Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Add Custom Processing Windows

We released a new feature that allows Modern Treasury customers to add custom processing windows in addition to our default processing windows for all supported payment types.

We released a new feature that allows Modern Treasury customers to add custom processing windows in addition to our default processing windows for all supported payment types.

When a user creates a payment order through Modern Treasury, we hang onto the payment order until the end of the banking day before sending it off to be processed. Once sent to the bank, payments cannot be cancelled. By holding onto a payment order until the end of the day, there is some leeway for customers to cancel their payment orders before they are sent to the bank. The payment orders are all sent out at a time unique to the bank processing the transactions: the bank cutoff time.

How our Current System Works

The lifecycle of an ACH payment made through Modern Treasury goes through a few different phases. First, the ACH payment order is created via the Modern Treasury app or API and is approved by someone in the organization with approval permissions. The payment is then batched along with other payments and is sent to the bank for processing. Finally, the bank sends transaction data confirming the payment cleared, and the payment is reconciled. This is the happy path for a payment, and there are many other paths a payment can take, for example, if the payment is cancelled.

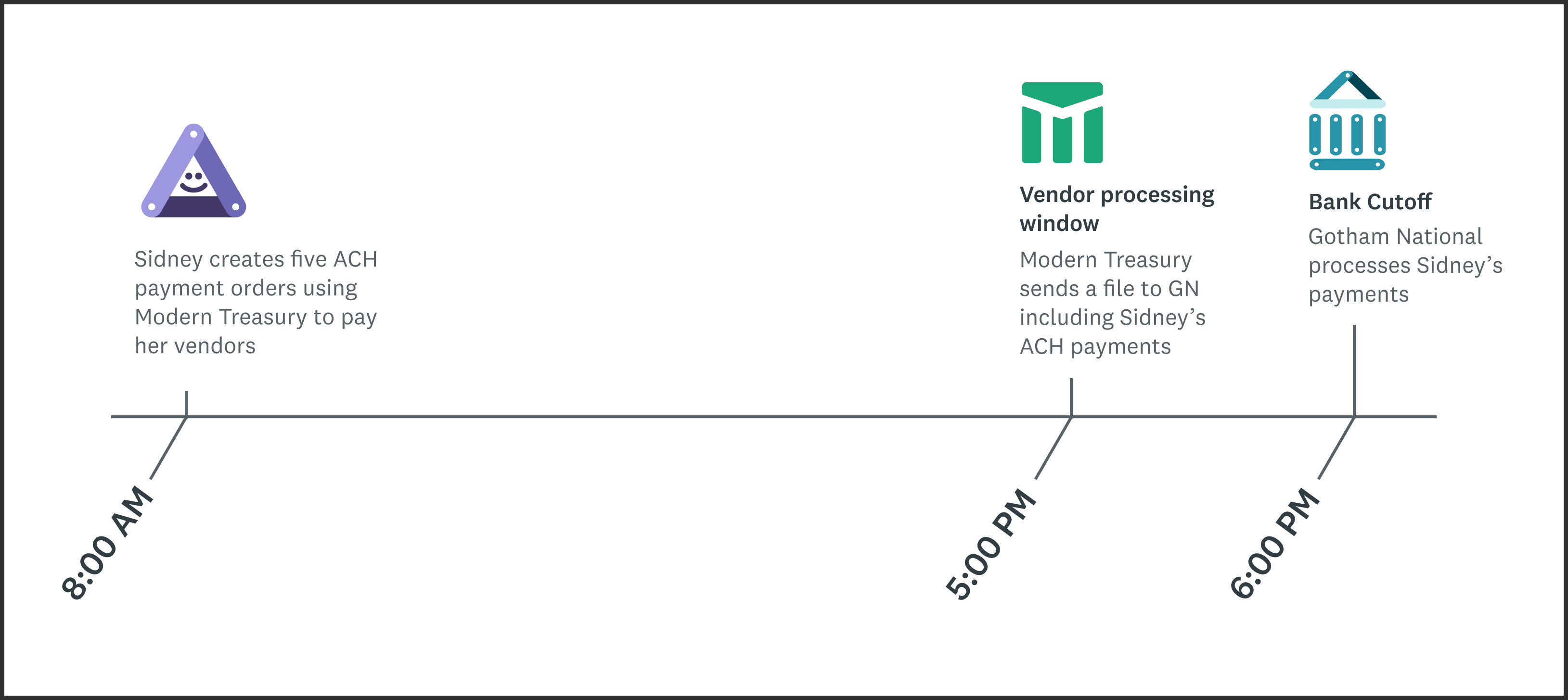

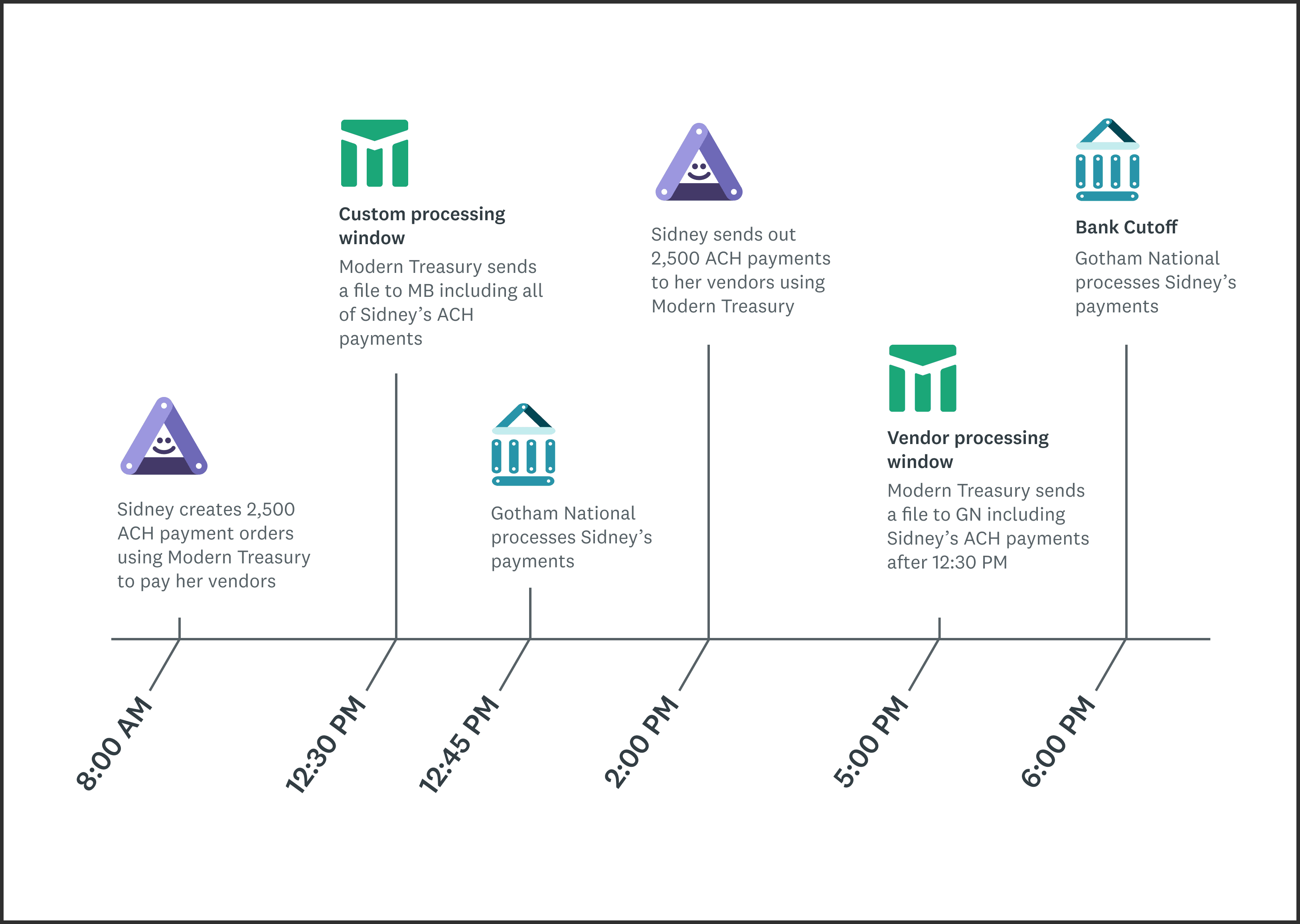

Let’s walk through an example. Sidney owns a bagel shop in San Francisco and pays her vendors every week via ACH. She banks with Gotham National and uses Modern Treasury. For the month of January, she creates five ACH payment orders at 8:00 AM however, they aren’t sent to the bank until 5:00 PM. In the meantime, Sidney can cancel her payment order, if she wishes, until 5:00 PM. Sidney decides not to cancel her payment order, so it is sent to the bank. The payment order arrives before the end of the banking day and is processed by Gotham National at 6:00 PM.

What is a Custom Processing Window?

