Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

How Tech Forward Banks Made Nacha’s Top 50 Originators List

Last month, Nacha released their top 50 ACH Originators, which included some surprisingly small financial institutions. In this By The Numbers journal, we dig into how tech forward banks are pursuing new strategies for revenue growth, enabling them to compete with bigger banks.

Explore with AI

In April, Nacha released their top ACH Originators and Receivers by volume. Overall, the top 50 Originating Depository Financial Institutions (ODFIs) processed nearly 25 billion payments last year. The network grew by a significant 8% in 2021.

The growth of the ACH network speaks to the continuing digitalization of financial services. It further confirms things we already know: that activities that used to take place in-person are now happening online. And the pace of our financial lives is only quickening. Today, we invest and trade more; we purchase more; we book more transportation and vacation rentals; we order more food delivery; we send money more between friends and family. A payment rail that 10 years ago was primarily used for payroll and rent, is now used for so much more.

Let’s break down the list.

The Big Banks

The top 10 originators will not surprise anyone. All are among largest financial institutions in the country, including

- Wells Fargo & Company (#1)

- J.P. Morgan Chase & Co (#2)

- Bank of America Corporation (#3)

- Citigroup, Inc (#4)

- PNC Financial Services Corporation (#6)

These FIs all have massive reach. They have entire business units dedicated to transaction processing and broad distribution networks made up of direct relationships with large corporates, and Independent Service Organization (ISO) arrangements that distribute their payment products wholesale. As an example, I pay rent each month through RealPage, Inc., a registered ISO of Wells Fargo.

Specialized FIs

There are a number of interesting speciality financial institutions on the list. Optum Bank, for example (#27), originated just 1.3 million ACH debits and a whopping 77.4 million ACH credits. This starts to make sense when you consider Optum’s business: Optum is one of the largest HSA providers and their money movement flows include sending funds (ACH credit) to a user’s HSA account through payroll contributions.

Goldman Sachs (#22) is another specialized FI. Goldman—previously a wholesale bank only—launched both a retail and commercial banking arm, in 2016 and 2018, respectively. In the past year, Goldman’s ACH origination volume grew 82.4%, a testament to the early success of both programs. In the past year, Goldman initiated over 100 million ACH debits, of which many were likely to help users pay down their Apple Card balances.

The Technology Forward Banks

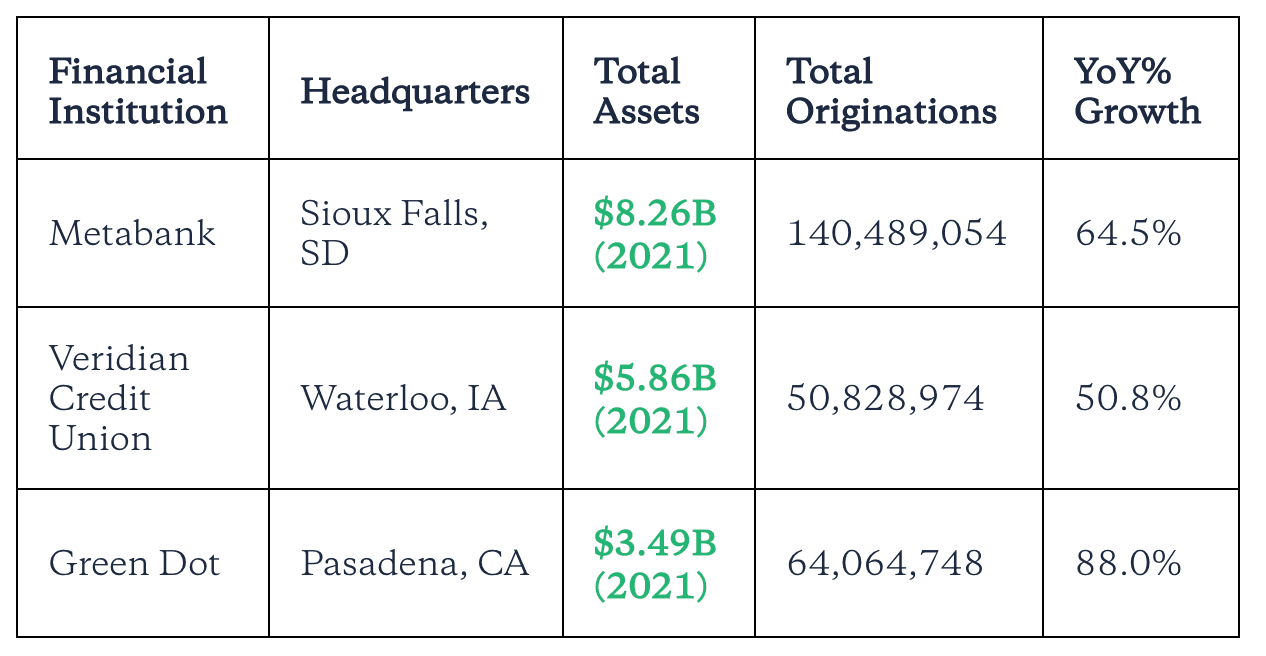

Most interesting is the number of FinTech and payments focused banks on the list. To highlight just a few examples, let’s look at MetaBank (#16), Veridian CU (#39), and Green Dot (#35):

