Announcing New Features for Real-Time, AI-Assisted Reconciliation

Modern Treasury is proud to release new features to help companies transform reconciliation.

Today at Transfer 2024, Modern Treasury is proud to release new features to help companies transform reconciliation.

For many teams, reconciling cash across a large number of transactions and accounts is an outsized challenge. Most enterprises deal with inconsistent reporting from varying sources, routine exceptions, and complex matching scenarios. Still, reconciliation is vital for full financial control and risk management—it shouldn’t be a nightmare.

During Transfer, we are also introducing the RISE Engine, which relays, integrates, structures, and enhances financial data. This engine is the infrastructure we’ve spent the past six years building and perfecting, and it powers the following reconciliation enhancements.

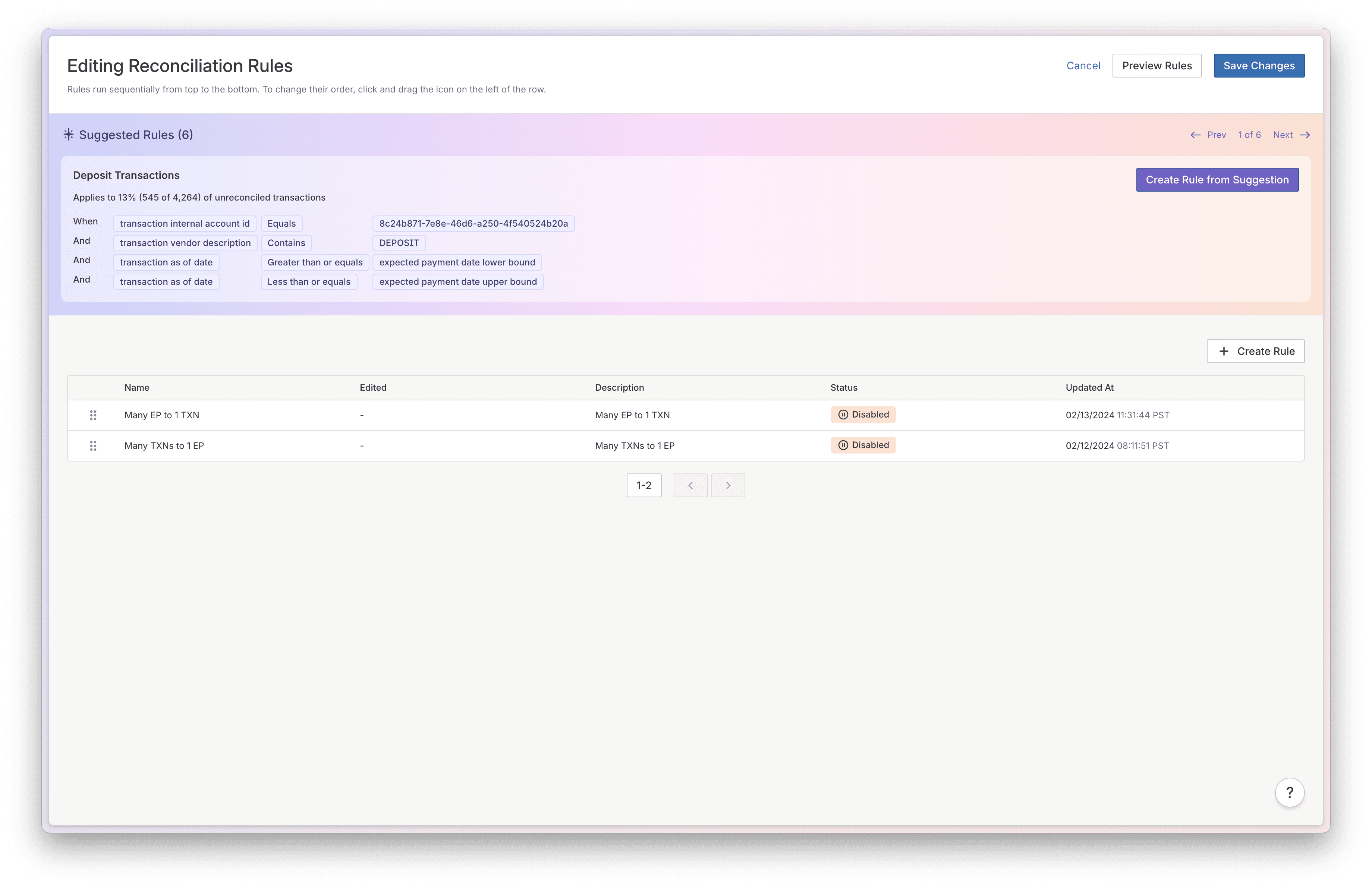

AI-Powered Rule Suggestions

We’ve continued to improve and expand our use of AI in reconciliation. Reconciliation match suggestions are now faster, and we are excited to announce reconciliation rule suggestions. As a learning system, Modern Treasury recommends reconciliation rules based on data available on the platform. Modern Treasury generates these rules using a combination of heuristics, deterministic algorithms, and large language models (LLMs).

