Join our next live session with Nacha on modern, programmable ACH on February 12th.Register here →

Key Learnings From Transfer 2024: Beyond Payments

On May 15th, Modern Treasury hosted Transfer 2024: Beyond Payments at The Midway in San Francisco.

On May 15th, Modern Treasury hosted Transfer 2024: Beyond Payments at The Midway in San Francisco. Hosts of the Acquired podcast, Ben Gilbert and David Rosenthal emceed again this year, and brought their warm energy and thoughtfulness to the event.

Attendees joined us in person and virtually for eight incredible sessions, as well as for networking and demos throughout the day. Here, we’ll take a look at some of the key learnings and top takeaways from Transfer 2024.

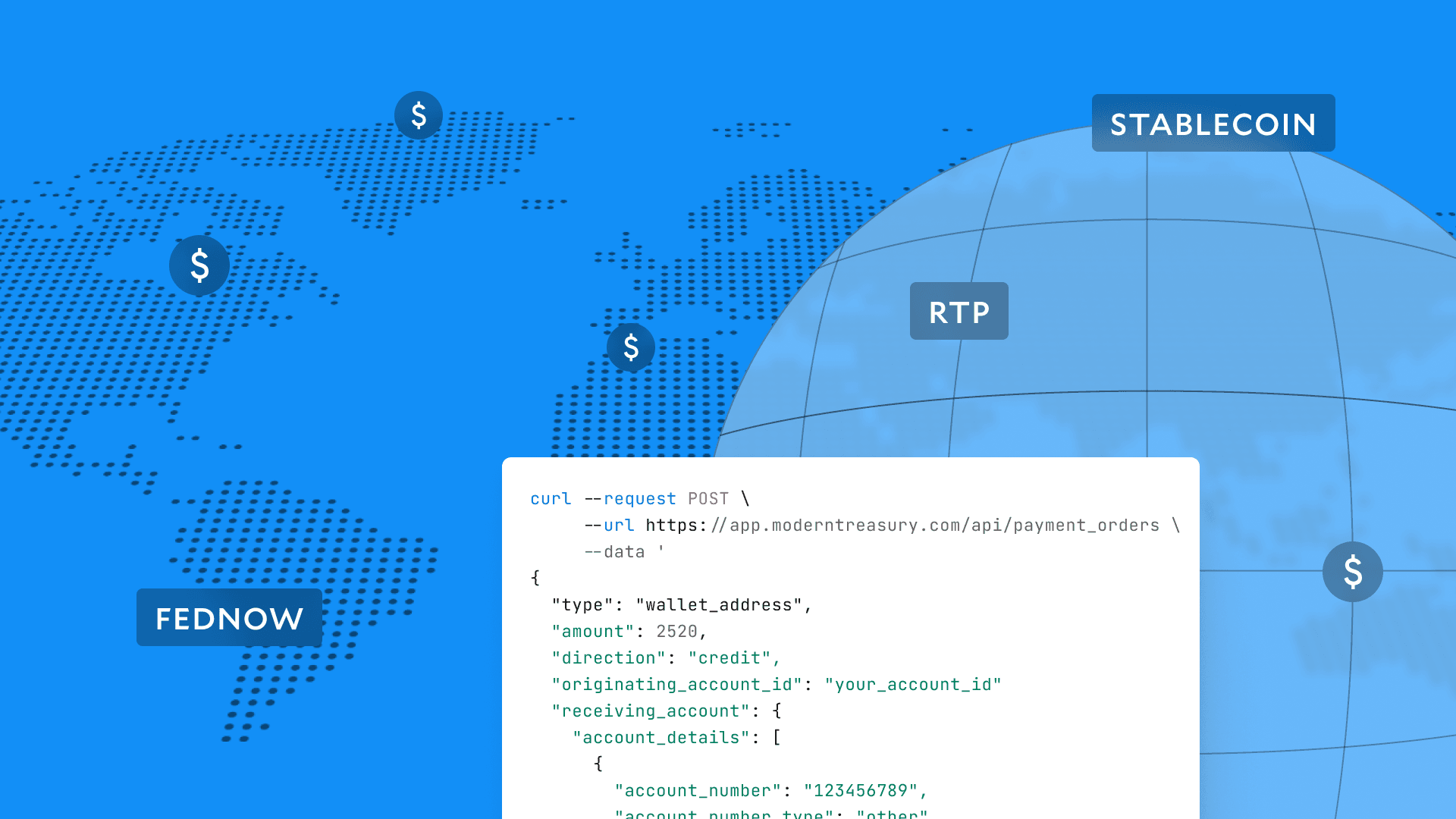

Money Movement Goes Beyond Payments

After last year, when we welcomed the New Era of Payments, which requires an operating system for the entire lifecycle of money movement—moving, tracking, reconciling. This session featured our three founders, plus a live demo of our new Reconciliation features.

Modern Treasury CEO, Dimitri Dadiomov, kicked off the event with a look at the current landscape of payments and how we are approaching its innovations and challenges:

“With real-time payments becoming a reality—and, make no mistake, it is becoming a reality with the Fed behind it—it will become IMPOSSIBLE to do manual reconciliation at scale. 24/7/365 money movement will complicate reconciliations throughout corporate America and beyond, and not trivially. We will need real-time software to meet this need.”

Dimitri Dadiomov, CEO & Co-Founder, Modern Treasury

Then, our CTO, Sam Aarons, took the stage to reflect on how two converging technologies—AI and faster payments—are shaping the future of payments.

He also reintroduced the backbone of Modern Treasury’s product set: The RISE Engine. This is what we’ve been building and perfecting for six years. The engine:

- Relays messages between the internal systems of banks and our customers, including ERPs, data warehouses, card processors, and more.

- Integrates siloed data sources. If you have multiple accounts and multiple banks, and need to see all of your balances, our system puts them behind a single pane of glass.

- Structures your data based on a semantic understanding. We get data in so many different formats but it’s all representing the same platonic idea; the engine can structure this, simplify it, and present it in a consumable format.

- Enhances itself through AI and data. The more data it consumes, the more patterns we notice, and the better the engine gets at working. The engine, using AI, can then present users with possible enhancements that make their day-to-day lives easier.

Taken together or not, all of our products—Payments, Ledgers, and Reconciliation—come with powerful platform features:

- Every single payment made through Modern Treasury is reconciled for you in real-time, automatically.

- And each one of those payments can be automatically entered into your Ledger.

