Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Global ACH Part I: Building Products to Move Money Internationally

Global ACH is the newest option for product managers and developers building products that move money internationally. In this article, you’ll learn why integrating with Global ACH is a superior choice for cross-border payment flows.

Product managers and developers building products that move money understand the complexities of integrating with US banks, and managing ACH and wires. These intricacies only increase when products move funds across borders. For companies looking to make and receive payments abroad, Global ACH presents a novel opportunity to amplify product flows and unlock new revenue.

As a product manager or developer considering international options, you might be building:

- A marketplace like ClassPass, paying out studios in Europe

- A SaaS platform like Settle, facilitating payouts to recipients abroad

- A fintech like Pipe, disbursing money internationally

This guide digs into the options at hand for expanding local payment flows abroad, with a focus on the advantages of Global ACH.

Cross-Border Payments: Understanding Global ACH and Alternatives

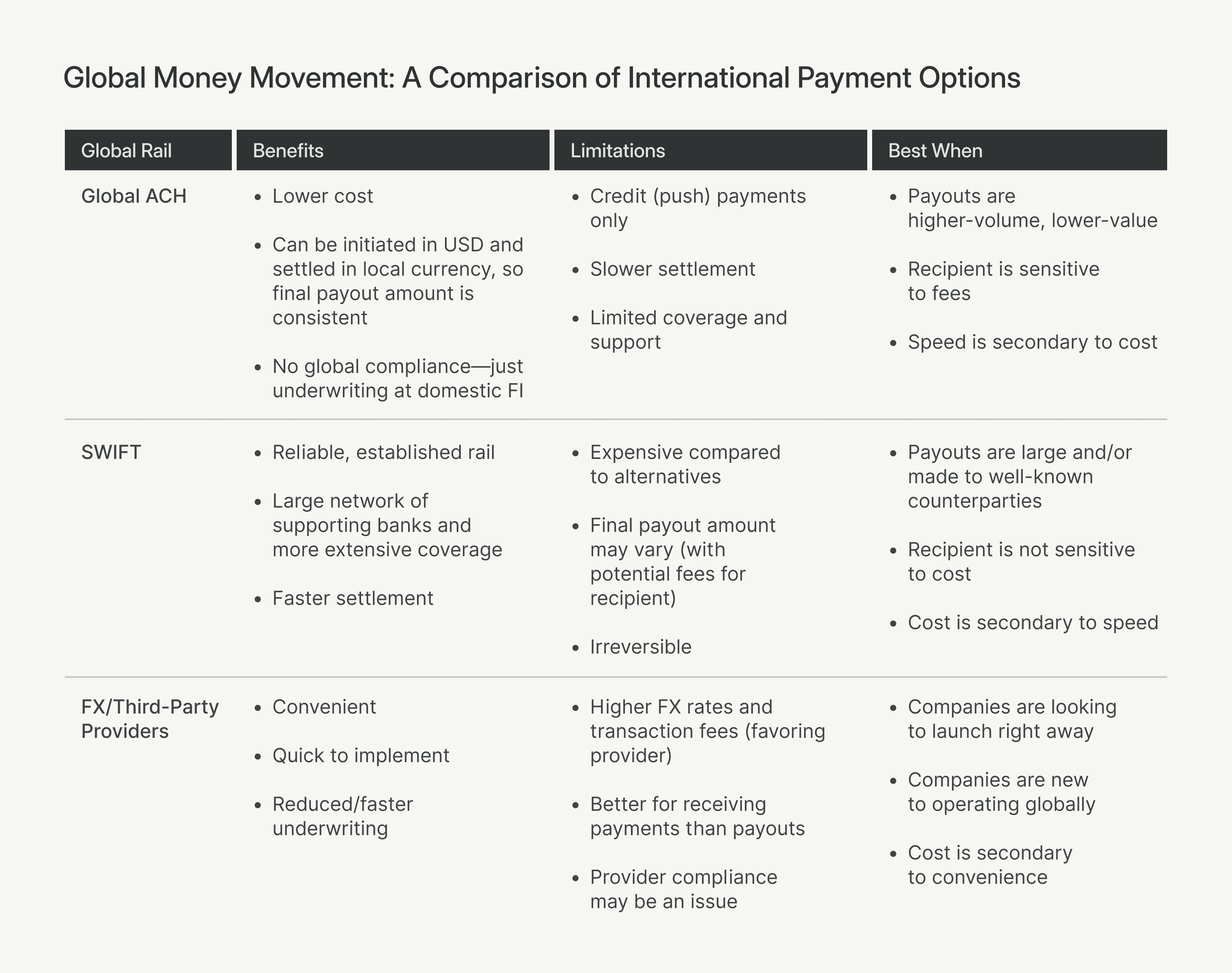

To choose the international payment option that’s best suited to your product and use case, you’ll want to consider pros and cons. Specifically, you’ll be looking to compare attributes like cost, speed, security, and convenience (for your company and payment recipients). As it stands, there are three primary options for moving money across borders:

- Global ACH

- SWIFT

- An FX provider or cross-border payment provider

Below, we’ll consider the benefits and limitations of each. Note: It’s also possible to open local bank accounts in every country where money will be moved—however, because this option is high-lift and challenging to scale, it may not be the best use of resources for product and engineering teams. Even if a company’s bank has a presence in relevant geographies, account creation still requires underwriting, compliance, and attention to local regulations and requirements, at every branch.

Global ACH

Global ACH has emerged as an alternative to SWIFT wires over the past few years. In technical terms, it operates much like ACH in the US, with the exception that payments can be settled in local currency using local bank accounts—Global ACH runs across rails including EFT in Canada, SEPA in Europe, BACS in the UK, and BECS in Australia.