These rules also increase reconciliation speed. Pattern recognition within a company’s dataset enables faster automation, achieving item-level reconciliation rates of 90-100%. Like all AI functionality at Modern Treasury, the end-user retains full control, with the ability to edit rule suggestions as well as choose whether or not to adopt suggested rules.

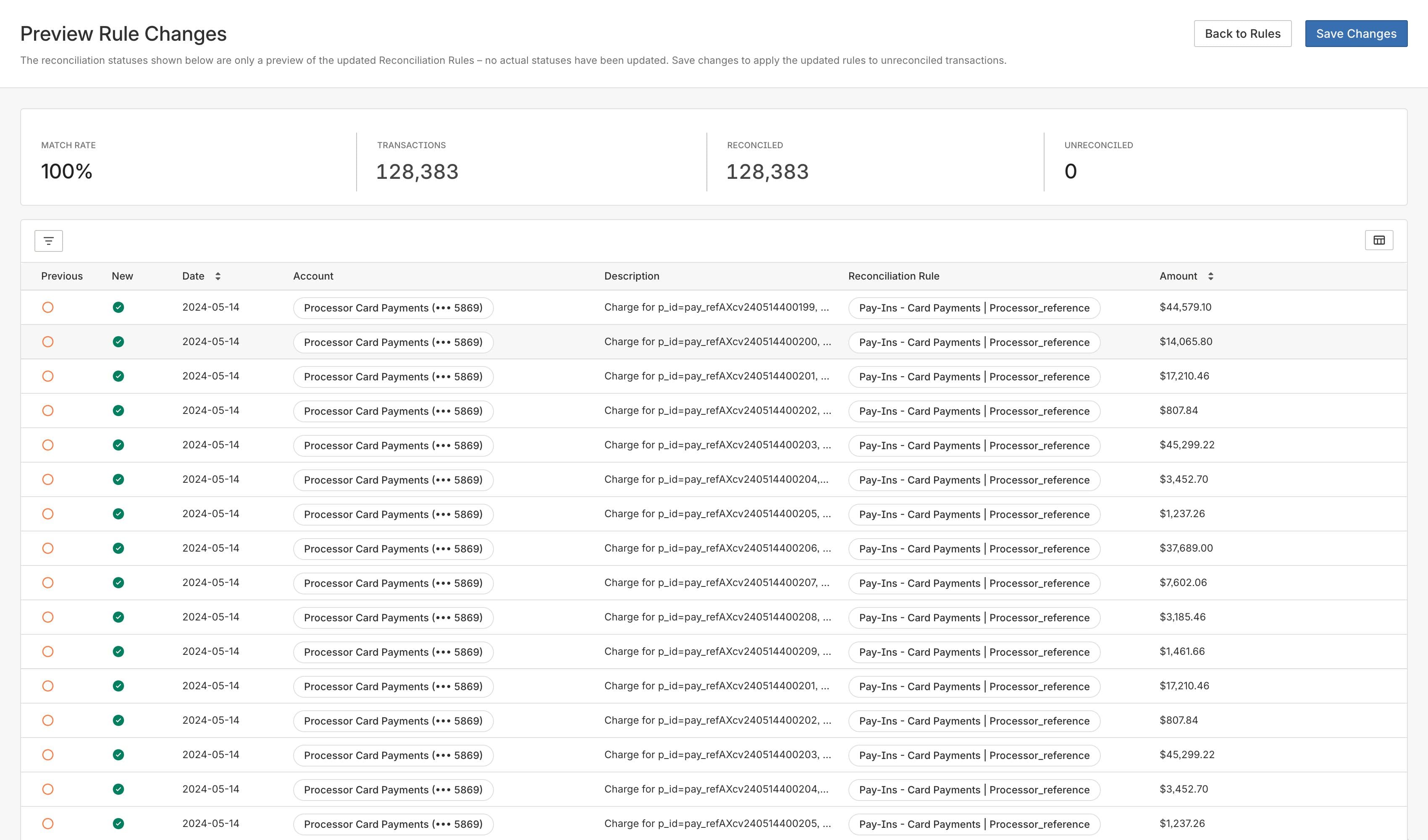

Rule Previews

To further ensure finance teams can achieve both high automation and pinpoint accuracy, Modern Treasury has released Rule Previews for reconciliation. Rule Preview allows finance teams to preview the results of all new reconciliation rules for a given dataset before implementing them.

In this flow, users can re-run reconciliation for transactions that settled from their desired interval. The dashboard then displays whether the transactions would have been reconciled given the new rule. With these previews, finance teams can make controlled changes to their reconciliation rules to ensure a higher reconciliation rate.

AI-Powered Data Ingestion

Every finance team relies on data, oftentimes from disparate systems, to complete key processes and workflows. We’ve launched AI-powered flexible data ingestion functionality for user-defined data formats, such as a custom CSV. Users can now seamlessly upload data into Modern Treasury to create transactions and expected payments with suggested data mappings, normalization and structuring. With the import functionality, finance teams can quickly import data. This workflow complements the API, and enables users to easily import data when needed—such as to handle exceptions, or when reconciling new payment scenarios.

