B2B Payments vs. C2B Payments: What Makes Them So Different?

This post lays out how money moves between companies, how that differs from consumer payments, and some surprising upcoming changes.

As consumers, most of us don’t think about how businesses pay each other. We live in a world of credit and debit cards, occasionally interspersed with cash and checks. This post lays out how money moves between companies, how that differs from consumer payments, and some surprising upcoming changes.

What’s the status in consumer payments?

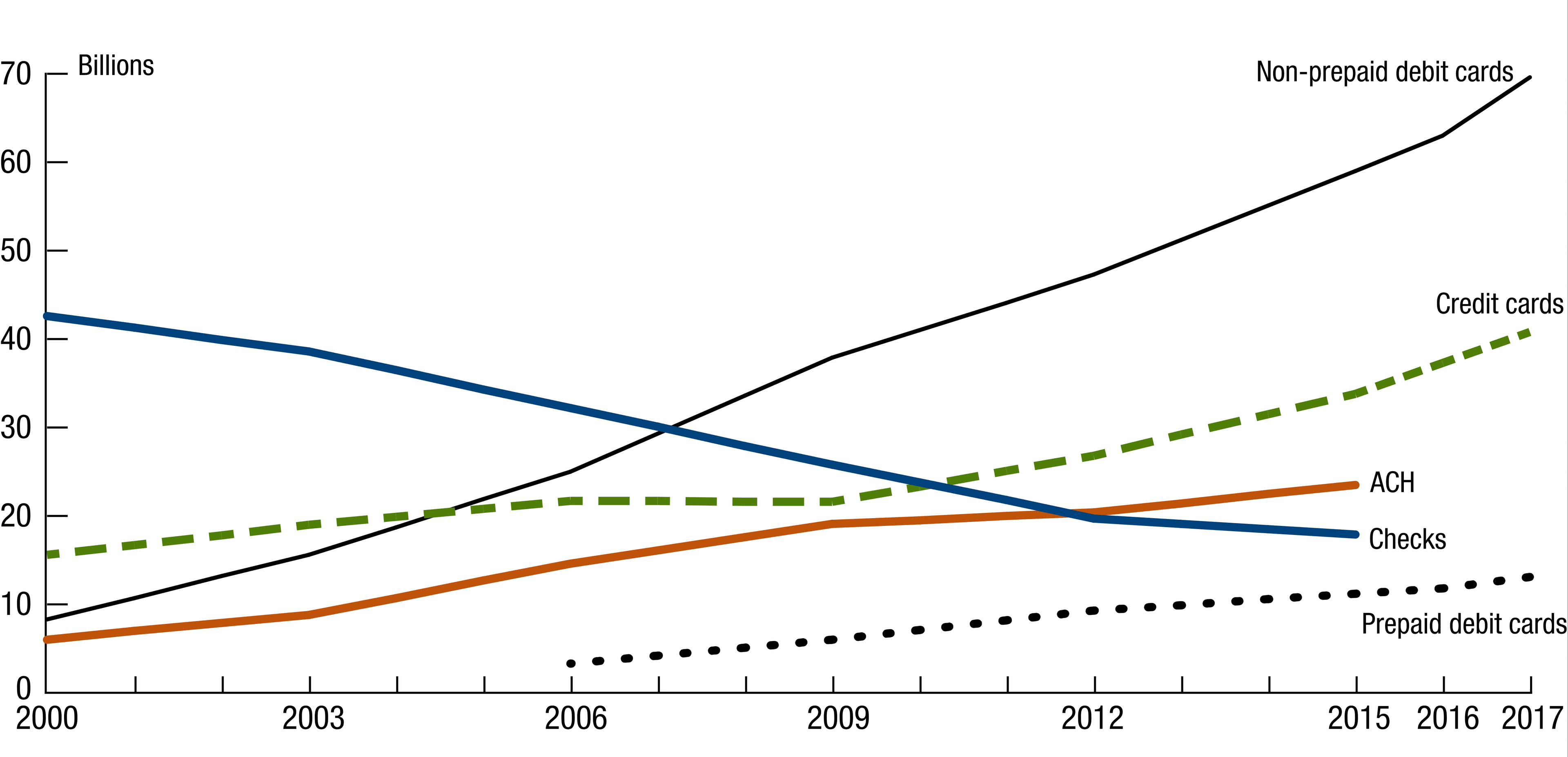

Over the last two decades, we have seen consumer payments change drastically. Debit card spend is on the rise as check payments fall, and we now pay each other with peer-to-peer systems such as Venmo (more on building those types of companies here). Here’s a summary from the Federal Reserve of shifting consumer payment methods over the last two decades:

How do B2B Payments differ from Consumer Payments?

