Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

How Lending Companies Use Modern Treasury

This article will explore the payments infrastructure modern lending companies need, across models. We’ll also dig into three real-world examples where an operating system for money movement proved essential.

Lending is a growth industry. Increasing over 44% within a decade, the total value of commercial and industrial loans was $2.8T as of October 2023. Consumer credit also hit an all-time high the same month, totaling nearly $5T. And this upward trajectory is global. The most cost-effective way for today’s lenders to capitalize on this trend is to move money through their own bank accounts (with fewer fees and greater control than cards, across rails).

Lending Companies Have Unique Payment Needs

From the first lenders of 2000 BCE Mesopotamia to today’s digital credit providers, lending has always been a diverse industry. There exists an ever-increasing variety of ways for individuals, institutions, and businesses to borrow funds and access them right away. Despite this variety, nearly all lending businesses share a common underlying structure: the lender disperses funds to the borrower who repays the loan over a period of time.

In the example below, we assume that the lender sets up two bank accounts: a “Funding” account that will hold all the money to fund a loan, and a “Collections” account that will hold all the monthly payments collected on an ongoing basis.

In terms of payments, the requirements for large lenders are also nearly universal. Lending companies need the ability to:

- Manage high loan volume. Companies with high dollar value and/or transactions for loans (without the right infrastructure) can incur significant operational costs to track payments on their own. Scale also increases the requirement for risk management, particularly in tracking fund flows. Compliance and security tools like KYC, KYB, and account verification are non-negotiable.

- Deliver speed and value. In the competitive landscape of lending, payout speed can be a key differentiator, offering customers superior experience and value. A payment operations system should allow for faster payments across rails (wires, ACH, RTP, and FedNow) and also manage error-handling.

- Handle payment complexity. Companies that offer flexible payback options (i.e., early repayments, flexible payment plans, etc.) need a programmatic way to track and move money. For compliance (and as a general best practice), lenders should use multiple bank accounts and hold cash meant for different purposes in different accounts, which increases complexity. These lenders also need real-time reconciliation to streamline the process of closing the books and prepare for audits.

Especially as interest-bearing lending products have increased in complexity over the years, the importance of robust infrastructure for payments has intensified. A lack of infrastructure shouldn’t be what holds lending companies back from these new opportunities.

Payments Challenges for Lenders

In our recent report on payment operations, a sizable portion of respondents represented lending companies—and shared insight on the challenges they face. For example, 40% were part of companies that offer invoice factoring services, 31% offered loan servicing, and 25% focused on lending.

In comparison to all survey respondents, fintech and traditional finance leaders reported:

- A higher rate of manual payment operations

- A greater likelihood to build payment infrastructure in-house

- A higher incidence of reported payment delays

Given the first two data points around manual work and in-house builds, the reported lags for finance teams aren’t surprising. These results also follow naturally for the lending companies represented.

Historically, options have been limited for lenders managing payments—primarily, building their own bank integrations and/or using third-party senders.

Both solutions can encourage delays. For in-house tooling, teams need time to build, maintain, troubleshoot, and upgrade systems. For third-party senders, time is consumed by the extra “hop” funds make—from the business to the third party to the bank and onwards (and the reverse), versus directly from business to bank or bank to business. Third-party senders also tend to have low transaction limits, minimal compliance checks, and many lack wire services.

Read more about Settle’s invoice factoring product below

Both options can also be more costly, since custom solutions require significant engineering investment, and per-transaction fees with third-party senders can add up. Without the right solution, however, it’s difficult for lenders to collect all funds they are owed, track user balances, track expected payments for cash flow management and visibility, or reconcile incoming loan repayments to loan balances.

Payment Operations Across Lending Models

Modern Treasury is an operating system for money movement that supports lending companies looking to scale. Key benefits for lending operations include:

Visibility and automation. Modern Treasury offers a unified ledger and real-time reconciliation—a unified source of truth for money movement. End-users benefit from automatic, reliable reporting on loan balances and lenders enjoy increased visibility into expected payments to help with forecasting cash flow.

Speed and flexibility. Lending companies can increase the speed of payments across rails—wires, ACH, RTP, and FedNow. They can also add new rails and access multiple banks, affording flexibility as businesses grow but also serving an important function when it comes to business continuity.

Security and troubleshooting. To facilitate secure onboarding, Modern Treasury offers integrated risk management, including embedded KYC, KYB, and account verification. Companies are also able to reduce and better manage hiccups. As an example, Modern Treasury reduces ACH returns through timely NSF checks, handles existing returns, deals with ACH errors, and tracks missing checks.

Composable APIs. Modern Treasury’s best-in-class APIs are flexible, serving as building blocks to power any lending model. For a look into APIs for lending flows, check out this article on building a lender.

