Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Introducing Real-Time Payments

We’re excited to announce that Modern Treasury now supports sending payments through the Real Time Payments (RTP) network. RTP instantaneously delivers fund to your customers and vendors at any time: 24 hours a day, 7 days a week, 365 days a year. For more background on RTP, here’s a useful primer.

We’re excited to announce that Modern Treasury now supports sending payments through the Real Time Payments (RTP) network. RTP instantaneously delivers fund to your customers and vendors at any time: 24 hours a day, 7 days a week, 365 days a year. For more background on RTP, a useful primer.

What You’ll Need

- A bank account at a financial institution that supports sending RTP payments. You can view the list RTP enabled banks that Modern Treasury supports here. [1]

- A recipient who has a bank account at an RTP receiving institution. Almost all large retail banks support receiving RTP payments. In the US, over 50% of direct deposit accounts are eligible to receive RTP funds today. [2]

The RTP Payment Process

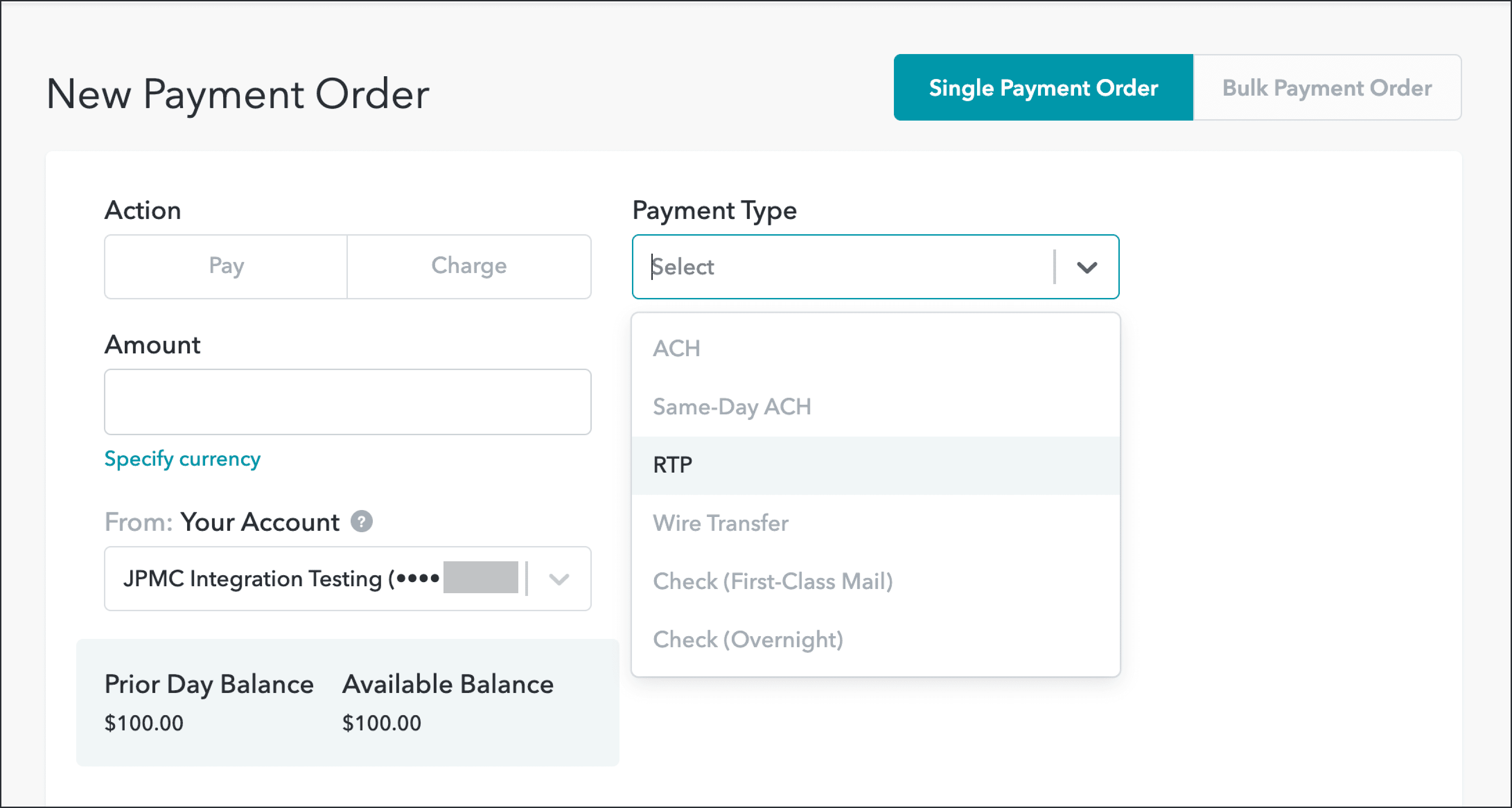

Creating an RTP Payment Order

RTP payment orders are available in the Modern Treasury app and API.

In the application, create an RTP payment order by using your RTP-enabled bank account. In the Payment Type drop down, “RTP” will appear as an option.

In the API, set payment_type to rtp when creating a payment order. The Modern Treasury API docs include a specific example request for creating an RTP payment order programmatically.

Processing an RTP Transaction

After you create an RTP payment order through the app or the API, Modern Treasury will send that payment instruction to the originating bank. The originating bank will transmit that payment instruction to the RTP network for settlement. Within as few as 15 seconds, the funds will be available to the recipient. [3]

Completing an RTP Transaction

Once the RTP payment is sent, the RTP network will either confirm and complete it or fail the transaction with an error code. If the transaction succeeds, the account that originated the RTP payment will be immediately debited.

