Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

What is Automatic Reconciliation?

The process of tying a payment to a transaction is called reconciliation and it is essential for a business to understand how completed and in-progress transactions add up to the cash balance in its bank account.

Businesses that manage payments at scale face the complex challenge of reliably monitoring cash. Most of us have experienced the time delays inherent to ACH, wires, and checks. These delays make it difficult to tie a payment you’ve made or expect to receive to the actual transaction that posts to your bank account. This process is called reconciliation and it is essential for a business to understand how completed and in-progress transactions add up to the cash balance in its bank account.

Most finance teams try to solve the reconciliation problem with spreadsheets, email and manual examination of bank statements—processes that are inefficient and error-prone. At Modern Treasury, we’ve built a better solution that helps finance teams save time and minimize errors. We call it Automatic Reconciliation.

With Automatic Reconciliation, Modern Treasury automatically matches your payments and returns to transactions as they are made available by your bank. Reconciled transactions are reflected in the previous day and intra-day balances available through the API and dashboard, allowing you to reliably monitor cash across all your business bank accounts.

How Does Reconciliation Help With Monitoring Cash?

Let’s say you run a marketplace for artisanal coffee that lets coffee aficionados buy coffee from artisanal coffee roasters anywhere in the country. You collect payments from the buyer, deduct your platform fee and pay the seller. You also need to handle other types of transactions, like refunds and bonus payments to your top performing sellers. Business is going well so you’re processing thousands of orders a week.

To reliably monitor cash, you need to be able to match every single payment you’ve made or received to the corresponding transaction in your bank statement. At scale, this quickly gets very complicated for three reasons.

