Adding AI to Modern Treasury Reconciliation

Today, for the first time, we're sharing some AI work we've been doing at Modern Treasury—namely, how we use AI to augment our reconciliation engine.

Today, for the first time, we’re sharing some of the AI work we’ve been doing at Modern Treasury.

AI is particularly well-suited to solve some of the problems we encounter daily in our world of payment operations: repeat spreadsheet workflows, data translation, and transaction disambiguation. In money, the consequences of being wrong—or of a model “hallucinating”—are large. Because this is the world we operate in, we’ve always built our software with an exceptionally low tolerance for inaccuracy or ambiguity. This is the same approach we’ve taken to implementing AI.

We talk a lot about the new era of payments, where modern software is a prerequisite for companies to provide excellent, new customer experiences. As one colleague quipped to me recently: no cloud, no AI. Infrastructure and design investment unlock technologies, like AI, for payment operations and payments data.

Modern Treasury helps companies do three main things: move money, track (ledger) money in a database, and reconcile the previous two to debits and credits in their bank accounts. Within each of those, there are places where AI can safely play a supporting role.

In fact, we implemented our first LLM use case at the beginning of this year, and we’ve been quietly building it into our product since. I’ll share two examples here. I want to “show our work” on how we thought about integrating AI into MT with appropriate guardrails.

