Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

The Federal Deposit Insurance Commission was created in 1933 to reinforce the public’s trust in the American banking system. Since the Great Depression, it has successfully prevented widespread loss of consumer deposits in the event of a banking crisis.

What is FDIC Deposit Insurance?

The FDIC is a federal government entity tied to Congress and charged with the prevention of and intervention in a banking crisis. The FDIC was created in 1933, when bank runs were common in the wake of the Great Depression. Bank runs typically occur when a large number of depositors all withdraw their money from a bank at the same time, generally due to fears that the institution will become insolvent or unstable. With so many depositors all withdrawing their money simultaneously, the bank uses up its cash reserves and ends up defaulting. The FDIC was created to step in during these types of scenarios.

Currently, the most well-known FDIC program is FDIC deposit insurance, where all deposit holders at licensed financial institutions are guaranteed the ability to access their funds in the event of a bank failure, up to a limit of $250,000. This deposit insurance applies to most banks within the US.

What is Covered By FDIC Insurance?

FDIC coverage depends on the types of depository financial institutions and types of accounts used by your business.

Banks

Nearly all banks carry FDIC insurance for their depositors. However, FDIC does not cover share accounts at credit unions. These are instead covered by the National Credit Union Share Insurance Fund, run by the National Credit Union Administration (NCUA), which plays a similar role to the FDIC.

If you’re interested in finding out how much FDIC deposit insurance coverage your accounts have, you can use the FDIC’s Electronic Deposit Insurance Estimator (EDIE).

Account Types

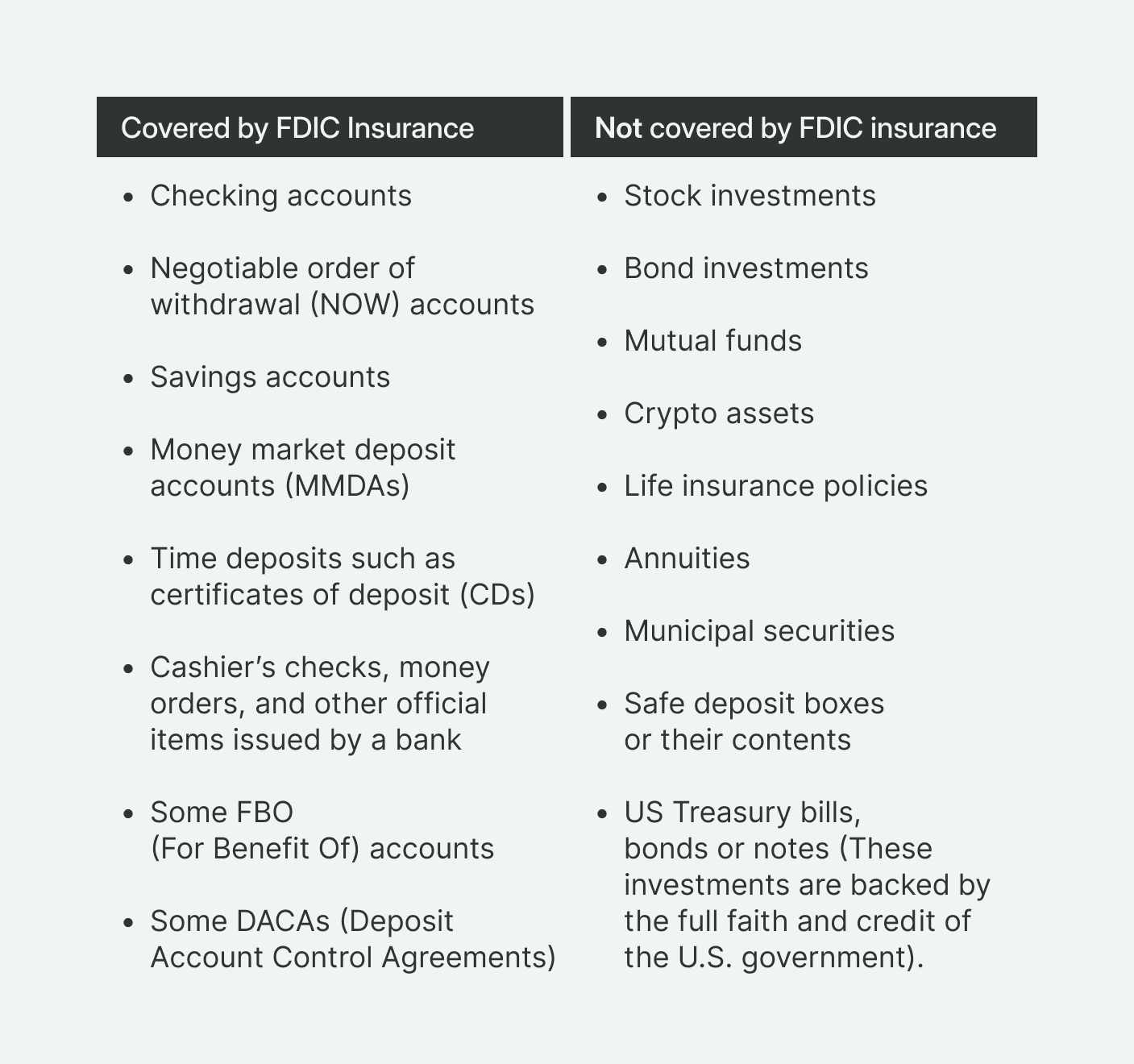

Most—but not all—cash and cash-like funds are covered by FDIC.