Just like you and me, every company has to pay and get paid, and manage the complexity of doing both at scale. What’s surprising is that B2B payment methods are outdated when compared to consumer payments.

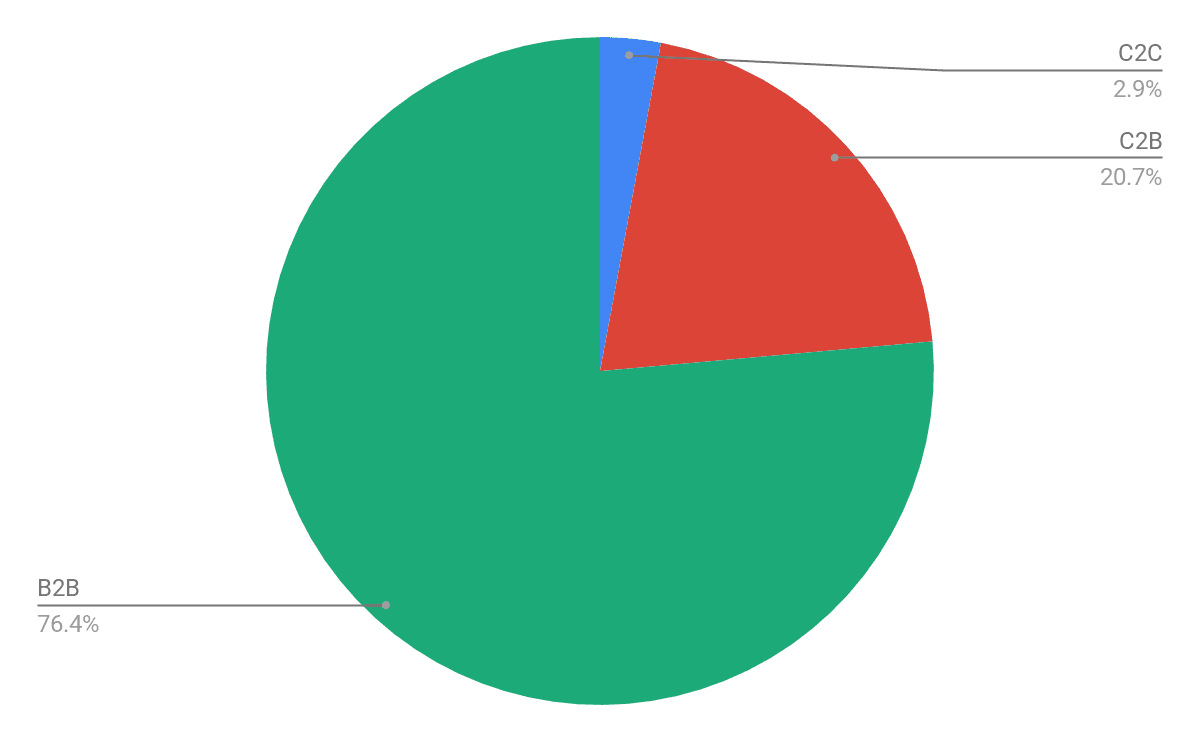

There are two categories of business payments. The first, C2B, stands for money that moves between a consumer and a business ("consumer-to-business"). For example, buying clothing online or paying for something in a store. This volume was recently estimated to be $5 trillion dollars and follows the payment methods outlined above. The second category, B2B payments, refers to businesses paying businesses ("business-to-business"). For example, a business paying suppliers or wholesalers or a corporation paying a consulting firm. B2B payments sum to a whopping $18.5 trillion, which is over 76% of payments in the United States.

