Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

Creating Custom Payment Workflows with Pre-Built UIs

Using Pre-Built UIs, companies can now create custom payment experiences to improve efficiency with minimal engineering and IT involvement.

Explore with AI

As the operating system for money movement, Modern Treasury helps businesses oversee and execute complex fund flows, from start to finish. For many companies, important steps in a payments workflow—collecting bank account information from customers, for example—can be challenging to stand up fast and manage securely.

Today we’re pleased to announce Pre-Built UIs, a set of low-code tools that directly address the complications underlying customized in-app payments. Pre-Built UIs enable companies to quickly leverage workflows such as user onboarding, bank account collection, and embedded payments, with minimal engineering involvement.

The Challenge Behind Common Payment Workflows

Payment workflows are complex whether you’re moving money through your product or managing internal workflows.

For product and engineering teams, building these custom workflows within applications can be complicated and time-consuming. Hurdles include handling sensitive bank account information, payment validation, and error handling. The nuances around international payments can also be a challenge, especially determining which information to collect for different rails and different origin or destination countries. Allocating engineering or IT resources to these workflows can come at a sizable opportunity cost (e.g., slower time to revenue or missed work on differentiating features).

Further, many finance and operations teams rely on insecure and inefficient manual processes for common corporate tasks. For example, companies often manage payment requests and approval flows through email, spreadsheets, and Docusigns. They may also need to connect payment workflows to systems like Salesforce, ServiceNow, and/or homegrown software. As a result, companies wind up duct-taping solutions together to compensate for limited technical help.

Using Modern Treasury's Pre-Built UIs, companies can create and maintain workflows with less IT and engineering assistance.

Low-code UIs for Finance, Operations, and Product Teams

Pre-built UIs from Modern Treasury offer key benefits including:

- Fast integration. Pre-built solutions can help companies get their products to market faster. With Modern Treasury UIs, teams are able to stand-up complete workflows with less code and resources.

- Security. With Pre-Built UIs, there’s no need to handle sensitive PII (personal identifiable information) like social security or bank account numbers, because Modern Treasury stores data securely on a company’s behalf. Alternatively, teams that use tokenization providers or spend time encrypting data no longer need to take on unnecessary cost, work, and risk by using Pre-Built UIs.

- Ease of use. Building comparable UIs in-house requires understanding multiple payment rail requirements (with increasing complexity on an international scale). With Pre-Built UIs, companies don’t need to worry about collecting different information for different rails—nor do they need to think about input validation and error handling. These workflows are optimized for speed and user-conversion, helping to increase a company’s top line without additional hassle.

- Ease of connection. Pre-built UIs can be easily integrated with the systems teams use to manage internal processes—including ServiceNow, Salesforce, and other internal tools.

- Customizability. Companies can maintain a consistent brand and user experience by customizing colors and fonts for select Pre-Built UIs.

Leveraging Pre-Built UIs

Currently, Modern Treasury customers can use pre-built UIs to execute the following:

