Introducing Modern Treasury Payments. Built to move money across fiat and stablecoins. Learn more →

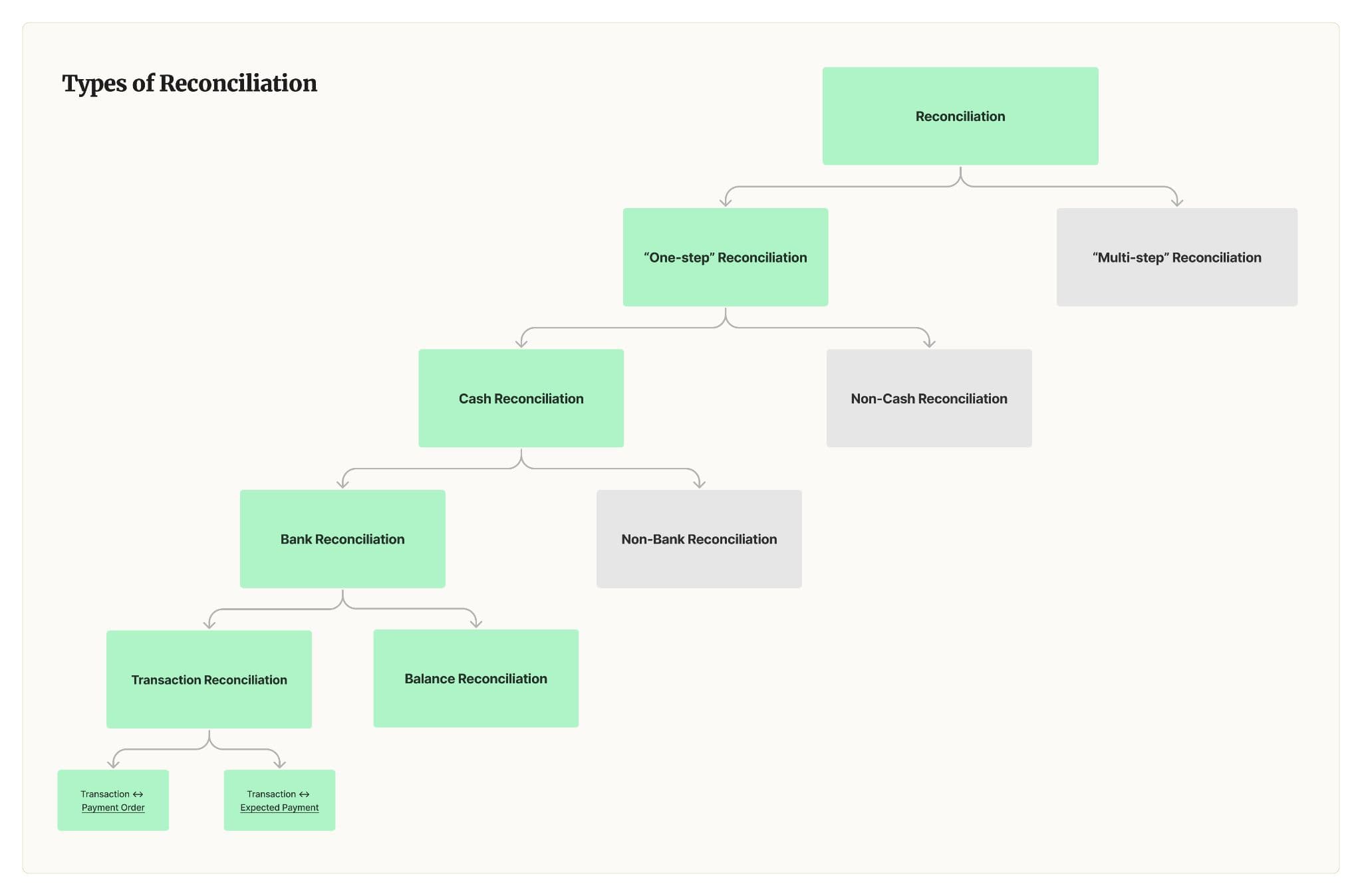

The Different Types of Reconciliation

In this journal, we’ll take a deeper dive into some of the variants of reconciliation, how they work, why they’re necessary, and how Modern Treasury can help your business better manage them.