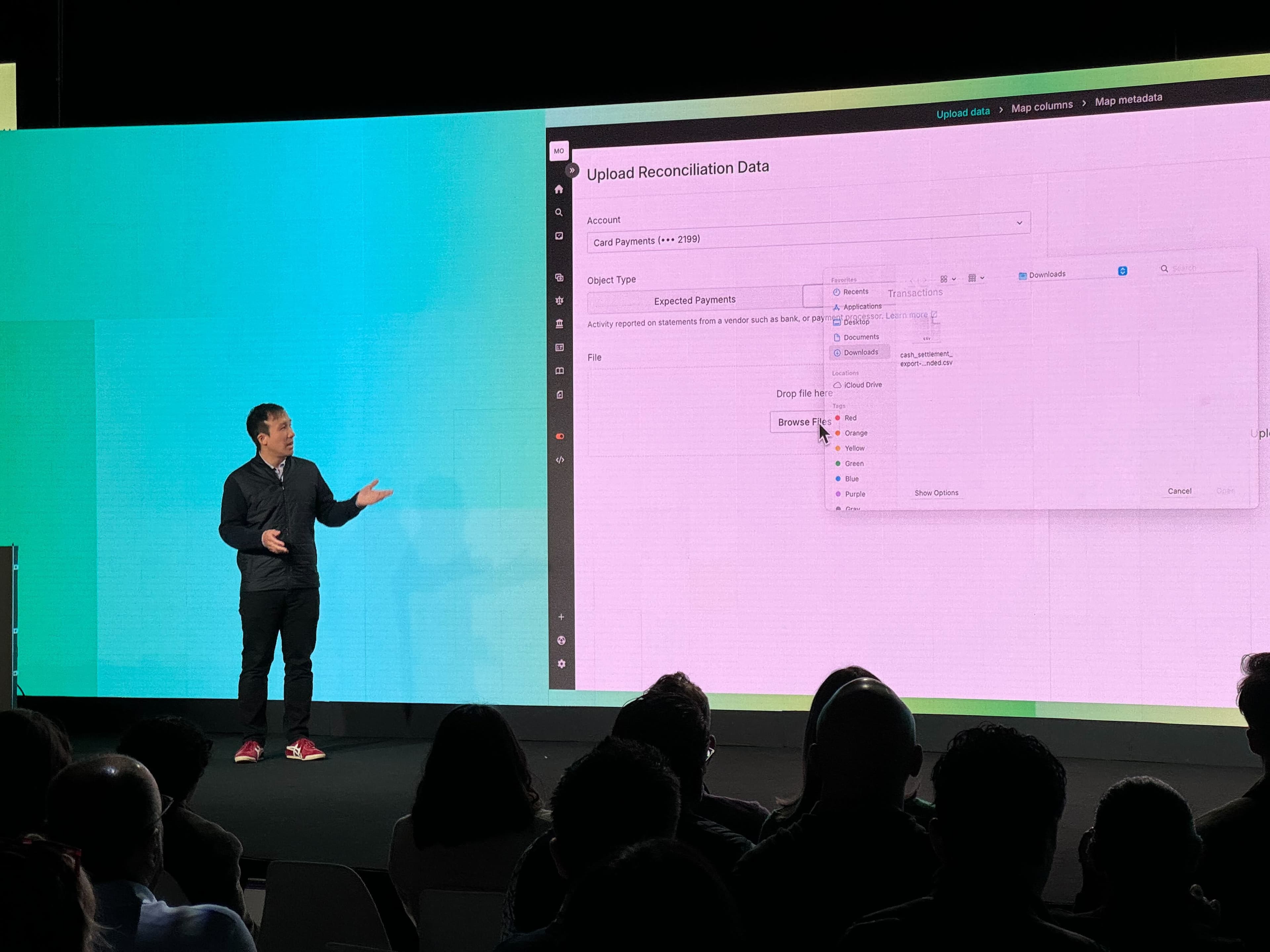

Finally, Matt, Modern Treasury’s CPO, took the stage to talk about reconciliation, why it can be challenging, and just how important it truly is to businesses operating at scale.

To round out the opening keynote, Matt was joined on stage by Wayne Lin, Modern Treasury’s Product Lead for Reconciliation to demo our new Reconciliation features.

“In a world of increasing payments complexity and speed, we know that real-time, item-level, and AI-assisted reconciliation is going to be essential for transforming financial operations.”

