Why We Built Our Reconciliation Engine

In this journal, we discuss why we built our new Reconciliation Engine and how it can help drive efficiency, reduce financial risks, and provide real-time data for businesses.

Since launching Modern Treasury in 2018, our goal has been to help companies move forward with faster payments, more efficient workflows, and full data visibility. A critical component of this is cash reconciliation—the ability to track and confirm all your money movement.

Cash reconciliation remains a challenge for most companies, especially those moving money within their products. That’s why we built our Reconciliation Engine: to automate and simplify the complex—and often difficult—operational work that accompanies the reconciliation process.

The Current State of Reconciliation

To reconcile their transactions, many companies rely upon multiple disparate tools, which can be narrow and difficult to maintain, and large operations teams to manually attribute their payments. In our recent State of Payment Operations survey: 80% of decision makers reported that more than half of their payment operations processes are manual.

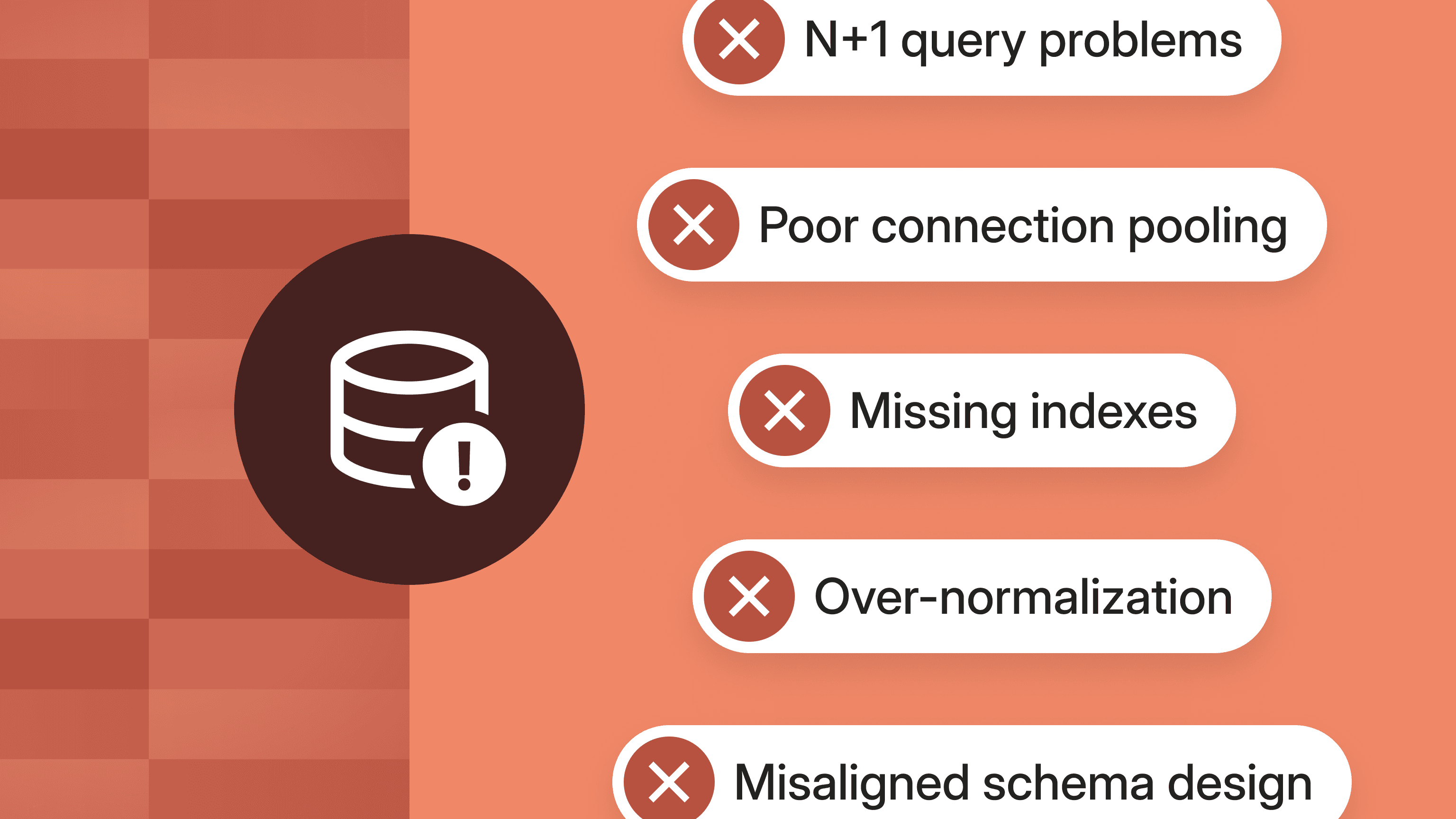

The inability to quickly and properly reconcile payments has wide-ranging business implications, including:

- Inefficiency: Batched, manual reconciliation disrupts product, financial, and accounting workflows; adds costs; and impacts ability to scale.

