How Product and Finance Leaders Think About Payment Operations

In this journal, we take a deep dive into how product and finance leaders view their payment operations based on data from our third annual State of Payment Operations Report.

Last week, we released our 3rd annual State of Payment Operations report. In conjunction with The Harris Poll, we surveyed 500+ financial decision makers for insights into payment operations at their companies.

At more and more companies, product and finance teams are increasingly collaborating, particularly with the growing prevalence of embedded payments. As Modern Treasury COO Rachel Pike noted, for cross-functional product and finance teams, “[embedded payments are] an enormous opportunity across so many industries and so many products…That’s when we see finance and product teams working together — they lock arms and they say, ‘we want to fix these problems with better tools.‘”

For this year’s annual State of Payment Operations report, we heard both from more traditional finance leaders (such as CFOs and controllers) as well as those in product roles (such as Chief Product or Payments Officers). Here, we’re going to look at how both product and finance leaders view their payment operations—where they align, where they differ, and their overall perspective on the current state of payment operations.

Negative Impacts

Both 89% of finance and 91% of product leaders noted that they face problems with their current payment operations—with legacy infrastructure and operational inefficiencies at the heart of a lot of these problems.

Let’s look at the breakdowns of some of these pain points below.

System Sprawl

44% of product leaders and 31% of finance leaders each said that they use more than five systems to manage payment operations. This type of operational sprawl can be particularly challenging as it makes it hard to get a complete view of a company’s current finances and money movement across multiple bank accounts. It comes as little surprise that a disparate approach to payment operations has negative ripple effects felt across the business.

Having so many systems cobbled together can also make reconciliation increasingly challenging, too. Finance leaders, especially, feel this stress, with 34% saying that it takes too long to reconcile payments, whereas this is only a problem for 27% of product leaders.

This lack of real-time visibility into financial position is a particular problem for product leaders who are facing low cash position visibility and high rates of payment failures: 36% of product and 29% of finance leaders specified a problematic lack of real-time insight into cash balances, while 32% of product leaders and 24% of finance leaders say they experience a high rate of payment failures.

Manual Processes

While 39% of finance and 38% of product leaders describe payment operations as manual, product leaders are more likely to describe payment operations as inefficient (31% of product leaders versus 27% of finance leaders) and slow (34% of product leaders versus 21% of finance leaders).