MetaBank

MetaBank is a small mid-western bank based in Sioux Falls, South Dakota. They have branches across Iowa and South Dakota, and roughly $8.26 billion in total assets. Despite their size, MetaBank was the 16th largest ACH originator in the country, ahead of Zion’s Bancorp, a Financial Institution with 10x the assets. Moreover, MetaBank grew their transaction volume by 64.5% last year.

So how did MetaBank get here?

Over the past decade, MetaBank developed a strategy that focused on fee-based income streams – that is, revenue from activities and services outside of lending.

In particular, MetaBank chose to invest in their payments business. As one part of that strategy, the bank partnered with innovative financial technology companies, providing them with access to regulated banking products and services. MetaBank’s partners range across financial services, including high-growth payment companies (e.g. Finix and Tabapay,) payroll providers (e.g. Clair), and digital banks (e.g. MoneyLion, Daylight, H&R Block, InComm Payments).

Through these partnerships, MetaBank has created new distribution channels for their products, and developed growth opportunities; MetaBank scales as their partners grow. As a result of these relationships, MetaBank is the backbone behind a wave of financial innovation that’s helping to create a more inclusive and accessible financial ecosystem.

Veridian Credit Union

Veridian Credit Union is another interesting story on the list. Based in Iowa, with just $5.86 billion dollars in total assets, Veridian ranked number 39 on the list, ahead of many financial institutions with much larger asset bases. Last year, Veridian CU’s ACH volume grew by 51%.

Like MetaBank, Veridian Credit Union has embraced payments as a key growth lever. The company has partnered with a number of high-growth FinTech money movement companies, such as Dwolla, Astra, and Moov. They recently announced their plans to support the Real-Time Payment network – a testament to their ongoing investment in their payment business.

Green Dot

One final story worth highlighting is Green Dot. Green Dot is one of the first “branchless banks”; they serve more than 33 million customers through multiple channels, including direct to consumer and partner networks. Green Dot ranked number 35 on the ACH origination list. Their volume increased by 88% over the prior year.

Green Dot, like the others, has leaned into payments revenues, offering banking-as-a-service, tax processing, and money movement services. They are the provider of the Walmart MoneyCard product. They also partner with a range of established FinTechs and brands, including Apple (Cash), Uber Technologies, Kabbage (American Express), Intuit, Amazon, and Stash Financial.

By partnering with established companies with deep distribution, Green Dot can access entire new customer demographics and deliver financial services within a deep contextualized experience.

Why is this important?

Veridian CU, MetaBank and Green Dot demonstrate how select financial institutions are pursuing new strategies to drive revenue growth.

This is important because the banking industry is undergoing significant transformations. Two currents worth highlighting:

- Regulation introduced during the Great Recession improved financial stability, but impacted bank margins by requiring strict capital ratios. As McKinsey notes: the industry has become “safer, more predictable, more commoditized.”

- Non-bank financial services providers – from brokerages (e.g. Robinhood), lenders (e.g. OppFi), payment companies (e.g. Dwolla), and insur(techs) – are delivering financial products to consumers in compelling new ways. They present a risk for incumbent banks who choose not to participate in their growth, and an opportunity for banks that do (e.g. MetaBank, Green Dot).

Within this landscape, fee-based strategies enable banks to navigate both of these currents. These strategies help banks develop relationships with fast growing companies. They also offer an attractive, recurring stream of revenue that’s valued by the Street. As McKinsey highlights:

“Fee Income is the greatest differentiator between the commercial banks that generate returns significantly higher than the cost of capital and those with average returns.”

The success of MetaBank, Green Dot, and Veridian CU bears this out. In fiscal year 2021, MetaBank and Green Dot outperformed the industry on ROE and ROA [1].

The average ROE for North American Banks is 8% (2020) [2]; MetaBank and Green Dot ROEs for 2021 were 19.41% and 25.3%, respectively [3]. Similarly, the average ROA in 2021 was 1.24%; the same year, Metabank ROA was 2.19% and Green Dot was 2.09% [4]. Veridian CU, a not-for-profit, was ranked in the top 1% of credit unions for returning value to members by Callahan & Associates.

How Modern Treasury Can Help

Modern Treasury supports these bank strategies by giving banks the technology toolset to better serve high-volume payment clients.

If you’re interested in learning more, you can talk to our Bank Partnership team at banks@moderntreasury.com

Get the latest articles, guides, and insights delivered to your inbox.

Authors