A custom processing window is a processing window where the cutoff time is determined by the Modern Treasury user instead of the bank. Custom processing windows are an addition to the default per-bank processing windows and help with sending payment orders throughout the day.

How Custom Processing Windows Change Our System

Let’s imagine Sidney’s bagel store has grown nationwide. She now purchases ingredients from 5,000 vendors. This means that her volume of outgoing ACH payments has increased significantly. Sidney, knowing that her ACH volume has increased, decides to add a custom window for her bagel store at 12:30 PM. Sidney creates 2,500 ACH payment orders at 8:00 AM to pay some of her vendors. The first batch of ACH payment orders are sent to Gotham National at 12:30 PM, the custom processing time, and start processing as soon as they reach the bank.

At 2:00 PM, Sidney creates 2,500 additional ACH payment orders to pay her remaining vendors. These payment orders are all captured before the bank cutoff and are sent to Gotham National at 5:00 PM. There is a slight trade off because Sidney doesn’t have as much time to cancel her ACH payments but sending the payments earlier in the day gives the bank more time to process the payments.

Why do Custom Processing Windows Matter?

When organizations send large amounts of payments orders right before the bank cutoff, sometimes the bank is unable to process them all in time before the end of the banking day.

Custom processing windows allow Modern Treasury to more closely map to a customer’s systems, workflow processes, or other business needs. Adding a custom processing window allows organizations sending large amounts of ACH payments to spread their volume throughout the day, or align with a workflow where payments are sent midday. This helps avoid any delays with processing. In addition, custom processing windows make operations for Modern Treasury customers more customizable with assurance that ACH payments are sent to the bank earlier in the day.

If you are building an app that requires custom processing windows, or want to learn more about optimizing your company’s payment operations, sign up or contact us.