Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

What is the main purpose of bank reconciliation?

The main purpose of bank reconciliation is to ensure the authenticity of a company's financial transactions. This process is especially vital for institutions involved in financial transactions since it ensures the accuracy of product records and internal finance.

In addition to ensuring an accurate financial picture, bank reconciliation can help companies boost efficiency and productivity. Since reconciliation involves tracking every transaction on a bank statement to its original purpose, the process provides an opportunity for reflection. Which expenses contributed to the biggest payoffs? Which were less impactful, or even detrimental?

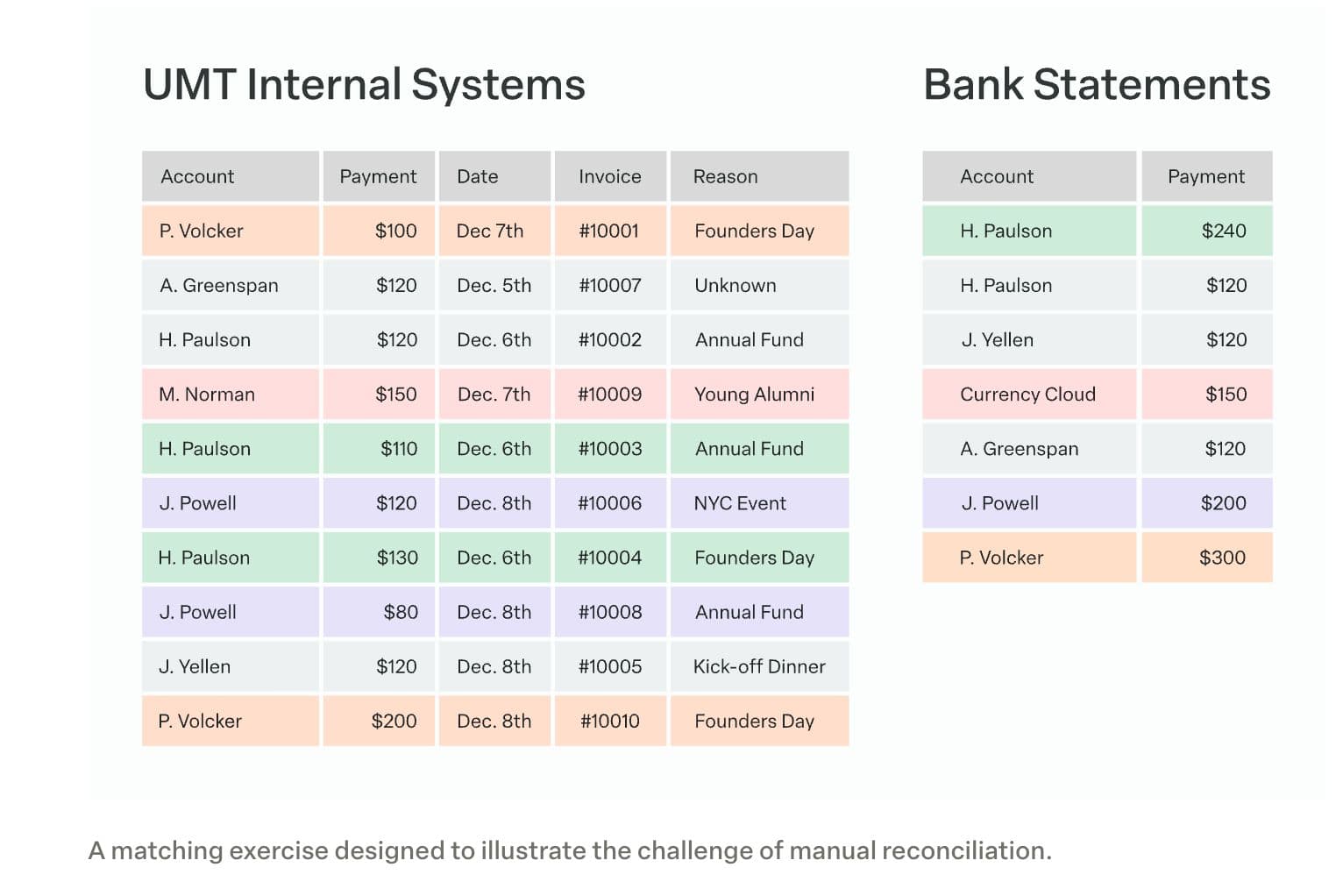

The example below shows how a fictional university—the University of Modern Treasury (UMT)—might compare alumni donations between an internal record and its bank statement for the purpose of bank reconciliation.

Learn more

Bank reconciliation is the process of verifying the completeness of a transaction through matching a company’s balance sheet to their bank statement.

Read more

The four steps in bank reconciliation are (1) accessing and comparing deposits between a company’s bank statement and its internal systems of record, (2) normalizing the bank statement as needed, (3) formatting of data from internal systems of record, and (4) comparing the bank statement and internal records to confirm a match.

Yes, bank reconciliation can be difficult, especially at scale. Primary difficulties stem from bank payment delays, the challenge of normalizing payments and bank data, and the need to match a high volume of transactions quickly.

To practice bank reconciliation, businesses may rely on manual processes, automating software, or some combination of the two. Regardless of process, bank reconciliation will always involved these four steps.

If bank reconciliation doesn’t balance, an error of some kind is indicated—be it a numerical mistake, oversight, or duplication, a human error in comparison or adjustment, or a software problem.

Read more

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.