Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

Recon Diaries, Entry III: Check Reconciliation

In the third part of our Recon Diaries series, we take a close look at check reconciliation and discuss why it matters.

The US payment networks are not modern technological marvels. In fact, they might more closely resemble, as Bill Gates called it, impossible dinosaurs. As mentioned previously in the Recon Diaries, most were built in the mid-20th century on COBOL software, run by underpowered mainframe computers. They have limited data capacity; they batch transactions; they take, in some cases, days to clear and settle.

Nevertheless, the US payment networks are marvels of coordination. Each has built networks that unite thousands of banks and millions of consumers and businesses. Each has created operating models that foster collaboration and facilitate trust. Collaboration governs information sharing across the network. Trust acts as the backbone of credit; outlined by the network’s operating model and enforced by each network participant.

In practice, this means that for each payment method (i.e., ACH, wire, check, RTP, card, etc.) there are agreed upon rules that dictate how payment information should be formatted and transmitted, and procedures to handle failures, and manage disputes and arbitration. That is, through collaboration and trust, the network creates clarity: around processes, risk, and ownership. Clarity then allows financial institutions, who manage and transfer financial risk, to understand the product, package it, price it, and promote it appropriately. Furthermore, with well-defined swim lanes, non-bank participants can identify opportunities to expand and enrich the network as well.

To highlight the most prominent example—Visa and Mastercard have built a stunningly elegant network that balances the competing interests of multiple participants. We’ve discussed this in previous posts:

The card networks created the interchange revenue model to balance the interests of both sides of the network. Interchange is the mechanism to transfer value from the merchants—who benefit from accepting payment cards—to the issuers, who incur costs associated with marketing, servicing, and supporting (e.g., credit / fraud risks) those cards.

It’s a near-perfect model. Everyone wins and, more importantly, everyone is incentivized to invest in the network. As a result, there’s been an explosion of innovation, unlocking trillions of dollars of value, that has benefited participants as varied as you, me, Apple, Stripe, Fiserv, Chase, Marqeta, Bill, Ramp, and nearly every merchant across the globe.

US Payment Networks Solve Hard Problems. Automatic Reconciliation Unlocks Them.

In sum, the US payment networks have solved hard coordination problems imbued with massive costs, which are born out over many decades. Each of these networks is incredibly valuable and sticky.

The pressing issue facing companies today is—How can I build products and processes that leverage the incredible power and utility of these payment networks, while integrating their stodgy technology and disparate processes into a seamless, modern experience? Sometimes, it can feel like building skyscrapers on sand.

The answer—at least, if you ask us—is software. Companies require a standardized software operating system that automatically tracks each payment, attributes it, and accounts for it (i.e., reconciles) across each network, and then integrates that payment seamlessly into a workflow. Automatic reconciliation is the technological bedrock upon which modern payment experiences are built.

The Check

We can illustrate through the payment network with the fewest defenders: the check.

The checking system is the oldest and most widely-used payment network. Its history is tightly intertwined with the history of US banking.

Checks, or an early incarnation, were created shortly after our country’s founding due to a lack of money, which slowed trade and commerce. Robert Morris, one of the founders of the US financial system, recalled that farmers would set up on Market Street in Philadelphia, only to drive their wagons home at the end of the day as full as they arrived. There were no buyers because there was no available cash to make purchases. Morris said, “Produce in the market had been plenty, and I had eagerly bent on the purchase of it, but could not command the money for the purchase although possessed of sufficient property.”

Merchants of Philadelphia created America’s first bank, called The Bank of North America, to help increase the availability of money. The bank furnished notes to merchants, secured by their debt holdings, which then served as a means of payment throughout the community.

The notes or checks—like newer payment methods after them—increased liquidity and cash-flow, which then helped to accelerate the velocity of trade, commerce, and economic growth.