Account Reconciliation & General UX Upgrades

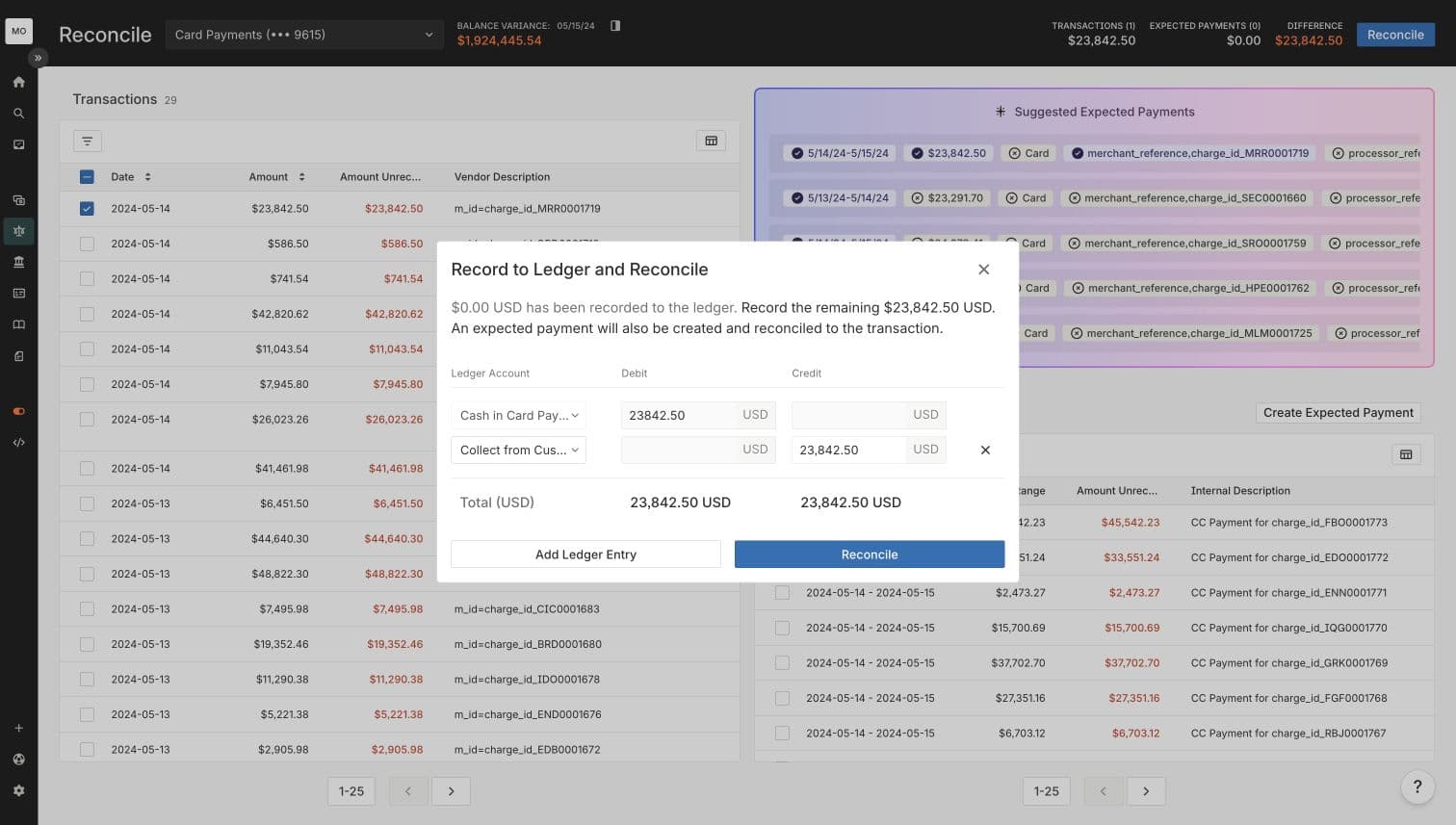

Modern Treasury is releasing Account Reconciliation to allow finance teams to resolve variances between a reported account balance and an internal ledger balance. With this feature, users can ensure that their internal ledger records fully account for all funds at the bank. In addition to serving as key validation that all transactions are accounted for during a given period, this ledgering of funds can also accelerate financial reporting.

Reconciliation users who also use Ledgers can link ledger accounts to internal accounts. This allows users to view a ledger variance column on each internal account and a detailed variance history.

When exploring variances for a given reporting period, users are taken to our updated reconcile dashboard, which allows them to book unreconciled transactions to the ledger.

We’ve also introduced several UI and UX updates that make using Reconciliation easier and more intuitive, including color coding a given set of fields, more prominent rule suggestions, custom columns, and improvements in performance.

Reconciling 100% of Your Transactions with Modern Treasury

Each enhancement announced today, in tandem with existing reconciliation functionality and the RISE engine, has been designed to help teams reach $0 variance and get to 100% reconciled every day via exception handling and reconciliation rules. As payments become faster and more complex, we believe real-time, item-level, and AI-assisted reconciliation is going to be increasingly essential for finance teams and companies. Reach out to explore our solution.