Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Building A Generational Payments Infrastructure Company

A look at how Modern Treasury and Beam are unifying software, bank connectivity, and full-stack payment accounts to build the next generation of payments infrastructure.

Explore with AI

A little over thirty days ago, I joined Modern Treasury through the acquisition of Beam.

As Beam’s integration into MT nears completion, I am more confident than ever that we are building a generational payments infrastructure company. The proof will be in the pudding, but for now, I thought it’d be useful to start with more context on why combining teams and platforms made so much sense.

The MT Origin Story

When getting started, most payment infrastructure companies set up a sponsored bank account, through which customer funds flow in and out based on the specific use cases they target. As such, in close partnership with their underlying financial partners, they manage the various risks of sending or receiving payments for third parties and charge fees for these services.

MT took a different approach and built a sophisticated software layer that sits on top of dozens of corporate banks, giving businesses robust API control over their own accounts and money. Anyone who’s ever tried to build a payments platform directly with a sponsor bank knows the challenges Modern Treasury has been solving since 2018. It’s one of those things you don’t appreciate until you’ve lived through the pain.

This model built trust with marquee customers and fueled initial scale with over $400B in payments processed. Today, Modern Treasury is the best solution for companies with existing bank relationships that need a robust API to their bank and a scalable payments platform. They serve large, innovative companies such as Navan, Procore, and RealPage, as well as cutting-edge startups such as Parafin, Gusto, and Anchorage Digital.

The Beam Bet: Accelerating a Full-Stack Platform

The next chapter of MT’s evolution is very logical: to complete the formula and not only offer best-in-class software for orchestrating payments, but also full-stack payment accounts.

This is where Beam came in. Since its inception, Beam has focused on building a full-stack payments platform that taps into both old (ACH, wire) and next-generation (RTP, Fednow, stablecoins) rails.

When we first met the Modern Treasury team, it was immediately obvious that we could go bigger and faster together. They’d built elegant software to make money movement programmable at scale; we’d built the low-level infrastructure to let customers plug into every U.S. payment rail and handle complex stablecoin orchestration via a single API.

Together, we can now serve the most “boring” ACH payment workflows that power the U.S. economy AND the most cutting-edge stablecoin orchestration use cases.

Now, MT can be the “forever” payments platform for businesses of any scale.

What’s Coming in 2026

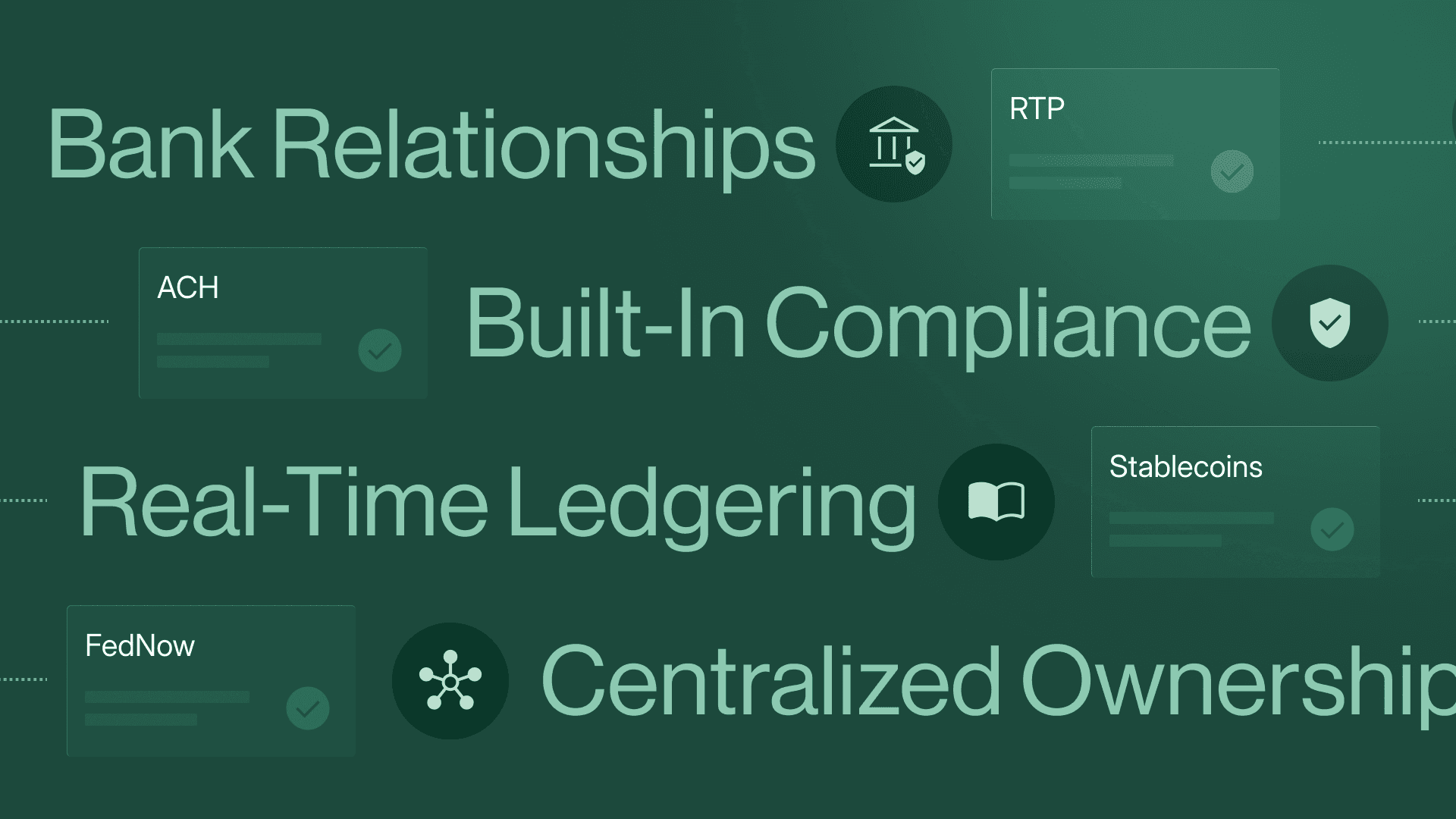

In 2026, MT will offer fully managed payment accounts and program management—meaning companies won't need an existing bank relationship (though they can still have one!). They'll be able to operate payments infrastructure directly through our platform, powered by our partnerships with regulated financial institutions, and with native support for traditional rails, RTP/FedNow, and stablecoins.

With our full-stack payments platform, businesses can:

- Accept pay-ins seamlessly. Collect funds from customers, partners, or counterparties across ACH, wire, card, or stablecoin rails — all through a single API.

- Launch instant payouts. Pay gig workers, creators, or marketplace sellers instantly via RTP, FedNow, Push-to-Card (Visa Direct, Mastercard Send), or stablecoins — with full ledgering, compliance, and exception handling built in.

- Embed stablecoin orchestration. Let users move between stablecoins and U.S. dollars directly within your product for treasury management, cross-border payments, and more.

- Scale with built-in compliance. KYC, KYB, screening, and transaction monitoring are included by default, so teams can focus on product and customer experience.

We are at a generational inflection point in payments infrastructure. Our joint vision is simple but ambitious: to build the most trusted infrastructure for global money movement. The fun has just begun, and I couldn’t be more excited about what’s ahead.

Get the latest articles, guides, and insights delivered to your inbox.

Authors

Daniel Mottice is Head of Stablecoins at Modern Treasury. Previously, he led teams at Visa Crypto and Visa Direct Payouts, where he helped build infrastructure for instant disbursements and digital asset payments.