Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

In its simplest form, a Ledger Database is a database that stores accounting data. More specifically, a ledger database can store the current and historical value of a company’s financial data. For example, you could utilize a ledger database to find the current value of a business bank account, as well as the historical value and transaction history for the same account.

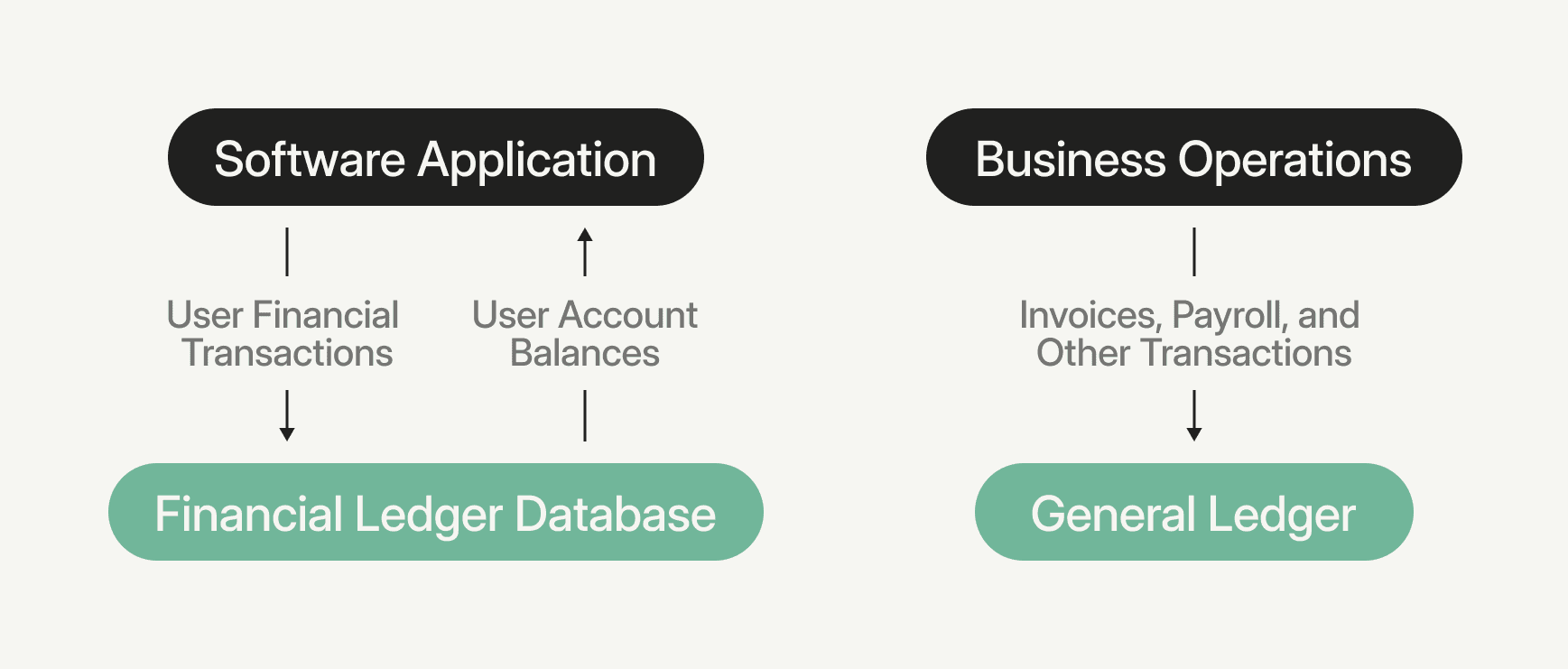

What is the difference between a General Ledger and a Ledger Database?

A general ledger is a master accounting document of all of a business' financial transactions. A ledger keeps a record of all of the different transactions made by a company throughout its lifespan. Most business ledgers utilize double-entry accounting and can exist as physical books or as digital records.

Businesses use ledgers to get a detailed view of their financial transactions across different periods of time. The information from the ledger is what businesses use to create income statements, balance sheets, or other significant financial documents. A typical company’s general ledger isn’t always up to date on a second-to-second (or even day-to-day) basis. Additionally, a general ledger only tracks transactions that directly affect a company’s financial statements.

