Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Operating at Scale: Announcing New Features for High-Volume Money Movement

Today, we are announcing new features dedicated to helping companies move, track, and reconcile a high volume of payments at scale.

Most of our customers handle a high volume of payments. With volume comes complexity. Modern Treasury is built to automate the initiation, tracking, and reconciliation of billions of payments a day for our largest customers. These features are meant to help companies better manage this complexity and automate money movement at scale:

- Support for increased rate limits for select customers

- Dedicated tenancy for data isolation

- Bulk operation endpoints to batch create API objects at high volume

Support for Increased Rate Limits with Priority RPS

Modern Treasury typically supports 100 requests per second across the API. However, it’s common for our customers to send, ledger, and reconcile hundreds of thousands of payments in high frequency. Many of our customers also tend to deal with time windows where performance needs to be temporarily upgraded (e.g. ledgering a peak number of transactions on a Black Friday).

To address this, we’ve introduced Priority RPS. This feature allows enterprise customers to make API calls up to 500 Requests per Second. With Priority RPS, our customers know their requests will be processed fast, reliably, and without hitting rate limits.

This feature is useful for any high-volume use case but is especially well-suited to:

- Ledgering card transactions or using a ledger to authorize card transactions in real-time

- Informing near real-time reconciliation and money movement in high-usage fintech consumer apps (i.e neobanks, digital wallets, consumer lenders)

- Looking for an accurate assessment of cash positions when dealing with a global scale and a high volume of bank accounts and counterparties being updated simultaneously

Dedicated Tenancy

Dedicated cloud infrastructure can help minimize the risk of incidents and throttled performance from other customers. We are launching Dedicated Tenancy to give customers limited exposure to performance degradation caused by exogenous behavior. Using a cell-based architecture, customers can better control feature releases and API usage, unlock the ability to process higher rate limits with Priority RPS, and get infinite headroom for fast scaling.

Dedicated Tenancy is designed to help customers meet stringent IT and system security requirements.