1. Collect user data and facilitate KYC and KYB

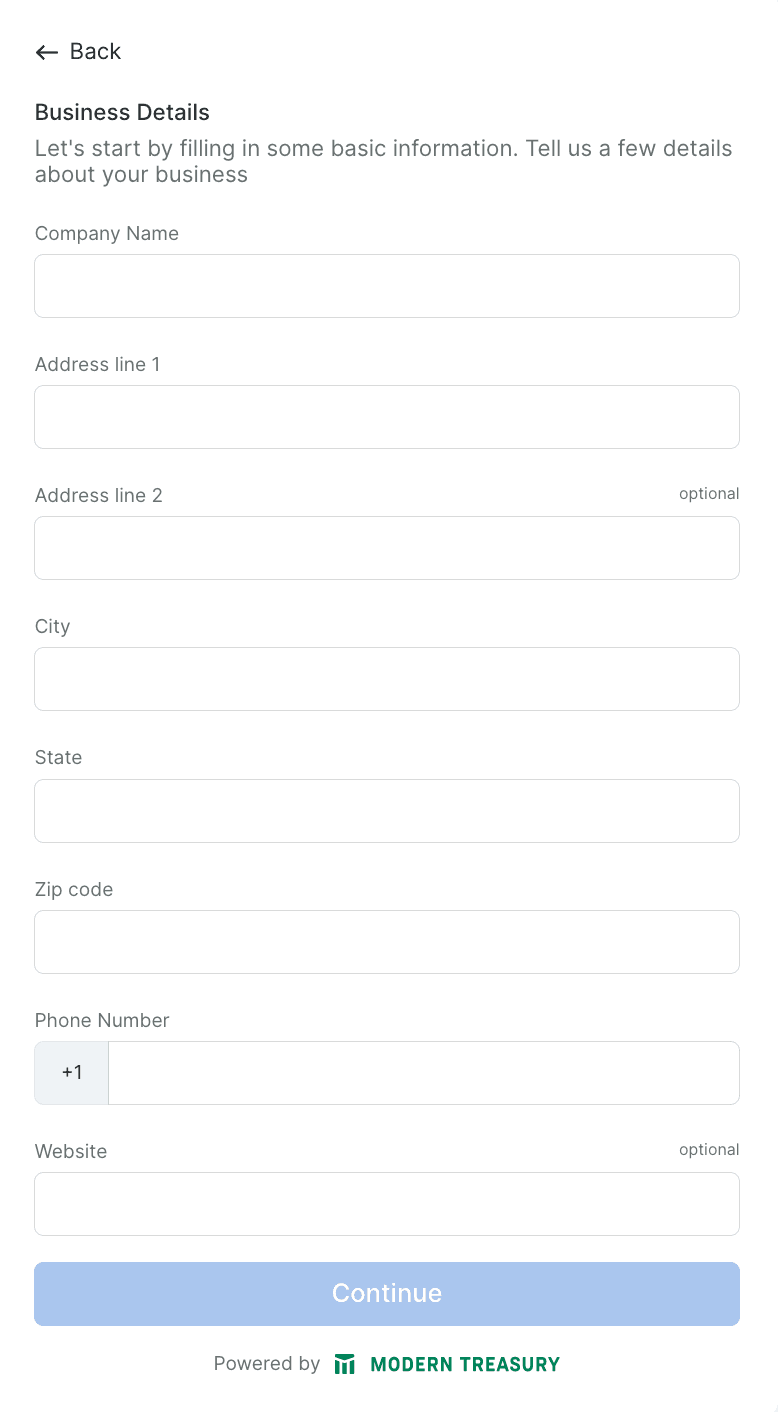

Using this pre-built UI workflow, companies can collect the information required to onboard individuals or businesses with minimal friction.

For onboarding individuals, customers can specify form fields including name (first, last), date of birth, phone number, email address, address, tax ID (SSN), and bank account details.

For onboarding businesses, customers can specify form fields including business name, address, phone number, website, tax ID (EIN), beneficial owners (each with name, date of birth, phone number, email address, address, tax ID, and control/owner prong), and bank account details.

Companies can optionally run KYC/KYB and bank risk checks seamlessly as part of this process using Compliance. If users are approved, Modern Treasury will automatically create counterparties and external accounts for use in payments.

As an example, imagine a B2B marketplace wants to run KYB on a new vendor. The marketplace simply needs to direct the new vendor to this form during onboarding and collect the required information to perform necessary compliance checks.

2. Collect bank account details

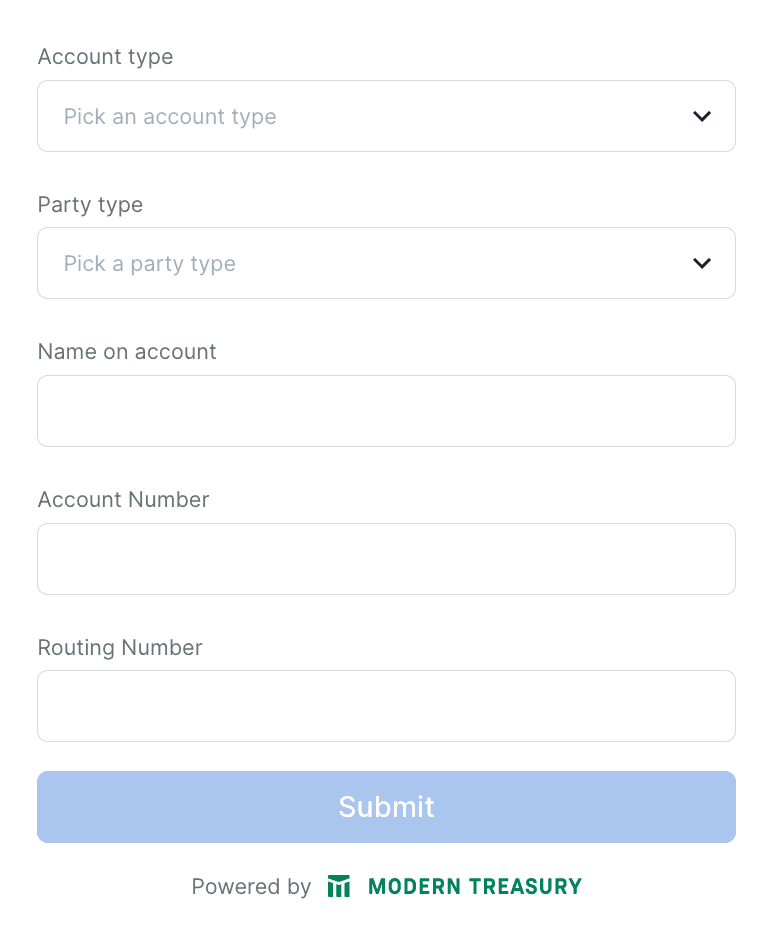

Modern Treasury customers can use a pre-built UI to collect bank account information from external parties via a customized embeddable form. These external parties can be customers, vendors, suppliers, investors, payees—any party that is sending money to or receiving money from a company.

Via this workflow, businesses are also able to specify which bank rails they want to use, including ACH, wire, and check—and Modern Treasury collects the required information from customers. The form color and font can be customized to give users a branded experience.