Benefits

- Global ACH is cheaper. On average, Global ACH is five to seven times cheaper than SWIFT, depending on your bank partner.

- Payees know exactly how much they’ll receive. There are no lifting or correspondent fees in Global ACH when payments are initiated in USD and settled in local currency.

- No need to manage global compliance. Once you’ve been underwritten by a domestic bank offering Global ACH, cross-border compliance and security is managed by that bank.

Limitations

- Payments are credit (push) only. Currently, Global ACH can only be used to move money in one direction.

- Global ACH is slower than SWIFT. Settlement times vary, depending on the payment rail, with an average of 2-4 days (vs. 1-2 days for SWIFT).

- Coverage is limited. Whereas SWIFT is widely established, Global ACH isn’t available everywhere.

- There is no support for returns or reversals. As opposed to SWIFT, Global ACH can be reversed. Returns can also be complicated because Global ACH is transmitted using local rails with less accompanying data than a SWIFT payment.

When To Choose Global ACH

- For companies performing a high volume of low-value payouts globally.

- When a recipient may be sensitive to fees. In these cases the reduction or elimination of fees can greatly improve customer satisfaction.

- When low cost is a higher priority than immediacy.

Examples of model use-cases for Global ACH (where recipients appreciate fee reduction) include (1) marketplaces, (2) gig worker and vendor payouts, (3) transportation, shipping, and logistics, (4) fintechs and financial services, specifically remittances and peer-to-peer payment networks.

SWIFT

Formed in 1973, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a network for sending and receiving international wire transfers. This network includes 11,000 member financial institutions and is the most well-established method for sending money internationally. The network does not transfer physical funds—SWIFT provides a standard way to send payment orders using SWIFT codes.

Benefits

- SWIFT is a reliable, well-understood rail. In operation for nearly fifty years, SWIFT is a trusted and established method for moving money cross-border.

- The bank network is large and coverage is extensive. SWIFT is available in 200 countries and territories, with 26 offices around the world.

- Settlement is fast. SWIFT payments settle, on average, in 1-2 days.

