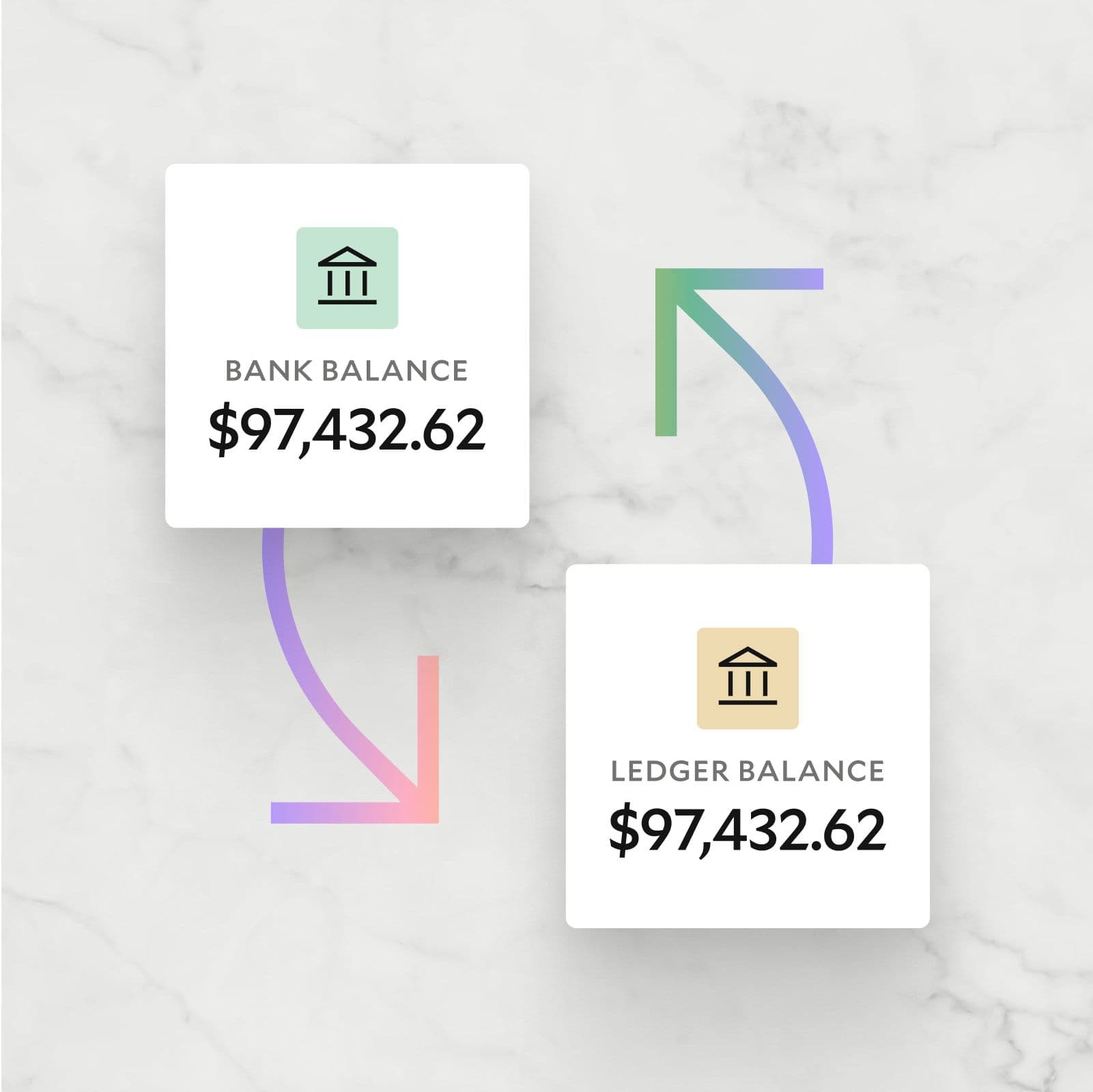

The Ledger for Real-Time Money Movement

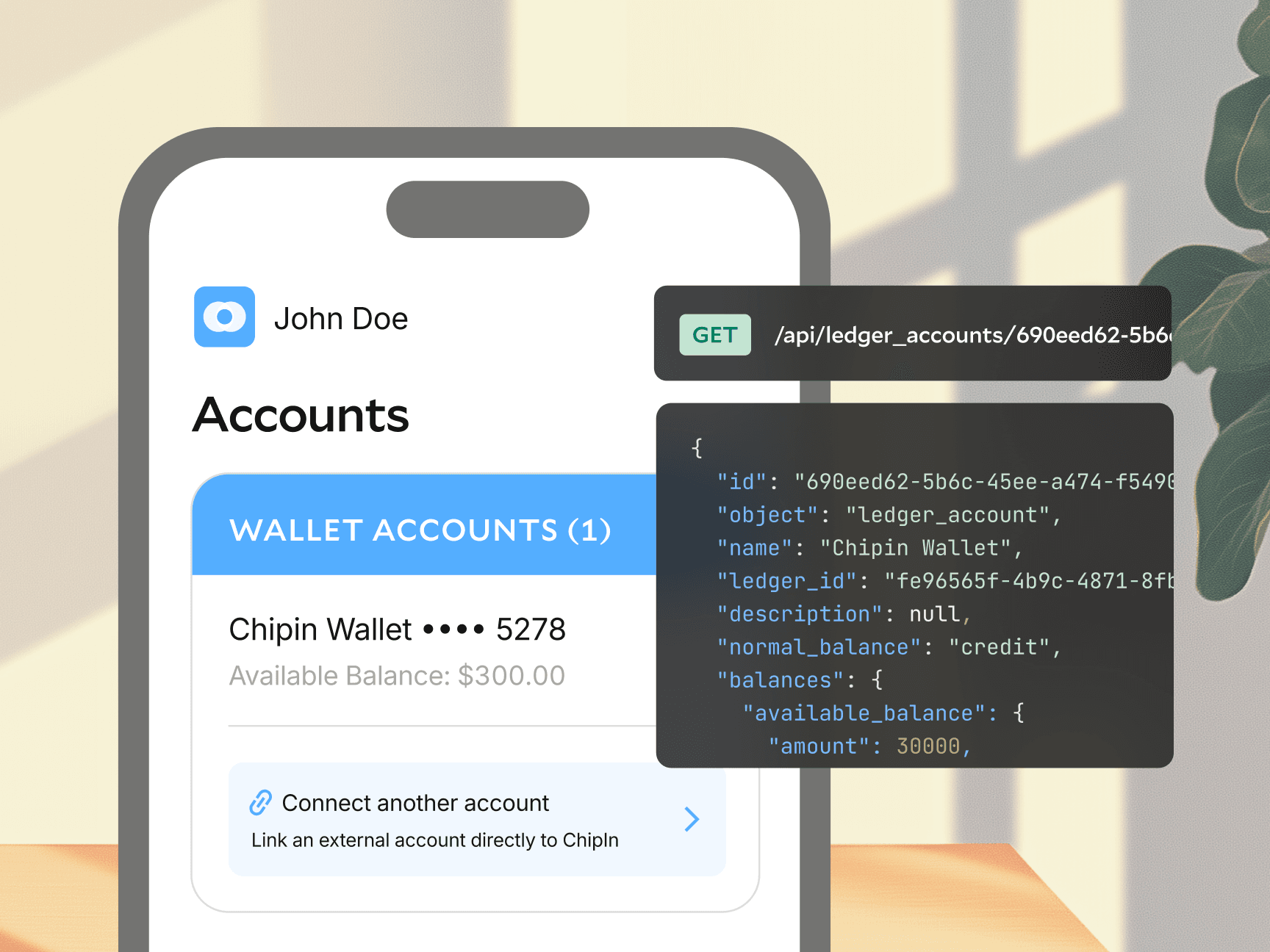

