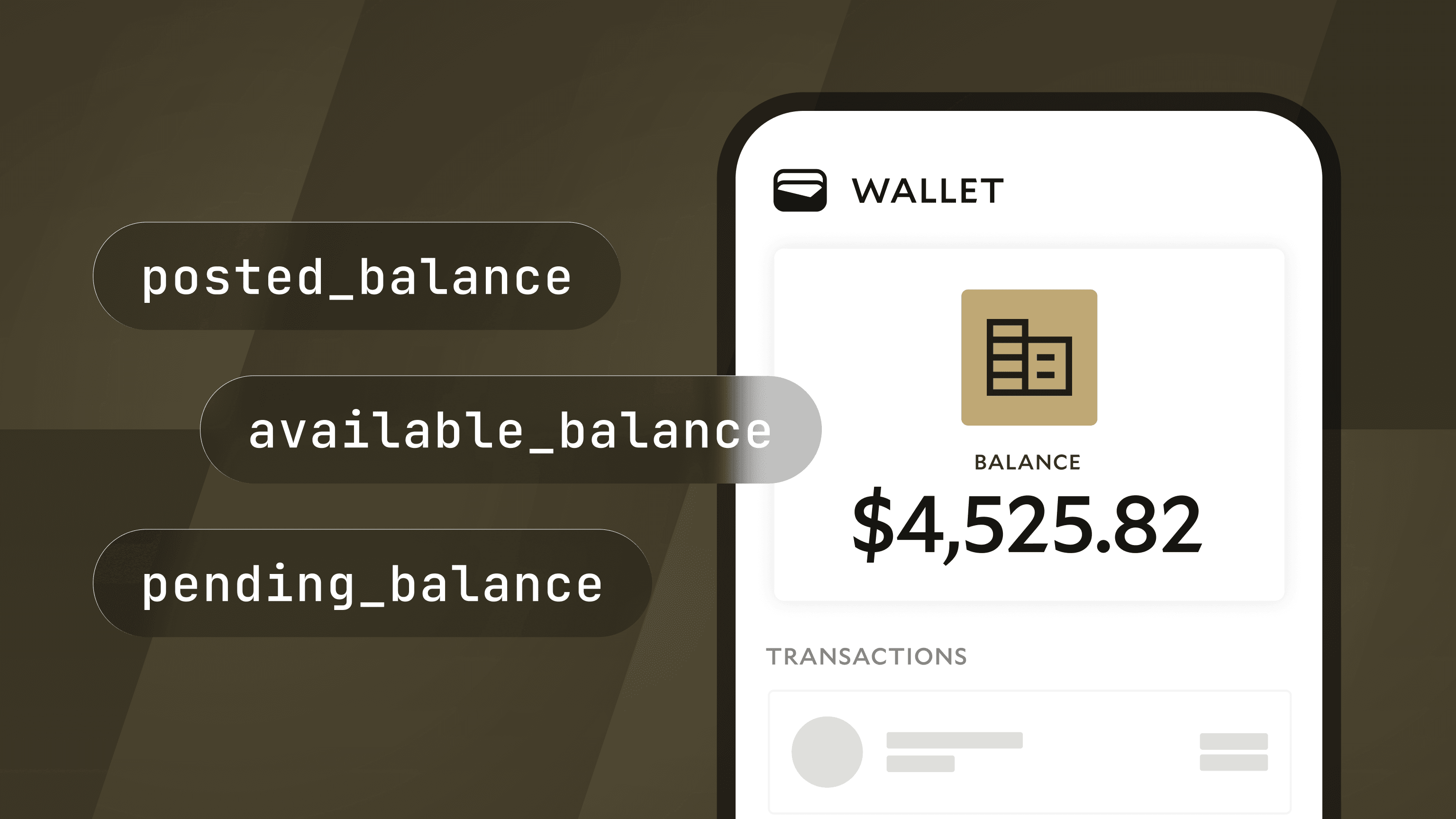

For teams who are weighed down by manual payment processes, Payment Order Templates make it easier to send faster payments at scale. The secret sauce? Data accuracy.

Users can create custom templates and pre-configure fields to ensure payments meet specific requirements, based on the use case, such as payroll or taxes. Not only does this increase efficiencies for operations teams, but it also gives finance leaders greater visibility and control via data accuracy. By allowing users to set required fields and lock critical details to prevent errors, templates support compliance and reporting. And, teams can maintain oversight with role-based permissions, approval chains, and detailed audit trails.

For example, ProducePay, a trade finance platform for the agriculture industry, plans to drive further efficiencies with Modern Treasury’s payment templates. With templates, the team will standardize payment orders to reduce manual, repetitive payments, improve data accuracy, streamline reporting workflows, and accelerate team onboarding. Not only will this save time, but they’ll also help ProducePay send faster payments to their customers at scale.

Jenna Cohen, VP of Treasury at ProducePay confirms, “The most valuable part of Modern Treasury, including features like payment templates, has been the data and the quality of the data that we get out because we're responsible for the review cycle, like checking cash data to loan tape data.”

Read more about how ProducePay works with Modern Treasury here.

Benefits and Strategic Applications of Payment Order Templates

Payment Order Templates support a variety of use cases to help teams gain more control and time back. By standardizing the way users create payment orders, they eliminate errors from manual data entry, support compliance with bank and internal requirements, and minimize payment delays or failures—ultimately, leading to faster payments at scale.

With Modern Treasury, companies can do the following:

- Execute recurring vendor payments with consistency

- Simplify payroll instructions for employee payroll across multiple locations

- Ensure accuracy and timeliness for tax and regulatory payments

- Increase transaction success rates for cross-border payments

Key features include the following:

- Customizable Templates: Users can create and reuse custom templates for specific use cases, reducing setup time and ensuring consistent execution.

- Pre-Configured Fields: Users can standardize payment details, including recipients, amounts, and metadata, supporting accuracy and compliance.

- Set Required or Lock Fields: Users can set required fields and lock critical details to prevent errors, reducing payment delays and increasing transaction success rates.

- Audit Trails: Users can maintain a clear record of template usage for compliance and accountability, giving finance teams greater visibility into payment operations.

As organizations grow, payment complexity increases exponentially. Payment Order Templates are architected to scale seamlessly with your operations, supporting diverse payment workflows across departments and geographical regions while maintaining an intuitive interface. This allows teams to effectively manage payment operations, transforming payment processing from a potential bottleneck into a strategic advantage that enables organizations to scale their financial operations with confidence and precision.

If you’re interested in learning more about Payment Order Templates and how they could work for your business, get in touch.