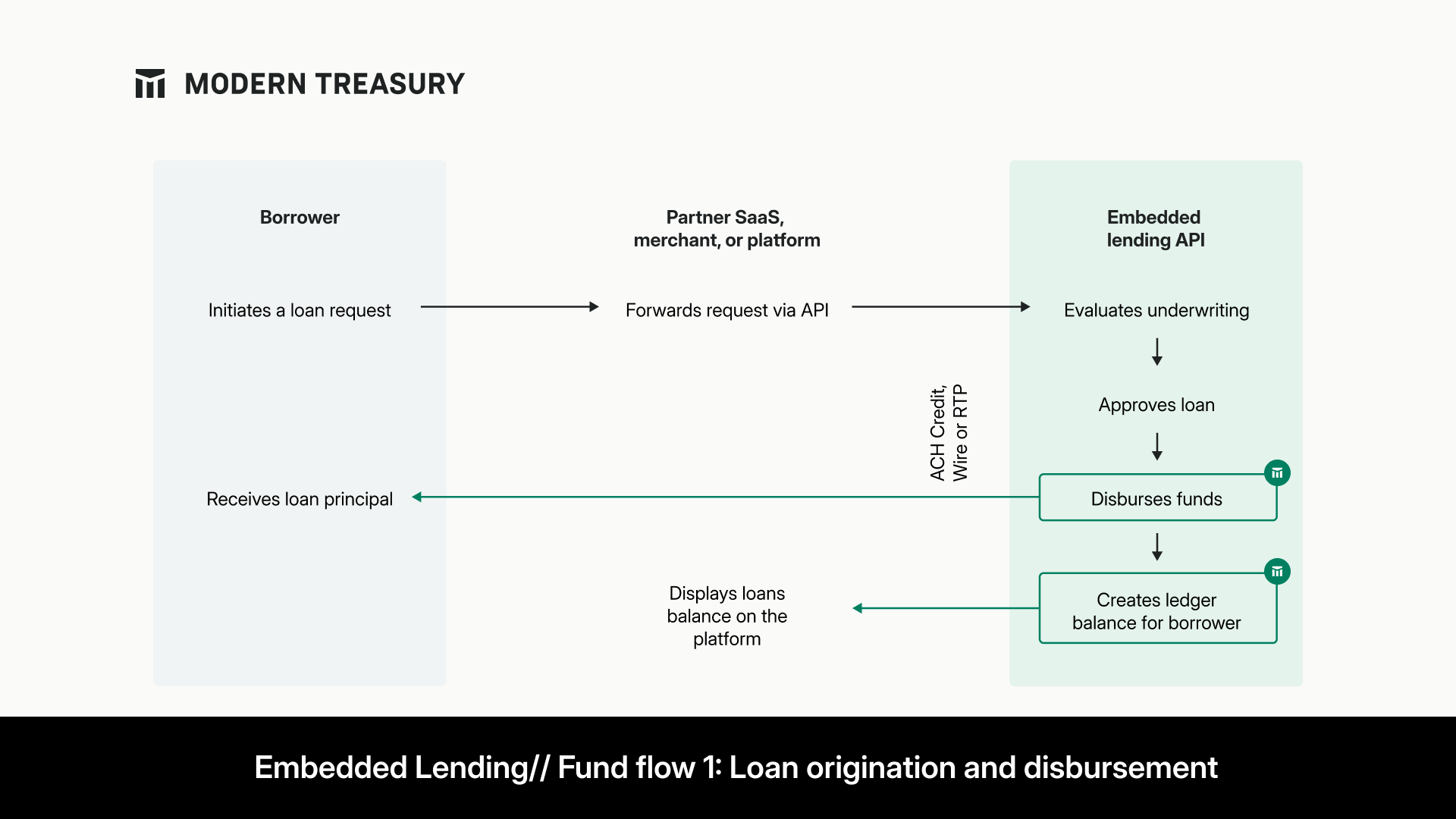

The two diagrams below give an example of how Modern Treasury can support embedded fund flows.

Modern Treasury can help lenders of all kinds automate and scale, including:

- Lending marketplaces

- Working capital financing

- Invoice factoring

- Mortgage lending

- BNPL

- Lending SaaS

- Loan servicing

- Debt facilities

Let’s dig into three of these—lending marketplaces, working capital financing, and invoice factoring—to explore payment operations at scale.

Model Lenders in Action

Although lenders across models seek similar outcomes (speed, automation, security), each model has specific requirements and concerns.