Example use cases for this UI include a fintech building a bill pay portal that enables customers to pay using ACH or a lender adding a new borrower to a portal and enabling recurring ACH debits.

In the future, this UI will be available for collecting information required for international payments. Additionally, customers will be able to perform bank account validation checks with these flows (e.g. microdeposits, bank consortium data).

3. Collect payments

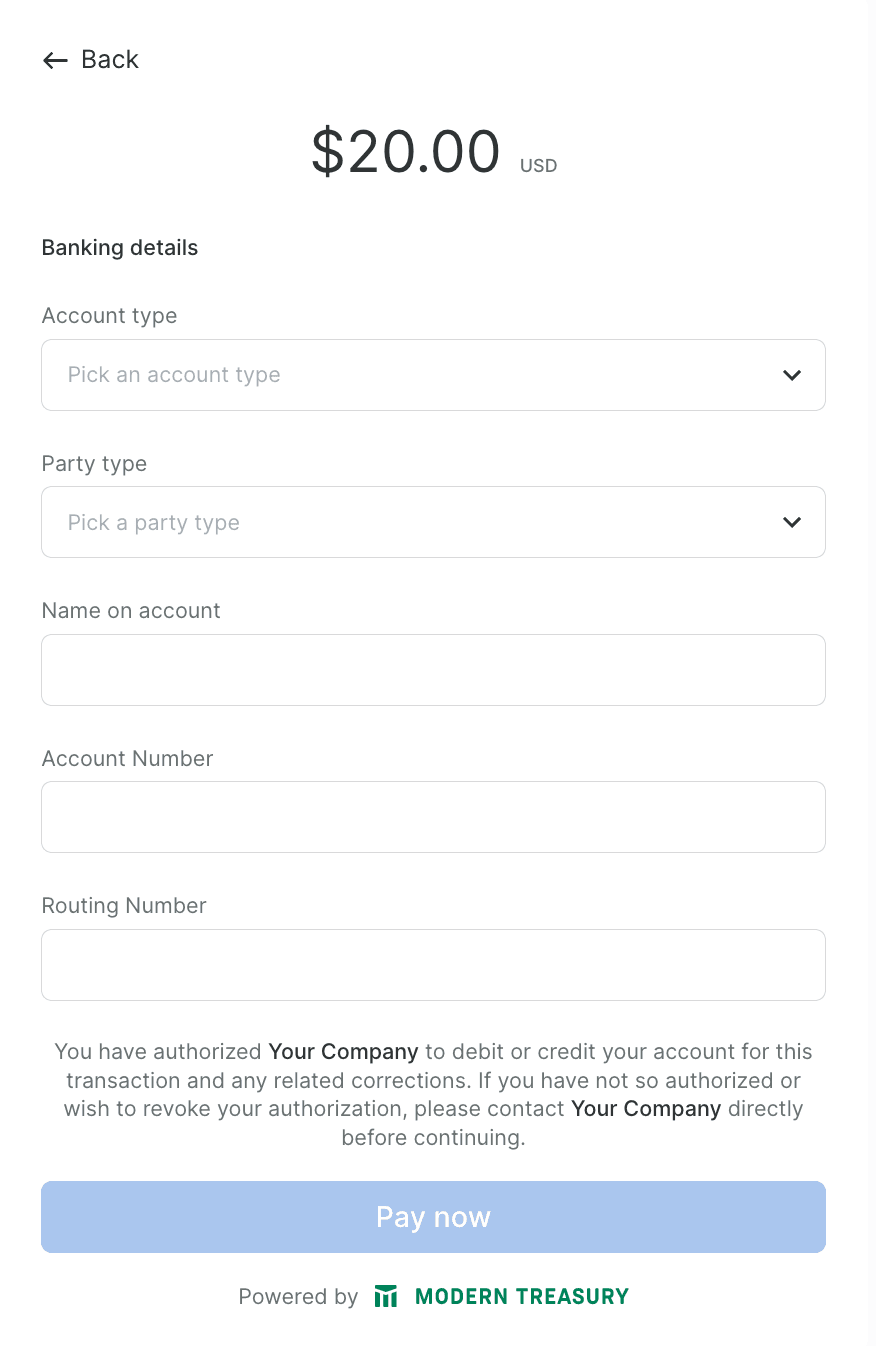

Akin to a checkout form for credit cards, this UI allows companies to embed a form in their portal to receive bank payments.

Using Modern Treasury, businesses can collect a payment from an external party, specifying the amount and internal account. The counterparty is then prompted to provide bank account information. Again, the ability to select font and color to conform with company style allows brands to create custom user experiences.

As an example, this UI could be used by a property management company building a portal so renters can pay online. Alternatively, it could be used by an insurance company collecting premiums via a portal. In both cases, an embeddable payment form can greatly improve convenience.

These payment flows will soon support additional rails, scheduled payments, and selection from existing external accounts.

How to Get Started

To get started now with pre-built UIs or learn more, please reach out anytime.

In coming months, Modern Treasury will expand on these offerings with new flows like invoicing, payment history, bank account management, and document uploads.

Get the latest articles, guides, and insights delivered to your inbox.

Authors