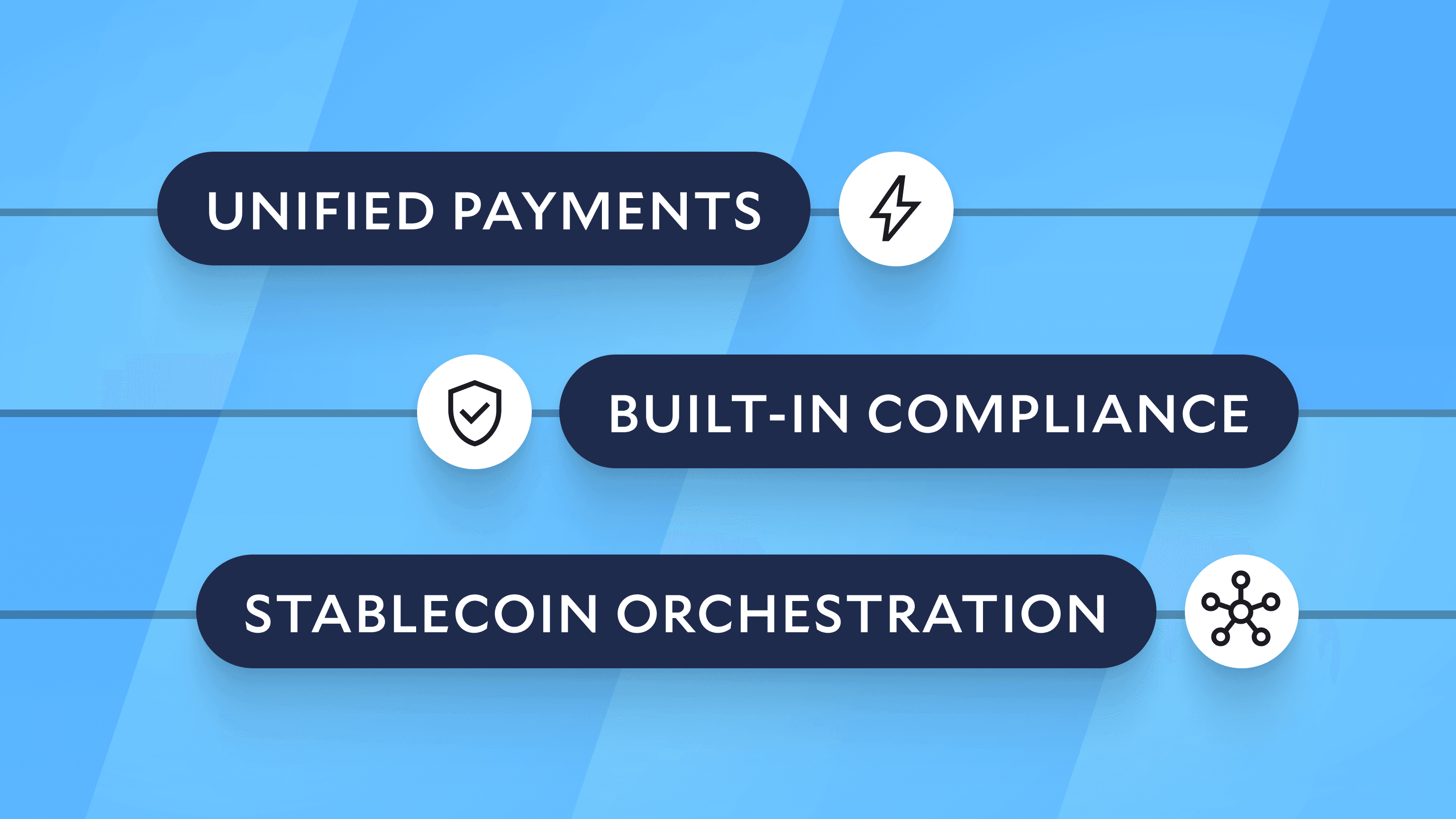

Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

The Evolution of Virtual Accounts at Modern Treasury

Modern Treasury supports extended functionality for virtual accounts. For each virtual account, you can now track balances, retrieve a list of transactions, and originate payments directly.

History

Over a year ago Modern Treasury released Virtual Accounts into the world. Fundamentally, the term “virtual account” refers to an alias account number that is linked to a physical bank account. These account numbers are used to receive payments that settle into the linked bank account. In this way, virtual accounts are similar to multiple email aliases that can be used to forward emails to a single email inbox.

With Modern Treasury, you can flexibly associate these account numbers according to your use case. Common use cases include: attributing incoming payments, holding funds on behalf of users, and operating an in-house bank.

New Developments

Recently, financial institutions such as Goldman Sachs have extended the functionality of virtual accounts. For each virtual account, you can now track balances, retrieve a list of transactions, and originate payments directly.

At Modern Treasury, we fully support the extended functionality of these virtual accounts. As before, you can programmatically create Virtual Accounts through our API. But now it’s also possible to craft custom payment flows and query for balances and transactions on each account through our API or dashboard.

How It Works

For a business with virtual accounts at Goldman Sachs, for example, a common use case is to hold funds on behalf of their users. This can be accomplished at Modern Treasury by simply creating a Virtual Account and linking it to a Counterparty. This allows for identifying users by name, email, external bank account, and more. The transactions will then credit and debit the Virtual Account automatically, allowing you to track the account balance just like any other bank account.

If your bank doesn’t provide balances for virtual accounts, you can track balances for each Virtual Account with Ledgers and Modern Treasury will automatically maintain an updated balance with each transaction. In these cases, transactions will be linked to the physical bank account instead of the Virtual Account.

Modern Treasury supports this functionality across multiple banks, regardless of whether your bank provides in-house balance reporting or not. If you are interested in learning more, check out our guide or contact us.