Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

How Incoming Payment Details Work

We have tools to make managing your financial transactions simple and straightforward. One of those tools is our notification of the details of an incoming payment.

Managing your business’s finances well is one of the most important things you can do as a business owner. Knowing when you’ll have funds in your bank account and where those funds are coming from allows you to make better-informed decisions about how to manage your business’s cash flow. Here at Modern Treasury, we have tools to make managing your financial transactions simple and straightforward. One of those tools is our notification of the details of an incoming payment.

What Are Incoming Payment Details?

Incoming payment details (IPD) are notifications of an incoming payment originated by someone other than the holder of your account. This happens when an external party pays you without you initiating the transfer. Think of incoming payment details as the opposite of a payment order.

Let’s imagine that a payroll company, That’s How We Payroll, uses their business bank account through Modern Treasury. In their day-to-day business, That’s How We Payroll receives money for their services via the Automated Clearing House (ACH) Network, check, and even wire transfer. Today, it received an incoming payment detail for the first time. The IPD notification lets That’s How We Payroll know that a transaction of $5,000 is on its way to its account from a different bank.

What Are the Benefits of Incoming Payment Details?

1. Provides Information About the Transaction

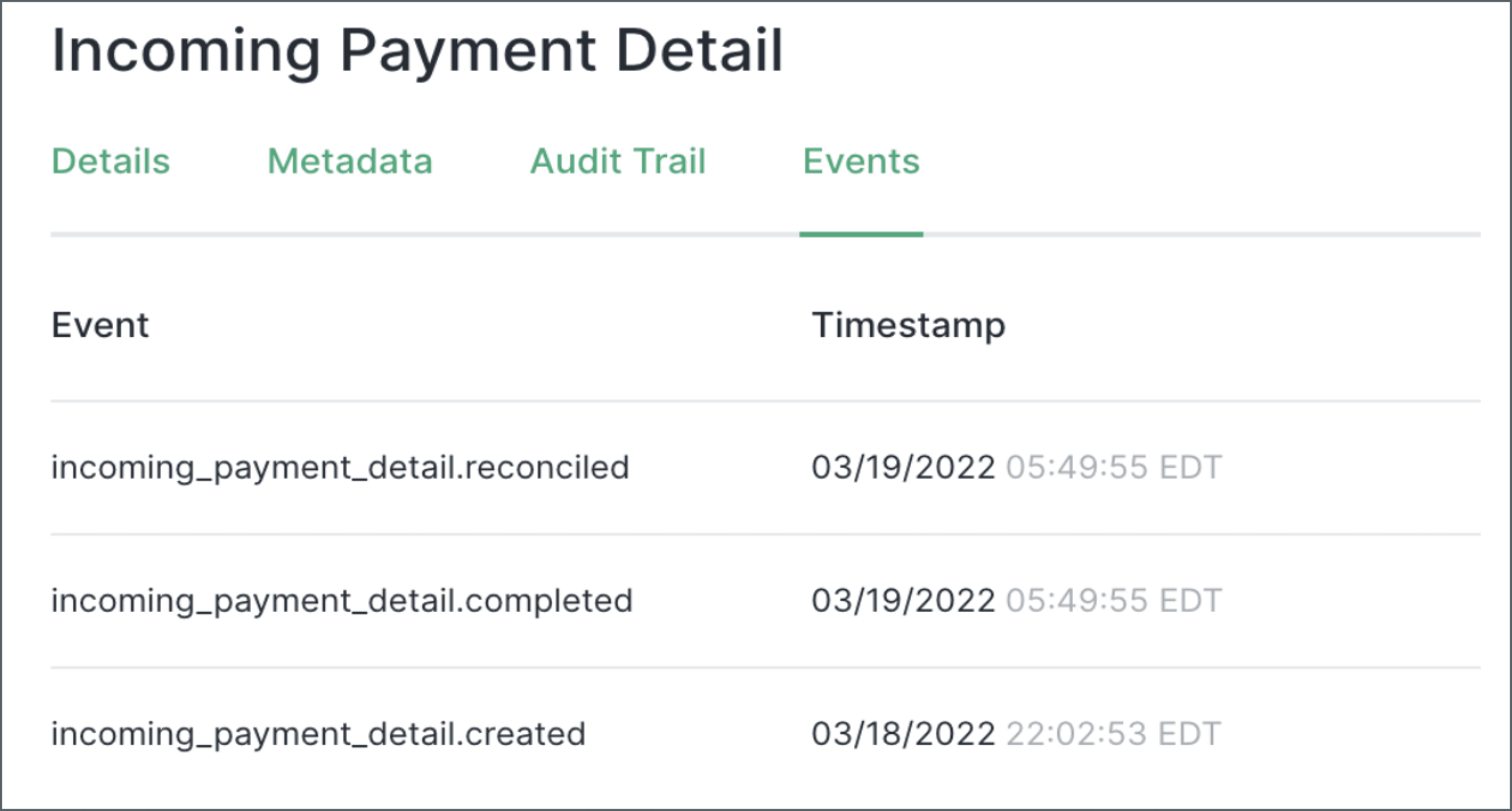

IPD notifications provide specific information about an incoming transaction before the funds clear in your account. The incoming payment detail does not represent the settled transaction, rather it is a notification that a transaction will be posted. Because IPD notifications alert finance or payment operations teams about an incoming transaction before the funds are settled, they can take action on those funds in advance, if needed.