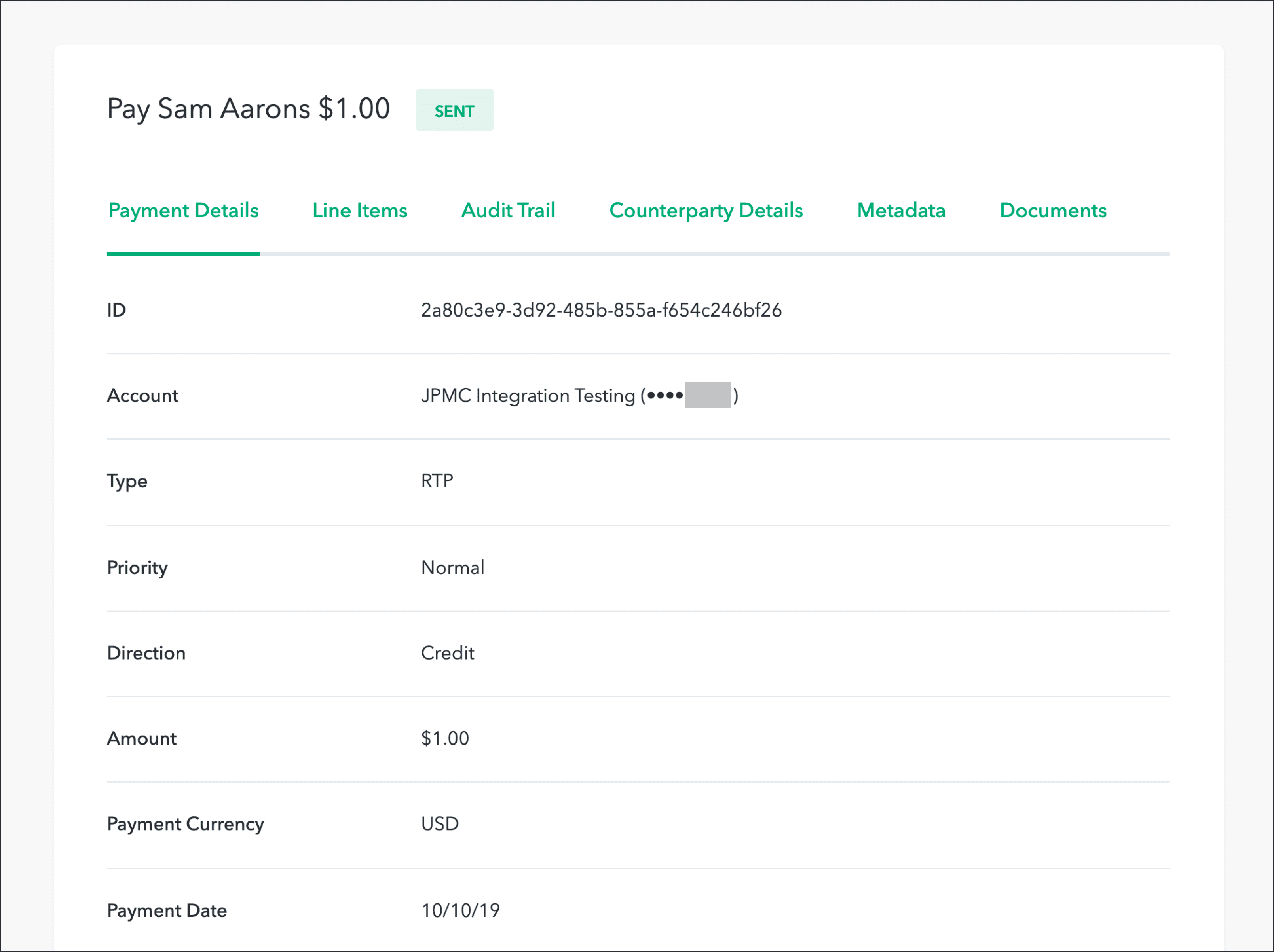

RTP Demo

Just before publishing this post, I sent a $1 RTP payment to my boss, Sam Aarons. Here is that payment in the Modern Treasury app:

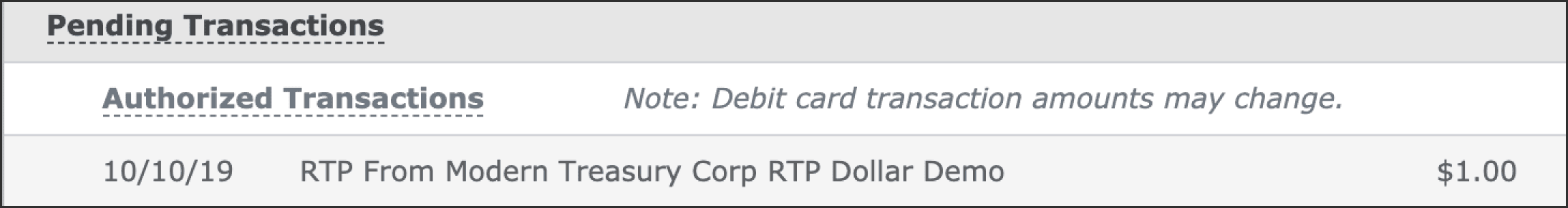

Seconds later, the payment shows up in Sam's bank account.

Screenshot from Wells Fargo showing the RTP payment. The $1 balance is available to Sam immediately.

RTP Network Restrictions

Please note the RTP network currently has some restrictions. These include:

- Each RTP payment is limited to a maximum amount of $100,000.

- RTP only supports USD payments.

- The counterparty’s receiving bank account must be at an institution that supports receiving RTP payments.

- RTP payments are only available in the credit (push) direction. [4]

Want RTP for Your Product?

We believe that RTP payments will help product teams build great payment flows, and help finance teams manage payment operations more effectively. If you’d like to learn more, schedule a demo or email us at getrtp@moderntreasury.com.

Corporate bank accounts held at an institution that can issue RTP payments still require some set up before you can send an RTP payment from that account. Talk with your support team at Modern Treasury to get RTP sending functionality, or contact your Treasury Services representative (or equivalent) at your bank.

The Clearing House. RTP FAQ. “Now that the RTP Network is live, who is using it?” Oct 8th, 2019.

JP Morgan, Treasury Payments Faster Payments - US RTP. Overview. Available in the JPMC Treasury Services Portal. October 8th, 2019

The RTP specification includes support for “Request for Payment” which can replace debit functionality, but that is not yet available.