Modern Treasury has acquired Beam.Build for what's next →

ISO 20022 files are a collection of XML-based schemas which standardize any type of financial message.

From payment clearing and settlement to account management, ISO 20022 files cover a diverse range of communications. Through consistent names and placements for each message’s attributes, all parties can rely on the same language.

How do ISO 20022 files work?

Every day, financial institutions, businesses, and banks exchange innumerable messages with private information regarding initiating payments, managing ATM transactions, or reporting fraud. ISO 20022 files facilitate this transfer, offering a universal format for domestic and global financial communication.

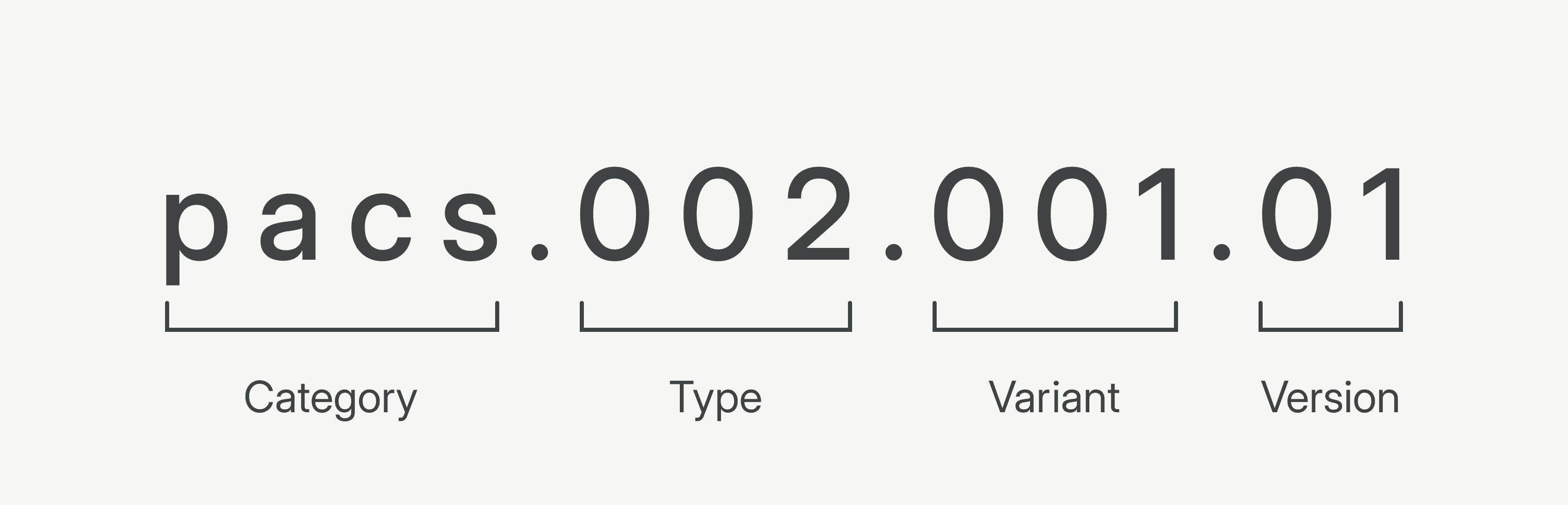

Every ISO 20022 file has a specific four-part identity, signifying its category, type within that category, variant, and version. These categories are four-character identifiers indicating the message’s broad classification, such as cash management, camt; securities clearing, secl; and ATM card transactions, catp.

Per the image above, if a bank wants to send an update about the clearing or settlement status of a payment, they can create an ISO 20022 file within the payment clearing and settlement category with the identity, pacs.002.001.01.

What are the origins of ISO 20022 files?

The International Organization for Standardization (ISO), created the ISO 20022 file format, a standardized communication framework for a global financial system. Before developing ISO 20022 files, payment systems around the world used their own proprietary file formats to communicate. Even the European ACH system and US ACH system used different file types.

For multinational transactions, financial organizations had to translate each region’s domestic format for payment rails like wire transfers, RTP, and ACH to be mutually understood. The only exception was SWIFT, which standardized international financial messaging using MT files that summarize transactions in a daily statement. In today’s globalized economy, ISO 20022 files incentivize domestic payment systems to evolve with the interconnected movement of funds.

Who uses ISO 20022 files?

The majority of real-time gross settlement networks and high-value payment systems have adopted or plan to adopt ISO 20022 files, including Europe’s EURO1, UK’s CHAPS, Fedwire, CHIPS, and SWIFT. Even real-time systems and low-value payment systems are either migrating to ISO 20022 or translating their files into the new format.

Most domestic payment systems across the globe will embrace ISO 20022 files within the next one to three years, and it’s expected that it will become the worldwide standard by 2025. This change has important implications for the future of money movement. The use of ISO 20022 files moves the world one step closer to a fully globalized financial system, prompting businesses, financial institutions, and banks to adapt to stay competitive.

Today, banks mainly use ISO 20022 files to communicate with each other. As these files become financial mainstays, companies can expect to interact with them more often. Banks may even ask businesses to prove their ability to communicate in this format and draw up ISO 20022 files. This shift to ISO 20022 reduces the inefficiency of translating one file type to another and facilitates more robust financial messaging.

What are the benefits of ISO 20022 files?

The creation and widespread adoption of ISO 20022 files marks a historic development in the evolution of money movement. By standardizing the representation of data, names, and addresses, ISO 20022 files increase message precision and prevent information loss between parties. They also have distinct implications for financial institutions and businesses.

Standardized financial messaging allows financial institutions to conduct complex multinational transactions across the global financial network. For these institutions, ISO 20022 files improve interoperability between payment systems and offer new functionalities. These files provide information about the ultimate originator and recipient of a payment involving up to four parties. Compared to more limiting file formats, ISO 20022 files can provide more context about payments like unit prices, quantities, and invoice descriptions.

Learn

File Standards are the payment reporting formats used by banks and payment industry bodies.

BAI2 files are a cash management reporting standard. They are widely accepted by banks across the United States for exchanging data regarding balances and transactions.

ISO 20022 files are a collection of XML-based schemas which standardize any type of financial message.

An MT940 (Message Type 940) file is a detailed SWIFT statement that provides information about account transactions.

NACHA files are the standardized file format that banks use to initiate and manage batches of ACH payments. These files help banks execute large volumes of ACH payments through The Clearing House (TCH) and Federal Reserve.

IBAN, or an International Bank Account Number, makes it easier and faster for banks to process cross-border financial transactions.