Wayne Lin, Product Manager, Modern Treasury

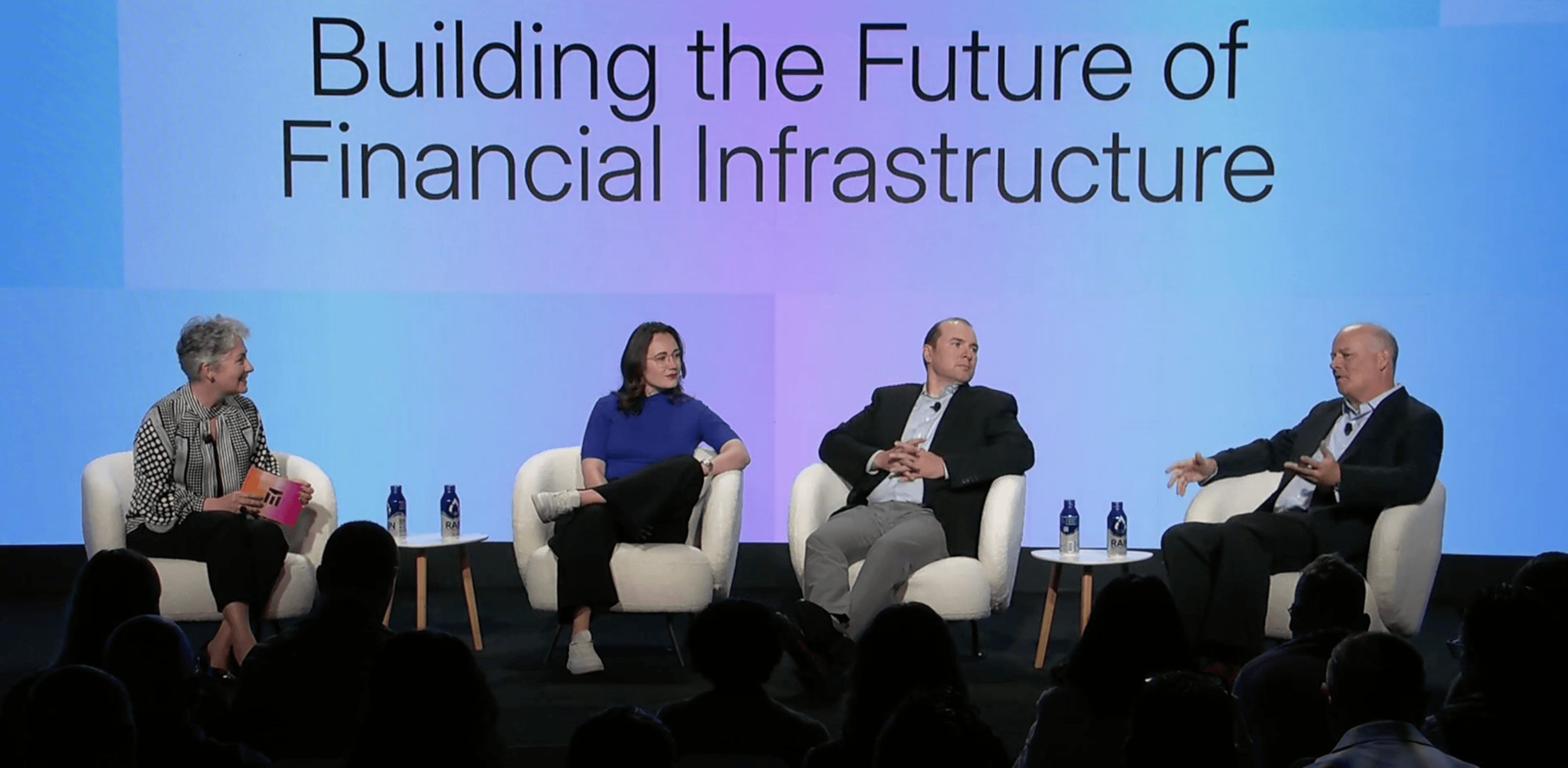

Building the Future of Financial Infrastructure

This panel featured enterprise leaders who have gone through or are going through modernizing payment infrastructure. Moderated by Erin McCune from Bain & Company, leaders such as Julia Jansen of Navan, Doug Anderson of AvidXchange, and Brian Glaze of Stewart discussed the challenges of modernizing payment infrastructure.

They explored the risks and benefits of migrating from legacy systems, such as data breaches and human error, and shared strategies for leveraging these changes to unlock new growth opportunities.

“It all goes back to the experience we want to deliver. Modern Treasury didn’t exist, so we were building bespoke and rail-by-rail. But there is a better way…Infrastructure is like roads: The difference between gravel and an interstate highway. That’s what infrastructure can be for payments.”

Doug Anderson, Chief Product Officer AvidXchange

Ultimately, the panelists agreed that, while shifting from legacy infrastructure can be labor and time intensive, it’s worth it—especially with a partner like Modern Treasury.

“Not having a team cutting checks in the back office is going to be huge. And the whole cost structure of new payment rails is so economical compared to wire transfers or cutting checks. We are excited about this.”

