Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

How do you practice bank reconciliation?

To practice bank reconciliation, businesses may rely on manual processes, automating software, or some combination of the two. Regardless of process, bank reconciliation will always involved these four steps: (1) pulling and comparing deposits between a company’s bank statement and its internal systems, (2) modifying the bank statement as needed, (3) adjusting the internal systems as necessary, and (4) comparing the bank statement and balance sheet to confirm a match.

Because a manual bank reconciliation process can be time consuming and error prone, companies may seek out automation to help. Ultimately, businesses benefit from the ability to verify transactions as they settle in real-time. This provides a more accurate picture of a company’s business transactions, and eliminates the need to maintain a balance “cushion” for unexpected costs.

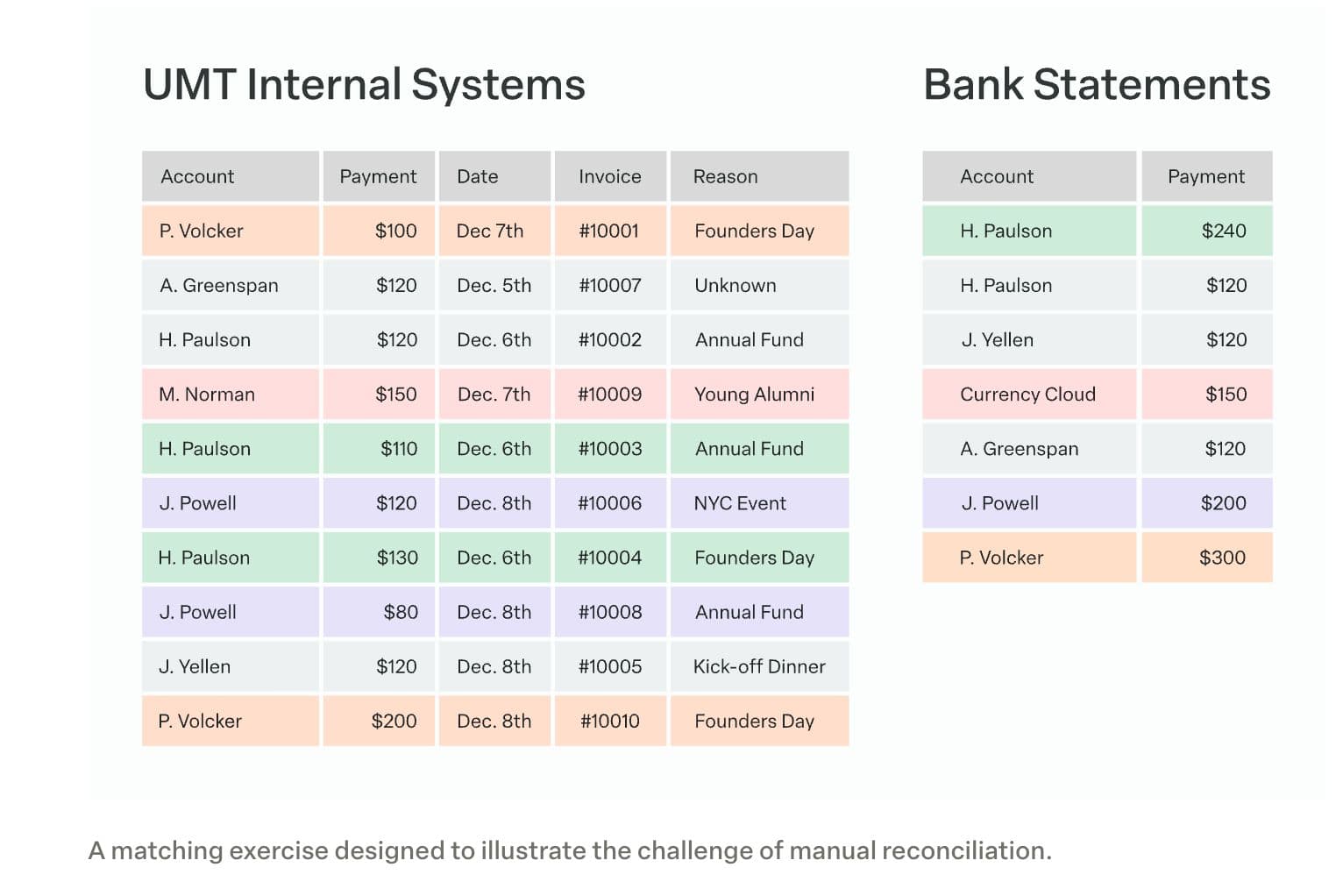

In the case of a manual process, the example below shows how a fictional university—the University of Modern Treasury (UMT)—might perform bank reconciliation. To reconcile alumni donations, it would be necessary to compare, adjust, and match transactions between an internal record and UMT’s bank statement.

Learn more

Bank reconciliation is the process of verifying the completeness of a transaction through matching a company’s balance sheet to their bank statement.

Read more

The four steps in bank reconciliation are (1) accessing and comparing deposits between a company’s bank statement and its internal systems of record, (2) normalizing the bank statement as needed, (3) formatting of data from internal systems of record, and (4) comparing the bank statement and internal records to confirm a match.

The main purpose of bank reconciliation is to ensure that a company’s finances are correctly documented.

Yes, bank reconciliation can be difficult, especially at scale. Primary difficulties stem from bank payment delays, the challenge of normalizing payments and bank data, and the need to match a high volume of transactions quickly.

If bank reconciliation doesn’t balance, an error of some kind is indicated—be it a numerical mistake, oversight, or duplication, a human error in comparison or adjustment, or a software problem.

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

Read more