Working Capital Financing: Capchase

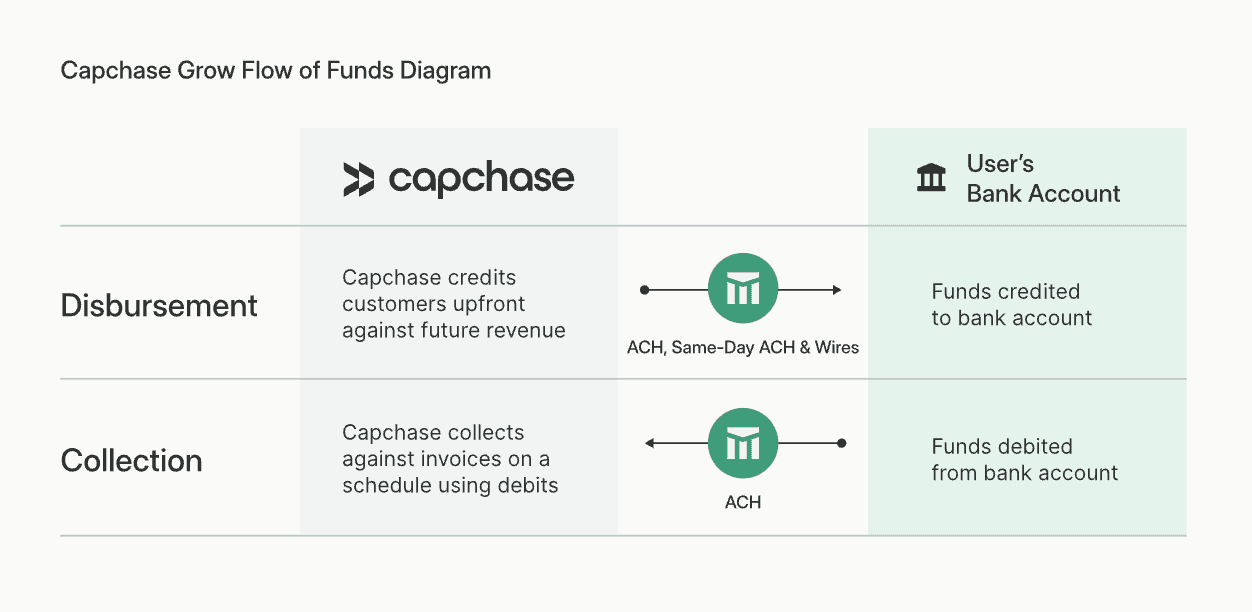

Capchase offers flexible, non-dilutive funding for global subscription-based and SaaS companies. Among other offerings, Capchase provides working capital for customers looking to scale startup investments.

The challenge:

Before working with Modern Treasury, Capchase was managing payments exclusively via manual payouts. However, as Capchase’s customer base increased—and in turn, the total volume of payments—a manual process was too time-consuming and error-prone. Capchase needed a programmatic payment solution.

Capchase wanted direct access to bank rails but a third party that sits in the flow of funds would introduce additional processing time and take control of underlying infrastructure away from Capchase.

How Modern Treasury helped:

Capchase went live with Modern Treasury within a month. This partnership helps Capchase make reliable payouts, leverage complete visibility into payment flows, and save hundreds of developer hours that an in-house build would have required.

Capchase now has reliability, control, and real-time insight moving an average of $750M through Modern Treasury per year.

The team has reduced manual payment operations work by 90%—they also have full confidence in financial data, as illustrated by a recent audit.

“Our ability to provide required information completely off the shelf during last year’s full financial audit was invaluable. That the auditor could track every single transaction associated with every single loan in our system, and then associate it to every single pay out in our bank, was incredibly powerful,” says Salima Ghadimi, Manager of Platform Operations.

Invoice Factoring: Settle

Settle provides a cash flow management platform for e-commerce companies that makes paying vendors anywhere in the world seamless and efficient. Among its offerings, Settle provides invoice factoring services to payers and vendors.

The challenge:

As a business focused on e-commerce and Consumer Packaged Goods (CPG) companies with long lead times between sales and revenue, quick payment settlement matters to Settle customers. Additionally, Settle needs:

- To accurately track and reconcile each transaction on time, given the risk Settle takes on transactions to provide faster payment settlement

- Correctly attribute transactions for the repayment of factored invoices to customer loan balances

- Provide both buyers and sellers with complete visibility into payment statuses

- Manage the increasing complexity of payment operations with Settle’s growing number of customers and transactions

In the conversation below, Settle co-founder and CEO joins other finance leaders to discuss the connection between automated payment operations and scalability.

How Modern Treasury helped:

It took the Settle team four weeks to complete the bank integration, set up the APIs, and make their first payment.

In addition to flows for accounts payable, Settle has used Modern Treasury to create a payments experience allowing customers to make payments anywhere in the world using ACH and wire.

Since its launch in 2019, Settle has scaled to over $100M in payments processed per month.

A Powerful Partner for Lending Operations

Modern Treasury is here to help lending companies scale. Our suite of APIs foster growth with automatic reconciliation, faster payments, and real-time financial data. Reach out to learn more.

More on real estate use cases here.