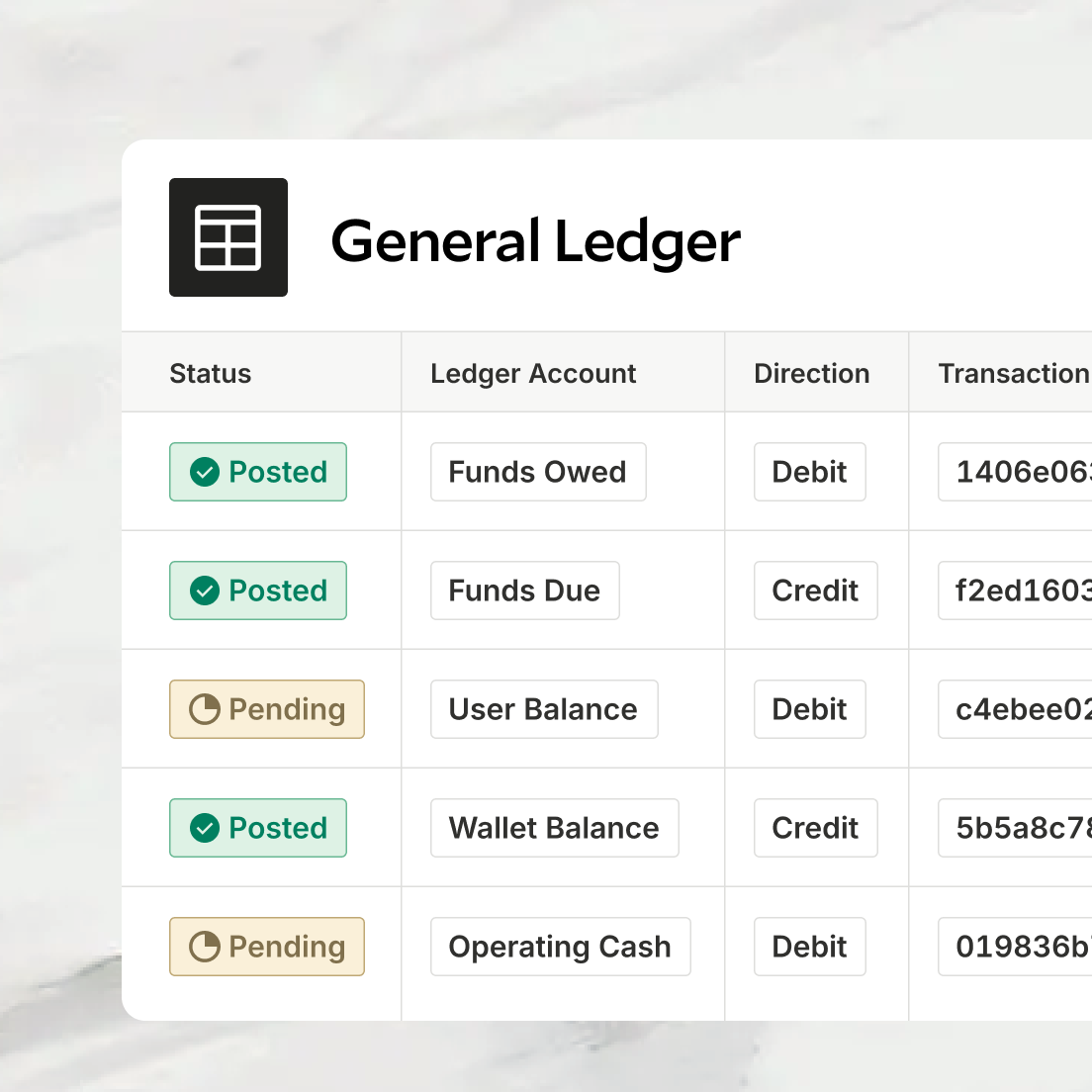

Scalable OLTP database for tracking transactions.

“Modern Treasury lets us track studio balances reliably and transparently, ensuring that we don’t have to manually verify studio balances before paying them out.”