Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

How Enterprises Use Modern Treasury

Here, we take an in-depth look at how Modern Treasury supports our enterprise customers.

As embedded payments have become more ubiquitous across products and industries, so have the associated challenges. For enterprises moving money at a high volume and high rate, operational complexity compounds. Businesses must juggle both creating a seamless product experience and ensuring they’re upholding an auditable trail across all of their transactions—so transactions are secure, issues can be tackled quickly, and the books can close at the end of the month, and more.

According to data from our 2023 State of Payment Operations survey, many companies are still trying to navigate payment operations spread across different systems and processes, in many cases manually. Respondents use an average of 6.6 systems to manage their payment operations; in fact, over one third (36%) of companies with greater than 1,000 employees use five (5) or more systems

This is costly in terms of time, money, and employee resources. Automating payments to be efficient, transparent, and secure—and ensuring that those payments are tracked and reconciled appropriately—is an unquestionable necessity for any company operating at scale.

As the operating system for money movement, Modern Treasury supports our customers in handling the complexity of initiating, tracking, and reconciling their daily high-volume and high-velocity payments. Below, we take a closer look at some of our enterprise customers, how they’re using Modern Treasury to help them manage payments and reconciliation at scale, and how our product has enabled them to grow and launch new products quickly.

Automating Payments at Scale: Navan

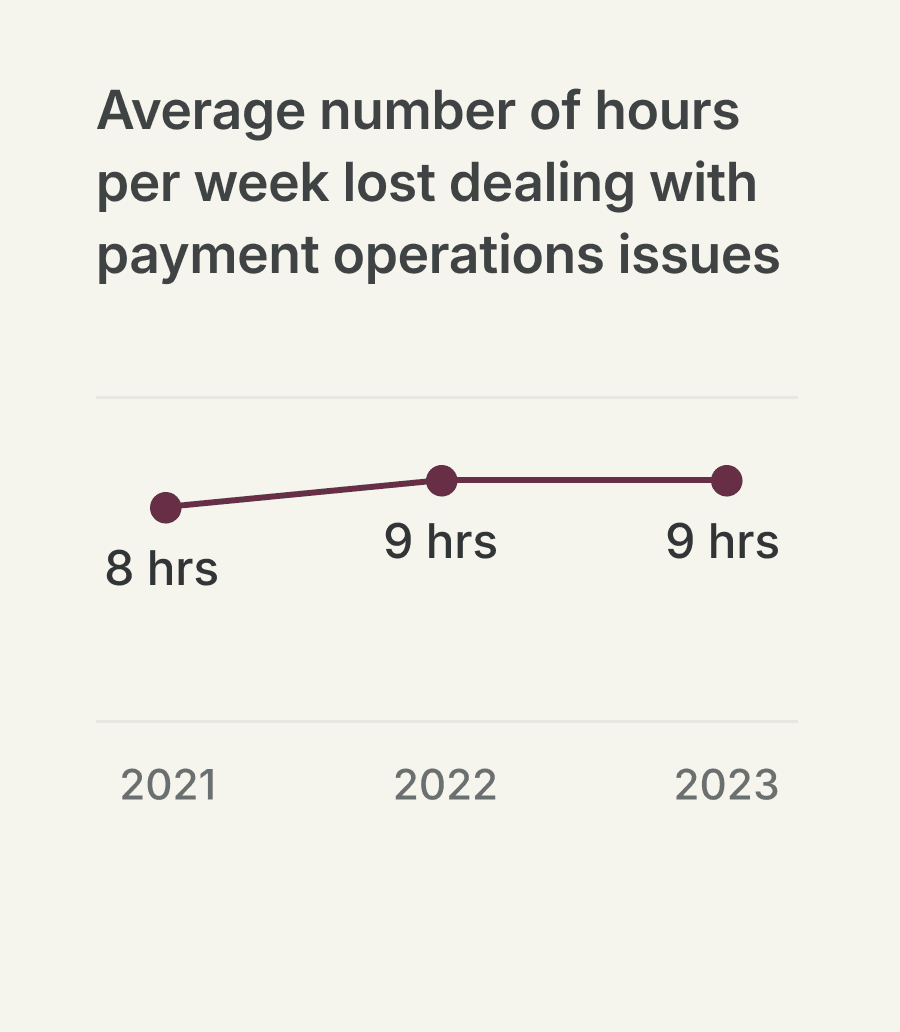

For enterprises that have high-volume, high-frequency transactions, manual operations can become an unnecessary slog. In fact, companies are losing up to nine hours per week to addressing issues with their payment operations.

Let’s take a closer look at how Modern Treasury’s operating system helped Navan (fka TripActions) successfully automate payment operations.

As an end-to-end travel and expense management platform serving more than 8,800 customers all over the world, Navan helps companies manage complex travel requirements, issue corporate cards, and set up employee reimbursements all in one place.

As they scaled their platform—including adding in Navan Expense to automatically reconcile employee purchases—the Navan product team realized that in order to have complete visibility into payment flows and build a faster, more customizable payments experience, they needed to work directly with banks instead of using a third party processor.

"Working directly with banks was the only long-term viable approach for us," said Yuval Refua, VP of Product for Navan Expense. "We needed a layer between our product and banks to ship faster and also provide reporting tools to our operations and treasury teams."

