How Do Faster Payments Work?

The payments landscape continues to shift towards speedier, more convenient options. In this journal, we explore how faster payments work in the US.

Introduction

As the payments landscape in the US continues to shift towards speedier, more convenient options, we’ve spent a lot of time talking and writing about “faster payments.” But what are faster payments, exactly?

In order to be considered a “faster payment” there are three basic qualities that need to be met: instant transaction settlement, 24/7/365 availability, and immediate confirmation of the payment for both sender and recipient. Due to their immediate nature—there is no extended processing time for faster payments as there are with, say, ACH payments—in almost all cases faster payments are irreversible.

Faster payments can operate in either “closed loop” or “open loop” systems. Closed loop systems process transactions through a single provider, and both sender and receiver are required to have an account with that provider in order to complete payments. Examples of closed loop systems include apps like Venmo, Cash App, and Paypal, where sending funds from one person to another is quick and simple. However, transferring funds out of the app itself can take 24 hours or more as the funds have to then move from the app to the payee’s account at a bank, which is outside of the “closed loop.”

Open loop systems enable transactions between accounts at different banks and don’t require participants to hold an account with a specific app or financial institution. Open loop payments are made via a shared network—like the RTP Network, Zelle, and the upcoming FedNow—that routes and settles payments for any financial institutions enrolled in that network.

Below, we’ll take a detailed look at how faster payments are processed and take a look at the different applications and potential use-cases for faster payments in the US.