1. Banks Don’t Move Money as Fast as Your Business

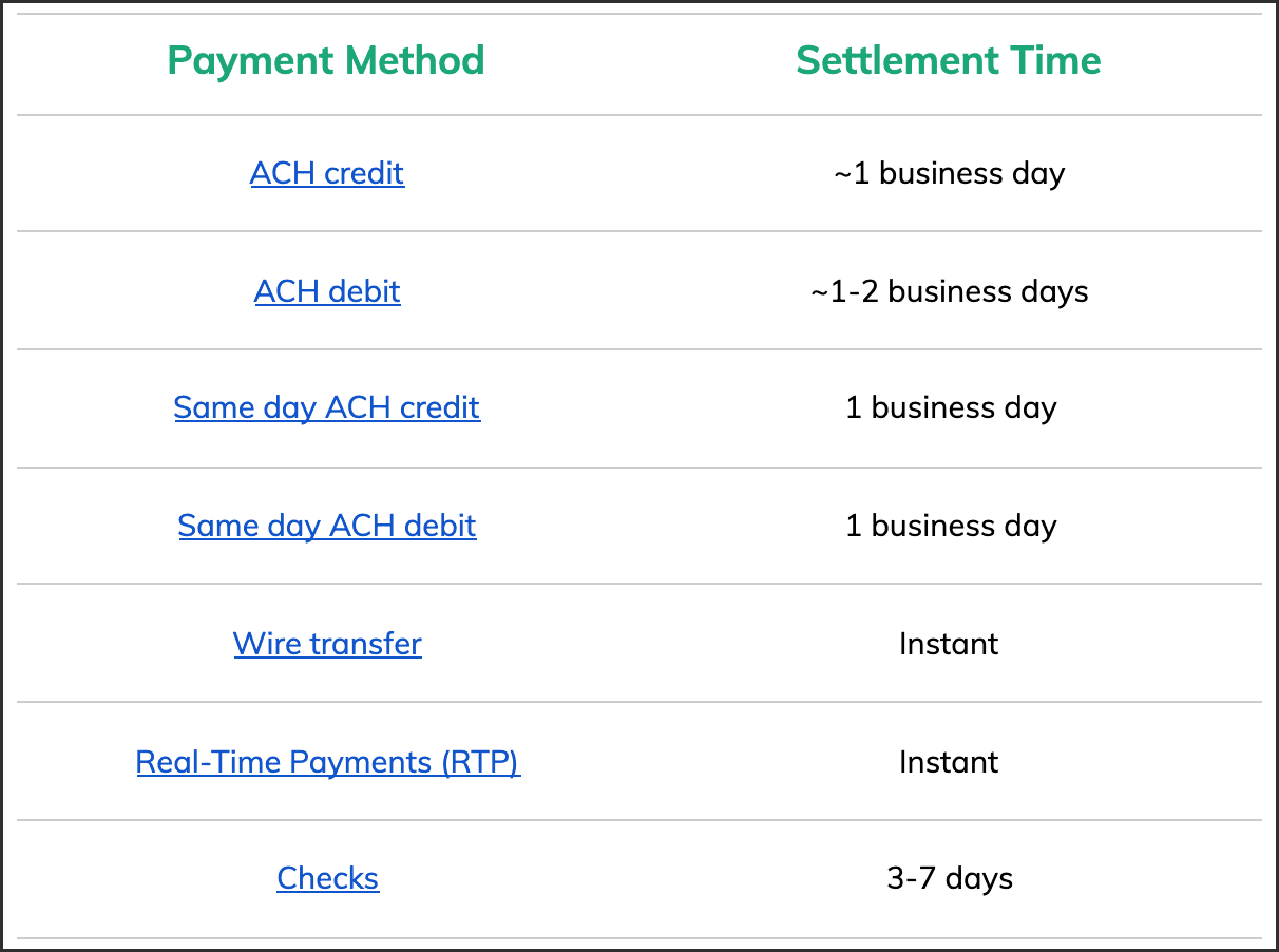

The time it takes for your transaction to settle depends on which payment method you use. Here’s a list of business payment methods used in the US and their typical settlement times. Because of these settlement timeframes, the rate at which you move money is slower than your business activities.

Let’s say you pay coffee sellers on a daily basis. If you initiate a number of ACH credits on Monday, they are likely to settle by Tuesday. But by the time they settle, you have already initiated a new batch of payments on Tuesday that will settle on Wednesday.

Without reconciliation, it’s hard to keep track of the cash available in your bank account, what transactions are processing versus complete, and when different sets of transactions are likely to settle.

2. Banks Process Transactions in Batches

Let’s say you need to pay 10 coffee roasters $1000 each at the end of the week. You initiate 10 ACH credit transactions, each for $1000 on Friday before the day’s cut-off. These transactions will likely post to your bank statement Monday evening or Tuesday morning next week.

When you ask your bank to make a payment, it’s placed into a queue that’s sent to the network for processing after a certain cut-off time for the day. Any transactions submitted after the cut-off time are queued up to be processed the next business day. Different banks have different cut-off times for processing transactions.

The next day, instead of seeing 10 separate transactions next week, you’ll see one transaction for $10,000 on your statement. Because ACH transactions take place in batches, your bank directly debits your account for the total amount even though it represents 10 separate payments. Reconciliation helps you tie each payment to the appropriate transaction on your bank statement.

3. Monitoring Incoming Payments and Returns is Difficult

Let’s say you’re also expecting 100 payments of $20 each from your buyers. You need to know when they hit your bank account to predict cash accurately. You also need to tie each payment to an order. Similar to when you make bulk payments, your bank may record all or some of those payments as a single transaction on your statement.

Payment returns also complicate monitoring cash flow. For example, ACH credits will fail due to incorrect account or routing numbers and ACH debits will fail if the counterparty doesn’t have sufficient funds in their account. In both scenarios, your bank will post a return transaction to your bank statement that needs to be reconciled with the original payment.

Automatic Reconciliation

Until now, many companies have relied on manual reconciliation processes that typically involve exporting transactions from the bank portal to a spreadsheet and manually matching them with payments. In addition to being time consuming, the need to email multiple spreadsheets back and forth makes collaboration painful.

With Automatic Reconciliation, Modern Treasury instantly reconciles every single payment with transactions in your bank statement. We tentatively reconcile the transaction when it’s pending and complete the process when it posts. Because ACH processes transactions in batches, a large number of transactions on your bank statement are likely to represent multiple distinct payments. If the transaction aggregates multiple Payment Orders, we automatically create matching Transaction Line Items.

When you see a Payment Order marked as completed, you can click into it in the web application to see the matching transaction.

The Expected Payments feature allows you to monitor your bank account for payments you do not initiate. When the transaction is made available by your bank, it is automatically reconciled with the Expected Payment. You can choose to be notified by webhook or email about its status.

The Returns feature automatically matches returned payments to transactions and the original Payment Order, making identifying, correcting and redrafting returns a breeze.

All the data you see in the app is also available through the API, allowing you to further automate and streamline reconciliation by integrating Modern Treasury directly into your business systems or platform.

Finally, because we connect to multiple banks, you can use Modern Treasury to reconcile transactions and monitor cash across all your business bank accounts.

Get Started With Automatic Reconciliation

Get in touch if you’re interested in exploring Automatic Reconciliation for your business. We’d love to discuss your use case in detail.

Get the latest articles, guides, and insights delivered to your inbox.

Authors