Modern Treasury and Paxos Make It Easier for Businesses to Move Money with Stablecoins.Learn more →

ACH Timings

ACH money movement is a common payment method for money transfers or automated payments. It’s relatively easy and cheap, but timing can be confusing. Since we get so many questions around ACH timings, we wanted to clear up timing for companies utilizing ACH and what they can expect.

ACH Overview

Automated Clearing House (ACH) electronic payments are the primary mode of domestic payments in the US. Funds move from one bank account to another with the help of the ACH system. An ACH payment can either be sent as a normal ACH payment, and clear the next day or later, or a Same-Day ACH payment. For more information and a further deep dive into how ACH works, see A Beginner's Guide to ACH.

Timing for ACH Payments

Let’s break down what an example of timing looks like for an ACH debit payment:

- Monday morning - Customer submits a payment order for ACH debit through Modern Treasury. This payment order moves into the approval queue.

- Monday morning - Payment orders are approved. Payment order file gets sent to the bank.

- Monday evening - Once a Bank’s ACH cutoff time occurs, the bank begins to process the payment order.

- Tuesday day - Payment is sent.

- Wednesday morning - Payment has completed; funds are in the bank account from the recipient early in the morning.

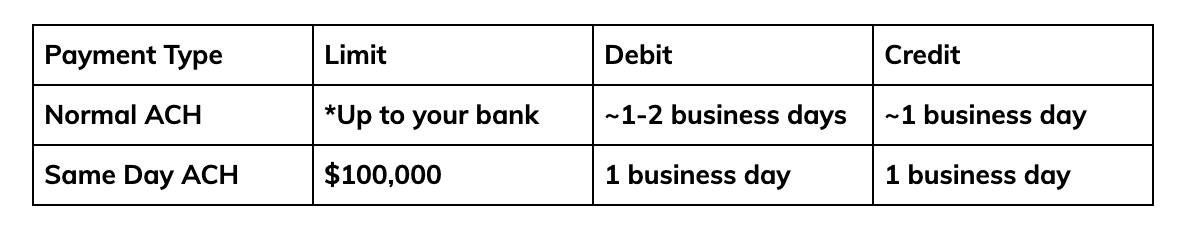

Normal ACH Payments

With normal ACH payments, the settlement time can vary depending on where you bank. It is common that debits (pulling money) will take longer to settle and complete than credits (pushing money). Using the example of a debit ACH payment above, when the ACH payment is processing, the bank collects all the ACH files that come in for the day before forwarding them as a batch to a clearinghouse for processing. From processing at the clearinghouse to the funds settling into the account, the payment can take 1-2 business days on average to complete. However, normal ACH credits can take around 1 business day to complete. Completion for both the debit and credit payment means that the funds are either in your account (debit) or the funds have left your account (credit).

Same-Day ACH Payments

Same-Day ACH works on the same rails as normal ACH, but can be batched multiple times a day. Technically, Same-Day ACH payments still have to run through the same flow as above. The only difference is that the funds will process in less than 24 hours. So long as you are able to initiate and approve your Same-Day ACH payment, it will complete within 1 business day.

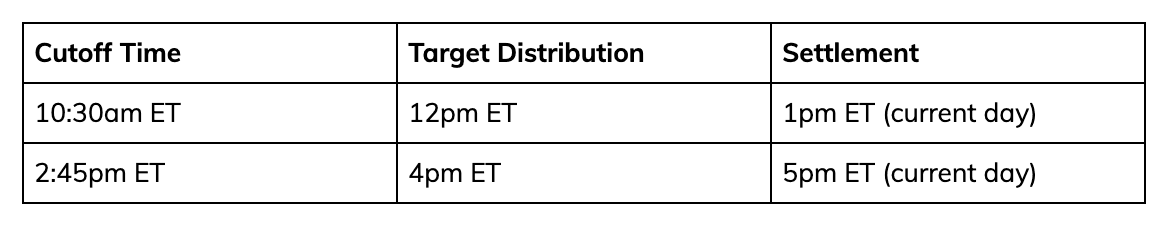

Same Day windows are as follows:

To find out more on our supported bank’s cutoff times, please click here.