Straight-Through Processing and Reconciliation: Key Takeaways from our Coffee Chat with Nacha

Modern Treasury recently hosted a coffee chat with Nacha to discuss straight-through processing and reconciliation. This journal digs into some of the key takeaways from our discussion.

The conversation, which featured Rob Unger, Senior Director Product Management and Strategic Initiatives at Nacha, and Sam Aarons, Co-Founder and CTO at Modern Treasury largely focused on how Nacha and Modern Treasury approach straight-through processing and why it’s a key component in simplifying reconciliation. Read on to hear more insights from these two experts or check out the full discussion here.

Q: Let’s start with a definition of straight-through processing (STP) How do Nacha and Modern Treasury approach STP?

Rob: When I think of straight-through processing, it brings to mind my days as a coin collector. During those times, there were various grades of coins to collect, with the best being proof sets that were issued annually. These sets remained untouched by human hands, and, to me, they serve as a metaphor for straight-through processing, where data about a payment is received and processed without human intervention.

In the US, ACH holds a unique position in assisting companies with straight-through processing. We facilitate a substantial amount of remittance information, which sets us apart from most other ACH systems worldwide. These systems are typically limited in the amount of remittance information they can handle.

In contrast, we observe significant growth in the Financial Electronic Data Interchange (FEDI) within the ACH system, marked by double-digit increases each year. Many individuals and entities are capitalizing on this trend to send information that aids in reconciling payments, including invoice numbers and applied discounts. This information helps payment receivers apply that cash appropriately.

Sam: When we consider straight-through processing, we approach it in two different ways. We have a lot of customers who send payments straight-through, and likewise, we have a lot of customers on the receiving end who receive payments straight-through. The approach we take at Modern Treasury depends on the direction that you’re sending the payments.

For users of Modern Treasury, the big idea is that you can add as much context and as much information as you want to a payment, because we will take that and store that information. Then we try to make sure to have all that information in the actual payment that gets sent to the network as much as possible, so that it can make it to the receiving side intact or in a way that a receiver can easily process it straight-through.

We encourage that on the Modern Treasury side by having data fields that contain this information, which can be attached to a payment when you're sending it. Our goal on the receiving side is, when we take in an incoming payment, with all of this rich information in it, we can take it, parse it, present it to the back end systems of the receiver, and say, “Hey, you just received a $100 ACH payment. Here's all the information we have on it. Here's everything we know about it.”

We're able to do that because we work very closely with Nacha to understand the standards and specifications, so that we can pass that information in a structured and understandable way to the receiver.

Q: Both of you touched on structured and unstructured remittance information and how it clarifies what a payment is for, which ultimately makes reconciliation easier. Rob, can you talk about the ways Nacha is tracking payments data and remittance information?

Rob: Absolutely, remittance information used to be straightforward during the check days. You sent a check, and your information was right there on the check. However, nowadays, it's like dealing with a massive, unruly blob. Remittance information can arrive via email, in PDFs, spreadsheets in the mail, through lockboxes, portals, EDI, value-added networks, and sometimes even by foot for all we know. This is where a company like Modern Treasury becomes incredibly important in the equation.

Our studies have shown that the majority of remittances, specifically less than 20% in a study from a few years ago, are processed automatically and straight-through. It's akin to the concept of untouched "proof sets." Companies struggle immensely with managing this remittance “blob.”

As we explore potential solutions, we have the ACH system at our disposal. As Sam mentioned, ACH allows for sending extensive information—up to 9,999 80-character records. So we're uniquely positioned in this regard to educate customers and the ACH community about best practices for straight-through processing.

Successful companies that achieve high straight-through processing also track payment costs. Hand processing and reconciliation are considerably more expensive, leading to higher exception rates and labor costs. Another distinguishing aspect is that these companies pay and get paid via ACH.

Q: Rob shared that only 20% of remittances use straight-through processing, which is staggering. It can take a lot of resources to do this type of work manually, especially if there are issues with payments. Can you tell us more about how STP and automation make it easier to handle exceptions?

Sam: It really depends on the category of the exception. So one type of exception is, “I received the money, but I don't know who it's for” and as a result, I need manual work to investigate. The other exception is just normal dealings with the ACH system. But both still have to have some manual intervention. There's a huge amount of manual work that goes into investigating an individual ACH payment.

Let's say that you're a utility provider—let's say you get millions of ACH payments. If you need a person to go in and evaluate each of the million ACH payments you get in the month to understand, “This is Chris's bill, and this is Rob's bill”—that takes a lot of time if you're doing it a million times a month.

But that is what some companies are doing—maybe not at that exact scale, but for a lot of payments a month. They are going through and saying, “Hey, I received an ACH Payment. Who is it for?” And the moment that you hear that you've got an ACH payment and you don't know what it's for, that's a clue that you need to automate the process. For example, if I’m a utility provider I'm going out and I'm debiting people, I could receive returns or knocks, or any of the other things that can come back through the ACH network to indicate that I didn’t get the money I was trying to debit. That is also an exceptional process.

And if you have humans in the loop who then have to manually go into a system to note that the money hasn’t arrived, you're not processing the return straight-through. And that is an often under-talked-about, but still equally big, problem where you're not straight-through processing: the exceptions themselves, returns, reversals, anything that can happen in the ACH system that is outside of the ordinary. There are a lot of exceptions and manual work if you don't have a straight-through system.

Q: Let’s take a step back and connect some of these dots. It sounds like there’s a lot of upside to straight-through processing, but there’s a gap in who’s taking advantage of it. What strategies can companies use to implement straight-through processing to start experiencing the upside?