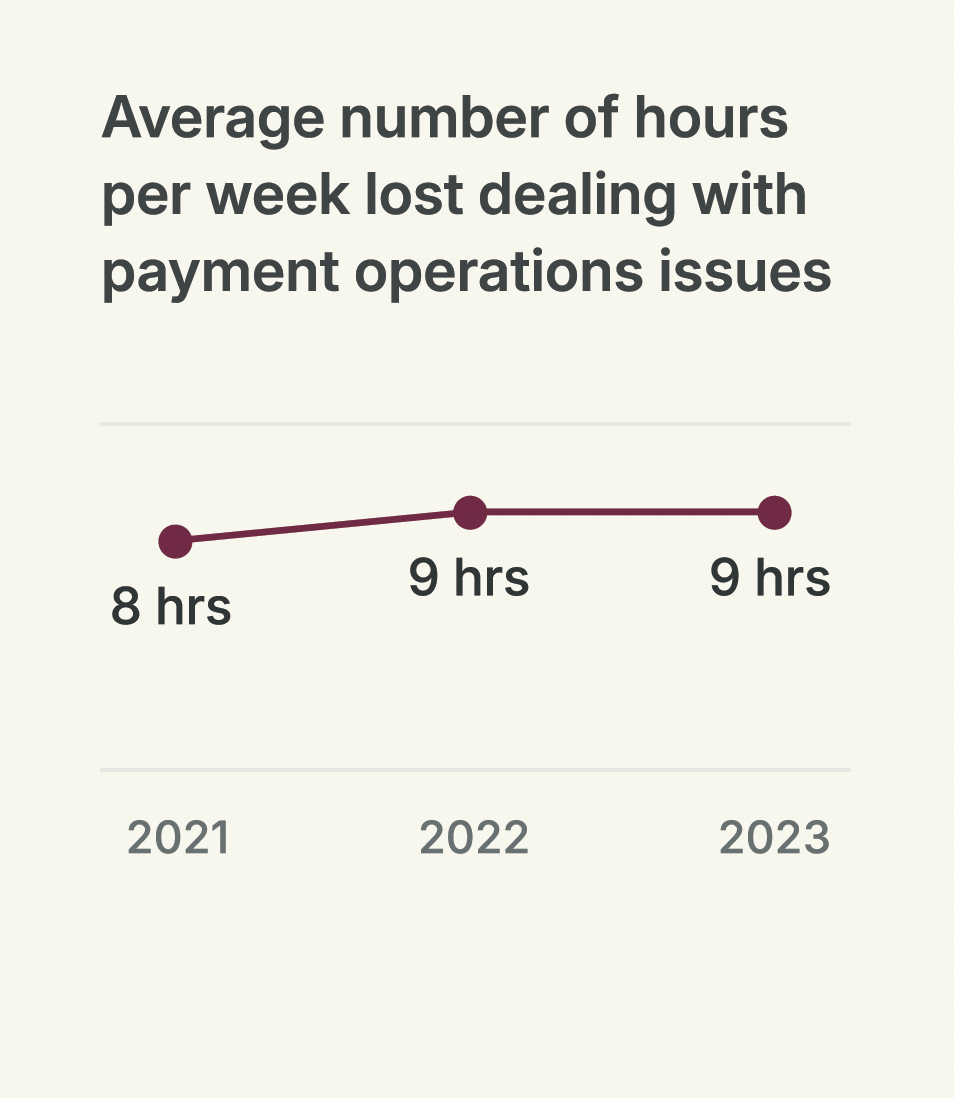

Additionally, 44% of product and 33% of finance leaders say they lose more than eight hours per week dealing with payment operations—largely due to the slow, manual work these processes require for companies that haven’t upgraded or automated. Notably, the number of hours lost to inefficient payment operations per week has continued to increase since our first State of Payment Operations Report in 2021.

Stress & Frustration

Leaders in both camps are dealing with stress and problems with their payment operations and seeing the negative effects. While more product leaders (54%) than finance leaders (47%) admit that their payment operations are causing them stress, both point out that one of the biggest negative impacts of problems with their current payment operations is overall employee frustration.

Financial decision-makers in product roles appear to be, overall, more willing to acknowledge the potential negative impacts of payment operations. While CFOs and those in similar roles contend with a distinct array of challenges linked to financial strategy, financial reporting, investor relations, and the broader fiscal well-being of the organization, CPOs and product leaders grapple with challenges more specific to the products they are developing. For CPOs, this entails ensuring that their products remain compliant with regulatory standards, stand out in the market with unique differentiators, and prioritize customer-centricity to meet evolving demands. As such, these specialized challenges underscore the increasing importance of collaboration between finance and product teams, especially in the context of modern payment operations.

The New Era of Payments

The need for automated and streamlined payment operations is clear. In the new era of payments—with the rise of embedded payments solutions and instant rails, and as consumer expectations for speed and convenience continue to grow—upgrading payment operations is a priority for product and finance teams alike. As the payment landscape continues to evolve, companies that prioritize streamlining and automation will be better positioned to thrive in the modern business ecosystem.

Bank Integrations

97% of leaders in both finance and product both recognize the importance of bank integrations to their companies, though product leaders are more likely to want to build their own (64% of product leaders say they would build or have built their own integrations versus 58%).