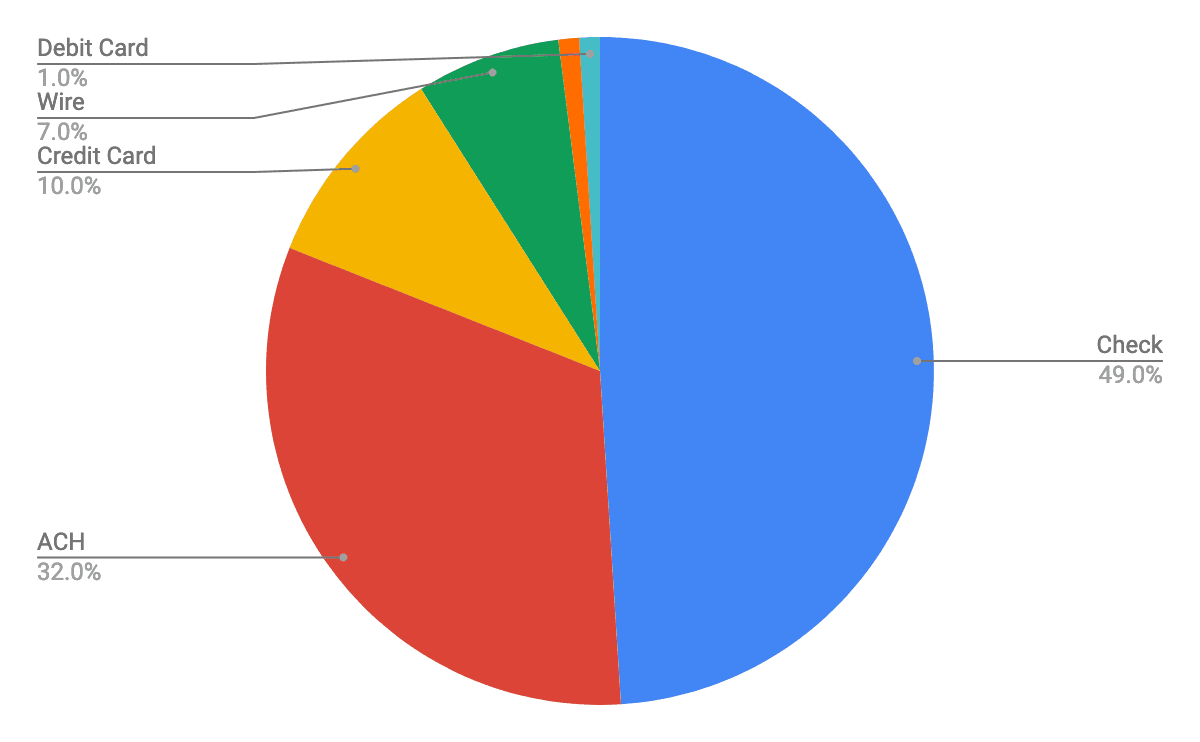

Even more surprisingly is the breakdown of payment method: nearly half of B2B payments happen by paper check. However, that is forecast to dramatically drop in the next three years as paper checks are overtaken by electronic payments. Already, 92% of the value transferred over ACH was for B2B payments, and ACH is growing at a rate of 6.9% per year.

In a 2017 survey of Fortune 1500 companies, here’s how B2B payments broke down on a per-transaction basis:

And here’s an even more surprising fact: each check is estimated to cost up to $39 to process.

Why are B2B Payments behind Consumer Payments?

It’s confusing that given the 26x difference in market size between B2B and C2B payments that more innovation in payment methods hasn’t happened yet. The 2017 Fortune 1500 study identified two main barriers to electronic payments innovation. They include sending remittance information easily, and proper processes and systems. In addition to historically underdeveloped systems, our regulatory framework has not supported payments innovation. The two largest regulatory challenges are:

- The United States has many more banks than other countries,

- The Federal Reserve does not have the authority to mandate new payment standards. [1]

For these reasons and more, we expect B2B payments improvements in the United States to happen a different way.

What’s set to change and why are we optimistic?

Three trends are happening that we are especially excited about:

- More fintech companies are being built, and they are demanding a higher level of customer and operational excellence. To support those companies, there are more APIs and enterprise fintech tools, and they are easier to implement. Examples include Stripe, Plaid, and Modern Treasury.

- Consumer pressure to transition payment methods is leaking into the enterprise. Business owners are asking themselves: if it’s so easy to pay my friends, family, and local coffee shop then why is it so hard to run my business?

- Cross-border payment volume is growing rapidly and global pressure for interoperability will change payment infrastructure.

We’re excited to follow these updates and continue to build Modern Treasury to give our customers easy access to these new innovations. Reach out if you’d like more info.

This contrasts with the move the Euro, which enabled European banks to transition to electronic systems and standards.