Brian Glaze, Chief Accounting Officer, Stewart

Capitalizing on the Opportunity of FedNow

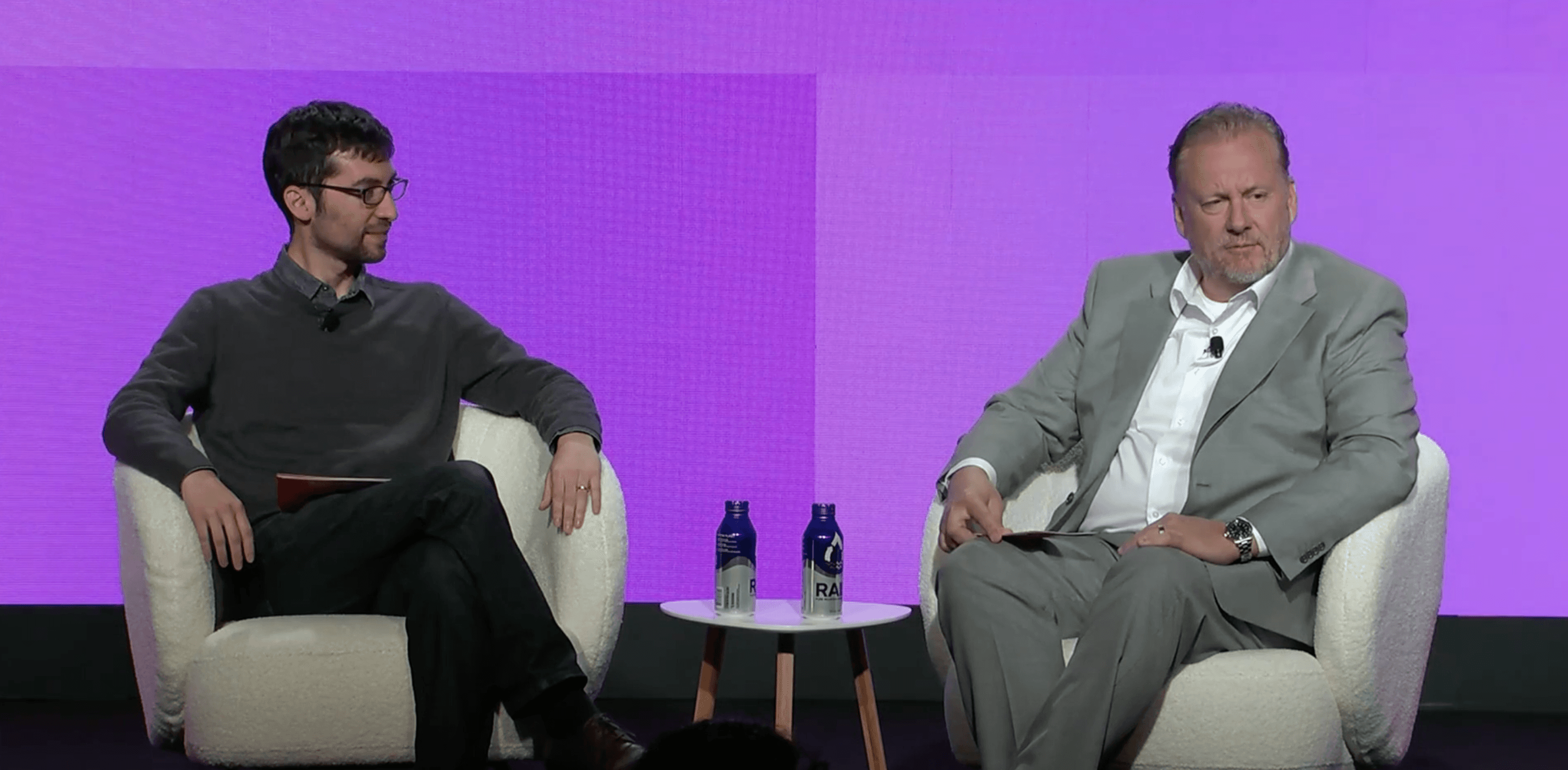

FedNow's launch last July marked a significant shift in US payments. Modern Treasury's Co-Founder, CTO and resident Payments Nerd, Sam Aarons, was joined in conversation by Tim Boike, VP of Industry Engagement from the Federal Reserve. Tim noted how faster payments can change the landscape for financial institutions: “When you start discussing moving from a traditional work day and moving to a more dynamic around-the-clock work day, there are a ton of different issues you have to resolve. One of those is customer service, and we’ve worked with financial institutions on that. If a transaction is declined at 3am on a Sunday, who do you call? Those are things we have to talk about.”