For companies looking to add redundancy to their bank infrastructure, Modern Treasury can help by providing access to multiple banks at once. Learn more here and reach out if we can be helpful.

Learn

Working with banks can be a complicated process. Understand intricate bank processes, learn how to approach potential bank partners, and discover how bank partnerships can drive growth in your business.

A clearing account acts as a temporary account that holds transactions before they are finalized or allocated to the correct permanent account.

The two kinds of financial institutions in the ACH network are ODFIs (Originating Depository Financial Institution) and RDFIs (Receiving Depository Financial Institutions).

BAI2 files are a cash management reporting standard. They are widely accepted by banks across the United States for exchanging data regarding balances and transactions.

Incoming payment details are notifications that a company is going to receive a payment it didn’t originate—meaning the receiving funds were not initially requested.

Lockboxes are secure bank-run mailing locations where businesses can redirect their paper-check payments, allowing banks to take over the depositing process.

Nacha files are the standardized file format that banks use to initiate and manage batches of ACH payments. These files help banks execute large volumes of ACH payments through The Clearing House (TCH) and Federal Reserve.

A sort code is a type of routing number used in the United Kingdom and in Ireland. It’s composed of six digits divided into three pairs. It routes money transfers by identifying the banks involved, as well as the location of the specific branches where the accounts are held.

Virtual accounts are unique account numbers assigned within traditional, physical bank accounts, which are also known as settlement accounts. They can be used to send and receive money on behalf of the settlement account.

Account-to-Account (A2A) banking, sometimes also called Me-to-Me banking, is the transfer of funds from one account to another account.

Balance reporting is similar to a bank statement and informs customers about their account balances in real time. Banks often perform balance reporting for businesses and larger organizations with more complex accounting needs, but it is also available to individual customers.

Bank reconciliation is the process of verifying the completeness of a transaction through matching a company’s balance sheet to their bank statement.

Implementing a multi-bank strategy is vital for companies looking to reduce risk exposure. In this article we explain how to reduce financial risk by implementing bank redundancy.

Batch processing is a method of processing various types of transactions. As the name suggests, transactions are processed in a group or “batch.”

Core Banking, or a Core Banking System, is a back-end system that processes daily banking transactions across all of the various branches of a given bank.

The Federal Deposit Insurance Commission was created in 1933 to reinforce the public’s trust in the American banking system. Since the Great Depression, it has successfully prevented widespread loss of consumer deposits in the event of a banking crisis.

The Federal Deposit Insurance Commission (FDIC) was created to protect deposit holders in the event of a bank failure. In this article we explain how FDIC receiverships work.

IBAN, or an International Bank Account Number, makes it easier and faster for banks to process cross-border financial transactions.

Money transmission is the act of one party receiving currency for the purpose of sending it over to another party.

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency under the jurisdiction of the US Treasury Department.

Real-Time Gross Settlement (RTGS) is a system for electronic payments between two banks, where the transactions process and settle in real time rather than being batched.

Two options for financial transaction settlement—differing in both speed and style—here, we’ll look at how both Net Settlement and Gross Settlement work in action.

A banking API is software that facilitates a digital connection between a company and a bank.

A Client Money Account (CMA) is an account opened by a UK and European Economic Area regulated firm to hold money that belongs to one or more of that institution’s clients.

A currency transaction report (CTR) is a report made by U.S. financial institutions aiming to prevent money laundering.

When businesses borrow funds, their lenders have options for protecting against the risks of extending credit.

Sweep accounts are a particular type of bank account where funds are automatically transferred between different accounts to optimize the use of available cash and maximize returns

An Agent of the Payee is a person, entity, or other intermediary specifically appointed by a payee to process and collect payments on their behalf.

An FBO account, or a For Benefit Of account, allows a company to manage funds on behalf of—or for the benefit of—one or more of their users, without assuming legal ownership of the account.

A merchant’s bank account must pay an interchange fee to the card-issuing bank each time someone uses a credit or debit card to purchase something from their store.

An MT940 (Message Type 940) file is a detailed SWIFT statement that provides information about account transactions.

The Bank Secrecy Act (BSA)—also known as the Currency and Foreign Transactions Reporting Act—is a piece of legislation designed to help prevent fraud.