Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

How Do Core Banking Systems Work?

Core banking systems revolutionized the way we manage money. In this Payments Primer, we dig into how they work and how they compare to modern day payment solutions.

Prior to the 1970s, money movement was highly manual and conducted mostly in-person. Transactions weren’t processed until the end of the day and banks didn’t have the technology to sync up their data. Then came mainframe and telecommunication capabilities, and banks were some of the earliest adopters. With the advent of the Internet and the rise of online banking came a new, revolutionary way of managing money: centralized online real-time exchange, or core banking. It formed the back-end system that processes transactions across a large network of bank branches.

Core banking systems streamlined banking, improved the customer experience, and created a domino effect of changes. For instance, deposits were immediately updated on bank servers and payment-related data was shared between branches, so customers could withdraw deposits from any of their bank’s branches.

The ripple effect pushes into today. This system is the reason businesses can check their account balance at any time and transfer money with the click of a mouse.

The Core Services

Equipped with a robust core banking system, banks are able to process thousands—some, even millions—of daily transactions, update accounts in real-time, and minimize payment errors by maintaining accurate financial records. That’s why banks all over the world spend hundreds of thousands annually on maintaining their core banking systems—it’s essential infrastructure.

Among the most common core services are deposit, loan, and credit processing capabilities. But core banking systems also interface with hundreds of other systems, including ledgers and reporting systems.

Many banks rely on ledger technology to keep an accurate record of their financial transactions, often referred to as a system of record (SoR). Without insight into the money coming and going from bank accounts, a host of problems can arise for companies, including missing funds, customer support costs, and regulatory and compliance challenges.

Ledgers offer real-time visibility and transparency into transactions and balances, while minimizing the potential for bookkeeping errors. This visibility is invaluable for businesses operating at scale in a fast-paced financial ecosystem.

Major Providers

While many legacy core banking systems are still in use—and largely still reliable—the shift to digital banking, cloud, and APIs has changed the way banks do business and build relationships with other financial institutions. As a result, many banking core providers have expanded their offerings to accommodate new payment operations needs.

Some major bank core providers who are already doing this include:

- Fiserv

- Jack Henry & Associates

- FIS

While banks can and do purchase banking core systems, many large commercial banks (like J.P. Morgan Chase for example) have in-house core banking systems.

Challenging Outdated Systems

Created in 1959 by Grace Hopper, Common Business Oriented Language (COBOL) is the programming language that was designed for computer mainframes to handle large-scale transaction processing. Despite being over 60 years old, COBOL remains central to many modern core banking systems. Its initial applications were for major corporations and government organizations to have a standardized communication method.

Despite more modern application development frameworks, like .NET or Java, roughly 43% of banking systems still rely on COBOL-based platforms. Institutions like the IRS and Social Security rely on COBOL-based files to distribute checks and manage benefits. And 1.5 billion new lines of COBOL are programmed each year.

The question is, as technology advances and banks look ahead to a digitized future, will this aging programming language still prevail? Modern-day payment solutions can’t operate using old-school legacy information technology platforms alone. The shift to more agile IT systems that use modern programming languages is an important consideration for banks that want to meet the evolving needs of their customers.

Conclusion

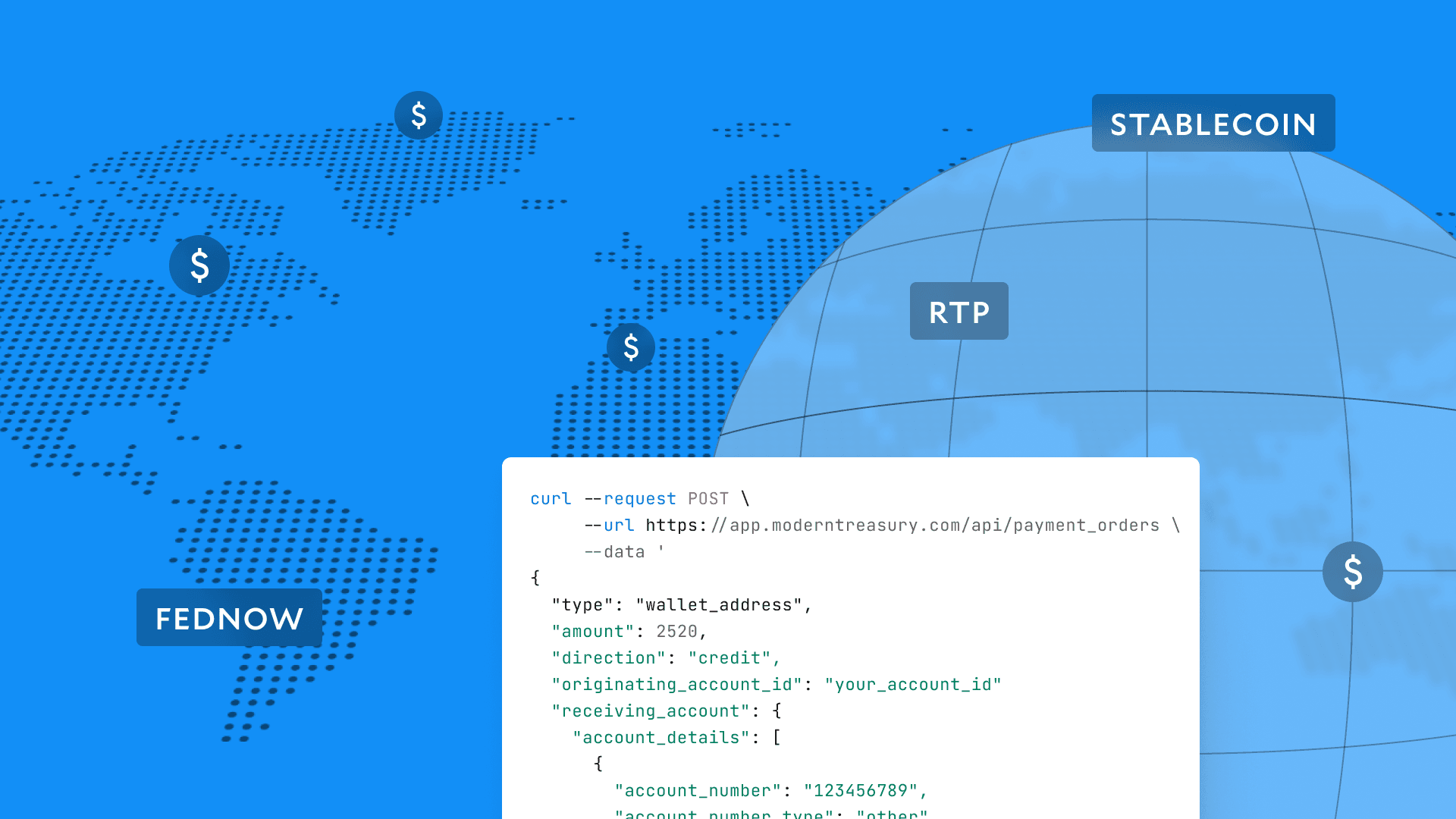

Fast forward to 2022—digital banking, the cloud, and APIs continue to redefine banking. As payment needs and operations inevitably change in step with new technologies, banks need to adapt to an increasingly digitized and automated world.

But they can only strengthen their operations and minimize payment errors if they have real-time transparency into payment operations. Visibility into payment operations is no longer just a benefit—it’s a necessity.

Get in touch

To get started with Ledgers, if you haven’t already, talk to a payments advisor. You can also sign up for a sandbox and try it out. You don't need a bank connection, nor do you need to be using our payments product; our Ledgers API can be used independently of the rest of the functionality in Modern Treasury.