The two also touched on security, authentication, and irrevocability of payments on the FedNow network and how that has affected adoption. Specifically, they focused on how the Fed, banks, and service providers can and should be working together to help continue to drive adoption and implementation for the service.

“The demand is there. I don’t think it's a question of if instant payments will catch on, I think it’s when. Working with companies like Modern Treasury and talking to your financial institution is going to be critical.”

Tim Boike, VP of Industry Engagement, The Federal Reserve

Partnering for Better Products: How Banks and Fintechs Can Work together

Chetan Puttagunta, General Partner of Benchmark joined John China, Co-Head of Innovation Economy from J.P. Morgan and Dimitri to discuss how financial institutions are driving innovation through strategic partnerships. They highlighted the importance of these collaborations in enhancing customer experiences and shaping the future of the innovation sector.

“We tend to measure the world in decades. I think this is one of the most exciting decades that we are all facing.”

John China, Co-Head of Innovation Economy, J.P. Morgan

Much of the conversation focused on AI and how it can be transformative for the payments world, specifically how the power of scale and how AI can shape the way we work and the ways banks work. Dimitri Dadiomov noted:

“It is a remarkable time in Silicon Valley history…There’s been a lot of hype around AI and you wonder if it’s really going to help me in my day to day life. When you think about problems like recon, that's a problem that, at a base level, computers should be good at……There’s a lot of excitement and optimism that AI could really free up a lot of days and time.”

John China also pointed out that, with the rise of AI, reliability and security have to become even more significant when it comes to payments and banking. Especially in terms of improving the customer experiences and how J.P. Morgan views this, he said,

“For us, our client experience is our number one focus area. That is the thing we care most about and ensuring that those transactions are kept safe and make it to their end destination. We lean in and listen to the things that [our clients] need the most. … Any opportunity for us to engage a client where they can share how we can improve their process.”

In terms of how Modern Treasury and JP Morgan work together, client experience and security were again top of mind for the panel. From limiting service outages, to providing top-of-line, best-in-class software, Modern Treasury and its bank partners are continuing to look towards ways to streamline and facilitate the most reliable, easiest payments solutions for shared clients.

“Our clients are coming to us and saying ‘we fell in love with this solution and it solves a real problem on the back end.’ That’s how we ended up working together. Our clients are pushing us towards Modern Treasury.”

John China, Co-Head of Innovation Economy, J.P. Morgan

Tracking Transactions at Scale: The Keys to Trusting Your Financial Data

Moderated by Ayo Omojola from Carbon Health, this panel featured Jon Bittner, Co-Founder & CEO of Splitwise; Doug McKay, Director of Engineering from ClassPass; and Koji Murase, Product Lead for Ledgers of Modern Treasury talking about the necessity of a robust ledger database for accurate financial tracking.

The panel emphasized the value of maintaining a single source of truth for financial data to ensure accuracy and trust in financial reporting. But with that comes the task of building or buying a ledger that can work for a company at scale:

“No engineer wants to build a ledger internally. It’s just not really differentiated work. We make it easier to abstract that away and make sure you’re focusing on your core business”

Koji Murase, Product Lead for Ledgers, Modern Treasury

ClassPass uses Modern Treasury to manage the ledgering for their global platform. On how they’ve found success in partnership with Modern Treasury, Doug McKay noted, “Our core business is not accounting. It’s about connecting consumers with great experiences and connecting vendors with those consumers.”

The panel also delved into what it looks like when things go wrong with a ledger. Homegrown ledgering systems, specifically, can struggle to keep up with the needs of companies that are focused on moving money—at scale—efficiently.

John Bittner playfully noted that, “Ledgering going wrong can create an absolute tumble of trouble.” Continuing on he said, “We’ve been fortunate since we started with Modern Treasury since day one that we haven’t had any tire fires… We don’t live in a fully real time world yet. If you want a ledger you can fully reconstruct that it is immutable, it can go way more wrong than we’ve ever experienced.”