Their first bank integration with Modern Treasury went live in under two weeks.

Modern Treasury also helped them:

- Programmatically initiate payments at scale

- Track real-time transaction status

- Provide multiple global bank payment methods to support Navan customers all over the world

- Identify and investigate payment failures and delays

Since the Modern Treasury API supports multiple payment methods and currencies, Navan has been able to issue reimbursements in the US, Canada, UK, Australia, and the EU all with only one integration.

“The best part about Modern Treasury is that sometimes I forget that you're there,” said Galen Grady, Director Financial Operations & Support at Navan. “It’s really done away with the headache and operational overhead of managing thousands of reimbursements a day for my team.”

Accurate Reconciliation & Full Data Visibility: DriveWealth

As we mentioned above, the more systems a company uses to manage payment operations, the more complicated it becomes to ensure data reliability. To data match across these systems, many companies use manual processes, which means introducing errors into the data becomes more likely.

For enterprises especially, reliable data is imperative with a high-volume of transactions. Modern Treasury’s reconciliation engine is built to support complex reconciliation use cases. One of our enterprise customers, DriveWealth, is a prime example of how reconciliation can be streamlined via Modern Treasury. Let’s take a closer look at this example below.

DriveWealth is a global B2B financial technology platform providing Brokerage-as-a-Service, and powering the investing and trading experiences for digital wallets, broker/dealers, asset managers, and consumer apps.

High-volume money movement capabilities are essential to their business model, and the company’s growth and success depends on their payments being fast, efficient, and highly secure.

In early 2020, having grown considerably, the DriveWealth team was looking to address both suspense account management and challenges with reconciliation. Their team chose Modern Treasury as their solution and were able to go live with payment automation in less than two months.

95% of DriveWealth’s partner payments now flow through Modern Treasury. DriveWealth uses our platform to manage tens of thousands of transactions while receiving tens of millions of dollars in virtual accounts every day.

Now, according to Anthony Ilario, DriveWealth’s COO, working with Modern Treasury helps DriveWealth increase revenue and reduce costs; but from his perspective, the primary benefit of automated payment operations is decreased risk and the peace of mind delivered by seamless reconciliation.

Launching New Products: C2FO & Procore

One challenge of operating an enterprise can be the ability to quickly pivot or launch new products and features—a task made more difficult by legacy systems, operational bloat, time constraints, and limited resources can make it difficult. Modern Treasury’s offerings can streamline this process, allowing large companies to move more quickly to release new products or innovate on existing ones. Below, we’ll cover two such examples.

C2FO: Launching a Card Program

C2FO enables business suppliers, customers, and partners to access and leverage funds quickly, efficiently, and reliably by offering a technology-driven financing marketplace for suppliers and borrowers of growth capital—for everything from small companies to the Fortune 100.

The innovative C2FO model intermediates the exchange of capital between two businesses—typically suppliers and buyers—without the need for underwriting or extending traditional credit.

C2FO began considering a card program in late 2021 with two primary objectives:

- Offering customers modern, flexible features—such as the ability to set rebates for invoices that are paid early—ensuring fast turnaround times on funds without additional business costs.

- Creating a scalable and reliable card program that could help grow the company's bottom line.

Modern Treasury allowed C2FO to avoid the associated cost and overhead of developing, building, and maintaining this new infrastructure required for their card program, which took only three months start to finish.

C2FO can now manage the instructions associated with moving money between businesses, funding and defunding cards, and automating payments.

Procore: Streamlining Payments for the Construction Industry

Several years ago, Procore—a construction management software company—began considering ways to address the payments pain points highlighted by their customers. Procore helps facilitate payments across the industry—both to and from contractors and subcontractors.

Payments within the construction space can be laden with “construction-specific paperwork, where if you don’t do it, you don’t get paid.” And while that paperwork might be necessary, it can also cause delays, which is problematic for contractors who are already bearing the upfront costs of payroll, materials, and everything else that goes into getting buildings built.

The payments themselves weren’t the problem, but rather all the additional work surrounding those payments. Geoff Lewis, VP of Product, said, “We wanted to make the process of getting paid and initiating payments less painful. We’ve talked about Procore Pay as a concept before this, but this was our first foray into payments, so naturally we ran into challenges.”

The payment platforms Lewis and his team looked into seemed to be simple enough to integrate, but wouldn’t have been able to support the volume, complexity, and size of payments that Procore needed to support. Construction is an industry where six-figure transactions are a regular occurrence, an amount which can be prohibitive to some smaller out-of-the-box solutions. Procore needed a solution that was more than just a payments product, making Modern Treasury a natural fit.

With Modern Treasury’s help, they launchedProcore Pay, an solution that allows general contractors using Procore’s software to pay out their subcontractors automatically within the Procore system.

As Lewis puts it, “I don't think we would have been as successful without modern technology, and a payment operations team to manage all the non-technical work between us and Goldman Sachs and between us and Modern Treasury.”

Next Steps

Modern Treasury empowers businesses to streamline payments, tracking, reconciliation, and other processes, harnessing the full potential of the ACH network. If you're ready to learn more, get in touch with us.

From the 2023 State of Payment Operations report: 84% of companies reported that up to half of their payment operations are still done manually.