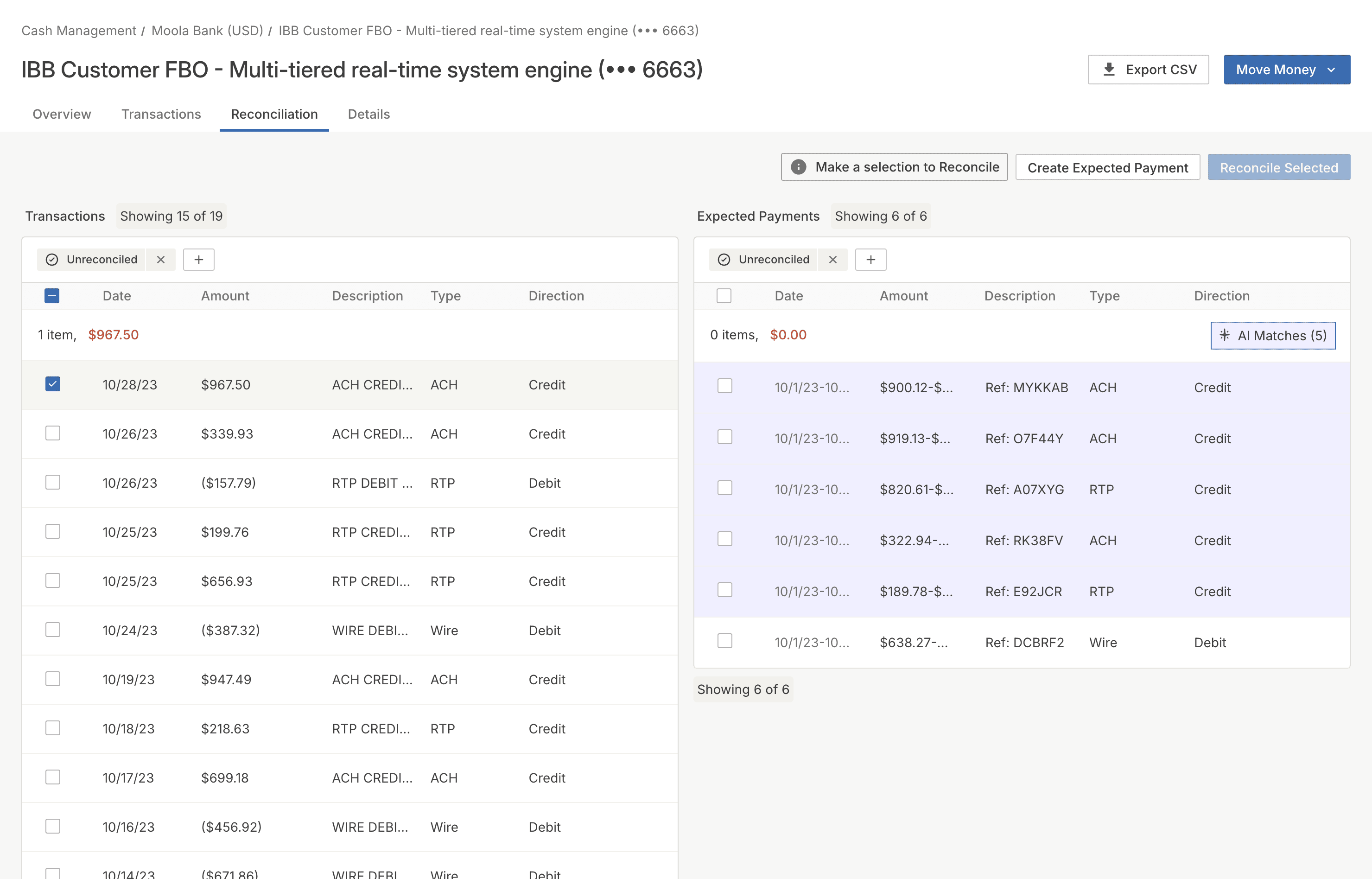

Reconciliation Suggestions

Within our platform, reconciliation is one of the most natural places for AI. The way our platform works is it runs transactions through our core reconciliation engine. This engine is one of the crown jewels of the Modern Treasury platform, honed after millions and millions of payments across more than 30 banks totaling billions of dollars each month.

We built our reconciliation engine to be entirely deterministic. This is to say, if the same transaction was fed to it twice, it would reproduce the same result 100% of the time. In addition to this repeatability, when it does reconcile a transaction, it’s 100% confident in its match. These two attributes are critical specifications for our software. As I said before, inaccuracy just can’t be tolerated when it comes to money.

Even within those constraints, we knew there were places where AI could benefit our customers. For reconciliation, the use case we built first is in edge cases. Our core engine matches 99% of transactions. For that 1% where it can’t be 100% certain, a customer can write custom business rules to catch transactions. And if even that doesn’t work, then a user logs into our app and reconciles a transaction by hand. Things come up. That’s just how finances work.

This exception-handling workflow is where we decided to implement AI. It has two attributes that make it appealing: it’s overseen by a user and critical to a business outcome.

So, we built a proprietary model to make suggestions for the transactions where manual intervention is needed. In these cases, when a user logs into our platform to reconcile a transaction manually, our AI dynamically computes up to five suggested matches for a selected transaction. By reducing the user’s solution space, the user can work at a supercharged pace and achieve 100% cash reconciliation much more quickly.

Routing Number Deduction

The second use case for AI is in our payments product.

Years ago, we noticed a certain bank reports all incoming SWIFT wires with the ODFI bank name and address instead of a routing number. Normally, this isn’t a problem. However, if a company wants to return the wire back to the original sender without a routing number, this is impossible. We worked with the bank to surface this data, but their core literally couldn’t relay it to their customers. Their preferred workflow was for customers to call them up, a human at the bank looked up the routing number in their systems, and the wire return was initiated.

Suffice it to say this is not a workable process for any company operating with wires at a significant scale.

AI is well-suited to this type of disambiguation and data extraction problem. So, earlier this year, we integrated an LLM to extract the relevant, often messy, ODFI bank information and help us structure it. Then, we trained a proprietary model to help us turn the LLM output into routing numbers. We filtered and validated the training data and placed strict guardrails against what the model could deliver. And then we tested it.

It turned out that this AI process translated unstructured address data to queries better, more accurately, and more efficiently than other approaches we tried. So we kept it, and now it powers wire returns in this particular exception workflow.

AI and the Future

Our team will keep working to implement AI in the right, safe, value-delivering places for our customers.

It’s hard to say precisely where AI goes, but it’s our responsibility to bring the best technology to the problems we solve for customers. We’ll keep learning, trying different things, and integrating the most effective ones into our platform while keeping our approach—exceptionally low tolerance for inaccuracy or ambiguity—the same as it has always been.