Reconciliation Reimagined

Rachel Pike, COO of Modern Treasury, led this fireside chat with Bill Reboul, SVP of Banking and Payments at Alegeus. The two shared insights on managing the complexity of payment reconciliation in high-volume environments and discussed the decision-making process for Alegeus when implementing Modern Treasury.

Alegeus’ use case is complex. Alegeus is a leading provider of consumer-directed healthcare solutions. They operate across multiple banks and with hundreds of bank accounts.

As Bill put it, “Recon for us is really an existential thing. If you think about what we do, we sit in the nexus of making sure that individuals who are going to the pharmacy and swipe their payment cards that those transactions happen and that we can reconcile it all the way through.”

Bill continued to share some of the lessons that he and the team at Alegeus learned through their reconciliation implementation.

“If you’re gonna build for scale, you have to understand the basics. And you have to have the right tools in place to be able to act as you scale. The problem doesn’t get bigger, it just gets harder to solve.”

Bill Reboul, SVP of Banking and Payments, Alegeus

Reconciliation is challenging for enterprises and companies operating at scale primarily due to the high volume and complexity of transactions they handle. Additionally, manual processes, still prevalent in many organizations, are prone to human error and inefficiency, making reconciliation labor-intensive and error-prone. As companies grow, scaling these processes to handle increased transaction volumes without compromising accuracy becomes a significant challenge.

Adapting to AI: How New Tech is Changing Financial Services

This panel brought together Artificial Intelligence (AI) and finance experts, including Alex Walvis, Managing Director at Allen & Company LLC; Erica Libby, Product Manager at Modern Treasury; Jenny Johnston, Account Director at OpenAI; and Seema Amble, Partner at Andreessen Horowitz, to discuss the responsible application of AI and Machine Learning in financial services.

The panel highlighted the potential of AI to transform money movement and outlined strategies to harness these technologies effectively, including notes for businesses that aren’t taking advantage of AI.

The panelists also dove into how AI can be leveraged to simplify work streams or help manage limited resources. Seema Amble pointed out:

“[If] you have a skeptical buyer who has limited budget, it does take more convincing around ROI and trust. But on the flip side, if this buyer has limited engineering resources, AI can really bridge that gap. You don’t need to go to an engineer to go build out all the integrations, you can use software to do that.”

Seema Amble, Partner at Andreessen Horowitz

The panel also moved through a discussion of the movement towards the ubiquity of AI, positing that most businesses have employees already leveraging AI to help with their jobs—whether the business knows it or not.

As Jenny Johnston put it:

“I think everyone can benefit from AI. Everyone in this room has a part of their job that sucks…. And part of their job that would benefit from an army of the smartest interns you’ve ever had. And that is what ChatGPT is….[B]e honest with yourself about why you haven’t started… If you’re adopting this you will benefit. If you’re not adopting this, you will be left behind.”

How to Win and Build Great Teams with Joe Montana

The event concluded with a captivating interview with four-time Super Bowl Champion Joe Montana, conducted by emcees Ben Gilbert and David Rosenthal. Montana shared experiences from his illustrious football career and his journey as an angel investor and venture capitalist.

When discussing the success of his venture capital firm, Liquid 2 Ventures, Joe said, “We have a large team for the size of our funds… but I just think the diversity behind everyone’s background really allows us to invest agnostically across all sectors.”

Throughout the discussion, Joe provided valuable lessons on leadership, teamwork, and navigating change both on the field and in business.

“Bill’ [Walsh]’s philosophy always was: ‘If you aim to be perfect and you miss, you can still be pretty good. But if you aim to just be mediocre and you miss, you won’t be on this team very long."

Joe Montana, 4x Super Bowl Champion & Managing Partner at Liquid 2 Ventures

Transfer Year Two is in the Books!

We want to thank everyone who joined us in person at the Midway in San Francisco and online for our virtual event. Our team is grateful for everyone who made this event possible—it was wonderful spending time with so many payments leaders. We had a great time at the conference and are already looking forward to next year!

If you want to learn about how Modern Treasury can help your business win in this new era of payments, reach out to us.