A ledger database is where the data from the ledger itself is stored. Larger companies that move money at scale have different needs than local small businesses. They need to track transactions at a high frequency, high volume, and across entities that are represented in a software application. This requires a purpose-built application ledger, also known as a financial ledger database. Where a general ledger is built for capturing and reporting all business activity, a ledger database is built to surface data within a product and capture a subset of business activity as a high higher level of granularity and speed.

Unlike a general ledger, a financial ledger database needs to be built to serve a company’s financial stakeholders and business model.

For example, a digital wallet product might need to check a user’s balance before allowing them to withdraw money. A ledger database allows you to segment a single store of cash, like a bank account, into multiple user wallets. Transactions between wallets can be tracked in the ledger without moving any money.

Alternatively, a marketplace needs a ledger database to record when a purchase is made and to separately keep track of the cash transactions for the buyer and the seller. It might also need to retrieve and show a user’s history of transactions every time that user logs into their dashboard.

The ledger database needs to be able to record user balances and financial transactions that affect those balances. Because these transactions impact the overall business, the financial ledger database can be regularly exported to general ledger software to simplify financial reporting.

What to consider when designing a ledger database

To ensure reliability, a ledger database should be built following several design principles to ensure an application won’t lose track of user funds or fail to make payments:

- Immutability: to enforce append-only data entry, coupled with a full audit trail

- Idempotency: to prevent duplicate transactions.

- Concurrency controls: to make the database able to handle a high volume of simultaneous requests.

- Double-entry bookkeeping (like a general ledger): to ensure money can’t be created or destroyed in the database.

To learn more about Ledgers, check out these additional resources:

Learn

Ledgers are foundational to any company that moves money at scale. Explore the accounting fundamentals behind the ledgering process, the differences between application ledgers and general ledgers, and more.

A Ledger Database is a database that stores accounting data. More specifically, a ledger database can store the current and historical value of a company’s financial data.

Pessimistic locking and optimistic locking are types of concurrency controls designed to handle concurrent updates in a ledger system, helping prevent race conditions and maintain immutability in financial ledgers.

Learn the difference between Single-Entry Accounting and Double-Entry Accounting

Data immutability is the idea that information within a database cannot be deleted or changed. In immutable—or append-only—databases, data can only ever be added.

GAAP, or Generally Accepted Accounting Principles, is the US system for preparing financial statements. It lays out the rules for how companies measure, present, and disclose their financial performance. The goal is to make reports reliable and easy to compare across businesses.

ACID stands for Atomicity, Consistency, Isolation, and Durability—the four rules that keep database transactions running smoothly. Together, they ensure every transaction is reliable, predictable, accurate, and intact.

Every Account in a double-entry ledger is categorized as debit normal or credit normal. Debit-Normal Accounts represent uses of funds (assets, expenses); Credit-Normal Accounts represent sources of funds (liabilities, equity, revenue).

Balance caching means storing the latest known account balance outside the core ledger for faster reads.

In the context of software, concurrency control is the ability for different parts of a program or algorithm to complete simultaneously without conflict. Concurrency controls in a database ensure that simultaneous transactions will be parsed appropriately.

Cryptographic immutability is a powerful tool for securing data, which requires encryption methods on each transaction to guarantee immutability. It’s often used for blockchains and distributed ledger systems to mitigate fraud.

An API call is idempotent if it has the same result, regardless of how many times it is applied. Inadvertent duplicate API calls can cause unintended consequences for a business, idempotency helps provide protection against that.

Sharding means dividing your database into horizontal partitions, called shards, which can each store a subset of data. to reduce latency; this often happens when data scales. Within a ledger, sharding is used to split transactions or accounts so that each shard holds a portion of the total ledger.

A chart of accounts (COA) is an index of all the different accounts within a company’s ledger.

A digital wallet (also sometimes called an electronic wallet) is an application that securely stores digital payment information and password data for a user.

A ledger API allows companies who need to move money at scale quickly and easily access, track, audit, and unify all of their financial data in one place.

The ledger balance, also called the current balance, is the opening amount of money in any checking account every morning. The ledger balance should remain the same for the duration of the day.

A ledger (also called a general ledger, accounting ledger, or financial ledger) is a record-keeping system for a company’s financial transaction data.

A subsidiary ledger is used to keep track of the details for a specific control account within a company’s general ledger.