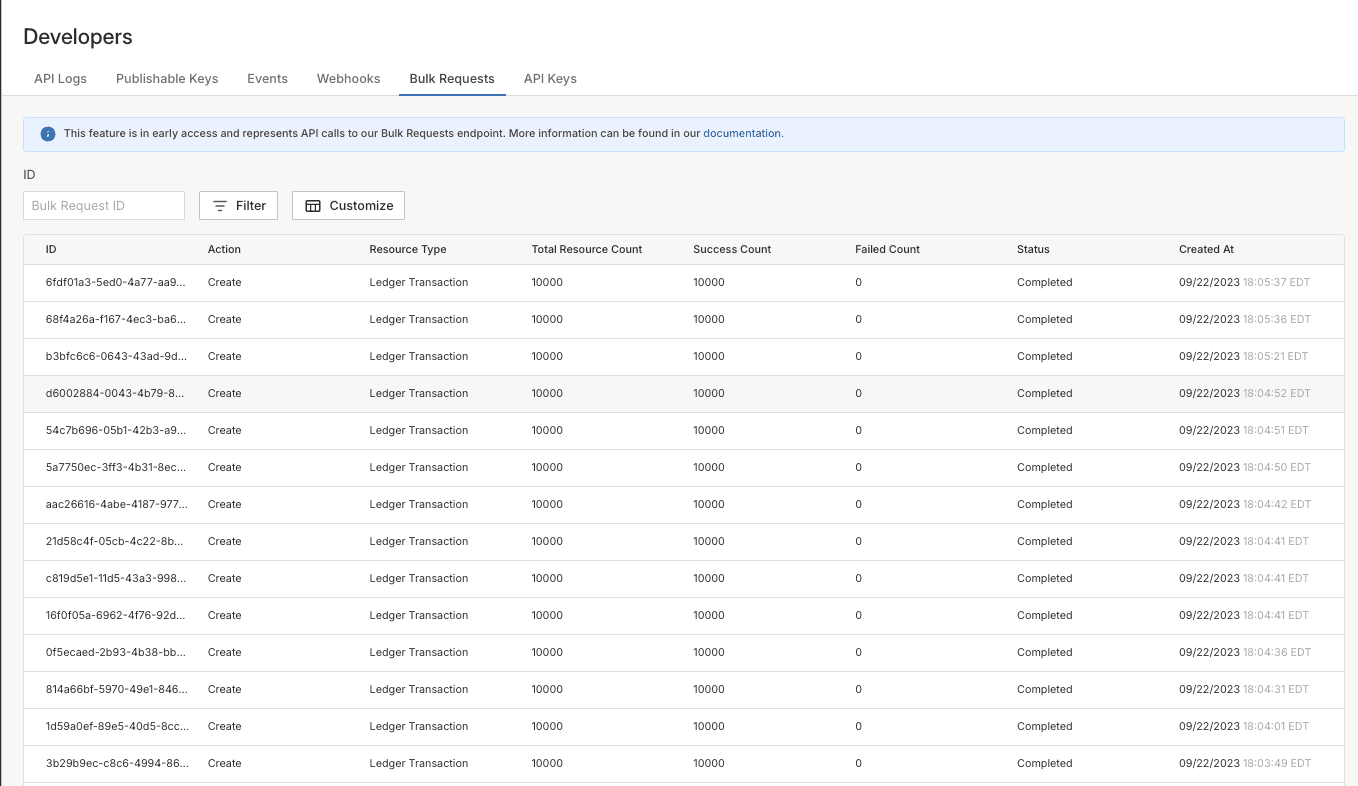

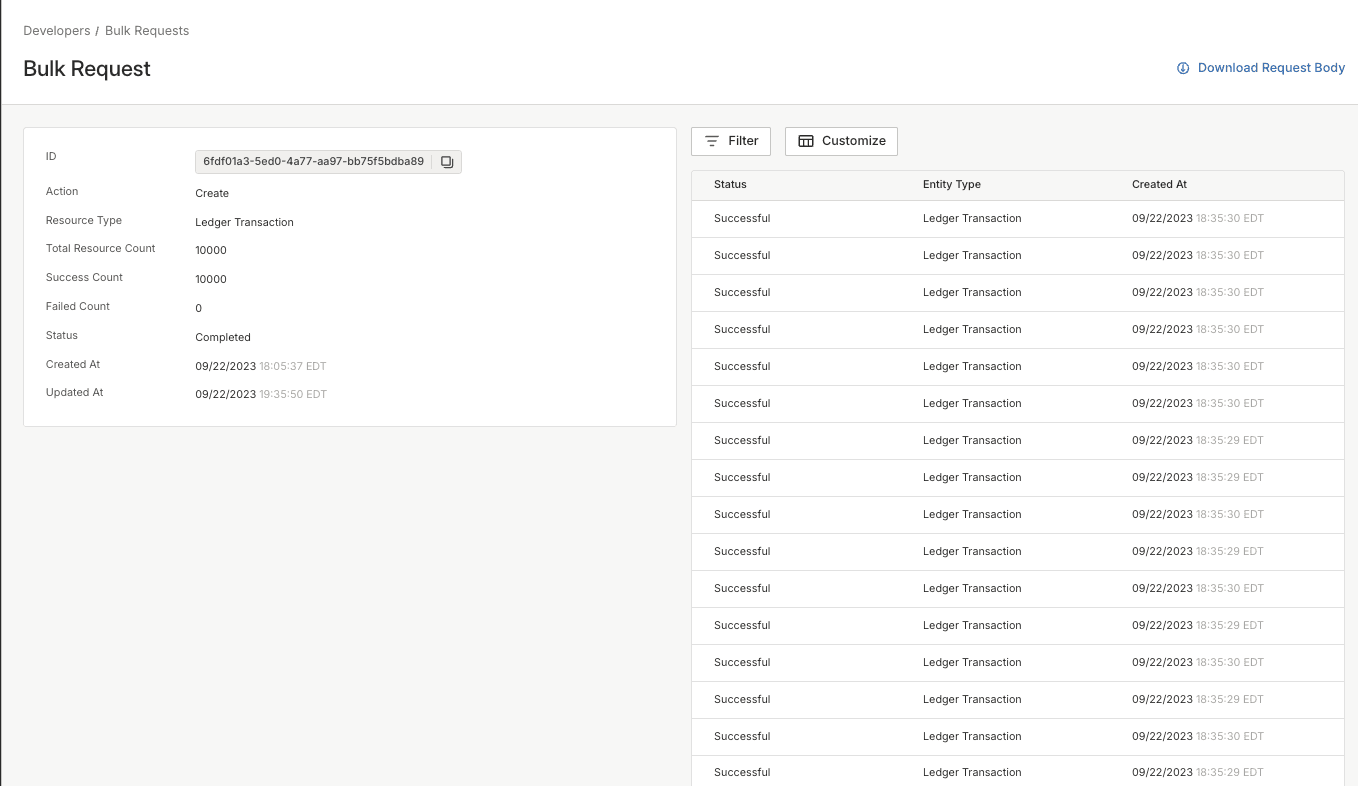

Bulk API Operations

Customers often need to create a high number of API objects with a single call. Our Bulk Operations API allows customers to create up to 10,000 of the following objects with a single request:

- Payment Orders

- Expected Payments

- Ledger Accounts

This feature is particularly useful for customers with concentrated transaction volume in time-sensitive windows:

- Large payroll providers that need to process payouts in tight timing cadences

- Lenders with pre-defined payment schedules who send and receive a large volume of payments on pre-defined dates of the month

- Marketplaces with a concentration of transactions caused by seasonality, holidays, or day of the week

Users can also now debug and view analytics for bulk operations in the app via the dashboard in the Developers tab.

Scale Your Payments with Modern Treasury

As the operating system for money movement, Modern Treasury was designed to give enterprise payments teams the tools they need to manage money movement programmatically, consistently, with context, and in real-time. If you are a payments leader looking to scale money movement, reach out to us here.