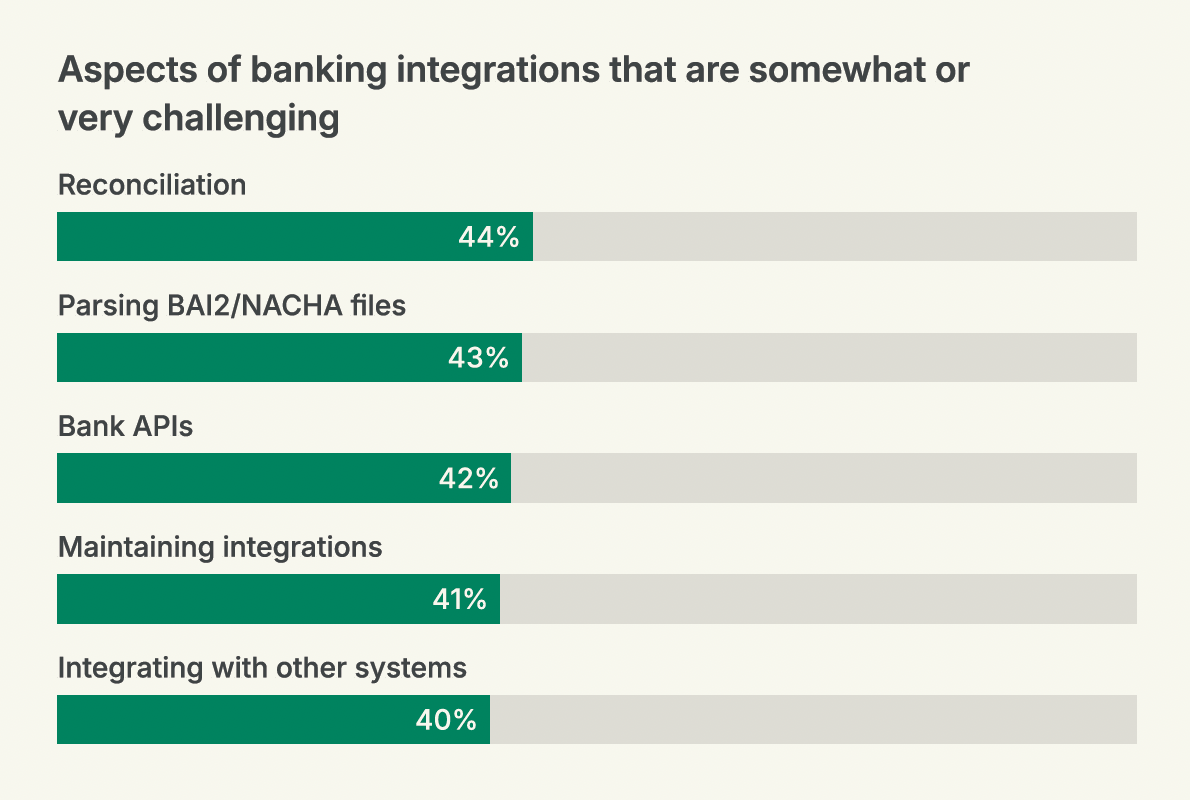

While bank integrations are critical to payment operations they can also present significant challenges when those integrations are built and need to be managed in-house. If more than one bank integration is needed, those challenges only compound and the likelihood of murky-at-best visibility into a company’s cash position increases as well.

Faster Payments

Both sides of the organization are keen to use faster payment rails like FedNow/RTP. Currently, 58% of product leaders and 61% of finance leaders claim to use faster payment rails, with an additional 33% and 25% respectively, planning to start using them in the near future.

Our respondents are using faster payments for:

- Remittance/bill payments: Product Leaders 80%, Finance Leaders 77%

- Payouts and disbursements: Product Leaders 75%, Finance Leaders 78%

- Request for payment (RFP): Product Leaders 73%, Finance Leaders 71%

As product leaders become more involved in payment operations, it’s likely they’ll want their products to make use of the latest payment rails and technologies to power and improve their customer experience. From a finance perspective, too, faster payments can also be more cost effective than wires for payments that require real-time settlement.

Improving Payment Operations

92% of both finance and product leaders agree that it is a priority for their company to improve payment operations and expect to do so primarily by growing the size of their teams and purchasing or building software.

90.5% of both finance and product leaders agree that automating their payment operations would allow their companies to spend more time on strategic matters. 48% of both agree the biggest benefit of upgrading would be delivering a better experience to customers.

What’s Next?

Product leaders understand that the payment process is a crucial touchpoint in the customer journey. Optimized and automated payment operations can enhance a company's reputation, drive customer retention, and improve efficiency. On the other hand, finance leaders are distinctly aware that inefficient payment operations can be a drain on resources. By prioritizing upgrades to payment operations, finance leaders can mitigate these risks and unlock significant cost savings.

While product and finance leaders may still have varying opinions and concerns when it comes to payment operations, one thing is abundantly clear: both think prioritizing upgrades to their payment operations would have numerous positive benefits for their companies. For more insight into how others are thinking about payment operations, read our full State of Payment Operations 2023 report here.

As the operating system for money movement, our platform helps companies improve their payment operations to unlock new payments revenue, strengthen customer experiences, and drive efficiency through their business. If you have questions about how to improve your own business’ payment operations or want to learn more about the Modern Treasury platform, reach out to us.

Note: This post contains insights gathered from a public online survey of 529 financial decision makers representing companies with 500-4,999 employees. Data was collected in June and July 2023 by The Harris Poll.