Limitations

- SWIFT is more expensive than alternatives. SWIFT wires can cost anywhere between $20 to $50 per transaction, with the possibility of additional fees to the counterparty.

- Final payout amounts can vary (with potential fees for payee). The payment recipient may be charged lifting or correspondent fees for receiving a SWIFT payment, thus reducing the payment amount.

- Payments are irreversible. Although SWIFT offers Stop and Recall for an additional fee, once a SWIFT transaction has settled, it cannot be reversed.

When To Choose SWIFT

- For companies sending large payments globally. SWIFT is also useful for payments to well-known counterparties (which may be recurring).

- When a recipient is not sensitive to fees. For large payments, SWIFT fees may feel relatively insubstantial to recipients.

- When speed is a higher-priority than cost.

FX Providers/Third-Party Service Providers

Product managers and developers looking to move money without going directly through a bank may consider FX providers and third-party service providers. Better-known options include Airwallex, Hyperwallet, Payoneer, Xe, Wise, Remitly, Western Union, and Ofx—PayPal and Stripe also have international options. These providers sit in the flow of funds, assuming risk and also securing the economic benefits from global fund flows (think transfer fees and exchange rates).

Benefits

- FX- and third-party service providers are convenient. These solutions are designed to help companies move money with maximum simplicity.

- These tools and services are quick to implement. Providers can get businesses set up to move funds abroad quickly.

- Underwriting is relatively low-lift and fast. Because these providers assume the bulk of the risk for international money movement, underwriting is much faster than it would be with FIs.

Limitations

- FX rates and transaction fees are higher (favoring the provider). Convenience comes at a cost—businesses will pay more using these providers, since chosen FX rates are more beneficial to providers than end-users, and transaction fees quickly add up.

- Better for receiving payments than payouts. Rates and fees are considerably higher for sending payments than they are for receiving payments.

- Provider compliance may be an issue. The levels of scrutiny under which FIs and networks like SWIFT operate don’t always apply to FX- and third-party providers—this ultimately can put end users at greater risk.

When To Choose an FX Provider or Third-Party Service Provider

- For companies looking to launch right away. These providers can be a good (if temporary) solution for businesses with tight timelines.

- For companies that are new to operating globally. For businesses dipping a toe in global operations, these providers are a convenient starting point.

- In scenarios where convenience is higher-priority than cost.

Global ACH: Building for Scale

For many product managers and developers preparing to build against international payment rails, Global ACH may be the best fit.

Likely the strongest testament is that Global ACH is much less expensive to scale.

Companies with high transaction volumes will save considerably over the long run by selecting Global ACH, which also favors a positive customer experience (i.e. few if any counterparty fees). Predictability around what amounts are actually credited into a counterparty’s bank account is paramount, in order to set in-product expectations accordingly.

Compliance is secured and protected by an established domestic FI. Comparing this level of underwriting to what individual accounts abroad would require makes the convenience clear.

Further, because funds are held and moved via the company's own bank account, Global ACH makes it much easier to tap into float and streamline payment operations.

First, money sits in your bank account as opposed to a third-party balance where it doesn’t earn yield. Also, immediate fund availability means payouts can be sent just in time.

Modern Treasury supports Global ACH through partners including JP Morgan and Silicon Valley Bank, enabling push payments in 50+ currencies using local rails. At a glance, our solution:

- Makes bank integrations easier with a unified API

- Full supports reconciliation on international payments

- Provides instrumentation and developer tools without the per-transaction cost—Modern Treasury doesn’t charge on FX either.

- Gives full visibility into global accounts, history of transactions, and balances across regions

Modern Treasury’s operating system for money movement is designed to support your cross-border expansion with speed, transparency, convenience, and security. And in cases where SWIFT transactions are preferable, these wires can be initiated via Modern Treasury using partner banks and CurrencyCloud. Reach out today to discuss your new global product with a payments advisor.