Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

What does reconciling an account involve?

Reconciling an account involves comparing financial records to ensure a balance is complete and accurate—most commonly, comparing the general ledger balance of an account against an additional external or internal system of record.

There are two main approaches to account reconciliation: document review and historical analysis. Document review involves comparing a business’s financial records against source documents for the account at hand, such as receipts, invoices, or other financial statements. Historical analysis is completed by comparing historical records of the account in question with current records for the account. Both approaches are aimed at helping finance teams identify discrepancies and address through them to ensure balances match.

Depending on the situation, account reconciliation is applicable to a variety of different reconciliation types including bank reconciliation, vendor reconciliation, intercompany reconciliation, business specific reconciliation, petty cash reconciliation, and credit card reconciliation.

Learn more

Bank reconciliation is the process of verifying the completeness of a transaction through matching a company’s balance sheet to their bank statement.

Read more

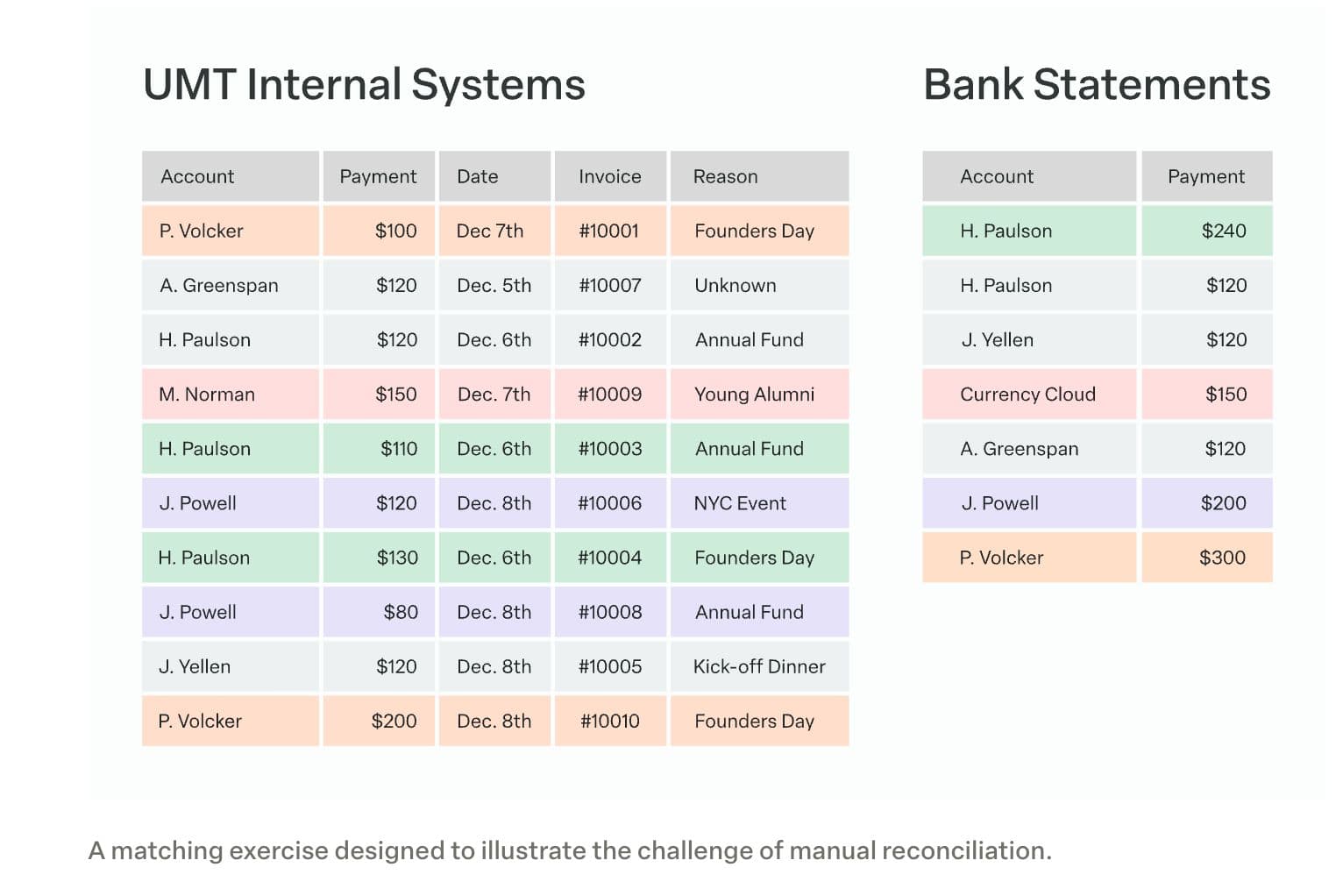

The four steps in bank reconciliation are (1) accessing and comparing deposits between a company’s bank statement and its internal systems of record, (2) normalizing the bank statement as needed, (3) formatting of data from internal systems of record, and (4) comparing the bank statement and internal records to confirm a match.

The main purpose of bank reconciliation is to ensure that a company’s finances are correctly documented.

To practice bank reconciliation, businesses may rely on manual processes, automating software, or some combination of the two. Regardless of process, bank reconciliation will always involved these four steps.

If bank reconciliation doesn’t balance, an error of some kind is indicated—be it a numerical mistake, oversight, or duplication, a human error in comparison or adjustment, or a software problem.

Read more

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

Yes, bank reconciliation can be difficult, especially at scale. Primary difficulties stem from bank payment delays, the challenge of normalizing payments and bank data, and the need to match a high volume of transactions quickly.