Last week, we held a Tech Talk, where Modern Treasury’s Reconciliation Engine Product Manager, Wayne Lin, and Senior Software Engineer, Sean Bolton, discussed reconciliation at scale.

For a business moving money, reconciliation is one of the most important parts of payments operations—it helps you understand where, why, how, and when your money is moving and ensures that your internal records match external sources of truth. Done correctly, reconciliation aids businesses in making informed decisions, because reliable and up-to-date financial information is essential for effective strategic planning and resource allocation.

We built our Reconciliation Engine specifically to help solve for the various pain points of managing reconciliation. But reconciliation is a loaded term that can apply to many different scenarios. Here, we’ll take a deeper dive into some of the variants of reconciliation, how they work, why they’re necessary, and how Modern Treasury can help your business better manage them.

One-Step Reconciliation

This is reconciliation in its most basic form: matching an internal document, like a ledger or an ERP, with a bank statement to confirm that all incoming and outgoing transactions match in both places. When you think of reconciliation, this might be what first comes to mind; however, beyond the smallest of businesses reconciliation is a much larger and more complex task.

Multi-Step Reconciliation

Multi-step reconciliation is dealing with three or more systems of record. Take, for example, a credit card payment. There’s the credit card, the bank, and the internal record through which all the transaction information must be confirmed and matched.

Cash Reconciliation

Cash reconciliation is the process by which a business confirms payment accuracy by matching “expected money movement” and “actual money movement.” Comparing these two against one another allows a business to ensure that:

