Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Answering Common Questions About Real-Time Payments

It’s no surprise that everyone from major financial institutions to consumers would have questions about a brand new payment method: Real-Time Payments.

For decades, the US economy has run on four main methods of payment: wire, ACH, check, and credit card. So it’s no surprise that everyone from major financial institutions to individuals working in accounting to consumers would have questions about a brand new payment method: Real-Time Payments.

How do I send an RTP payment?

You will need a corporate bank account with a bank that is enabled for sending RTP payments. In addition, you'll need to work with your bank to get approved to send RTP payments.

Does RTP work in both credit and debit directions?

No. The RTP network is strictly “credit push.” Unlike debit, credit transactions reduce certain types of fraud risk.

Can I reverse an RTP network payment?

No. All RTP payments are irrevocable. This enables immediate, final settlement to the payee, which is a key characteristic of Real-Time Payments.

Does a bank have to be a member of The Clearing House to use the RTP network?

No. Any federally insured depository institution can be an RTP network participant. That’s why the RTP network is expected to reach nearly all U.S. accounts by 2020.

Is the RTP network the same as Same-Day ACH?

No. The RTP network is a separate and new infrastructure. RTP network payments clear and settle individually in real-time and are irrevocable. Same-day ACH payments clear in batches and settle once the payments clear. Here is a primer on ACH and the key players that enable it.

How much does an RTP payment cost?

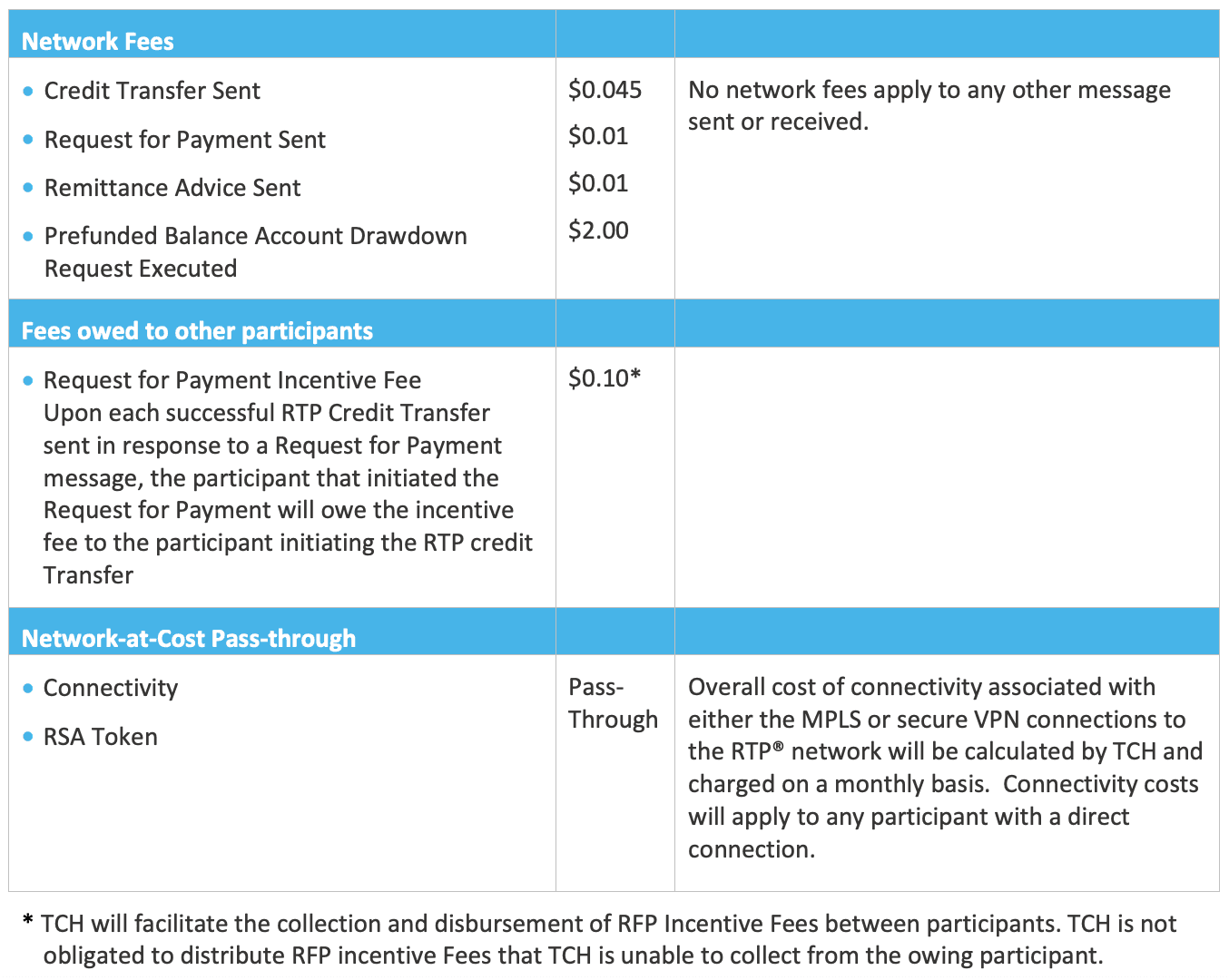

For financial institutions, the RTP network has a single price for all participants with no volume discounts, no volume commitments, and no monthly minimums. It’s one way to ensure financial institutions of any size can participate. Financial institutions pay only for the transactions they originate. Here is the full list of fees due depending on the type of request:

RTP fees for participating banks.

These are the fees that the banks pay. [1] However, the amount you will pay in bank transaction fees is negotiable with your corporate bank.

How can I connect to the RTP network?

Federally insured U.S. depository institutions connect directly to the RTP network. Product, finance, and payment operations teams can connect to the network through their corporate bank, and by using a third-party service provider such as Modern Treasury.

Are there transaction limits in the RTP network?

Yes. The credit transfer limit on the RTP network is currently $100,000, though that amount is expected to grow as the network matures.

Real-Time Payments truly is the future of payments. The rollout has been slow, but with nearly 100% of US transaction accounts expected to connect with RTP by 2020, we expect adoption to speed up. Reach out to Modern Treasury if you want to build Real-Time Payments into your own systems.

Pricing from The Clearing House: https://www.theclearinghouse.org/-/media/new/tch/documents/payment-systems/rtp_-pricing_02-07-2019.pdf?la=en.

Pricing from The Clearing House: https://www.theclearinghouse.org/-/media/new/tch/documents/payment-systems/rtp_-pricing_02-07-2019.pdf?la=en.