Rob: The US ACH, unlike a lot of systems worldwide, facilitates both credits and debits. And the debit is like a magic tool. A lot of companies think B2Bs don't accept debits, but in reality lots of them do.

It's an especially great tool as you interact with smaller or medium sized businesses, because they don't have to have the systems in place or try to figure out how to send remittance information. Utilizing ACH debits can make your customers' lives easier. They just need to have an agreement as part of that upfront negotiation that says, “Hey, you can debit my account.” And maybe you can even provide them with some sort of incentive to allow for those debits—which will solve a lot of remittance problems.

Sam: I would just add that this is an immense strength of the ACH network, that debit capability. I was on a podcast recently, talking about different types of payments.

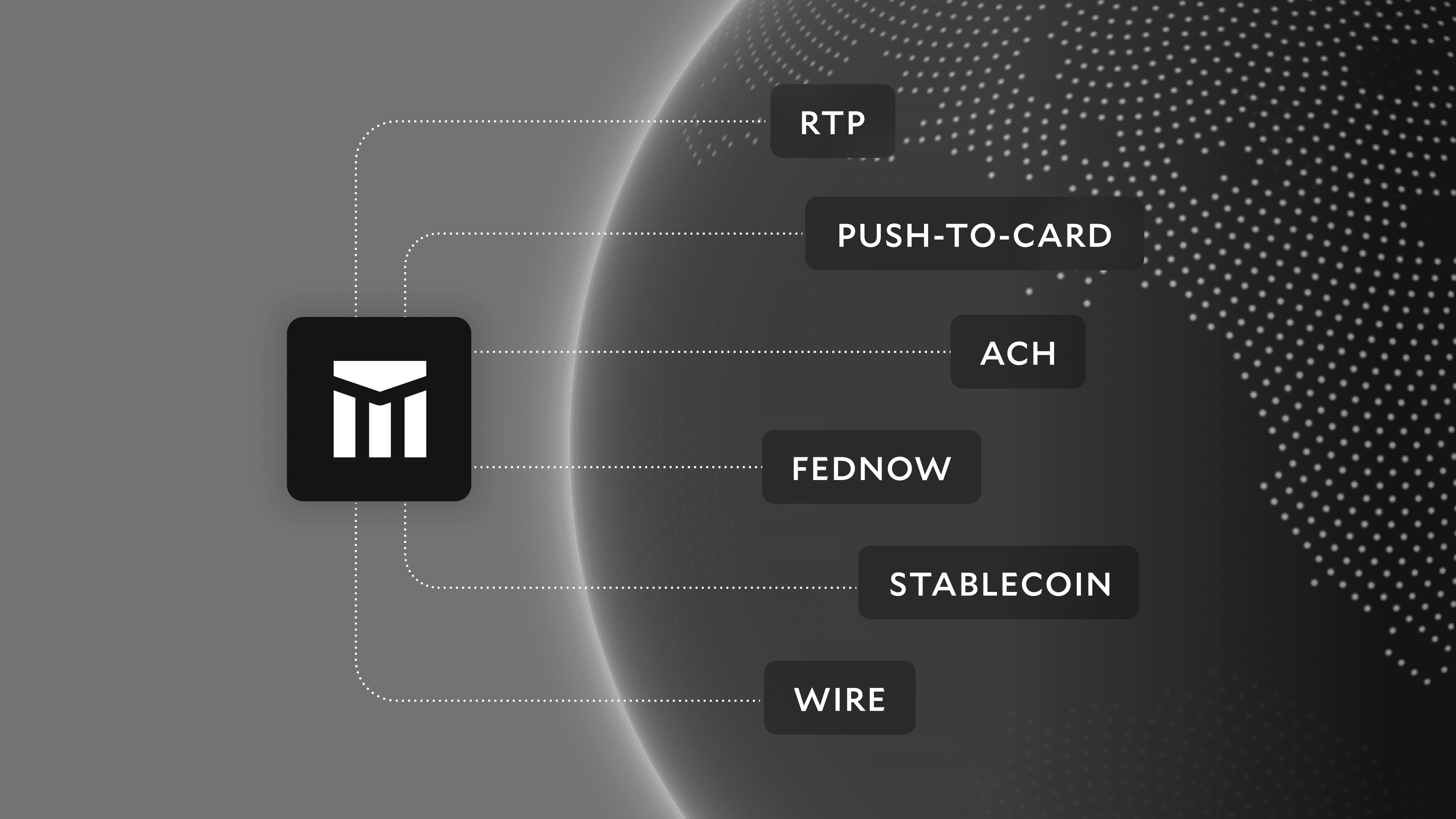

Obviously a lot of people want to talk about FedNow and RTP and credit cards, because we have all these great payment systems available to us. But I made a point to say that ACH is amazing, because it is the only system that allows for those debits. A lot of countries have new, fast, even instant payment systems and those are great, but many still don’t allow for debits.

The originator of the debit gets to control the payment flows and be on top of it and they will still need a way to manage and stay on top of returns. But in a business-to-business debit scenario I still think straight-through processing is important because it allows for the originator of the debit to say, “Hey, this is why I’m debiting you. It’s for these invoices.”

But for the receiver of that debit, it is extremely important for them to know why, for example, $10,000 just left their account. And if they have that rich remittance information that Nacha lets you send in an ACH file, then they will have that context. Remittance information and straight-through processing is still really important, even in the world of ACH debits.

Rob: When you look at ACH, which is the biggest payment system in the United States— 50 billion transactions annually moving 70 trillion dollars—the bulk of that is in consumer debits. Consumers that are being debited by utility companies and mortgage companies and businesses that are being debited. So the debit is huge and it's available via US ACH.

To hear the full discussion, including a Q&A session with the audience, watch the recording here.