- All expected payments took place as expected

- No unexpected payments took place

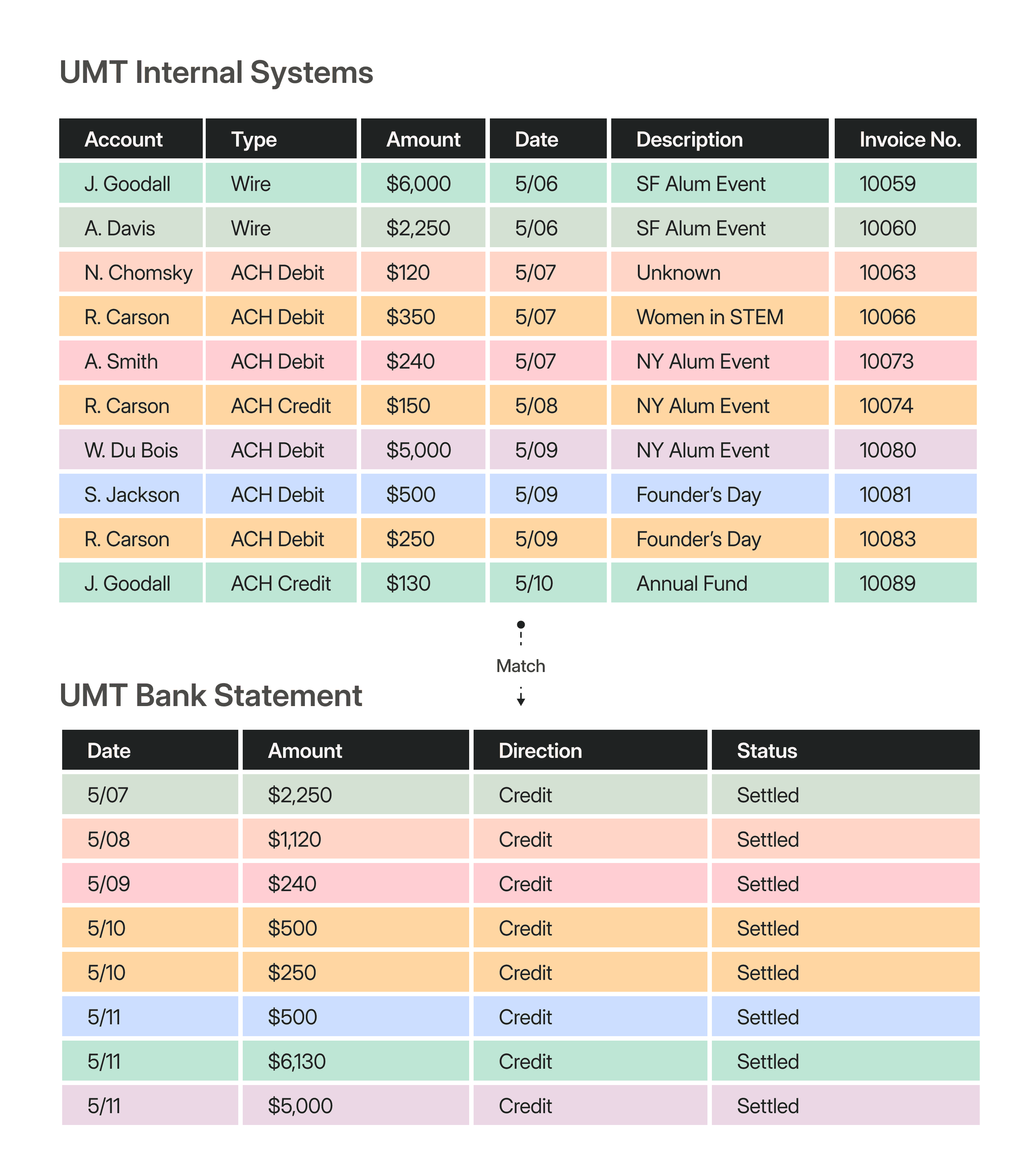

The example below shows how a fictional university—in this case, the University of Modern Treasury (UMT)—could reconcile alumni donations by comparing their internal records against their bank statements.

Because the data in these two datasets are presented differently, it’s not as simple as a one-to-one match. And this is just a small example. As your business grows, reconciliation only gets more complicated. As UMT expands and grows their payment volume, they must also increase their back-end operations teams to meet their reconciliation needs. This is something that companies, both small and at the Fortune 500 level, have hired armies of employees to manage—a large operational burden for a company from a time and resource perspective.

Non-Cash Reconciliation

For a non-cash example of reconciliation, we can look to customer loyalty or rewards points offered by a business. As customers engage with the business, they accumulate points through purchases, referrals, or other loyalty-related activities. Conversely, they also redeem points for discounts, free products, or other rewards.

In this case, the business will need to reconcile between the external ledger (or other documentation system) that houses and tracks their customers’ loyalty points as they are earned and the internal documentation that shows customer points balances and records of usage. Reconciliation becomes essential to avoid discrepancies between the points recorded in the rewards system and the actual points earned and utilized by customers.

Bank Reconciliation

Bank reconciliation is a flavor of cash reconciliation–it means that the external source of truth you are reconciling your internal system of record to is the bank. Think: bank statements from various bank accounts and how they compare against entries in a company’s general ledger. This can further be broken down into balance reconciliation (comparing to see if there is any variance in the net amount in the accounts) and transaction reconciliation (comparing if specific payments match to bank statement transactions).

Non-Bank Reconciliation

Conversely, non-bank reconciliation means the system of record you’re reconciling your internal database to is something that’s not a traditional bank: things like credit card processors.

Why it Matters More Now

Managing reconciliation at scale can be challenging at best, but the rise of faster options like the newest payment rail, FedNow (which launched last week), can complicate things even more. Because they operate, send, and settle 24/7/365, businesses also have to consider managing reconciliation 24/7/365—this could mean considering staffing your reconciliation team over the weekend or overnight, which poses a specific challenge. Fortunately, these are problems that computers and software can solve, with options for automatic reconciliation that can manage all payment types at all times.

How Modern Treasury Can Help

With automatic reconciliation, Modern Treasury automatically matches your payments and returns to transactions as they are made available by your bank.

At Modern Treasury, our Recon Engine is designed to address the challenges of reconciliation in a variety of ways:

- We provide best-in-class financial ledgering infrastructure to help companies build their own scalable databases to centralize “expected payments,” track transactions, and record balances.

- We integrate directly with bank partners to provide real-time, automated access to “actual money movement” within your bank.

- We provide the software bridge that links these two together.

With Modern Treasury, companies can take advantage of automatic reconciliation to help deliver a better product, and simplify and automate their operations. If you’re ready to learn more about how Modern Treasury can support your company with your reconciliation needs, reach out to us here.

Get the latest articles, guides, and insights delivered to your inbox.

Authors