- Financial Costs: Impaired visibility results in errors that increase financial exposure. It prevents finance teams from optimizing their cash positions to earn interest or forex income.

- Product Problems: Poor reconciliation interferes with companies’ ability to deliver fast, integrated products that exceed clients expectations.

Modern Treasury’s Reconciliation Engine

Our engine offers three core capabilities, each designed to drive efficiency throughout product, financial, and accounting workflows; reduce financial risks; and provide a real-time source of truth for payment flows.

Access Real-Time Payments Data

For most companies, transaction data is retrieved in batches. Finance and Operations teams retrieve payment transaction reports from their banks and processors for a specific window. They then match those transactions against data within their internal systems that correspond to that same time window.

Our Reconciliation Engine integrates directly with 20+ bank partners, to access continuous, real-time data for reconciliation. We’ll expand our integrations to support third-party payment processors such as Worldpay, Braintree, Adyen, and more.

In addition to programmatic partner integrations, our Reconciliation Engine accepts free-flowing client business data (e.g., receivables, invoices, payables) via no-code, data ingestion tools.

Automate Real-Time Cash Reconciliation

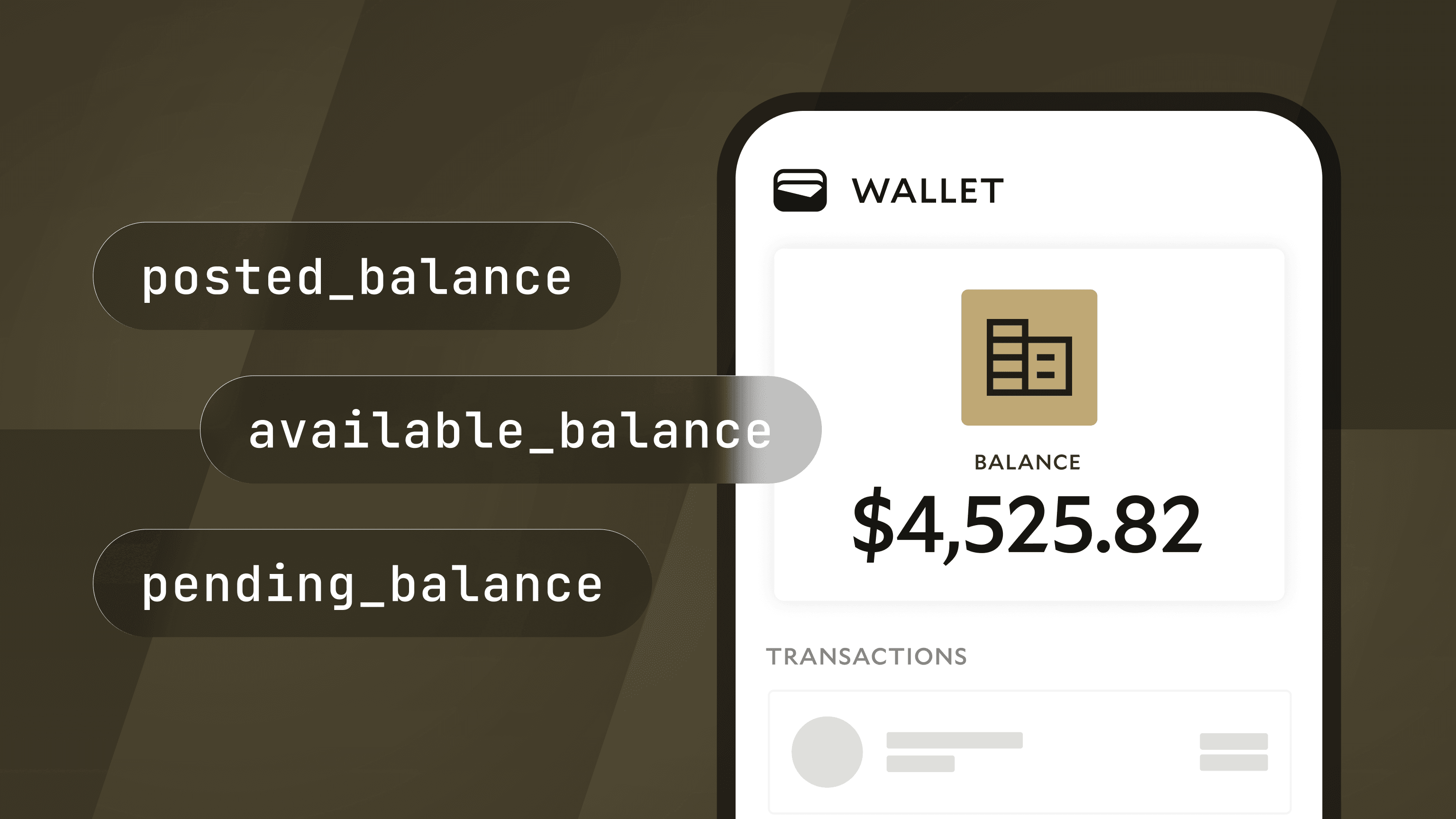