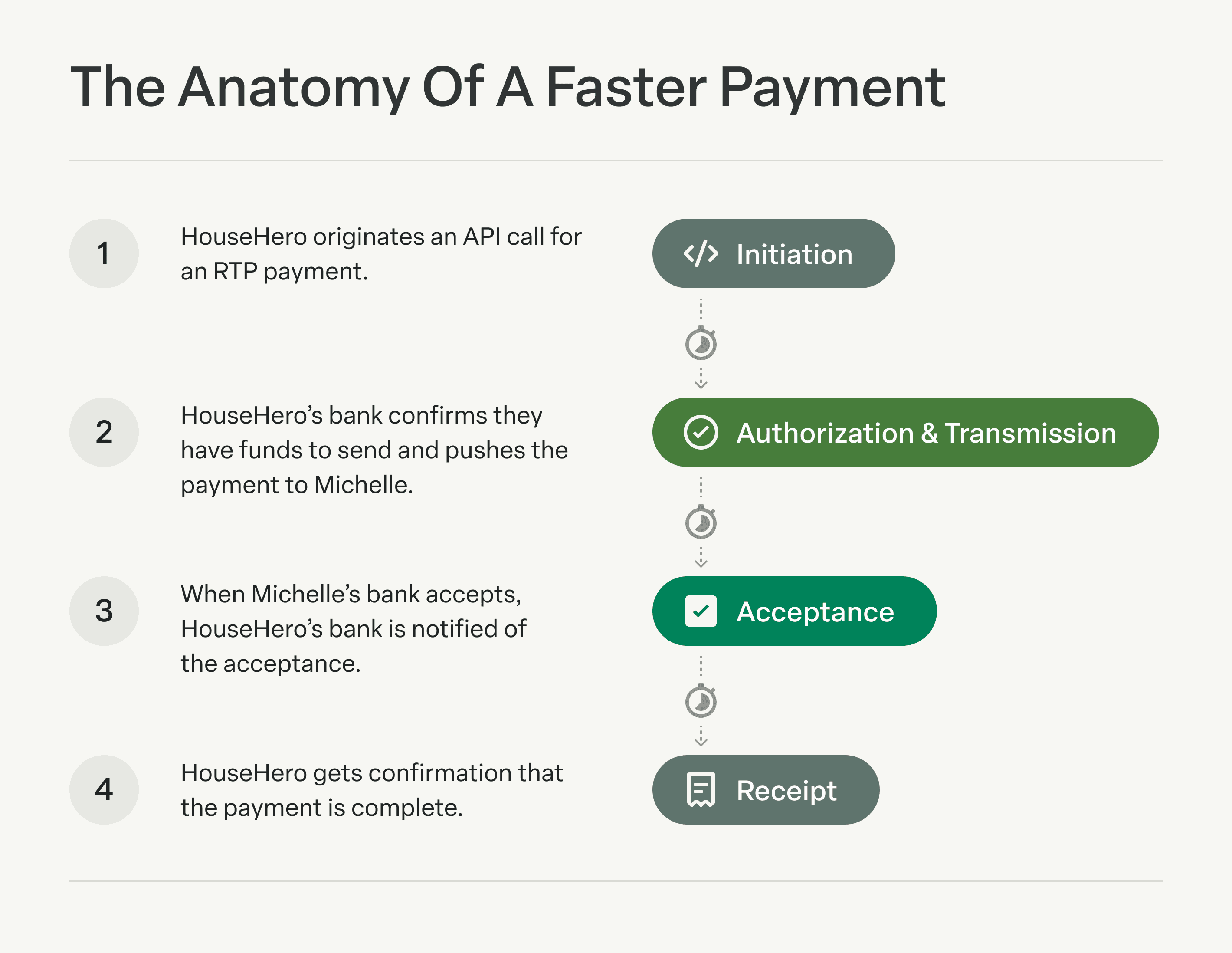

The Anatomy Of A Faster Payment

You may already be familiar with how ACH, wire transfers, checks, and other existing payment rails work, and the process for “faster” (also called “instant”) payments rails is similar.

Let’s walk through an example of a faster payment, from start to finish. Imagine that a home equity lending fintech, HouseHero, uses RTP to fund loans. In this instance, they're sending $50,000 of a home improvement loan to their customer, Michelle.

Step One: Initiation

HouseHero originates an API call for an RTP payment. In the API call below, the amount is listed in USD cents:

Step Two: Authorization & Transmission

HouseHero's bank confirms they have funds to send and pushes the payment to Michelle. At this point, the payment is en route and HouseHero cannot make changes. When Michelle's bank receives the payment, it will validate the information and accept the transaction

Step Three: Acceptance

When Michelle's bank accepts, HouseHero's bank is notified of the acceptance. Michelle's bank is credited with the $50,000.

Step Four: Receipt

HouseHero gets confirmation that the payment is complete. Michelle also gets an immediate notification about the payment and has access to the money in her account right away.

Though the example above is overly-simplified, it includes the basic framework of the path that every faster payment transaction will take. Transactions can look different depending on the network used to send the payment, the financial institutions involved, the amount of the transaction, or whether the transaction occurs in a closed- or open-loop system.

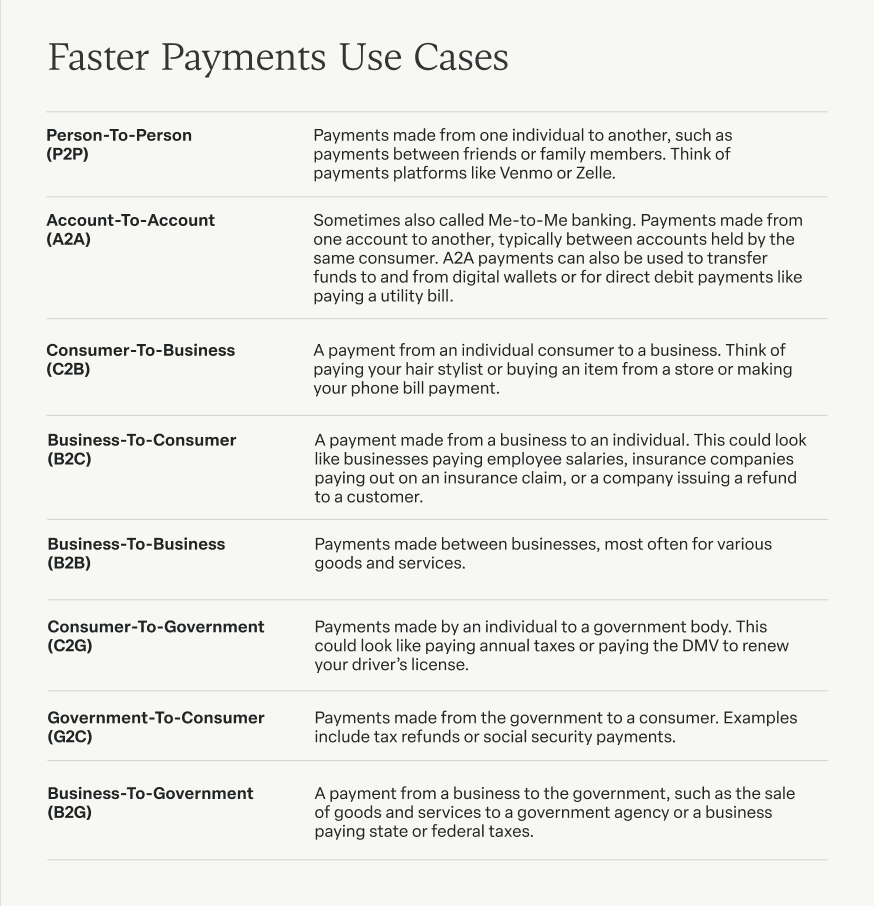

Faster Payments Use Cases

Many other countries have had established faster payments systems for years already. In the US, we will likely see traction gained in the person-to-person (P2P) space first; indeed, we’re already seeing this via apps like Zelle. But as adoption and familiarity with faster payments grows, we will likely see more use cases for faster payments.