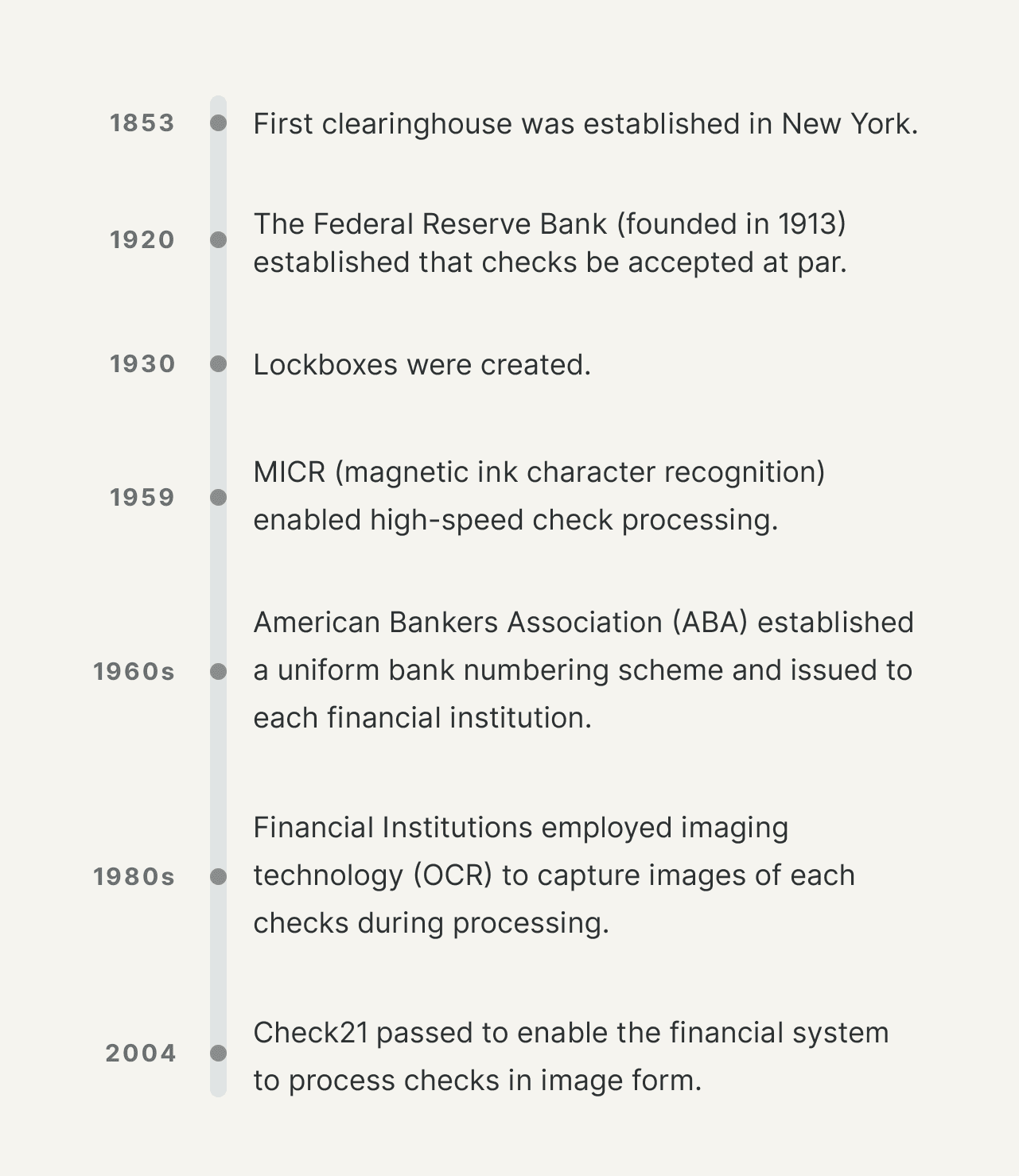

Banks across the United States soon began offering their own notes, which were traded as payment. Organically, a system of exchange arose. Incremental organizational and technological innovations soon followed:

It’s an incredible feat of alignment, but, technologically, no modern marvel. One could say that the technology backbone of the US check network dates back to the 1980s.