The information provided in an incoming payment detail varies depending on an organization’s bank. Generally IPDs include the amount of the transaction and the originator of the transaction. The currency of the transaction, trace numbers, or perfect receivable numbers may also be included in an IPD notification. Even if a bank does not support early notification, Modern Treasury is able to create internal payment detail notifications for certain transactions.

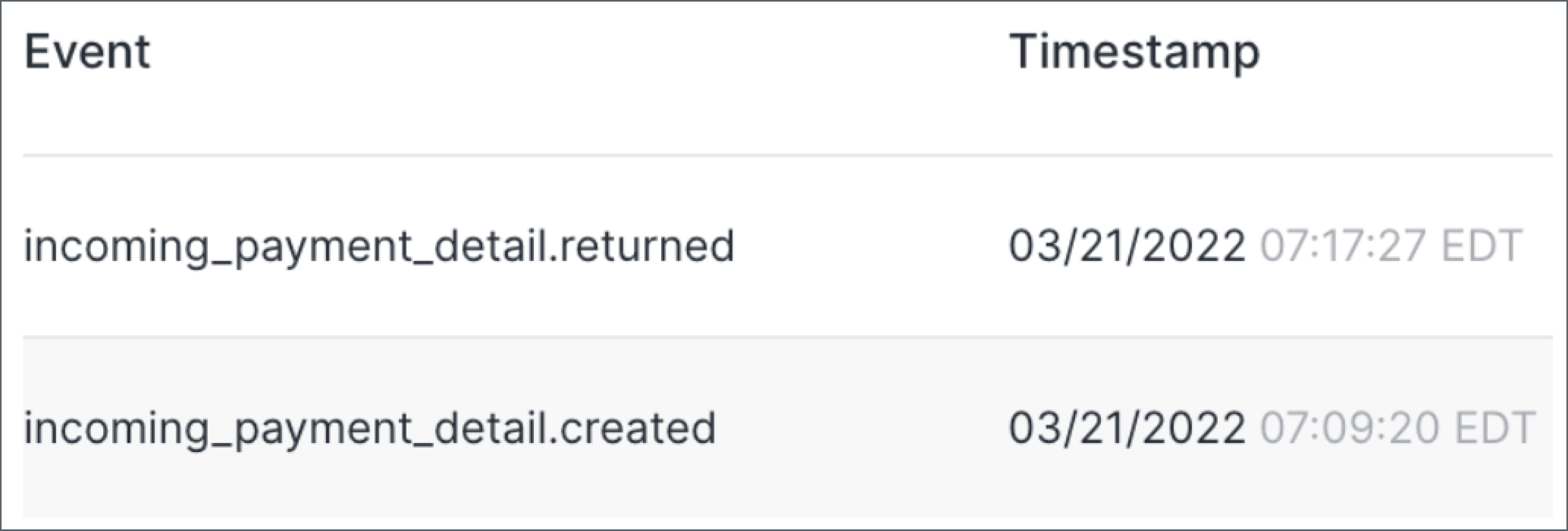

2. Allows You To Initiate a Return Before Funds Settle

If, for some reason, an incoming payment needs to be returned to the sender, IPD notifications make it straightforward to create a return for the funds. Modern Treasury automatically parses out the information from the IPD needed to create a return, so that customers don’t need to worry about how much money to return or where to send it.

Looking at our earlier example, That’s How We Payroll received an incoming payment detail notification for a $5,000 transaction on its way to their business bank account. Let’s imagine That’s How We Payroll does not want this $5,000 because their payment operations team flags that it doesn't know who sent the payment nor the reason for it. Because of the IPD notification, That’s How We Payroll can save time and initiate a return of the payment through Modern Treasury before the funds settle.

3. Allows You To Keep Track of Transactions Using Virtual Account Numbers

Virtual accounts allow companies to attribute specific transactions to certain people or businesses. For example, one internal account may hold all of the funds from customers and separate virtual accounts for each individual customer. IPD notifications can track inbound payments into virtual accounts assigned to different customers.

That’s How We Payroll has some customers who pay them via wire transfer. When a customer asks to pay by wire, That’s How We Payroll provides them with a specific virtual account number for where to send the funds. Once the funds are sent by the customer, the incoming payment detail will contain their assigned virtual account number, helping That’s How We Payroll properly attribute inbound transactions.

4. Allows You To Plan for Funds That Will Be in Your Account

Another benefit of incoming payment details is that they can provide you with a clear picture of additional funds coming into your account. Knowing what funds will be available in your bank account is crucial when budgeting for business expenses.

For example, That’s How We Payroll knows from their incoming payment details that they have $5,000 heading into their account. Now that they are aware of the incoming funds, That’s How We Payroll can trigger money movements to and from other accounts or send notifications that the funds were received in an app.

Close

With so much data moving between accounts, this is where Modern Treasury steps in. We match your bank statements to your financial transactions, so your payments team can focus on the work they need to do instead of sorting through bank transactions by hand. To try simulating IPDs in our sandbox, get in touch with us here.