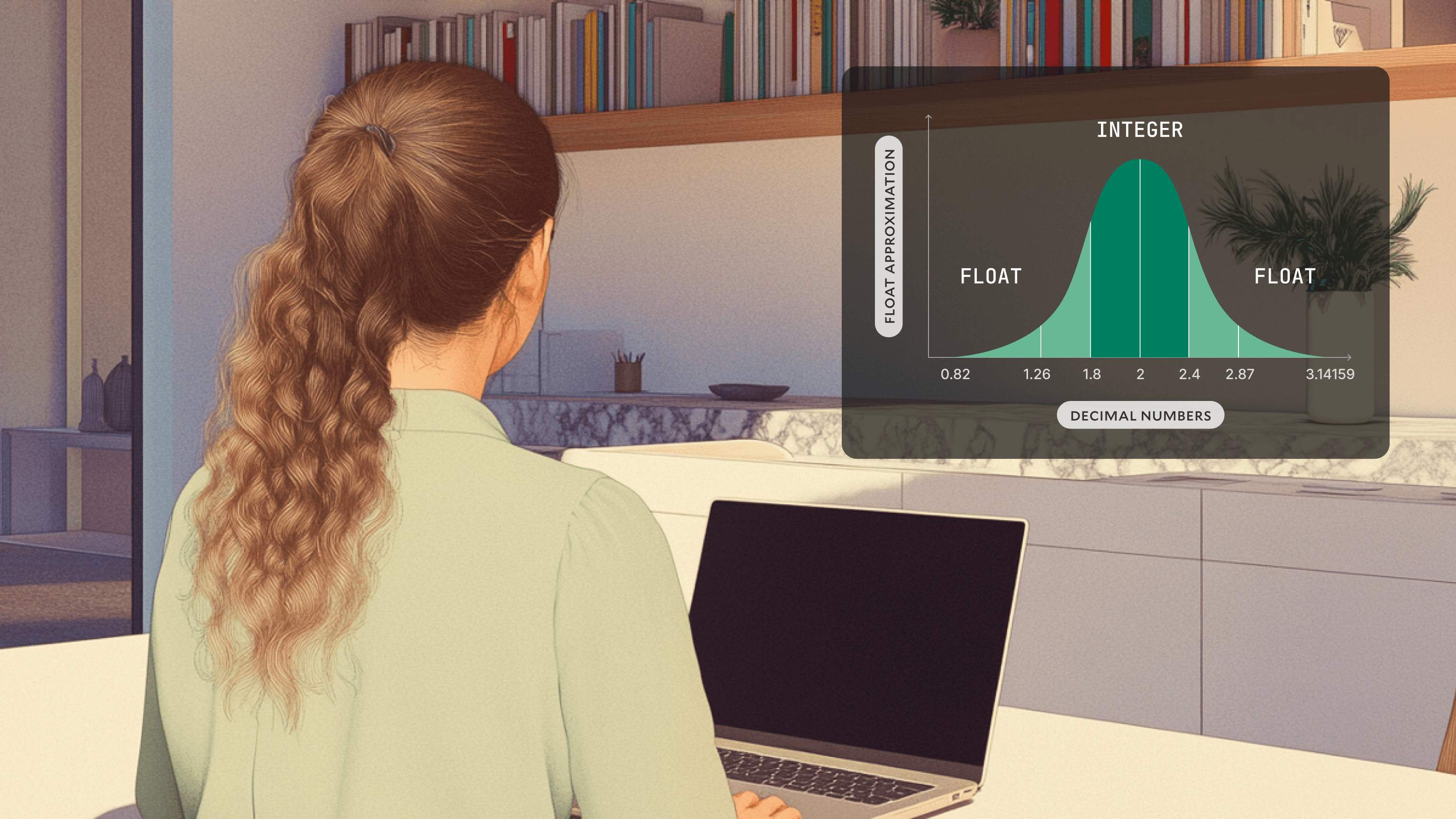

With both data sources in our platform, we use AI and machine learning models to enrich, normalize, and automatically reconcile the data to streamline your operations. All reconciliation statuses are available both via our API and within our financial dashboard.

Oversee Your Financial Operations

Lastly, our Reconciliation Engine incorporates new capabilities to support finance and treasury teams via our financial dashboard. These capabilities, which include case management, exception handling, and cash monitoring, provide finance professionals with powerful tools to manage their financial operations and an insightful real-time source of truth for all money movement.

Move Forward With Better Data

With Modern Treasury’s reconciliation engine, companies receive enriched, up-to-date payments data at all levels of their organization. This enables better products and operations, stronger decision-making, and greater transparency and trust across the organization.

“Modern Treasury’s reconciliation provides a payment level view into payments in-flight at any given point across multiple banks, which would be near impossible to do manually at scale.”

John Quine, Head of Accounting, Parafin

Try It Now

We hope the launch of our Reconciliation Engine unlocks new efficiencies and opportunities for you. If you want to give it a try or learn more, visit our Reconciliation page or reach out to us.