Check Usage

Checks, like every payment method, serve an important function in our financial system. As we noted in a previous Journal entry, in 2018, consumers and businesses deposited 14.5 billion paper checks, totaling nearly $26 trillion. A stunning 70% of B2B payment volume is processed with checks. Although certainly not sexy, checks have strong utility and a number of compelling benefits:

- Flexibility. Checks are easy and flexible. They can be sent to any recipient simply with a name and address.

- Security. Checks are secure. Recipients do not need to share sensitive banking information, such as account and routing number.

- Float. Checks offer payers float due to their lengthy transit and settlement windows.

In addition to these benefits, checks are familiar and habitual. And, habits, as we know, are very sticky.

Due to the strength of the check network, today’s companies need the ability to support check capabilities to satisfy their customer preferences, and meet their industries ‘where they are.’ In a recent webinar, Ashton Braun, CEO of Silo, and Jess Levin Conroy, CEO of Carats & Cake, both spoke of the need to support a broad diversity of payment networks to offer platform completeness: “Folks want one place to do all their payments. And so we have to support all of them.”

Nevertheless, each payment method is different; sending or collecting a check, as Ashton noted, has totally different processes and tracking and transparency then sending a wire or an ACH. And translating an analog payment instrument into a simple, automated digital product experience is especially tricky.

At Modern Treasury, we often hear companies ask: How can I deliver a delightful, transparent consumer lending platform that enables members (i.e., borrowers) to see their loan repayments made via check? Or, How can I build a modern vertical-specific B2B payment solution that allows companies to receive and send check payments?

We tell them: “You need a recon platform.”

Check Recon

We can revisit the University of Modern Treasury (UMT) to illustrate why.

As you might recall, to offer a sleek and seamless donor experience, UMT needs the ability to integrate their check donations into an automated donor workflow. In particular, when UMT receives a check donation in their bank account, UMT wants the ability to automatically update the payment entry in their internal financial database from “pledge” (i.e., expected payment) to “gift” (i.e., received payment).

Then, once the payment is confirmed and the UMT internal database updated, the system can automatically initiate an integrated workflow that:

- Acknowledges the gift and thanks the donor.

- Provides insight into how the funds will be used.

- Invites the donor to future community and engagement events.

It’s a great alumni experience, and a simple and seamless back-office process. Reconciliation is the lynchpin of the integrated workflow.

Nevertheless, reconciling (i.e., tracking and attributing) the incoming check is especially difficult. The fundamental issue is that checks, unlike other electronic payment methods, handle payment messages in unreliable ways.

In Recon Diaries Entry II, we discussed how the banking system—and even specific banks––introduce noise (i.e., batching, data limiting, asynchronous settlement) into payment messages predictably. As a result, the MT recon platform is able to utilize strategies, based upon pattern matching, to reliably cut through the noise and match each “expected payment” to “an actual payment” on your bank statement. Success: transaction reconciled.

However, because checks are analog payment instruments, they require an additional step in the reconciliation process—they must first be converted into a digital payment message. Banks do this by offering lockbox services that collect and process individual checks on your behalf. In most cases, we’ve found that banks outsource these services to a wholesale bank provider, such as BNY Mellon.

