Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Announcing Our Series B

There are many important moments along the journey of never-ending work it takes to build an enduring and valuable company. Today we’re excited to share that we’ve reached another stepping stone on that path: we raised a $38M Series B financing led by Altimeter Capital.

Explore with AI

There are many important moments along the journey of never-ending work it takes to build an enduring and valuable company. Today we’re excited to share that we’ve reached another stepping stone on that path: we raised a $38M Series B financing led by Altimeter Capital. We’re excited to add Ram Woo to our Board of Directors and welcome the whole Altimeter team to the Modern Treasury family.

The Altimeter team brings impressive founder and operator experience with both private and public market expertise. Their appreciation for the craft of building a software business is apparent to anyone who spends time with Brad Gerstner, Ram Woo, and the rest of the Altimeter team. This will be a long journey, and we’re excited to work with investors whose focus is firmly on the long term.

Every day, we support over fifty customers, ranging in size from seed stage startups to publicly listed corporations, in managing complex payment flows. In this world of payment operations, our platform helps these teams initiate, track, and reconcile corporate payments.

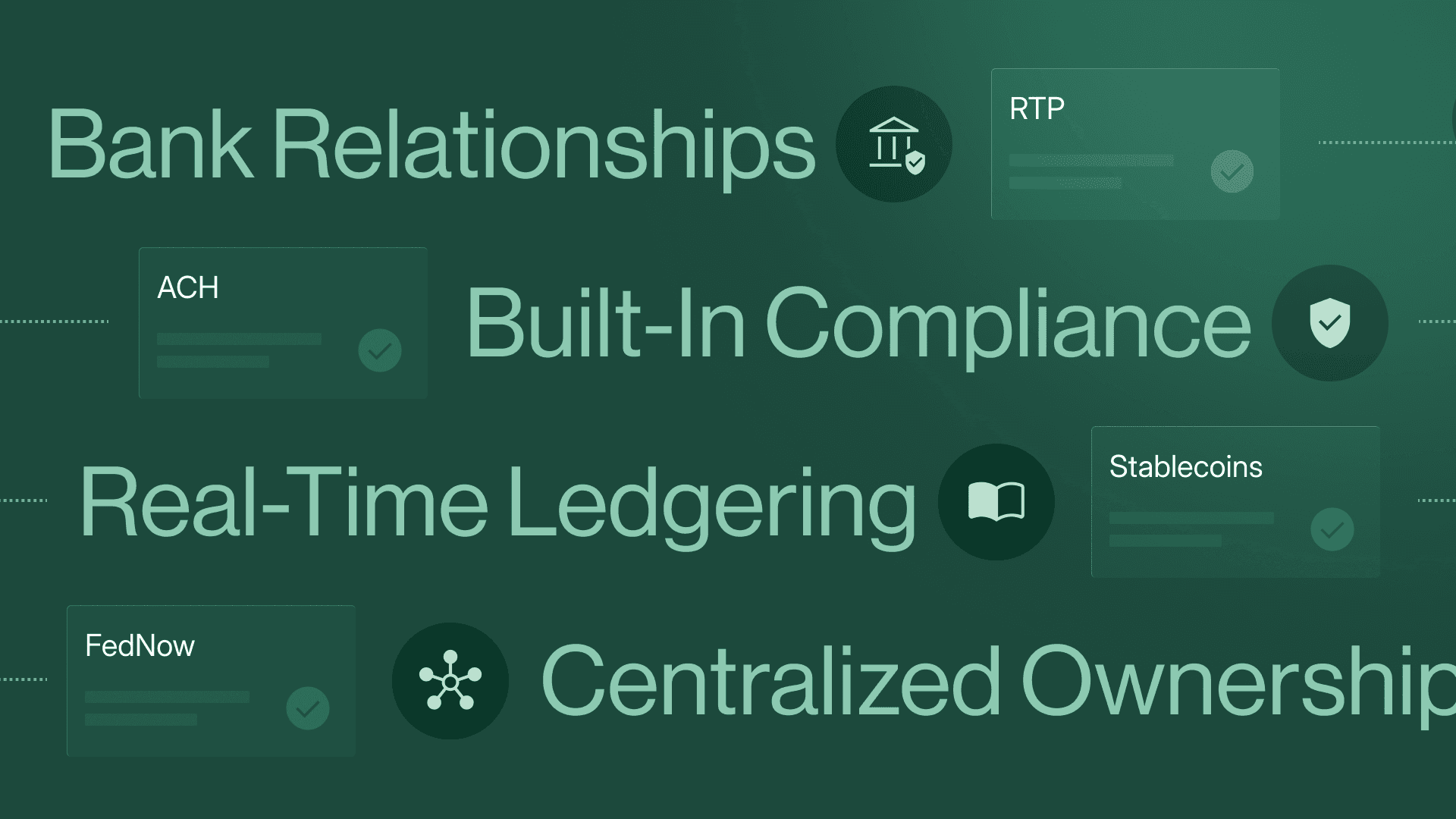

Moving money over ACH, wire, check, and RTP is critical to many, many business models. Examples include insurance, lending, health care, financial services, logistics, trade, payroll, B2B vendor payments, education, and real estate. And we’re lucky enough to have customers in each one of these verticals.

Yet while moving money is core to these businesses, building payments software and bank integrations is not. That’s where our product comes in.

Our early customers have built entire product and operations teams on top of our software, and in December we reconciled our billionth dollar after growing at a compounded 23% monthly rate during 2020.

The past year has been challenging for everyone on the planet, and we count ourselves lucky that our business was not detrimentally affected by the pandemic. Through it, we stayed focused on product development: we launched a self-serve experience, the first of its kind in corporate payments. We also doubled our count of supported banks, scaled up Real-Time Payments, and launched support for EFT in Canada.

Thank you to our dedicated, smart, and fun-loving team for all your hard work. Look what we accomplished in a year like 2020! (And if you’re not a part of our team yet, we’re hiring: send us a note or check out our job postings.)

We’re incredibly grateful to our investors, including Benchmark and Y Combinator, who are participating in this round. Thank you, too, to our partners, customers, banks, and the fintech community for supporting us along the way.

What is past is prologue, and we’re just getting started with Chapter One.

Get the latest articles, guides, and insights delivered to your inbox.

Authors

Sam is co-founder and CTO of Modern Treasury. Before that, was an engineer at Kiavi (fka Lending Home), was co-founder and CTO at Agustus & Ahab, and worked for Everlane and Rearden Commerce. He earned his BS from Columbia University, where he also worked on hacking projects. Sam is known to celebrate company milestones with Krispy Kreme deliveries.

Dimitri Dadiomov is the co-founder and President of Modern Treasury. Dimitri started his career in product and business development at Better Place and then moved to venture capital before earning his MBA at Harvard Business School. Dimitri is a graduate of Stanford University and spends his free time skiing, hiking, writing, and devouring books.

Matt is co-founder and CEO of Modern Treasury. Previously, Matt worked at First Round Capital and Ultimate Kronos Group. Matt graduated with a BS in Computer Science from Dartmouth College, where he was captain of the men’s lightweight rowing team. Matt is an avid hiker and is known to celebrate company milestones with SusieCakes deliveries.