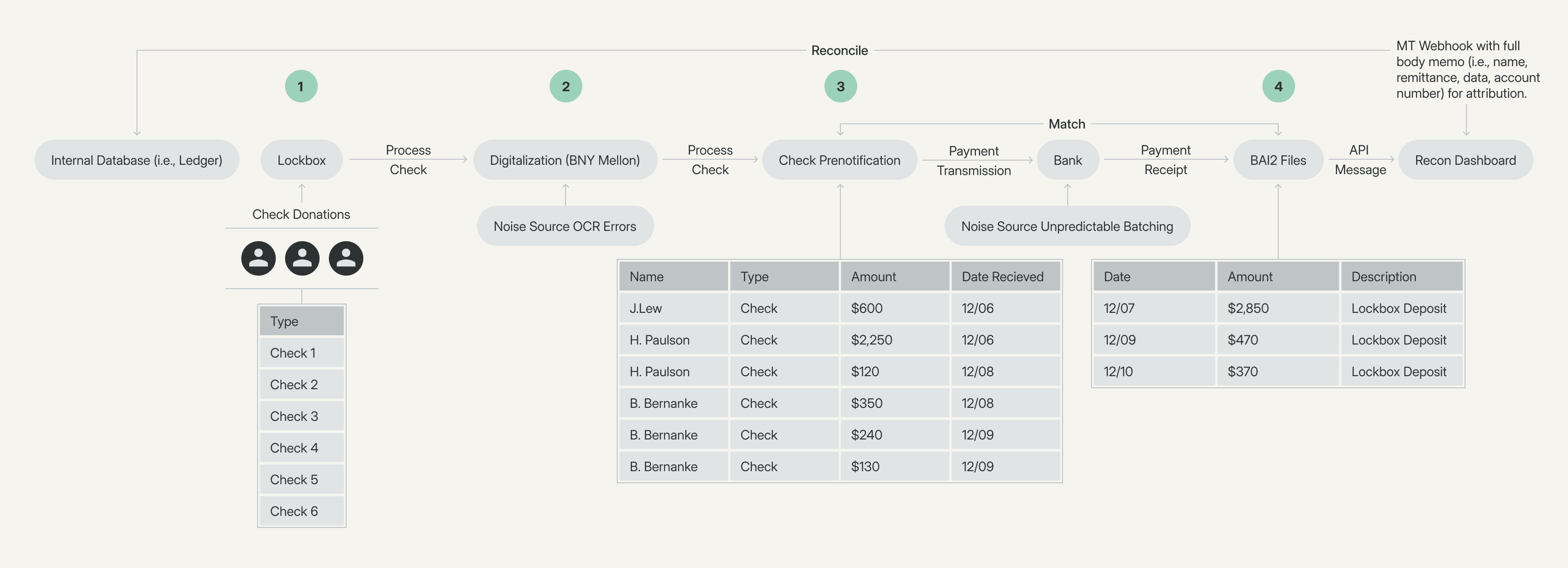

Here’s how it works:

- Lockbox attendants process the checks in your corporate lockbox by scanning the payment with OCR technology.

- Once digitized, the checks (i.e., paper items) are collated in a payment message, called a pre-notification.

- These paper items in the pre-notification message are then processed by your bank.

- The bank then returns a batched bank file, called a BAI2, that reflects the actual, received money in your account.

To reconcile the transaction, one must match the check transactions in the pre-notification file (Step 3) against the batched transactions in the payment file (Step 4).

Nevertheless, the issue with checks is that, because humans are processing the individual checks, the payment messages are susceptible to human quirks and variation. Humans work shifts; they have different work habits; they make mistakes. As a result, compared to other electronic payment methods, checks are particularly susceptible to shifting patterns. To give an example, when a lockbox employee changes shifts, we often notice a pattern switch. One employee might organize and process checks by counterparty; another might process checks by size, date, or some other criteria.

To account for these shifting patterns, our team has developed a sophisticated multi-pattern matching engine that automatically reconciles 99.9% of all transactions. We’ve tuned this engine to have extremely low false positive rates so that we’re confident about every reconciled payment. And, for any transactions flagged as unreconciled exceptions, we’ve deployed a human-in-the-loop system to ensure that they are reviewed by our team of experts. This allows us to identify new patterns and (if needed) operationally resolve unmatched transactions so that clients have few exceptions to worry about.

Taken together, our recon platform automatically tracks, attributes and accounts for each check transaction, allowing our clients to deliver products and workflows that leverage the power of the check network within a modern, streamlined user experience.

To learn more about recon at Modern Treasury, reach out to us.